Overview

Packaging Overview

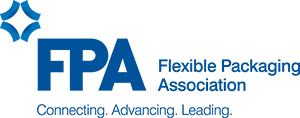

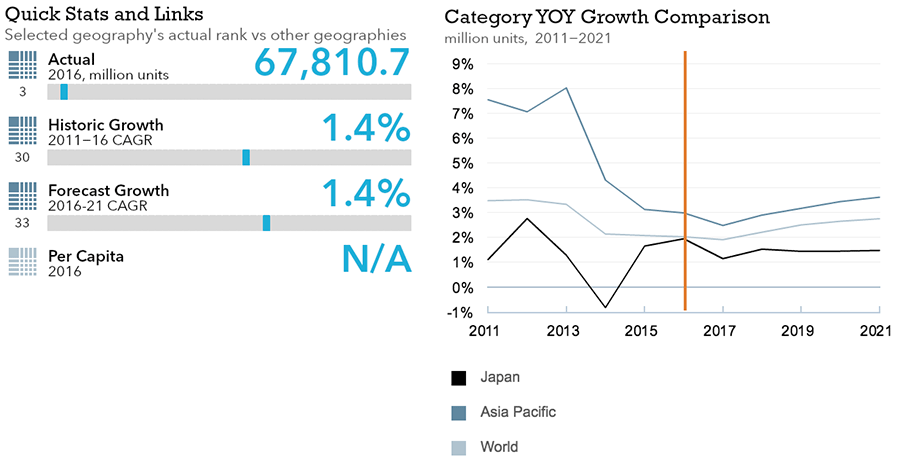

2016 Total Packaging Market Size (million units):

201,772

2011-16 Total Packaging Historic CAGR:

0.7%

2016-21 Total Packaging Forecast CAGR:

