Overview

Packaging Overview

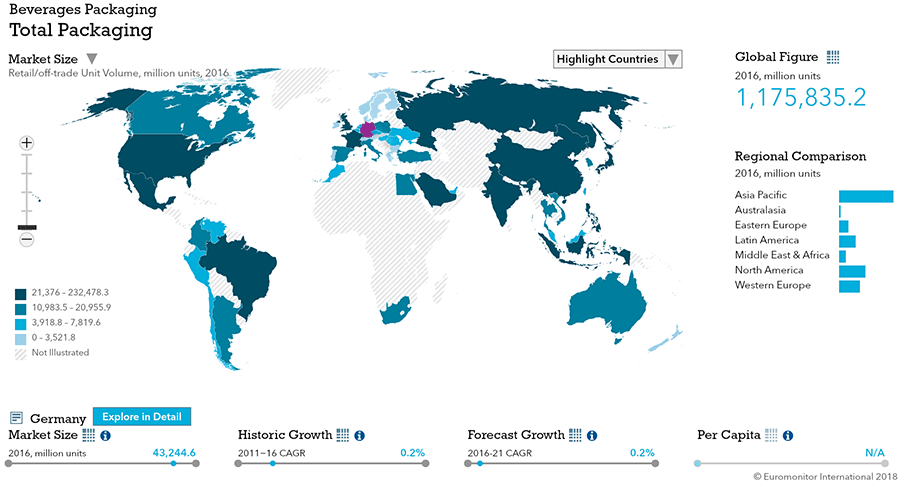

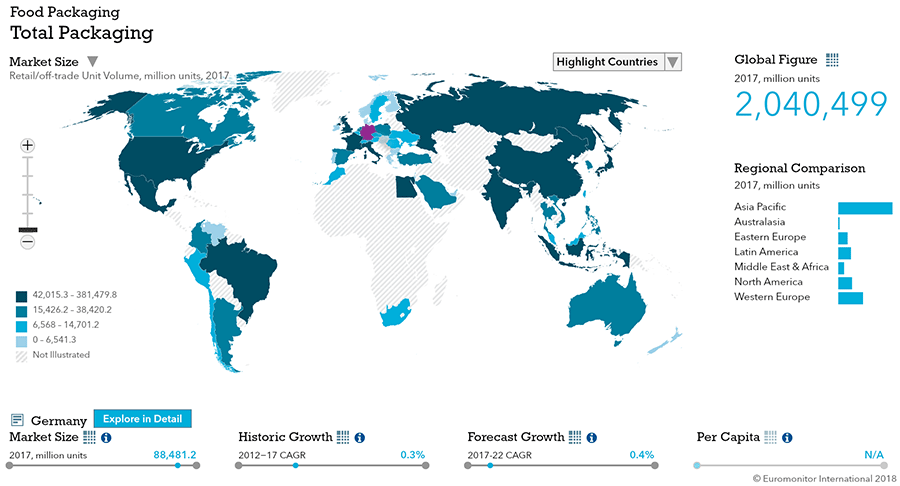

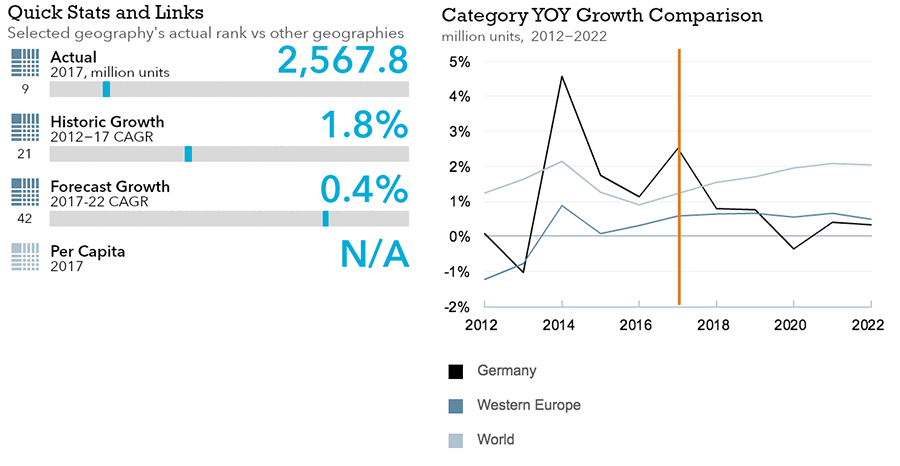

2016 Total Packaging Market Size (million units):

144,016

2011-16 Total Packaging Historic CAGR:

