Overview

Packaging Overview

2016 Total Packaging Market Size (million units):

134,379

2011-16 Total Packaging Historic CAGR:

0.0%

2016-21 Total Packaging Forecast CAGR:

1.2%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

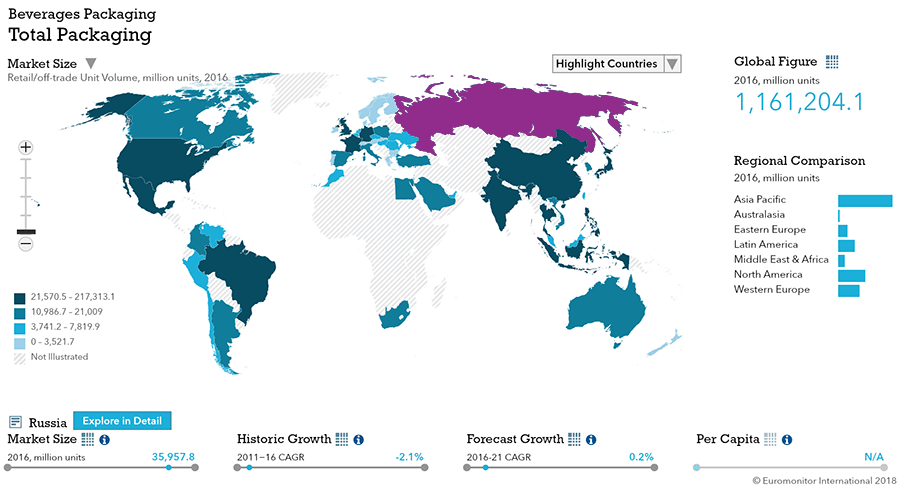

| Beverages Packaging | 36,363 |

| Food Packaging | 89,276 |

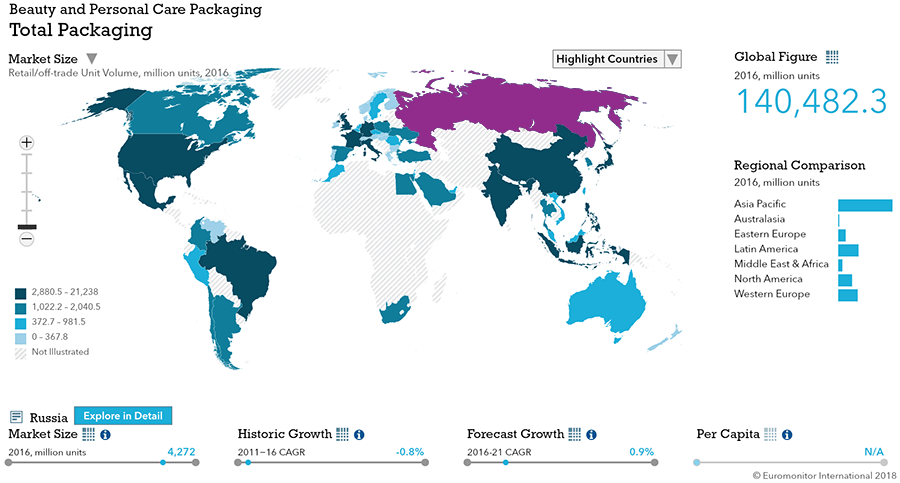

| Beauty and Personal Care Packaging | 4,272 |

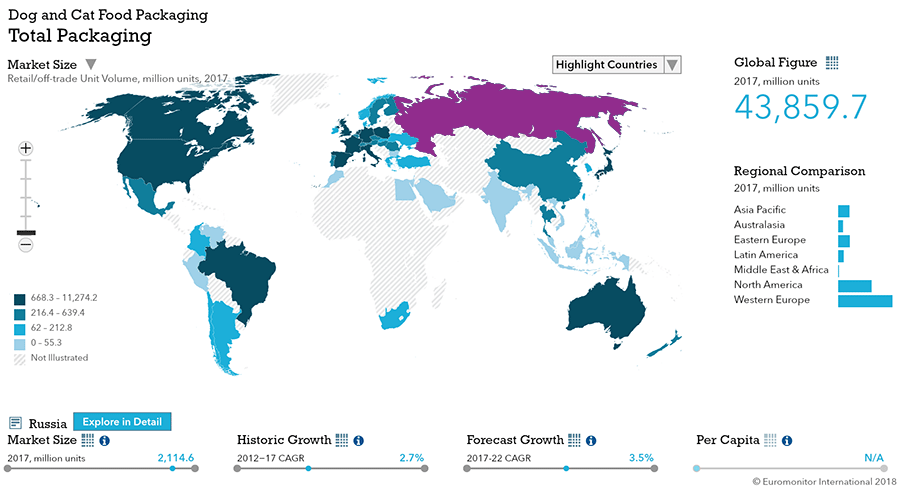

| Dog and Cat Food Packaging | 2,060 |

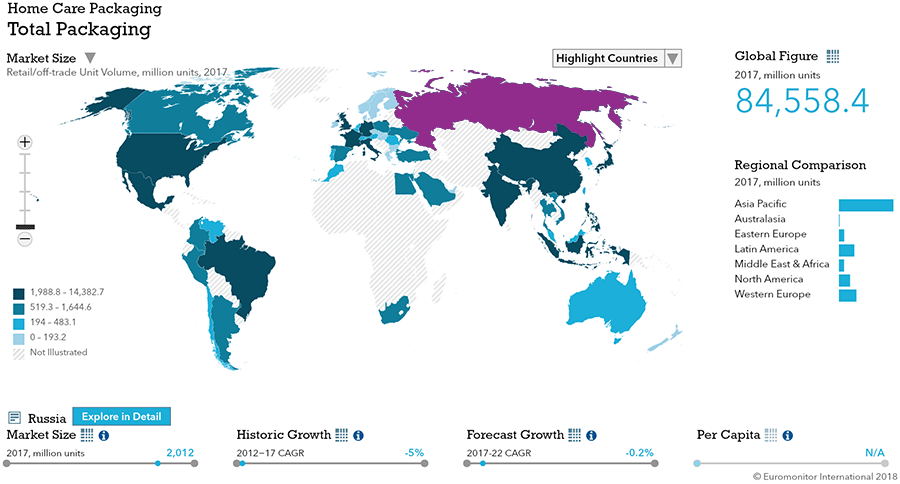

| Home Care Packaging | 2,409 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 29,673 |

| Flexible Packaging | 62,906 |

| Metal | 9,553 |

| Paper-based Containers | 9,709 |

| Glass | 14,438 |

| Liquid Cartons | 8,054 |

- The total Russian packaging industry, sized at over 134 bn units in 2016, is expected to see moderate growth.

- Food and beverage packaging continues to dominate packaging, but dog and cat food packaging presents a niche growth opportunity.

- Flexible packaging leads in size, and rigid plastic ranks second.

Key Trends

- Food packaging total unit volume continued to decrease in Russia over 2016 as the struggling economy led to stagnant packaged food sales. Cheaper plastic-based packaging formats have started to be used more in food packaging, largely at the expense of relatively expensive packaging formats such as glass and flexible paper.

- Demand for bottled water continues to rise, increasing demand for PET bottles.

- Russian consumers opted for beauty and personal care products in more affordable packaging formats in 2016. This involved both cheaper packaging materials such as PET bottles and the use of flexible plastic instead of HDPE bottles, as well as larger and smaller sizes, depending on the category.

- Home care packaging also saw increased demand for more affordable packaging—including flexible plastic, PET bottles and metal aerosol cans—in 2016 due to weakened consumer purchasing power.

Packaging Legislation

- Large PET beer bottles are prohibited: As of 2017 beer can no longer be packaged in PET bottles larger than 1.5 liters. The aim of this regulation is to reduce the affordability of beer, and it is expected to increase demand for smaller PET bottles and draft beer. Overall, though, it may reduce total demand for PET beer bottles if the demand for draft beer surpasses that of beer in smaller PET bottles.