0.6%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 66,372 |

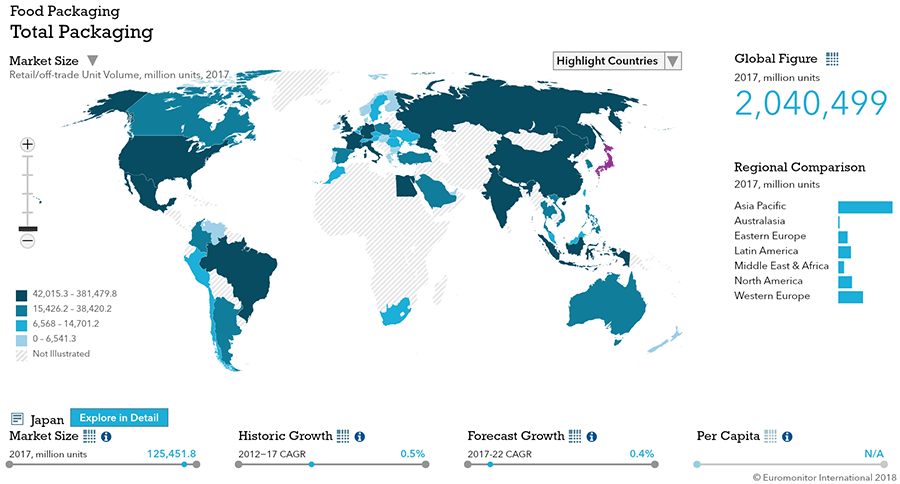

| Food Packaging | 124,871 |

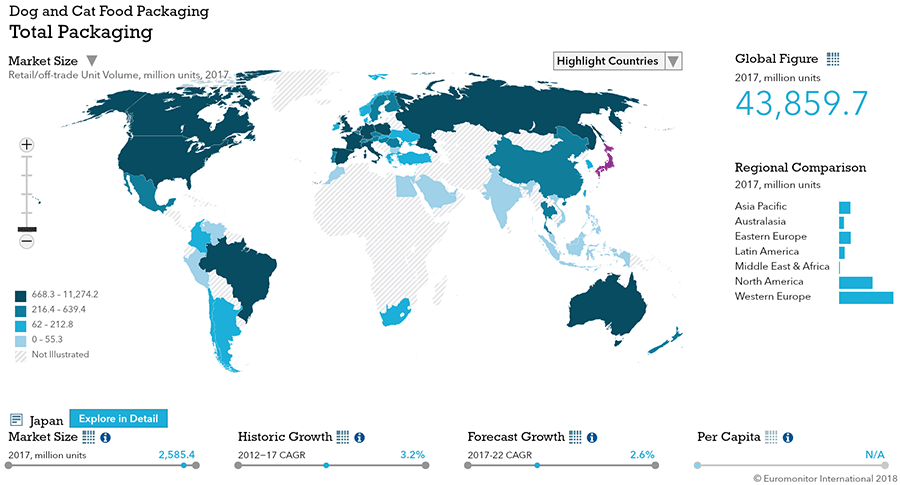

| Beauty and Personal Care Packaging | 4,982 |

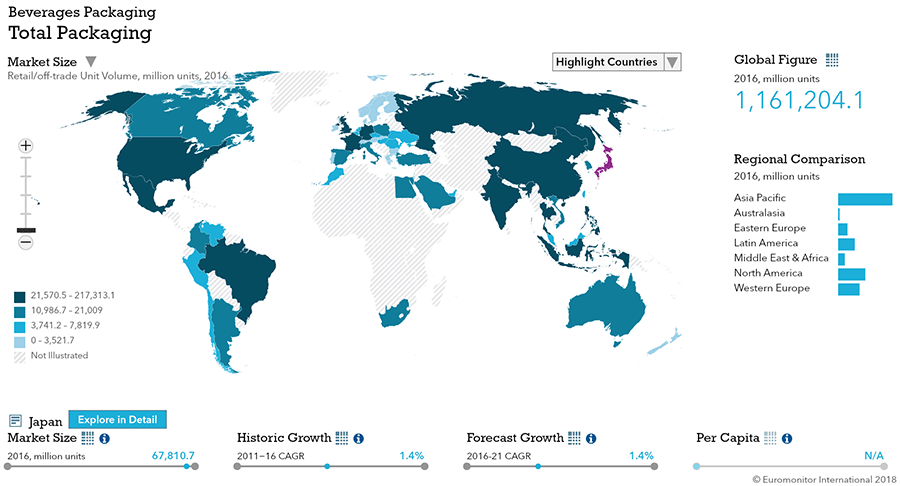

| Dog and Cat Food Packaging | 2,505 |

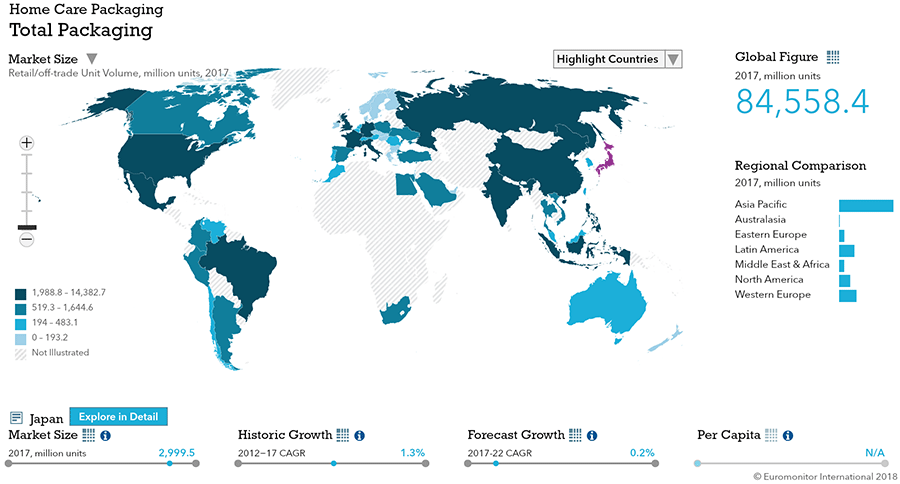

| Home Care Packaging | 3,043 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 54,666 |

| Flexible Packaging | 72,349 |

| Metal | 33,712 |

| Paper-based Containers | 19,707 |

| Glass | 10,129 |

| Liquid Cartons | 11,162 |

- The total Japanese packaging industry, sized at over 201 bn units in 2016, is expected to continue seeing cautious growth.

- Food and beverage packaging continues to dominate packaging, but a niche growth opportunity exists in cat food.

- Flexible packaging continues to lead in size, and rigid plastic ranks second.

Key Trends

- In home care, small pack sizes are benefiting from product formulations becoming increasingly concentrated, while bulk packs are seeing good growth due to the popularity of refill packs. These trends are being partly driven by environmental concerns, while refill packs also benefit from offering low unit prices and appeal to increasingly price-sensitive consumers.