0.3%

2016-21 Total Packaging Forecast CAGR:

0.4%

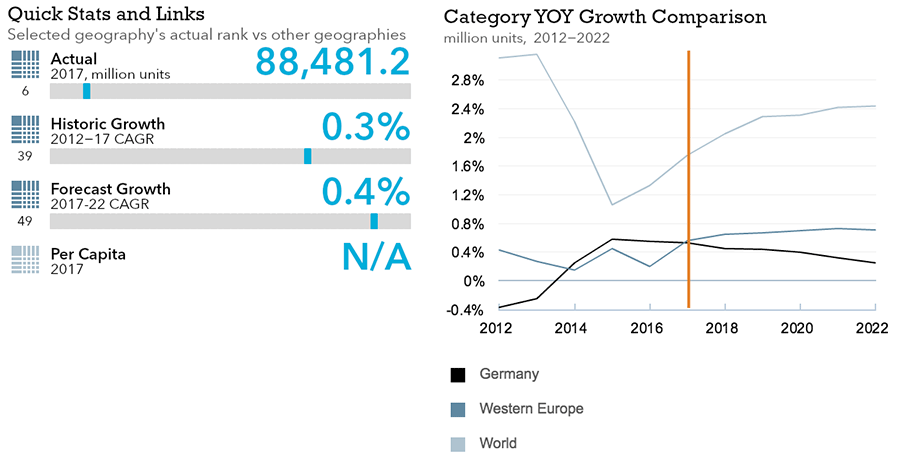

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 43,245 |

| Food Packaging | 88,012 |

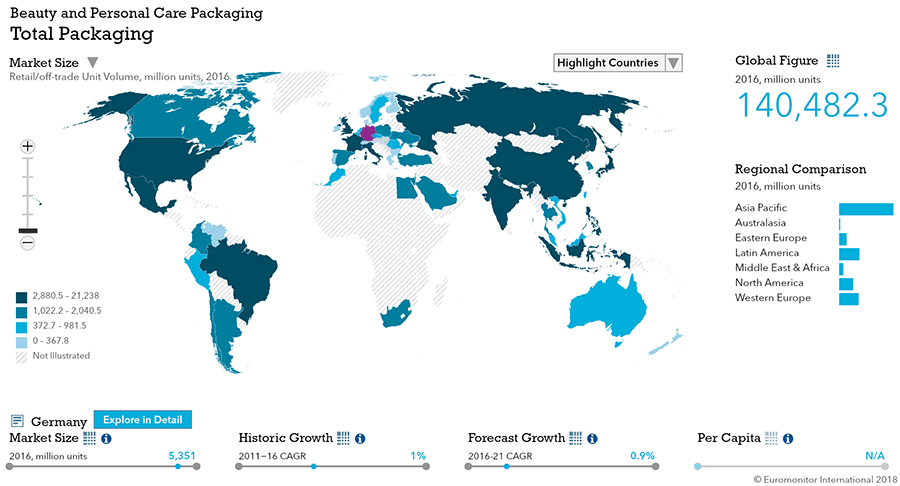

| Beauty and Personal Care Packaging | 5,351 |

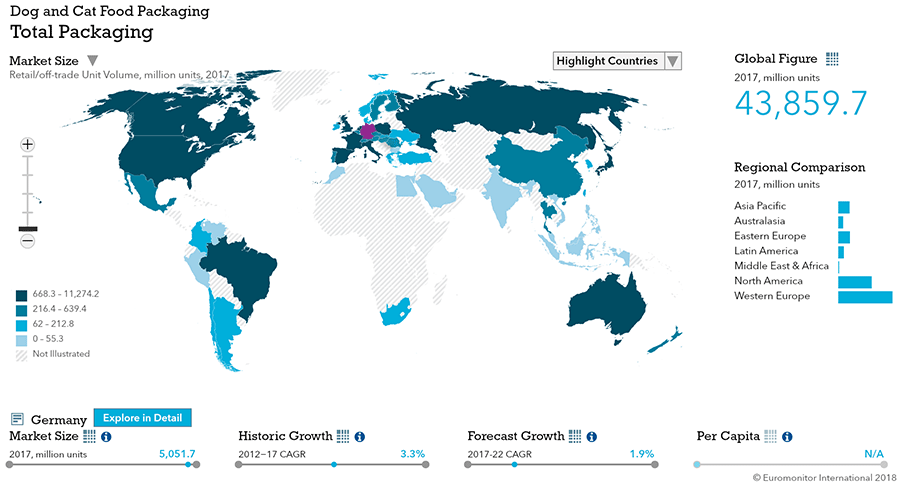

| Dog and Cat Food Packaging | 4,926 |

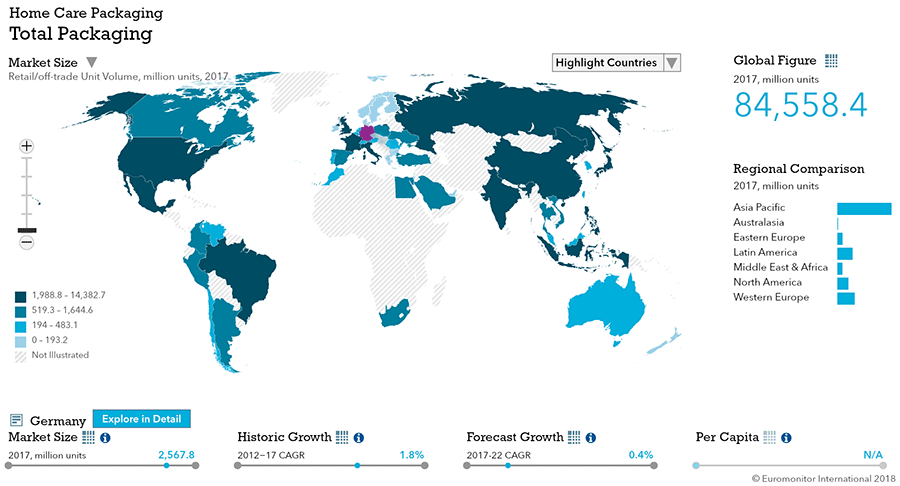

| Home Care Packaging | 2,482 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 44,750 |

| Flexible Packaging | 49,530 |

| Metal | 8,073 |

| Paper-based Containers | 10,627 |

| Glass | 23,318 |

| Liquid Cartons | 7,353 |

- The total German packaging industry, sized at over 144 bn units in 2016, experienced stagnation at only 0.3% growth, with a scant 0.4% expected over the forecast period.

- Food packaging overwhelmingly dominates all packaging, with drinks packaging only half of food packaging.

- Rigid and flexible plastic share the lead in size and growth rate.

Key Trends

- Many areas of packaged food see a shift towards smaller pack sizes as households shrink, older consumers eat less, and healthy portion control gains popularity.

- Alcohol consumption declined as health-consciousness went up among consumers. The on-trade channel was hit particularly hard, with foodservice packaging falling at a slightly stronger rate than retail packaging sales over the review period.

Packaging Legislation

- A March 2017 packaging law (Verpackungsgesetz) will come into effect in 2019 to prevent packaging waste by extending deposit obligations to carbonated fruit/vegetable nectars and beverages containing with 50% milk, and encouraging the use of returnable packaging, with a target reusability rate of 70%, among other measures

- Verpackungsgesetz encourages recycling through the Grüne Punkt ("Green Dot) system, indicating manufacturer contribution to cost of recovery and recycling. Significantly higher recycling rates will be implemented from 2019 onwards, with a target rate for plastic packaging increasing to 63% by 2022 and metal packaging and glass set to rise to 90% by 2022.

- The Closed Substance Cycle and Waste Management Act of 1996 in which producers of goods responsible for materials' reuse, recycling or environmentally-sound disposal.

- The city of Hamburg banned coffee pods from government-run buildings, on the grounds that they cause resource consumption and generate waste while containing polluting aluminum.

Recycling and the Environment

- Players face growing pressure to offer environmentally-friendly packaging with higher recycling rates. Consumers increasingly scrutinize packaging's environmental credentials.

