Overview

Packaging Overview

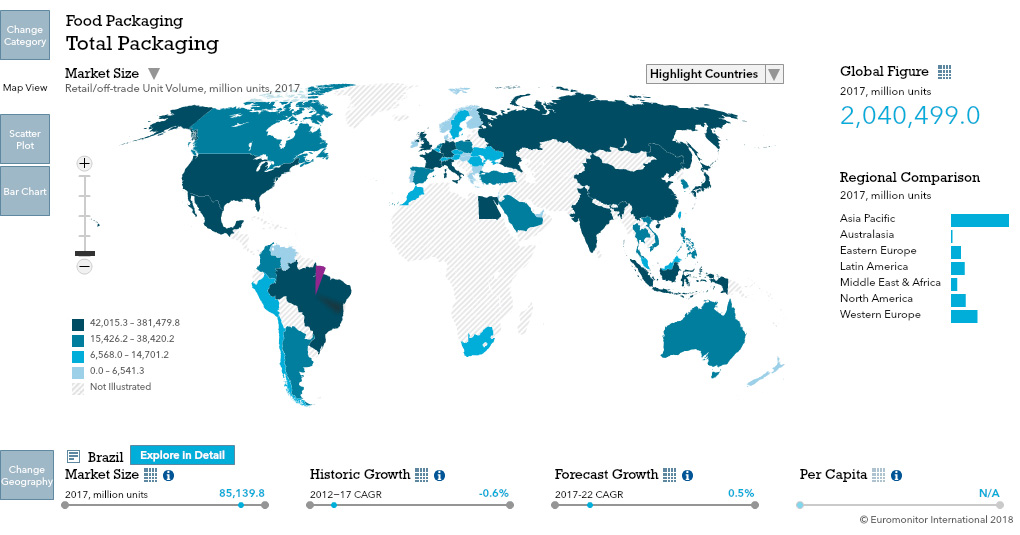

| Category | Unit | 2017 Retail volume (million units) | 2012/17 CAGR | 2017/22 CAGR |

|---|---|---|---|---|

Total Packaging | MN units | 149,916 41,345 62,563 18,124 10,214 6,734 10,936 | 0.1% 0.1% -0.1% 0.4% 1.4% -0.4% 0.2% | 1.4% 1.6% 0.8% 1.6% 2.6% 2.5% 1.1% |