- Consumers are increasingly seeking more ethical lifestyles in Japan, with this impacting consumer purchasing trends and nearly all aspects of life, including eating, housing and clothing. The ethical living impact is having a significant impact on beauty and personal care, with a good performance for natural and organic products. Consumer demand for more natural and environmentally friendly products is in turn proving a major driver for innovation in beauty and personal care packaging.

- Sustainable packaging is a strong trend in soft drinks, benefiting from a growing focus on environmental issues among Japanese consumers and rising concern over the impact of discarded soft drinks packaging. PET bottles are benefiting from this trend, not only due to being light in weight and recyclable but also from the widening use of recycled PET.

- Population ageing is impacting alcoholic drinks and packaging in a number of ways. Older consumers often cut back on their overall consumption of alcoholic drinks, which is impacting overall sales. They also often prefer drinking at home rather than socialising in the on-trade with colleagues or friends, with population ageing contributing to the strong cocooning trend seen during the review period.

Packaging Legislation

- Food with function claims: Food with Function Claims (FFC) is a new accreditation that came into force in April 2015. This accreditation covers food sold in Japan and making specific health claims, both processed and unprocessed, Packaged food was already seeing a good performance for Food for Specified Health Uses (FOSHU) products. However, obtaining FOSHU accreditation is time-consuming, difficult and expensive for manufacturers, as the process requires clinical trials to support health claims with scientific evidence.

- New food labelling standard: The new Food Labelling Standard came into force in April 2015, with this legislation aiming to make food labelling simpler and easier to understand. This law combines the former Food Sanitation Act, the Japanese Agricultural Standard Law and the Health Promotion Act. The new law regulates food sold in Japan by setting new standards for labelling. Prior to April 2015, food labelling was often very complicated as the three previous regulations were applied according to different food types, which contained different classifications for the same product.

Recycling and the Environment

- Complicated waste management system in Japan: Complicated waste management systems remain a challenge in Japan. While consumers are required to separate household waste, waste categories vary widely across different areas and can be complicated, being the responsibility of the local authorities. Even Tokyo's 23 wards feature different systems. Waste collection dates also vary for different waste categories, with some types collected weekly, some fortnightly, some monthly and some such as batteries being collected only once per year.

- Overall recycling rate stagnates: The most recent recycling rates available for MSW date from fiscal 2014. In this year, the ratio of recycled MSW reached 21%, with this being the same rate seen in fiscal 2013. In fiscal 2015, steel metal tins had the highest recycling rate of 93%, followed by aluminum metal tins at 90%. PET bottles also had a high recycling rate at 87% in the year, with this increasing by four percentage points from fiscal 2014. Glass packaging and liquid cartons recorded rates of 69% and 34% respectively in 2015. Returnable glass bottles are also increasing in popularity.

Packaging Design and Labelling

- Japan’s aging population drives growth of universal design: Japan has the world’s highest old-age dependency ratio, with this reaching almost 46% in 2016 and increasing rapidly from below 37% in 2011. The country's population will continue to be the oldest in the world in the forecast period. There is a growing focus on offering more accessible and easy- use packaging as a result, with the term universal design referring to designs that can be accessed and used by anybody regardless of age, size, ability or disability. Universal design has become a key concept for manufacturers and packagers in areas such as beauty and personal care, mostly due to the country’s large number of elderly consumers. As people age, it becomes more difficult to use certain types of packaging, including small closures, complicated designs and packaging or closures that require strength to use.

- Food packaging trends are expanding into beauty and personal care: With growing demand for more natural and fresher products, packaged food is seeing a rise for vacuum packaging. This includes plastic bottles that shut out air in order to avoid oxidisation. In 2016 this trend increasingly expanded into beauty and personal care. One innovative example was Japan Gateway’s shampoo and conditioner line Reveur Fraicheur. The range is positioned as "raw" to emphasise its natural nature and uses vacuum packaging for its plastic pouches with a lotion pump closure. This approach is proving popular among the growing number of Japanese consumers attracted by natural and organic products. Vacuum packs are likely to see more innovative launches over the forecast period.

Beverages

Flexible Packaging Landscape

- Total Japanese beverage packaging volume is expected to see slow 0.7% CAGR growth through 2021.

- Flexible beverage packaging is expected to continue declining through 2018 before becoming essentially stagnant in 2019-2021.

Trends

- In soft drinks, PET bottles were the leading packaging type in 2016 with 48% volume share, followed by metal beverage cans with 29% volume share.

- In hot drinks, flexible packaging dominated in 2016 with 66% volume share, due to its popularity as a cost-effective option for hot drinks.

- In alcoholic drinks, metal beverages cans dominate with 70% volume share in 2016.