- Many feel that the beauty and personal care industry has not reached adequate standards of recyclable, environmentally-friendly packaging.

- Germany has impressive recycling rates and continued to reach the highest recycling rates in Europe in 2015, with over 66% recycling rate for municipal waste in 2015.

Packaging Design and Labelling

- Aging society creates challenges and opportunities for labelling and packaging Germany had a high median age of 46 and over 21% of the population over age 65 in 2016. Many older consumers reduce food consumption, resulting in smaller pack sizes within packaged food, in processed fruit and vegetables and sauces, dressings and condiments. There is thus likely to be a focus on clear and legible fonts. New printing technologies point to future of packaging design

- The focus on differentiation results in a growing number of bottles that can only be reused by one brewery. The more non-standard bottles launched by large breweries, the bigger the problem becomes for small breweries, with many facing higher costs for standard reusable beer bottles as the supply of this packaging diminishes.

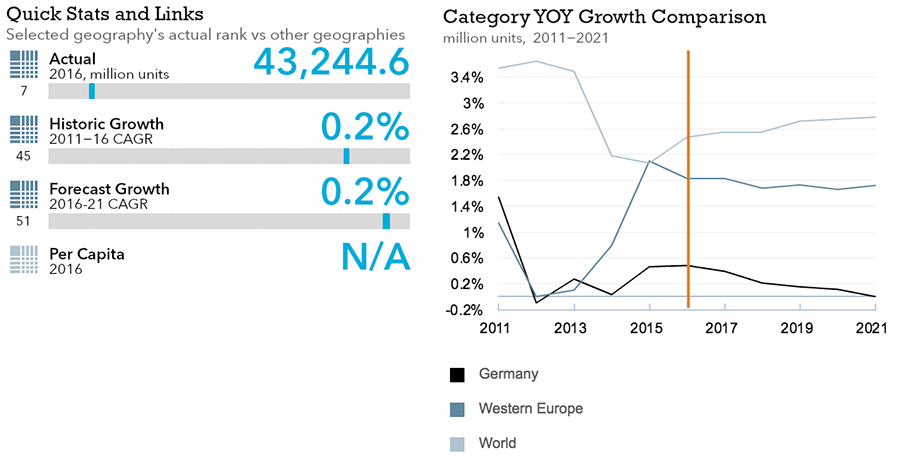

Beverages

Flexible Packaging Landscape

- Busy lifestyles result in on-the-go consumption for soft drinks leading to growth of convenient pack types such as small PET bottles with push-pull or flip-top closures.

- Alcoholic drinks packaging sales remain stable at 22 billion units, limited by premiumization.

- Soft drinks packaging total volume sales increase by 1% to reach 28.7 billion units in 2016

- Hot drinks total packaging volume sales grow by 1% in 2016 to reach 3.5 billion units

Trends

- Metal packaging continues to lead in alcoholic and soft drinks in 2016, with sales rising 11%.

- Paper-based containers record strong growth within wine and beer in 2016

- Total unit volume sales within alcoholic drinks packaging stagnated in 2016, an improvement compared with the negative review period CAGR of 1%.

- Consumers turn towards premium products, packaging with premium designs performed well.

- Beer packaging performed better in 2016 compared with the review period, as sales increased marginally. Glass bottles led, and metal beverage cans and PET bottles grew in popularity.

- Cork, once considered the only legitimate closure type for quality wine, loses to wider acceptance of metal screw closures. Cork accountsfor 26% of still white wine closures and 41% of still red wine closures in retail channels in 2016.

- Soft drinks packaging total unit volume sales increased marginally in 2016, mainly due to rising demand for energy drinks and RTD coffee, which are typically sold in relatively small units.

- Demand for juice and RTD tea, which are typically sold in larger units, declined.

- Convenient pack types grow in popularity across soft drinks. Consequently, metal beverage cans and stand-up pouches see stronger growth than glass or liquid cartons as do small PET with push-pull closures or flip-top closures instead of simple screw closures.