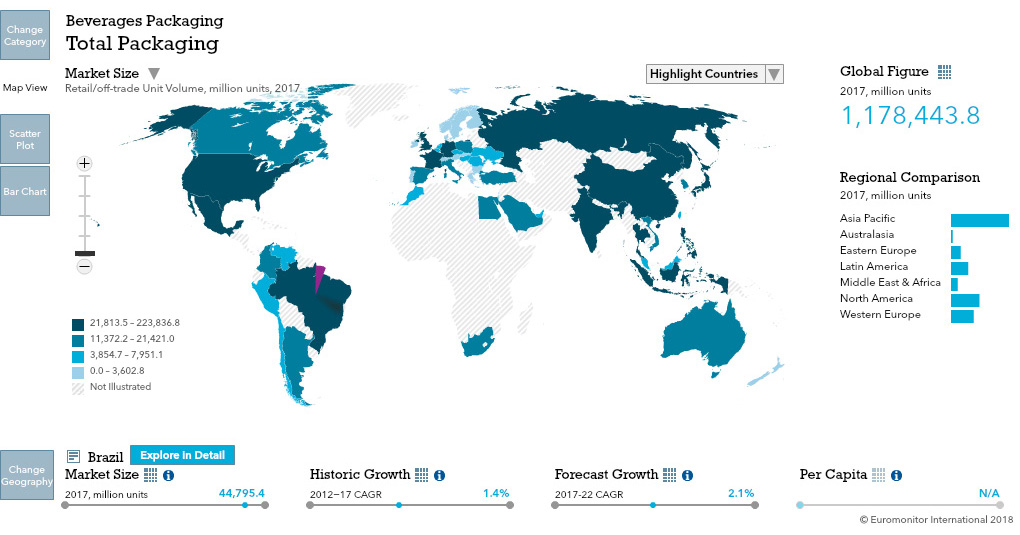

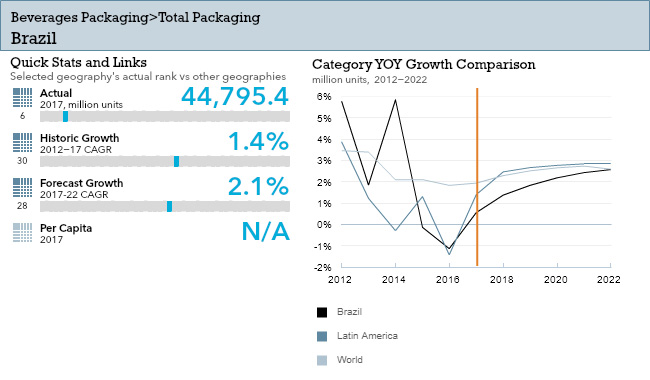

| Beverages | MN units | 44,795 | 1.4% | 2.1% |

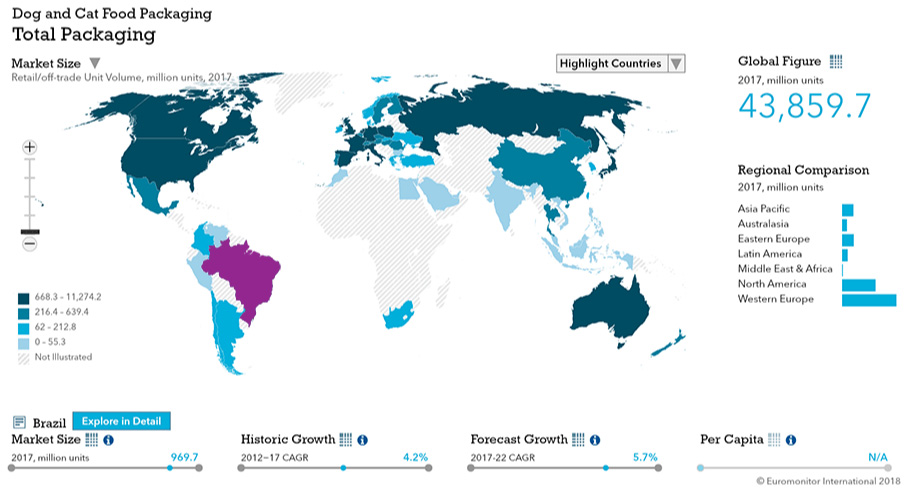

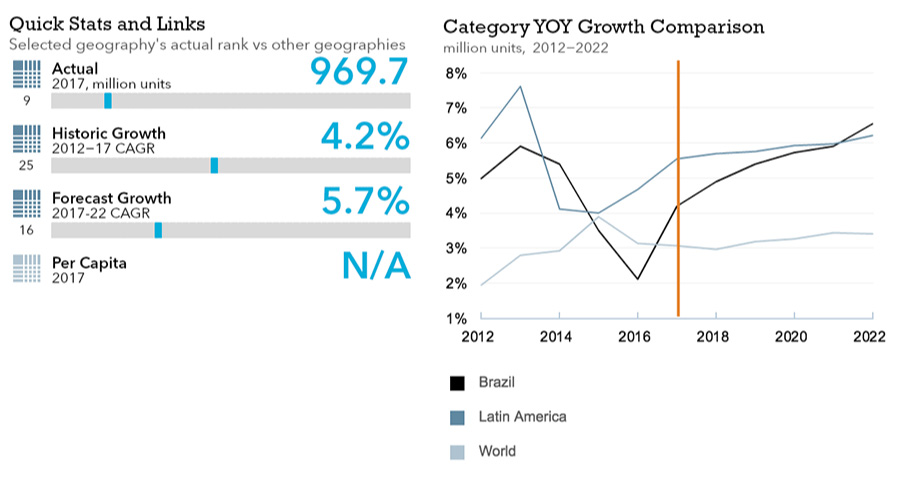

| Dog and Cat Food | MN units | 970 | 4.2% | 5.7% |

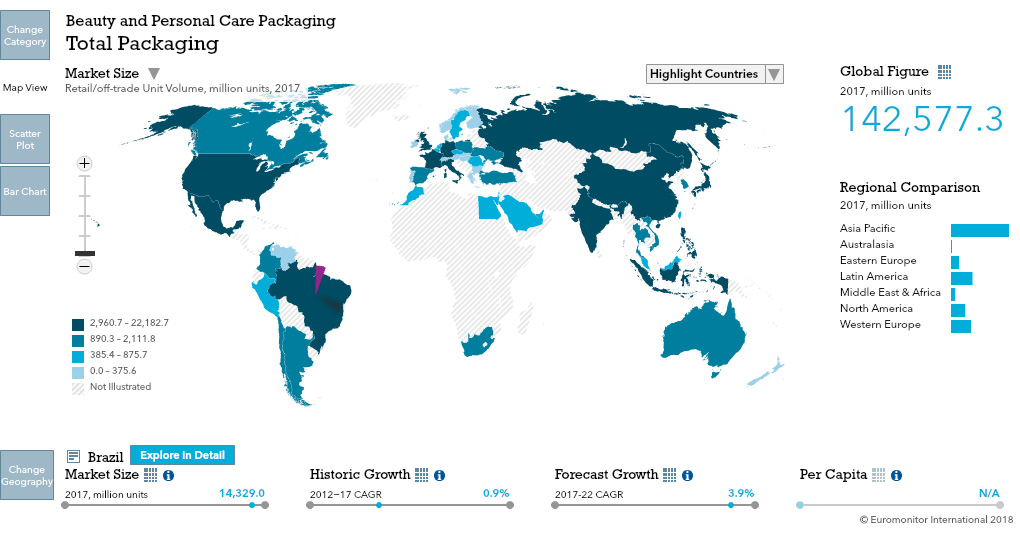

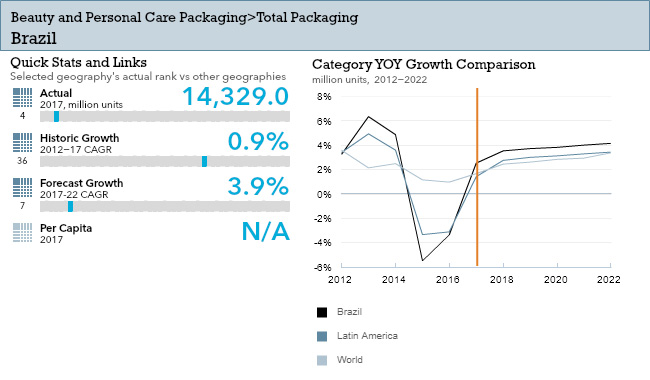

| Beauty and Personal Care | MN units | 14,329 | 0.9% | 3.9% |

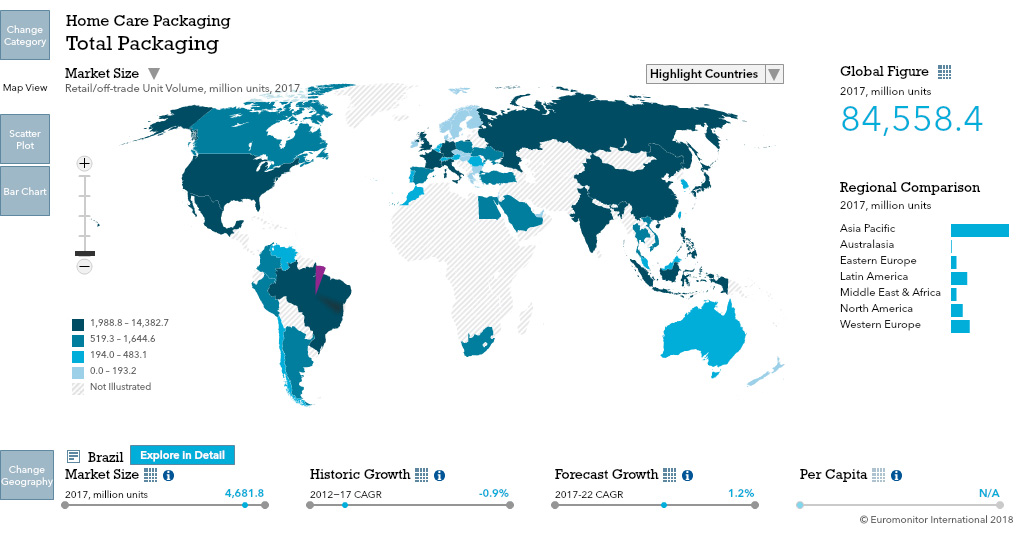

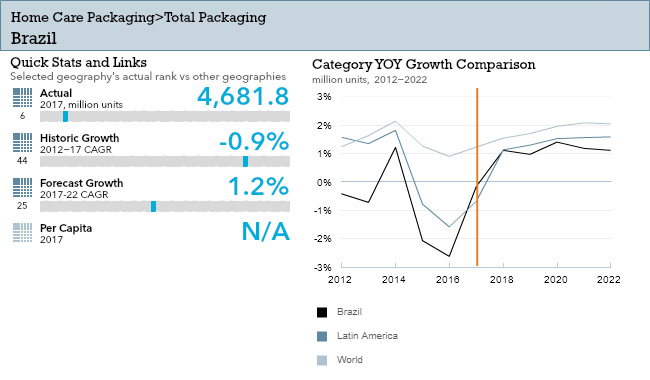

| Home Care | MN units | 4,682 | -0.9% | 1.2% |

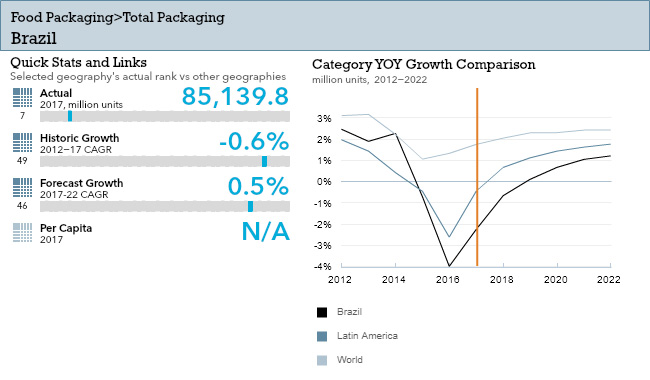

| Packaged Food | MN units | 85,140 | -0.6% | 0.5% |

Click here for more detailed information from Euromonitor

Key Trends

- As consumers increasingly seek greater transparency from brands in terms of packaged food ingredients and value least processed products, new packaging technologies emerge and consolidate to reinforce brands’ health attributes. This is the case with modified atmosphere packaging (MAP) in Brazil. Although it still has high costs that would make some products prohibitive for