- Alcoholic drinks pack sizes have been decreasing as manufacturers continue to launch smaller trial-size products and increasingly look to cater to aging consumers, who drink less than they did in years past.

Outlook

- In soft drinks, The PET bottle format is expected to remain the leading pack type in soft drinks, with its total unit volume share standing at 51% by the end of the forecast period, following a near 2% total unit volume CAGR, to reach 26.3 billion units in 2021.

- In hot drinks, flexible packaging is expected to continue to dominate off-trade unit volume sales of hot drinks over the forecast period, with a 64% share in 2021.

- In alcoholic drinks, packaging is expected to record a 1% CAGR over the forecast period. With Japan seeing demographic changes, smaller pack sizes are expected to become more prominent in usage, which will drive growth in the number of units of alcoholic drinks packaging over the forecast period. Alcoholic drinks manufacturers are likely to expand their selection of pack sizes to meet various consumer needs.

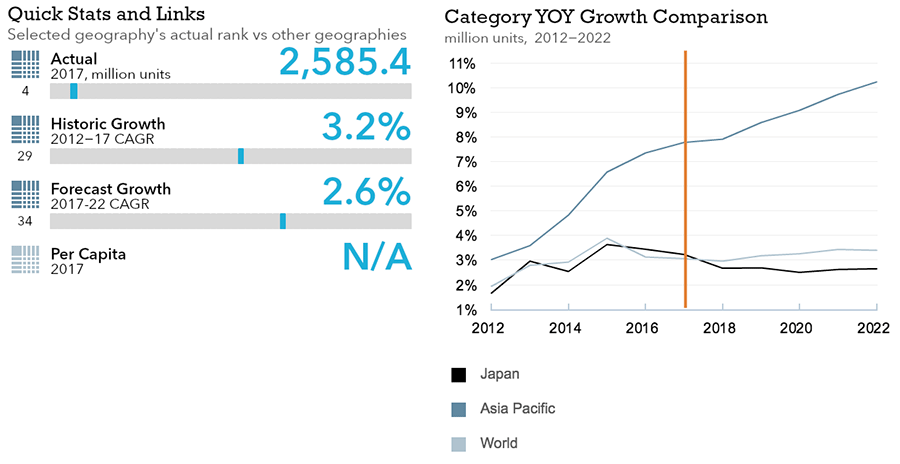

Dog and Cat Food

Flexible Packaging Landscape

- Total Japanese dog and cat food packaging volume is expected to see strong 2.6% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see even stronger 4.9% volume CAGR growth through 2022.

Trends

- Dog and cat food packaging in Japan saw positive growth in total volume sales of 3% in 2016 to reach 2.4 billion units due to the increasing popularity of cats in urban areas. While dog food continued to record negative growth of 1%, cat food continued to lead positive growth in dog and cat food packaging volume at 6%.

- Overall, pouches recorded the fastest growth in 2016 due to manufacturers’ shifting away from metal cans. In particular, plastic pouches for cat food recorded 24% volume growth in 2016.

Outlook

- Dog and cat food packaging is projected to continue growing strongly in coming years, driven by the increasing popularity of cats as pets, which will offset the decline in dog ownership.

- Plastic pouches is expected to see the fastest growth with a CAGR of 15% over the forecast period due to the shift from metal food cans and because wet cat food is expected to continue performing well. Metal food cans, meanwhile, is expected to see the worst growth of the forecast period with a CAGR of -7%. Flexible paper, which is most typically used for larger packs of dry dog food, is also set for a decline due to the declining number of large dogs.

Beauty and Personal Care

Flexible Packaging Landscape

- Total Japanese beauty and personal care packaging volume is expected to see - 0.6% CAGR decline through 2021.

- Flexible beauty and personal care packaging, however, is expected to remain essentially stagnant through 2021.

Trends

- Beauty and personal care packaging volume sales declined marginally in 2016 due to the declining Japanese population and the maturity of the beauty and personal care market in the country.

- Rising awareness of health and wellness and ethical consumerism influence packaging design in beauty and personal care, supporting growth in the use of recyclable packaging materials.

- 2016 sees packaging trends from packaged food moving into beauty and personal care due to the need to keep products fresher after being opened, driving innovation in other plastic bottles.

- The ageing of the Japanese population pushes manufacturers towards universal design packaging, including functional pack design and the use of large and tactile print and braille text on labels.

Outlook

- With the Japanese population in decline, total packaging volume is also set to continue registering negative growth, with a marginally negative CAGR expected.

