Overview

Packaging Overview

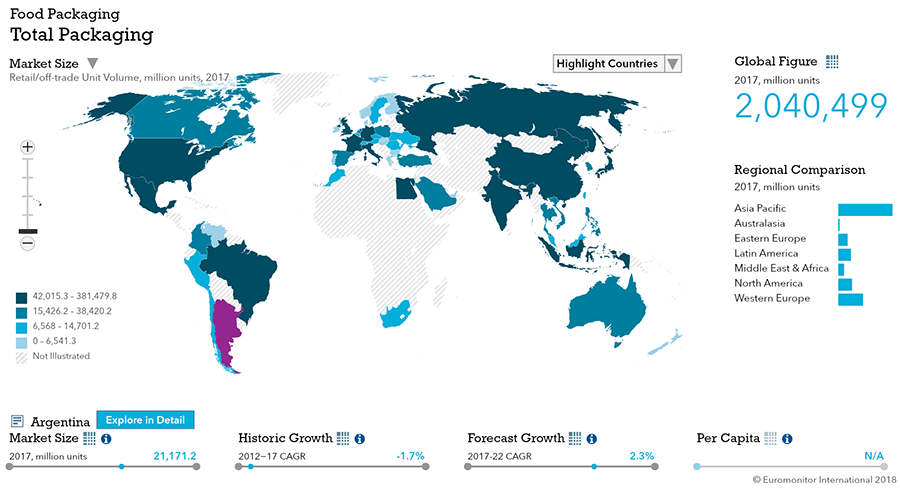

2016 Total Packaging Market Size (million units):

38,770

2011-16 Total Packaging Historic CAGR:

-0.5%

2016-21 Total Packaging Forecast CAGR:

2.1%

| 2016 Total Packaging Market Size (million units): | 38,770 |

|---|---|

| 2011-16 Total Packaging Historic CAGR | -0.5% |

| 2016-21 Total Packaging Forecast CAGR | 2.1% |

| Packaging Industry | 2016 Market Size (million units) |

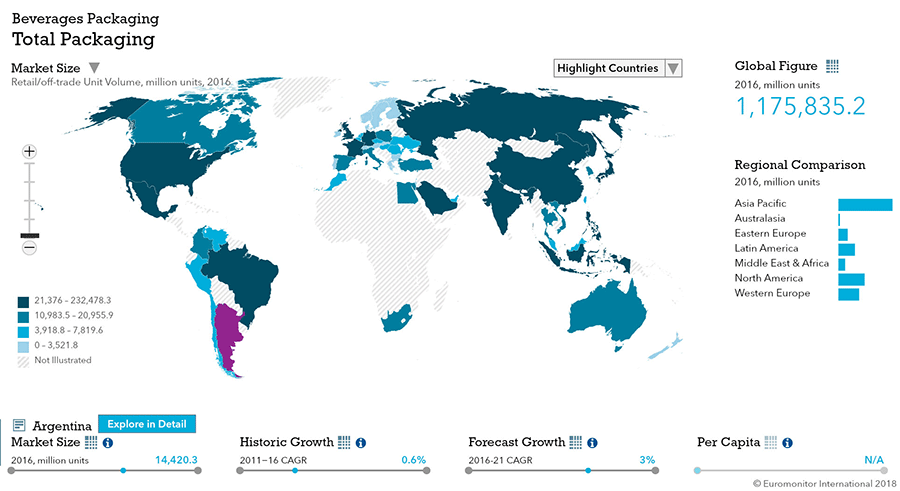

| Beverages Packaging | 14,420 |

| Food Packaging | 21,348 |

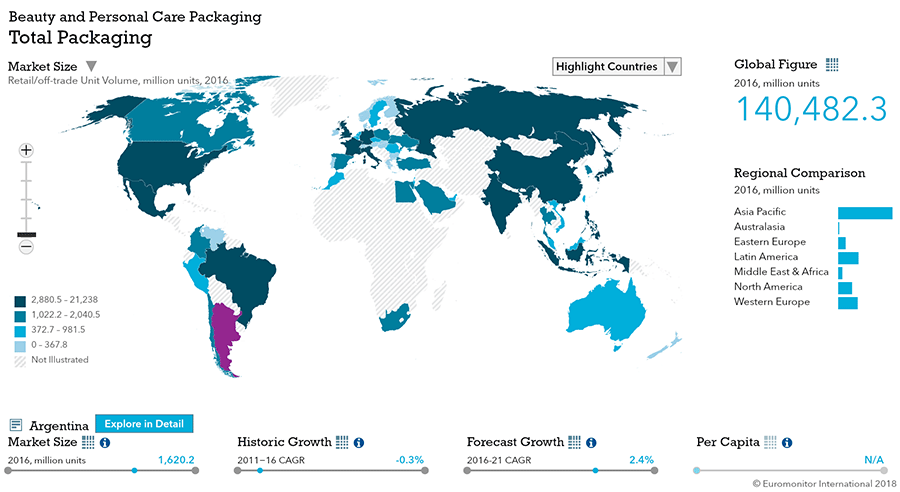

| Beauty and Personal Care Packaging | 1,620 |

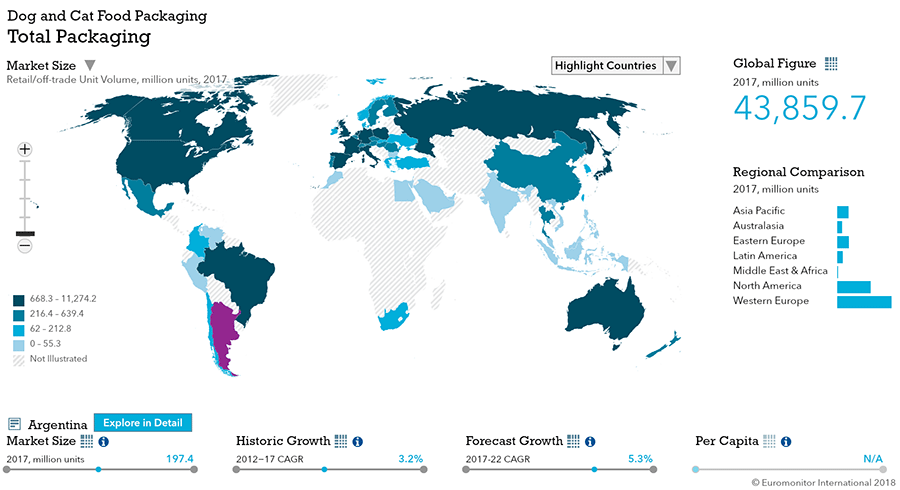

| Dog and Cat Food Packaging | 191 |

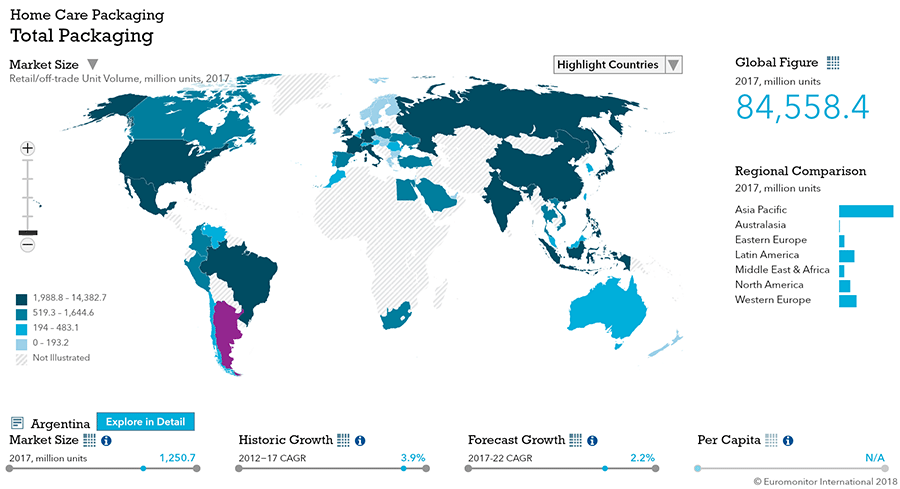

| Home Care Packaging | 1,191 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 10,610 |

| Flexible Packaging | 19,153 |

| Metal | 1,697 |

| Paper-based Containers | 1,962 |

| Glass | 3,249 |

| Liquid Cartons | 2,100 |

- Innovative and premium packaging diminished along spending in all consumption categories. As such, manufacturers encouraged consumers to trade down to returnable PET and glass bottles in the beverages industry, while larger pack sizes emerged in packaged food, driven by a lower price per kg/litre.