- Changes in food packaging labeling are expected: In 2016, the head of the Federal Service for Surveillance on Consumer Rights Protection and Human Wellbeing (Rospotrebnadzor) proposed a “traffic light” color scale for food packaging in which healthy products would be marked green, intermediate ones yellow, and those high in sugar or salt red.

- Palm oil content must be noted on dairy product packaging: As of January 2017, all dairy products containing palm oil must be marked with a corresponding indication. According to the anticipated technical regulation, such food products will need to have clear inscriptions in bold letters stating that they contain palm oil. Fines for failing to do so are expected to be harsh.

Recycling and the Environment

- Russian law places recycling burden on manufacturers: Since 2015, Russian law has required manufactures to either manage the waste disposal or recycling of their products’ packaging or pay a tax of 1.5%-4.5% of volume production costs. Given the lack of a waste sorting system in Russia, most companies opt to pay the tax. However, Coca-Cola announced in 2016 that it plans to collect 40% of its products’ packaging by 2020.

- Low awareness and motivation impedes recycling: The system allowing for the collection and sorting of waste from domestic households is still rather immature in Russia. The sorting of waste is still not a widely recognized approach in the daily routines of most Russians. Thus, the mentality of most Russians remains one of the most difficult obstacles to the creation of the waste-processing and recycling infrastructure.

Packaging Design and Labelling

- Low-cost packaging gets dressed up: In an attempt to bolster sales during the economic downturn amid increasing consumer cautiousness, food product manufacturers are increasingly using low-cost techniques such as high-resolution food images set against black backgrounds to appear more premium in the hopes that consumers will opt for their products over the competition.

- Rising demand for convenience drives innovation: Due to their increasingly busy lifestyles, Russian consumers are attracted to products that are designed to be easy to use or consume. Consequently, manufacturers are adapting their packaging designs to make them more ergonomic and/or smaller and easier to carry on the go.

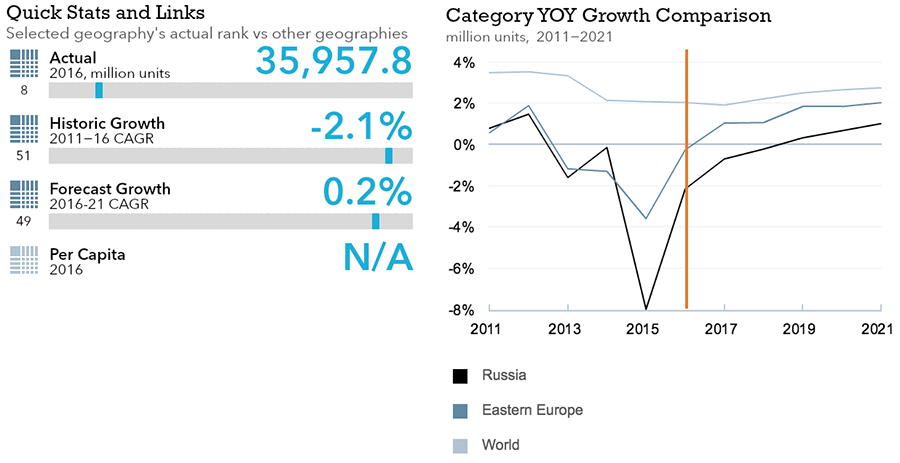

Beverages

Flexible Packaging Landscape

- Total Russian beverage packaging volume is expected to see limited 0.1% CAGR growth through 2021.

- Flexible beverage packaging is expected to see stronger 1.9% CAGR growth through 2021.

Trends

- In soft drinks, PET bottles accounted for the largest volume share at 58%, driven by increased demand for bottled water.

- In hot drinks, Flexible packaging continued to increase dynamically in 2016, to account for 63% of primary retail unit volume against 57% in 2012. The rise of flexible packaging – dominated by flexible aluminum/plastic – was due mainly to the increasing popularity of fresh coffee and a consumer shift towards lower-priced instant coffee mainly packed in aluminum/plastic pouches.