- However, there is a wide range of opportunities for players in the beauty and personal care industry to target senior consumers, with packaging innovation expected to increasingly cater to this consumer group, especially by targeting those with certain physical limitations.

- Refill packs are expected to see a particularly strong performance in beauty and personal care packaging over the forecast period. This is set to be thanks mainly to the eco-friendly features of these products and their generally lower prices.

- The shift towards more attractive limited edition packs is also expected to be a strong trend in beauty and personal care during the forecast period, given the popularity of these product types among foreign tourists visiting Japan as well as among domestic consumers.

Home Care

Flexible Packaging Landscape

- Total Japanese home care packaging volume is expected to see slight 0.5% CAGR growth through 2021.

- Flexible home care packaging is expected to see much stronger 2.1% CAGR growth through 2021.

Trends

- Home care packaging recorded a marginal increase in 2016 in volume terms. The popularity of concentrated products in home care, especially in laundry care, as well as large-sized refills, resulted in slower growth compared to the home care value growth of 2%, according to Euromonitor International home care data.

- Consumers usually prefer small boxes/bottles for home care products, reflecting the limited space in many homes, but this is not necessarily the case when it comes to refills. In Japan, most liquid refills of such products including liquid detergents, liquid fabric softeners and hand-wash detergents are packaged in plastic pouches, which are durable but lightweight.

- Plastic pouches is one of the most popular options for refill packaging – not only for economical reasons, but also for environmental ones.

Outlook

- Home care packaging in Japan is expected to record a CAGR of 1% in retail unit volume terms, mainly due to the maturity of home care products in Japan.

- Plastic pouches are expected to remain popular for refill packs as sustainability becomes even more important to consumers and manufacturers.

- Automatic dishwashing tablets in folding cartons is expected to decline substantially over the forecast period due to the packaging shift to plastic pouches.

Packaged Food

Flexible Packaging Landscape

- Total Japanese packaged food packaging volume is expected to see limited 0.4% CAGR growth through 2022.

- Flexible packaged food packaging is expected to see slightly higher 0.8% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, flexible packaging remains a popular pack type in Japan with a 33% total retail unit volume share in 2016.

- In processed meat and seafood, flexible packaging continued to dominate with an 89% share of total retail unit volume in 2016. Most flexible packaging in processed meat and seafood packaging is flexible plastic, which was widely available across product types in chilled and frozen form.

- In processed fruit and vegetables, flexible packaging is the most popular packaging type in Japan with a 54% total retail unit volume share in 2016. The pack type posted 4% growth in 2016 due to the strong performance of frozen products.

- In confectionery, flexible packaging continued to dominate, with 78% of total retail unit volume in 2016.

- In dairy, rigid plastic remained most popular pack type with 49% of total retail unit volume in 2016, due to its frequent use for other dairy and yoghurt and sour milk products.

- In baby food, flexible plastic remained the most popular pack type in Japan, due to its high presence across baby food categories, and accounted for 29% of total retail unit volume in 2016. Flexible plastic was most commonly used in other baby food, especially baby snack products in Japan.

Outlook

- In sauces, growth is projected to be flat through 2021 as the population decline offsets increasing use of smaller pack sizes.

- In processed meat and seafood, flexible packaging is expected to continue to dominate over the forecast period and account for a total retail unit volume share of 89% in 2021. Thin wall plastic containers and stand-up pouches are expected to continue posting the strongest growth and register double-digit total retail unit volume CAGRs.

- In processed fruit and vegetables, flexible packaging is expected to remain the most popular pack type with a 54% total retail unit volume share in 2021. Stand-up pouches is expected to increase its presence over the forecast period due to the continuous transition from metal food cans.

- In confectionery, flexible packaging is expected to continue to dominate over the forecast period and account for 78% of total retail unit volume in 2021. Within flexible packaging, flexible paper is expected to post strong growth due to high popularity in chocolate confectionery, while stand-up pouches is also expected to increase in popularity for sugar confectionery.

- In dairy, rigid plastic is expected to remain the most popular pack type over the forecast period. PET bottles is expected to register the strongest total retail volume CAGR, driven by the increasing popularity of smaller sizes used for drinking yoghurt products.

- In baby food, thin wall plastic containers is expected to post the strongest growth in baby food packaging over the forecast period with a total retail unit volume CAGR of 4%, driven by the popularity of prepared baby food and healthy performance of newly launched prepared baby food products in thin wall plastic containers.