consumers, some niche brands are already taking advantage of this technology’s benefits to clearly communicate that their products have fewer preservatives or fresher appeal.

Packaging Legislation

- According to the Law 11,903/2009, the Sistema Nacional de Controle de Medicamentos - SNCM (National System for Medicines Control) foresees the use of bi-dimensional bar codes technology to ensure medicines’ traceability within the national territory. It aims to create greater control and accompany drugs throughout the whole production and distribution process until they reach final consumers. As a well-established system, with almost 10 years of implementation and already reaching different stages of technology evolution, it has been taken as examples to other products, such as packaged food, for example.

- Although some packaged food brands have been using this technology for a period of time, others are just now adhering to this movement. Grupo Pão de Açúcar, a leading retailing group in the country, has been using the technology both in Qualitá and Taeq, its two private label lines, to show consumers information on the entire production chain. By the end of 2017, SIG Combibloc, one of the most important liquid carton packaging manufacturers in the country, had also launched a pack line with the same technology.

- Especially after 2017, when significant scandals impacted the market for processed meat, consumers are increasingly sceptical about packaged food brands and seek greater information on their production processes. Challenges in the democratisation of these platforms rely on limiting final unit price increases due to higher production costs and communicating well with consumers about these new features.

Recycling and the Environment

- In accordance with the Brazilian Association of Manufacturers of Metal Beverage Cans (ABRALATAS) and the Brazilian Association of Aluminium (ABAL), in 2016, Brazil remained in the leading position, globally, when it comes to metal beverage can recycling. The index for this material reached up to 97.9% of all metal beverage cans sold in the Brazilian market in 2015. For 2017, the target is to have this penetration rise to 98%.