- In alcoholic drinks, glass packaging dominates, with a 59% volume share in 2016. Traditionally, glass has been the most popular packaging in all major categories of alcoholic drinks despite its higher price relative to other packaging formats.

- Metal beverage cans continue to account for about a quarter of total alcoholic drinks packaging in unit terms, with their share being limited by their being confined largely to beer.

Outlook

- In soft drinks, PET bottles are projected to continue to grow in popularity, with 59% of total soft drink volume units packaged in PET bottles—equivalent to 10.1 billion units—in 2021, due to increasing demand for bottled water and lower-priced products, including private label products.

- Family formats in bottled water, particularly units containing 5 liters and above, are expected to gain popularity. At the same time, smaller packaging sizes in bottled water are also expected to perform well, driven by the health and wellness trend that will continue to influence water consumption habits.

- In hot drinks, flexible packaging is set to increase given the expected shift to cheaper hot drinks, at least in the short term. Aluminum/plastic pouches will witness the highest growth, which will allow brand owners to cut packaging costs and remain competitive in lower price segments – especially the highly saturated instant coffee category. Flexible packaging will see the highest growth in all major categories in hot drinks including coffee, tea and other hot drinks. Glass will suffer the most as a result of the increasing share of more affordable products, while folding cartons will perform stably mainly due to steady demand for tea.

- In alcoholic drinks, glass packaging will enjoy strengthening demand in wine, as well as holding its current sales in wine and beer, with the advertising of the latter allowed until the end of 2018. As a result, alcoholic drinks in glass will increase its presence in total packaging, holding a 62% volume share in unit terms in 2021, up from 57% in 2016.

- Metal beverage cans are predicted to post a marginal CAGR decline between 2016 and 2021, in line with the general trend of the beer category. The performance of metal cans is entirely related to beer sales, which are predicted to register a 2% annual average decline in volume over the forecast period. However, sales of metal cans will be supported by the increasing use of smaller pack sizes, and stable consumer demand for beer packed in convenient and stylish metal cans. In addition, metal beverage cans will benefit from the ban on large PET bottles in beer, as they represent an attractive alternative for packaging.

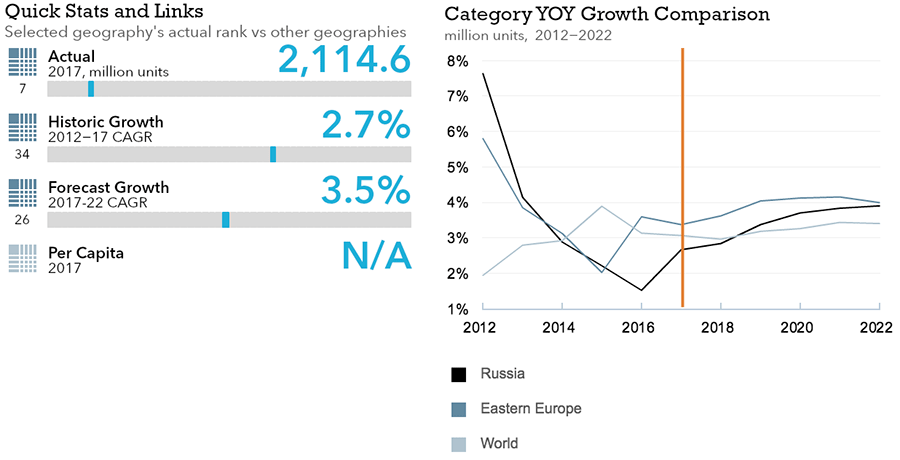

Dog and Cat Food

Flexible Packaging Landscape

- Total Russian dog and cat food packaging volume is expected to see strong 3.5% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see even stronger 5.6% volume CAGR growth through 2022.

Trends

- Total dog and cat food packaging volume sales increase by 2% in 2016 to reach 1.8 billion units. Dog and cat food packaging lacks significant innovations as the economic downturn forces manufacturers to cut costs.