- Rigid plastic performed well and benefited from growth in PET bottles, which are the cheapest type of packaging in soft drinks

- Glass bottles, traditionally used in bottled water, remain under pressure as discounters grow at the expense of traditional food/drink/tobacco specialists, with traditional channels focus on glass packaging and modern discounters preferring PET bottles

- Rigid plastic was the most dynamic hot drinks pack type, with total unit volume sales rising 9%

- Fresh ground coffee pods packaging growth continues to be fueled by manufacturers’ attempts to differentiate their products through innovative packaging

- Paper-based containers and flexible packaging continued to account for the vast majority of hot drink packaging sales in Germany in 2016.

- Distribution of hot drinks was characterized by the dominance of hypermarkets, supermarkets and discounters

- Flexible packaging remained the largest packaging category in hot drinks due to the broad use of different forms of flexible packaging as primary and secondary packaging in this area.

Outlook

- Alcoholic drinks packaging is expected to post a negative total unit volume CAGR of 1% over the forecast period, with sales falling to 21.3 billion units in 2021.

- Glass will remain the main packaging type for alcoholic drinks due to image of being more natural and environmentally friendly than metal cans or PET bottles.

- Although metal beverage cans and PET bottles are growing at the expense of glass bottles, sales are expected to remain limited. Most German consumers still consider glass the safest pack type in terms of protecting taste and purity compared to other packaging materials.

- On-the-go consumption and single-person households grow demand for smaller convenient packs. This will be reflect in growing sales of 330ml glass bottles, metal cans and PET bottles.

- Efforts to differentiate through appealing designs and eye-catching shapes will impact developments within alcoholic drinks packaging going forward.

- Environmental friendliness will be key in alcoholic drinks packaging during the forecast period.

- Soft drinks packaging expects a slight decline in total unit volume sales. Overall, soft drinks is a mature and saturated area which means the aging population contributes to a decline in volume sales. Despite the expectation of stronger sales of small packs, packaging is not expected to achieve growth in unit terms.

- Rigid plastic could be affected by food safety and ecological impact, but will benefit from to the format’s lower weight compared to glass and the popularity of thin wall plastic containers in hot drinks. Bio-plastic bottles made from polyethylene furanoate (PEF) are predicted to be ready for market entry in 2018 and could eventually challenge PET packaging.

- Convenient small pack sizes will play an important role as manufacturers launch convenient variants of their core brands. Growth is set to be fueled by rising demand for metal and rigid plastic, as other pack types have further decline.

- Metal beverage cans are set to see the strongest performance, with innovations such as self-cooling cans or hygiene covers.

- Hot drinks packaging total unit volume sales are expected to record a CAGR of 2% over the forecast period due to the strong overall performance of coffee and tea.

- The hot drinks packaging landscape will display relatively stable development with no significant changes seen during the review period. Consequently, paper-based containers and flexible packaging are likely to lead growth and continue to dominate hot drinks sales.

- Within hot drinks packaging, competition is likely to remain intense as multinational packaging companies compete with local players. An increasing number of different packaging formats compete. Overall, this development will continue to be beneficial to consumers and end product manufacturers.

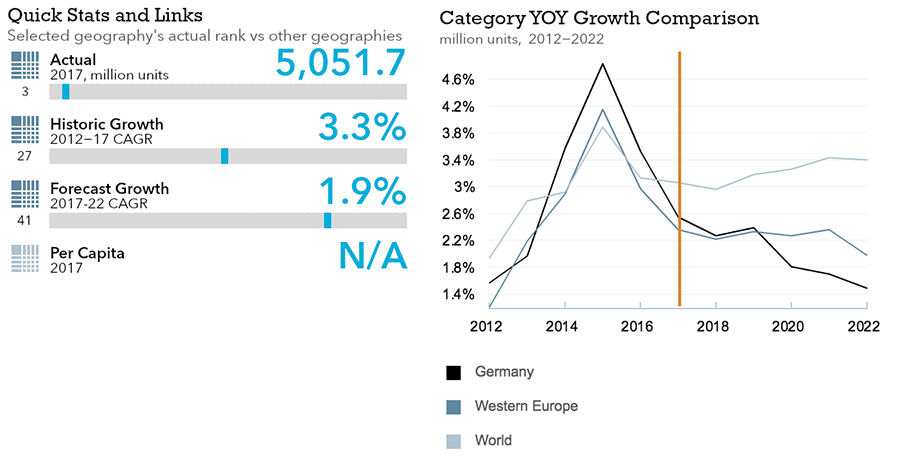

Dog and Cat Food

Flexible Packaging Landscape

- Cat and dog food packaging grows 3% to reach 4,968 million units in 2015

- Packaging volume growth driven by growing demand for small pre-portioned cat food and treats