- To attract consumers with deteriorated income, companies launched plastic pouches with a price per kilogram/litre much lower than traditional packaging In beauty and personal care and home care, which afforded plastic pouches the most dynamic evolution in 2016.

Key Trends

- Together with sluggish demand and difficulties importing, the unfavorable economic situation meant that companies had little interest in investing in new packaging, and were more focused on keeping packaging costs as low as possible.

- Metal beverage cans in RTD and beer are a key growth area, but in Pet Foods, consumers are moving away from metal in favor of plastic pouches.

Economic Crisis

- The economic crisis will continue to affect the purchasing habits of consumers over the forecast period. Larger pack sizes are therefore likely to outperform individual pack sizes in unit volume growth terms, as their per litre unit prices are more economical.

- The economic crisis has led more consumers to purchase unpackaged dry dog and cat food in "forrajearías", which are part of the other grocery retailers channel according to Euromonitor International definitions. These retailers buy in the largest pack sizes available, then repackage product into smaller packs for sale to consumers. According to industry sources, this practice tends to increase during periods when purchasing power decreases sharply and pet owners try to save money by mixing or switching between various brands.

- The economic crisis boosts the sales of plastic pouches, which are used as a refill pack type, with volume growth of 3% in 2016

- Economic instability means fewer consumers spending in foodservice premises such as bars, restaurants, and discos, with foodservice unit volume declining by 6% in 2016.

- The economy is expected to reboot driven by pro-market ideological orientation, therefore inflation is expected to decrease in 2017.

Packaging Legislation

- Law number 27,279 regarding empty plant protection products was passed in 2016, requiring all empty containers used for herbicides and agrochemicals be disposed of safely.

- Provinces and municipalities increased the tax burden with in 2013 and 2014. One was Ecotasa, a tax paid by supermarkets that sell products with packaging that is non-returnable.

Recycling and the Environment

- Packaging that saves the planet: The majority of returnable PET plastic bottles will continue to be offered by Coca-Cola Argentina SA and Cervecería y Maltería Quilmes SAICAyG over the forecast period.

- Companies continue pushing for recycling: The use of environmentally-friendly packaging by will be increasingly important over the forecast period due to two key reasons. One, company image improves amongst consumers who are increasingly more aware of environmental issues.

- Consumers are showing increasing concern for the environment: companies will use packaging to communicate that they are care about the environment by using slogans like "70% less plastic" and the symbol of a hand with a thumb up to indicate the use of recyclable polyethylene, recyclable polypropylene and recyclable PVC.

Packaging Design and Labelling

- Product labelling must by law bear all the necessary information, and that this information is true and valid. Packaged products sold in Argentina contains description of product, country of origin, purity or blending description, and net weight.