Packaging Design and Labelling

- One of the most important themes being discussed by (Agência Nacional de Vigilância Sanitária) ANIVSA in 2018 is new guidelines for food and beverages labelling. Discussions include three different regulatory processes: general labelling; nutritional data labelling; and allergenic ingredients. In this project phase, there are five different front labelling models being analysed. IDEC - Instituto de Defesa do Consumidor (Consumers’ Defence Institute) supports the application of black triangles as a warning sign for harmful components, such as sugar, salt or fat.

Click here for further detailed macroconomic analysis from Euromonitor

Beverages

Flexible Packaging Landscape

- Hot drinks volume sales continued to grow in 2017, despite the challenging economic situation. This positive performance was mainly driven by sales of coffee, which accounts for majority of the volume and packaging unit sales.

- The positive performance of flexible packaging was fuelled by sales of other hot drinks, especially chocolate-based powder drinks. Although this area has shrunk in terms of sales, flexible packaging registered growth through plastic stand-up pouches.

Trends

- While glass bottles and metal beverage cans continued to dominate alcoholic drinks packaging in Brazil in 2017, other formats are gaining ground thanks to the ongoing growth of RTDs/high-strength premixes.

- Although the economy already shows signs of recovery, most Brazilians are still concerned about their financial situation and are thus making more rational purchasing decisions. However, this does not always mean opting for the lowest priced product or brand, but rather the best pack type and size in accordance with one’s budget.

Outlook

- Over the period of 2017/22, manufacturers will follow the trend of diversification and look to offer consumers alternative sizes and types to better fit their needs. It is important, however, to have clear price positioning for each size and precise execution at sales points to avoid one packaging type cannibalising others.

- Over the period of 2017/22 small pack sizes are expected to gain ground in spirits, which continues to be dominated by larger formats. This should help certain categories such as pre-mixes and lager achieve wider penetration, as well as create new consumption occasions and offer manufacturers better profit margins.

Dog and Cat Food

Flexible Packaging Landscape

- Packs which allow for longer storage periods within dog and cat food are seeing significant growth, with flexible packaging and resealable zip/press closures both performing well.

- Grandfood has switched all its 1kg and 3kg dry food from flexible plastic packaging to flexible aluminium/plastic stand-up pouches with zip/press closures to offer consumers greater convenience and product durability.

Trends

- After years of a severe economic recession, the Brazilian economy has finally started to show signs of recovery in the second half of 2017, with this having a direct impact on pet food consumption in general and consequently also on dog and cat food packaging.

- Besides convenience and practicality due to a reheating economy, other lifestyle trends impacting packaging developments are urbanisation and smaller homes. This has led to a preference for smaller pets, such as cats, as well as smaller dog breeds. Consequently, the actual amount of prepared food necessary per pet is declining, in turn driving sales of smaller pack sizes.

Outlook

- Further polarisation in pack sizes is expected to occur in the period of 2017/22 as 10kg packs from marketplaces are virtually eradicated owing to the cheaper availability of other pack sizes.

- Convenience and stronger purchasing power owing to a reshaping economy will continue to drive growth of dog and cat food packaging in the period of 2017/22.

Click here for more detailed information from Euromonitor on the Dog and Cat Food Packaging industry

Beauty and Personal Care

Flexible Packaging Landscape

- One of the most dynamic categories in beauty and personal care packaging is flexible packaging. Many companies have invested in this option to provide convenient packaging solutions to consumers.

- Besides being easier to use, such packaging allows consumers to optimise consumption, as it enables users to utilise almost 100% of the content.

Trends

- Packaging plays an important role in the success of some products and offering the right packaging size allows consumers to continue purchasing products from the brands they desire. Smaller packaging types offer convenience to consumers, allowing many to carry the product in their purse or bag.

- There are companies that have introduced new products with packaging types that resemble procedures taken at dermatologists. For example, Anna Pegova and Under Skin have launched an anti-ageing product that is sold in packaging that seems to look like a needle injection.

Outlook

- Over the period of 2017/22, it is expected that flexible packaging will continue to gain in presence among beauty and personal care items, offering either more convenience or prices at slightly lower levels.