Trends

- Aluminum/plastic pouches within wet cat food, cat, and dog treats, record ongoing strong volume growth

- Rigid plastic sees 29% volume growth in 2016 as premium wet cat food in thin wall plastic containers launches

- The most common packaging type for dog and cat food remains metal containers.

- The fastest growing packaging type in terms of retail/off-trade unit volume sales was rigid plastic containers in 2016.

- Most small pack types in dry dog and cat food and some mid-priced and premium treats feature zip/press closures, which reported rapid growth rates over the review period.

- Thinner and more compressed packs with fewer folding cartons as secondary packaging are seen in dog and cat food. Folding cartons declined during the review period, and were primarily seen in multipacks as a secondary packaging type by the end of the review period.

Outlook

- New premium products in glass jars use metal screw closures to underline exclusivity and increased sustainability

- Dog and cat food packaging retail/off-trade unit volume to see 2% CAGR over forecast period to reach 5,546 million units by 2021.

- Treats in new formats such as creams and liquids are likely to grow in popularity. These require different packaging types such as squeezable plastic tubes.

- Smaller portions will be in demand, creating strong growth potential pre-proportioned food.

- Wet cat food and small pack sizes and dry cat food in pouches are expected to grow. Realable pouches make additional containers to store pet food unnecessary. Convenience will drive demand for packaging with zip/press closures across dog and cat food packaging.

- Metal food cans are expected to decline due to their perceived low level of sustainability. This pack type's significance within wet cat and dog food is expected to remain high. Most metal food cans are equipped with easy-open can ends.

- As long as premium brands use aluminum trays, this pack type will continue to see strong volume sales in Germany. New product launches such as the innovative Snap & Feed solution might offer valid alternatives and significantly impact their future development.

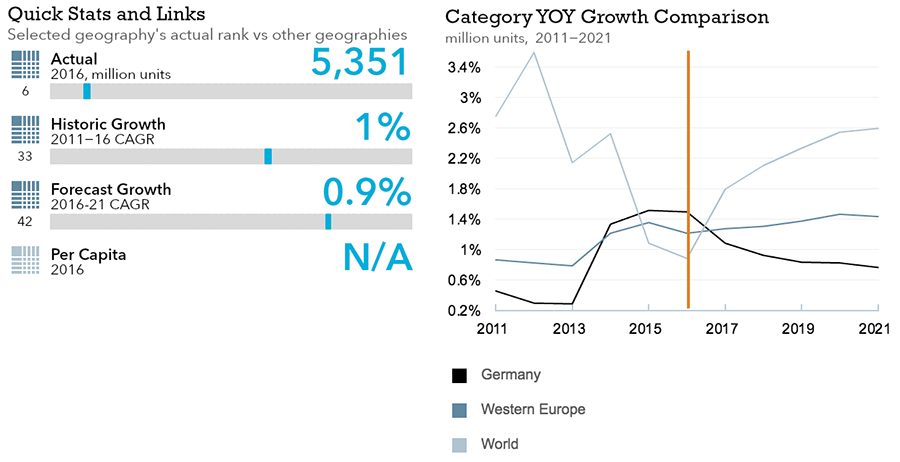

Beauty and Personal Care

Flexible Packaging Landscape

- Mini and compact packs perform well in beauty due to a shift towards concentrated formats, particularly in deodorants, but also linked to convenience.

- Beauty and personal care packaging retail unit volume sales rise by 2% in 2016

- The trend towards exclusively designed and premium image packaging continues in 2016

- The trend towards smaller pack sizes continues to dominate beauty and personal care packaging.

Trends

- There continues to be a shift towards premiumization which, alongside the increasing popularity of products that look appealing, fuels the trend towards distinctive and luxurious packaging.

- Products such as skin care usually come in smaller pack sizes with secondary packaging such as folding carton, which is often glossy or textured to add a more luxurious feel.