- Flexible packaging remained by far the most popular type in dry dog food and dry cat food in 2016, as it is less costly and considered more convenient than folding cartons. Among the main flexible packaging formats, stand-up pouches posted the fastest volume growth rates in both categories.

Outlook

- Total dog and cat food packaging volume sales are expected to grow at a CAGR of 4% over the forecast period to reach 2.2 billion units in 2021. Healthy volume sales growth will be sustained by the stable development of the wider pet food and pet care products market in Russia, as well as by growth in the country’s pet dog and cat populations.

- Dog and cat treats and mixers are relatively new in Russia. As a result, both categories are expected to post healthy growth in retail volume sales over the forecast period, albeit from a low base. Both categories are also expected to witness greater diversity in terms of packaging types. Smaller pack sizes (i.e., less than 100g) will remain dominant in cat treats and mixers. Stand-up pouches with zip/press closures are expected to become more popular in both dog and cat treats and mixers, especially for portioned products.

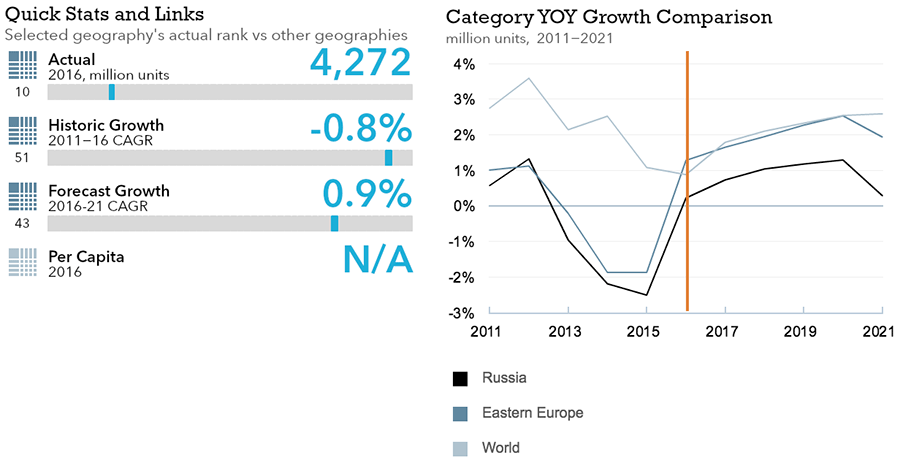

Beauty and Personal Care

Flexible Packaging Landscape

- Total Russian beauty and personal care packaging volume is expected to see limited 0.9% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see slightly stronger 1.3% CAGR growth through 2021.

Trends

- Due to increasing prices and decreasing consumer incomes, manufacturers are increasingly offering cost-efficient packaging rather than increasing product prices.

- At the end of review period stand-up pouches continued gaining ground in Russian beauty and personal care, especially in hair care and bath and shower. This format provides a combination of economy and practicality that consumers increasingly demand in Russia’s challenging economy.

- Convenience continued to be a major factor driving packaging innovation in 2016. Thus, upside down squeezable plastic tubes and bottles with the closure on the bottom (tottles – a tube and a bottle combined) grew in popularity across a range of categories within beauty and personal care during the review period.

Outlook

- Plastic pouches have strong potential in beauty and personal care packaging in Russia, with this pack type still underdeveloped but presenting an economical option for price-sensitive consumers with limited disposable income. In the forecast period, it is expected that beauty and personal care packaging in stand-up pouches will register a CAGR of 12% in total unit volume terms.

- Metal aerosol cans should continue to deliver a strong performance, driven by hair care and deodorants. As a result, beauty and personal care packaging in metal aerosol cans is expected to see a CAGR of 1% in total retail unit volume terms over the forecast period.

- The rapid growth of lotion pumps closures is expected to continue in the forecast period, especially for bath and shower products, liquid soap and facial make-up products. The closure is not only being adopted as a solution that is perceived as more hygienic by consumers, but also as a way of boosting a brand’s profile and shelf visibility.