Click here for more detailed information from Euromonitor on the Beauty and Personal Care Packaging industry

Home Care

Flexible Packaging Landscape

- Flexible stand-up pouches lead home care packaging in Brazil. Manufacturers prefer flexible stand-up pouches since they use less plastic in the production process and enabling them to reduce production & distribution related costs.

- More-distinguishable added-value and premium products are typically marketed as offering flexible plastic materials serving mainly as refills.

Trends

- There was increased polarisation in terms of packaging sizes during the economic downturn, and this is likely to remain in the short and medium term. This is due to the negative impact on consumption habits observed during the period owing to the continued period of waiting for the economic crisis to pass.

- A basic effect of the economic crisis on packaging was more-intensive use of labelling as a tool to communicate a product’s differences, orientation and cost benefits in comparison to substitutes. Since consumers became more diligent about their home care purchases, they automatically devoted more time to evaluating products based on their claims.

Outlook

- Design oriented packaging is broadly used in more-developed countries for dishwashing purposes and is set to gain recognition in Brazil, especially for gel concentrated versions that require a minimal dosage, as consumers have difficulties in dispensing the correct amount.

- Over the period of 2017/22, other categories may gain momentum in terms of innovation, such as through the launch of in-wash laundry scent boosters. This novel product type, albeit substantially targeted at a niche group of consumers initially, could benefit from design-centred packaging.

Click here for more detailed information from Euromonitor on the Home Care Packaging industry

Packaged Food

Flexible Packaging Landscape

- Cheaper packaging types such as folding cartons and flexible aluminium saw slightly growth rates in boxed assortments, which is noteworthy given the overall decline in confectionery. This was driven by low-end assorted chocolate boxes with several small-version chocolate pieces, such as Nestlé’s Specialty Box.

- Requiring less storage space than original folding cartons, flexible packaging attracts consumers who buy in bulk and store items or who live in single person households and require longer storing periods. The popularity of bulk buying has been fuelled by the recent recession and expansion of atacarejo stores.

- Flexible plastic pouches are revolutionising the industry standard of cardboard boxes. The gradual economic recovery is fuelling demand for practicality and portability, which is satisfied better by flexible packaging rather than boxes. As unemployment falls, more women join the labour force, and the number of single households increases, consumers will increasingly look for practicality.

- Non-chocolate products are seeing an increase in rigid packaging over flexible packaging. This is being driven especially by increasing growth rates for rigid plastic packaging in gum. As consumers slowly regain purchasing power post-crisis, they will become more able to trade up to packaging that is more convenient and easier to store.

Trends

- Stand-up pouches and smaller pack sizes adapt to portion control trends and new consumption moments for confectionery products. Re-sealable pouches that allow for easy storing fulfil the need for portion control as they allow products to be consumed in several instances rather than all at once.Additionally, they are also ideal for urbanised on-the-go out-of-home consumption, as more consumers spend hours in transit given expected lower unemployment rates and gradual economic recovery.

- Within boxed assortments, premium pack types like metal tins, rigid plastic containers, and plastic trays saw a drastic decline in sales that negatively impacted overall confectionery packaging. This is likely due to the higher perceived value of such packaging, with consumers opting for cheaper chocolate options or other product types to give as presents instead of boxed chocolate assortments.

- Plastic containers and ready meal trays post strong growth, while metal cans sales continue to fall, and folding cartons sales growth remains very limited. Metal cans are perceived as an inconvenient packaging format which resulted in its decline.

- The gradual economic recovery is fuelling demand for practicality and portability, which is satisfied better by flexible packaging rather than boxes

Outlook

- Within powder milk, consumers are likely to instead opt for healthier and more practical packaging, switching to plastic and aluminium pouches that offer the same re-sealable function as traditional tin cans for powder milk but are relatively less expensive.

- Dairy packaging in Brazil will continue to see packaging size polarisation over the period of 2017/22. Smaller pack sizes are expected to grow in popularity due to the on-the-go and healthy lifestyle trends, which increasingly value convenience and portion control.

- As Brazilian consumers become more rational and as major supermarket chains increase investment in opening atacarejo stores across all regions of the country, larger packaging sizes and multipacks are expected to grow.

Click here for more detailed information from Euromonitor on the Packaged Food Packaging industry