- There has been a shift towards smaller pack sizes as customers are demand lower amounts of products in areas such as cosmetics or compressed deodorants. When it comes body lotions or shampoos, larger pack types are more popular as they last longer and are a lower price.

Outlook

- Beauty and personal care packing unit volume sales are expected to grow at a CAGR of 1% over the forecast period to reach 5.6 billion units in2021

- Premiumization and packaging design trends are expected to continue, resulting in more refined packaging. The natural trend indicates that packaging must also become more eco-friendly.

- Squeezable plastic tubes are expected to grow as they are seen as an alternative to glass bottles and have the advantage of not breaking and being lighter

- The trend towards multifunctional products will provide opportunities for companies to launch innovative packaging that is functional, convenient and looks appealing to consumers.

Home Care

Flexible Packaging Landscape

- In 2016, home care packaging increases by 1%, reaching 2.5 billion units.

Trends

- HDPE and PET bottles lead home care packaging in Germany as these types of packaging require fewer resources and materials.

- Plastic pouches with zip closures for automatic laundry detergents enter in 2016

- Blister and strip packs remain popular, especially for rim blocks and rim liquids due to visibility, minimal shelf space taken and the positive sales performance.

- Automatic washing powderpack sizes are increasing, with Family sizes and XXL gaining over the review period, due to better value and online shopping.

- Primary packaging increased 1% in retail unit volume terms in 2016, whereas secondary packaging witnessed a marginal decline.

Outlook

- Home care packaging is expected to be flat in volume terms over the forecast period, with a CAGR of less than 1%

- Packaging of home care products will move further towards sustainable options

- It is likely that so-called “maxi packs” or family sizes, will increase further.

- With increasing popularity of candle air fresheners, opportunities for new primary packaging designs and closures.

- Appealingly designed product packaging to attract consumers, such as dishwashing liquids and multi-purpose cleaners offers further opportunities.

Packaged Food

Flexible Packaging Landscape

- Total retail size of dairy packaging increases to 27.2 billion units in 2016

- Sauces, dressings and condiments stagnate at 4.0 billion units in Germany in 2016

- Sauces, dressings and condiments primary packaging continues to record growth, while secondary packaging posts a decline

- Retail packaging of processed meat and seafood declines marginally to reach 8.7 billion units.

- Total retail packaging of confectionery stagnates at 17.9 billion units in Germany in 2016

- Packaging of processed fruit and vegetables grows by 1% to reach 2.4 billion units in 2016

- The total volume of primary and secondary baby food packaging increases by 1% in 2016.

Trends

- German consumers stick to preferred packaging types in dairy towards the end of the review period

- Because of the ongoing success of chilled snacks, flexible plastic performs positively in 2016

- No real innovation occurs in 2016, as dairy packaging has been of the highest standard for years

- Rigid plastic packaging performs the best in 2016 with 2% growth in volume terms in sauces, dressings and condiments, followed by metal with 1% growth. Because of the very large number of packaging alternatives already available, no real innovation takes place in 2016

- The freshness trend and the trend towards larger pack sizes limit growth opportunities as most packaging types within processed meat and seafood decline significantly for the second year running

- The packaging industry is missing growth opportunities within confectionery, apart from the trend towards smaller pack sizes

- Metal confectionery packaging continues to benefit from the premiumization trend in 2016

- Innovation occurs in terms of better protection of the actual product in 2016

- Trend towards smaller pack sizes supports volume growth of processed fruit and vegetables packaging in 2016

- Flexible packaging is high in demand in 2016 for processed fruit and vegetables and posts the strongest volume growth within baby food packaging in 2016.

- The performances of individual pack types vary alongside a widening product offer in baby food.

- Limited packaging innovation focuses on the core requirements of baby food.

Outlook

- Stagnation expected for dairy packaging over the forecast period and no significant developments are expected in sauces, dressings and condiments are expected.

- Total packaging of processed meat and seafood is set to continue to decline in volume terms over the forecast period

- Confectionery packaging is expected to largely stagnate in volume terms over the forecast period

- Further low annual growth is expected for packaging of processed fruit and vegetables over the forecast period

- Baby food packaging is set to grow at a CAGR of 1% in volume terms over the forecast period.