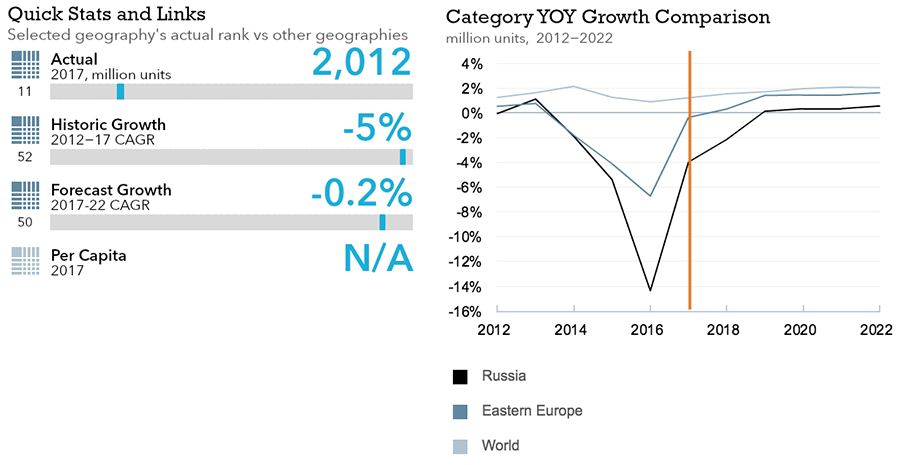

Home Care

Flexible Packaging Landscape

- Total Russian home care packaging volume is expected to see limited 0.9% CAGR growth through 2021.

- Flexible home care packaging volume is expected to continue to decline through 2017 before turning positive in 2018 and remaining so through 2021.

Trends

- Due to the challenging Russian economy, more basic packaging types such as flexible plastic in standard powder detergents, PET bottles in liquid fabric softeners or metal cans in air fresheners gained popularity in 2016.

- A significant portion of Russian consumers have returned to hand washing dishes in 2016, leading PET bottles—the most affordable packaging type—to grow volume share at the expense of the still-dominant but more expensive HDPE bottles.

- Following general market trends, manufacturers responded to demand for more basic solutions in pack types as well. As a result, historically key pack sizes such as 300ml metal aerosol cans in spray/aerosol air fresheners, or 400-500g carton packaging in standard powder laundry detergents, gained share

- Facing the saving mode prevalence among market players in Russian home care, the most basic closures enjoy a growing presence on market. Plastic dispensing closures is the major choice of manufacturers in hand dishwashing, and serves as a good illustration of this trend. However, in some categories the more convenient although more expensive options continue gaining share. A good example of this is kitchen and windows cleaners, where trigger closures became a standard during the years of product presence on the Russian market, and continue boosting share even in times of economic uncertainty.

Outlook

- The growth of more affordable packaging solutions will be a visible and key trend over the forecast period. If economic fluctuations stabilize in the country, some revival of more sophisticated products such as laundry or dishwashing tablets may post better-than-anticipated results, however this will not significantly change the general mood on the market.

- As private label home care products increase in popularity, metal aerosol cans will grow volume share, as they are the key packaging format for private label air care. Additionally, metal aerosol can production facilities are located in Russia, which allows home care product manufacturers to better manipulate the consumer price for air care products.

- With some exceptions, manufacturers will opt for simpler, less expensive closures in coming years to keep prices low. However, some more expensive closures, such as child-resistant closures for toilet cleaners and trigger spray closures for window cleaners—have become entrenched in the market and will remain so in coming years despite their higher costs.

Packaged Food

Flexible Packaging Landscape

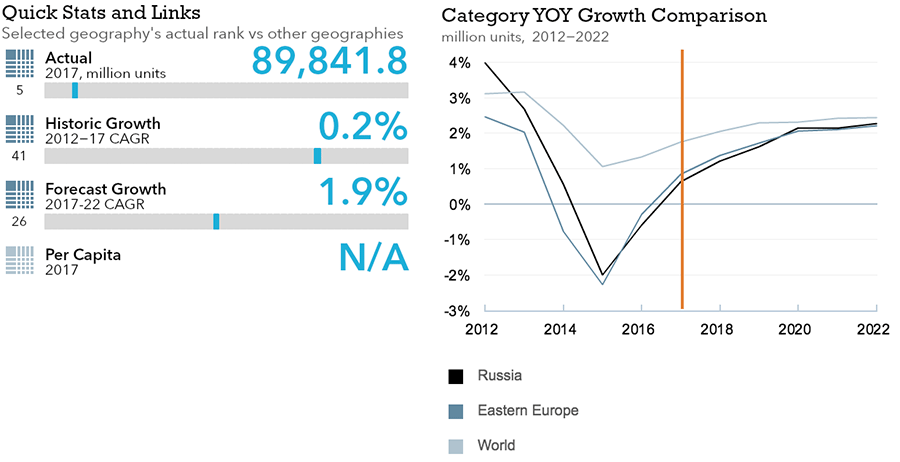

- Total Russian packaged food packaging volume is expected to see moderate 1.9% CAGR growth through 2022.

- Flexible packaged food packaging volume is expected to see slightly slower 1.7% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, stand-up pouches is the most common packaging type, accounting for 31% of total volume unit sales in 2016, due mainly to their widespread use in the ketchup and mayonnaise categories. Brick liquid cartons was the most dynamic packaging type in 2016, recording 16% unit volume growth as consumers increasingly opted for tomato pastes and purees rather than more expensive fresh tomatoes.

- In processed meat and seafood, 1% total packaging volume decrease is attributed to declining consumption, particularly among processed seafood. Other plastic trays recorded 8% unit volume growth, due to increased availability and demand for chilled processed meat.

- In processed fruit and vegetables, metal food cans dominate, increasing their unit volume share to 61% in 2016. Flexible plastic’s volume share fell by two percentage points to reach 19%, as that packaging type is primarily used for frozen fruit and vegetables, a category that is reliant on imported raw materials and that has suffered in the face of Russia’s import embargos.

- In confectionery, flexible plastic is the most common packaging type, but stand-up pouches registered strong unit volume growth in 2016, driven primarily by the strong growth of the Mars and M&M’s brands.

- In dairy, 1% packaging volume sales growth resulted from increased domestic dairy production. Milk is the largest dairy category, accounting for 26% of all dairy packaging volume sales. Plastic packaging is the most popular type for fresh milk, and liquid cartons dominate shelf-stable milk.

- In baby food, unit volume sales declined by 1% in 2016 due to declining sales of baby juices. Glass packaging is the most popular baby food packaging type, with a 53% unit volume share in 2016. Stand-up pouches unit volume sales increased by 2%, as consumers increasingly view the packaging type as convenient and safer for children.

Outlook

- In sauces, growth will mainly come from stand-up pouches, which are forecast to post 18% volume sales growth to reach 36% of overall sales in 2021, due mainly to their convenience and affordability.

- In processed meat and seafood, total volume CAGR is expected to be 3% through 2021, led by rigid plastic packaging, thin-wall plastic containers and other plastic trays.

- In processed fruit and vegetables, unit prices for frozen processed fruit and vegetables are not projected to increased in coming years as quickly as they did in previous years. As a result, consumers will increasingly opt for frozen fruit and vegetables, which are typically in flexible plastic packaging.

- In confectionery, 1% volume sales growth will be driven by increasing demand for confectionery as the Russian economy improves. Flexible plastic will remain the most popular packaging type as chocolate pouches and bags will remain the largest confectionery category. However, flexible plastic will lose a slight amount of volume share to aluminum foil as chocolate with toys becomes more popular.

- In dairy, rigid plastic will continue to post volume sales growth to reach 16% of total packaging volume sales by the end of 2021. The volume sales share of glass jars is projected to more than double to reach 86 million units in 2021, driven by increasing demand for premium dairy products.

- In baby food, forecast 1% CAGR through 2021 is expected to come from continuous growth of stand-up pouches which will account for 12% of total volume sales in 2021 (up from 4% in 2016).