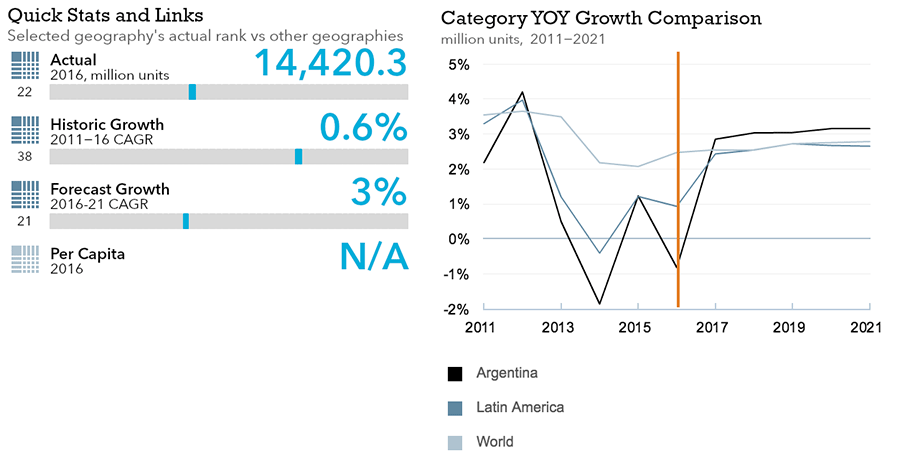

Beverages

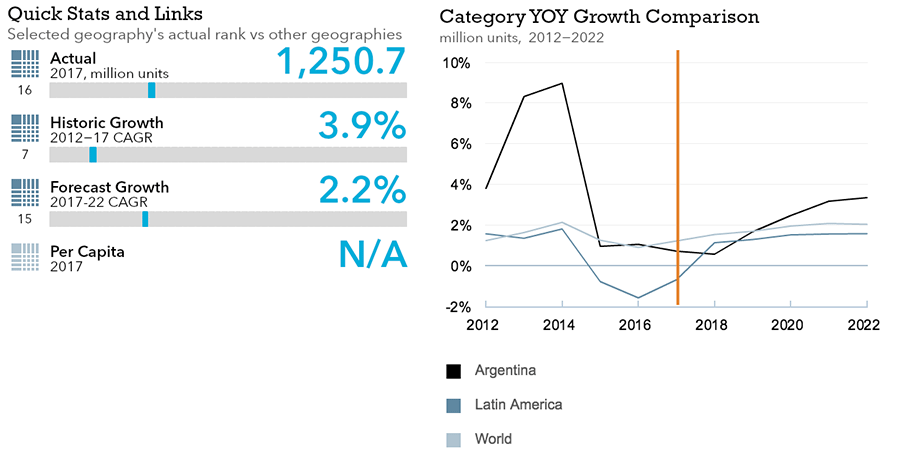

Flexible Packging Landscape

- Flexible Beverage packaging is forecast to double the historic CAGR of .9% to a whopping 2.2%

- Argentinian demand for Beverages flexible packaging is expected to outpace demand in Latin America and line up with worldwide demand by 2021.

Trends

- Alcoholic drinks packaging total volume sales decreases by 4% in 2016 to 3.5 billion units

- Metal beverage cans are becoming a key growth area, used in the packaging of beer and RTDs. The beverage can, as one-way packaging, enables brewers to stand out on the shelves of new retailing outlets; at the same time, the can also answers demand from Argentinian consumers for more single-serve pack sizes.

- In Argentina, medium- and high-quality wines are sold exclusively in glass bottles, while lower-quality wines are sold mainly in liquid cartons. Liquid cartons saw a deep retraction in 2016.

- Liquid cartons saw a stable performance in soft drinks packaging types, with total volume in 2016 reaching 571 million units.

- The saving of glass in the production of glass bottles is an increasingly strong trend in alcoholic drinks packaging in Argentina. This strong growth is due to more companies buying eco-friendly packaging to make significant cost savings in materials and logistics.

- In carbonates PET bottles gained ground in total packaging in the off-trade channel, increasing their retail share over the review period to reach 77% in 2016.

- Successful performance of metal beverage cans in RTDs and beer; RTDs in metal post a 71% rise in total unit volume sales in RTDs in 2016

- Liquid cartons post total unit volume growth of 16% in 100% juice in 2016.

- Following the boom in craft beer, domestic mid-priced and economy lager suffered as consumers demanded gourmet experiences. Thus, beer from domestic producers sold in metal kegs through multi-brand beer bars registered explosive growth.

Outlook

- A 4% total volume CAGR is expected in alcoholic drinks packaging over the forecast period to reach 4.3 billion units in 2021

- The use of metal beverage cans in alcoholic drinks will register upbeat growth. By 2021, total unit volume sales are projected to grow by an 11% CAGR to reach 506 million units.

- By 2020, it is predicted that 1-litre returnable glass bottles will account for almost three quarters of off-trade units sold.

- The outlook remains good for packaged water, with this product receiving a good lift from the continuous growth of home delivery other still water.

- Liquid cartons is expected to post a total unit volume CAGR of 3% in soft drinks packaging over the forecast period to reach 665 million units in 2021. The dynamism of liquid cartons is most visible in 100% juice, where it is projected to post a 10% total unit volume CAGR over the forecast period.

- Shaped liquid cartons, launched in 100% juice in 2014, are predicted to see an 18% total unit volume CAGR in this category over the forecast period. This projection is based on the pack type/size’s replacement of 1-litre brick liquid cartons and stronger competition to 3-litre HDPE bottles.

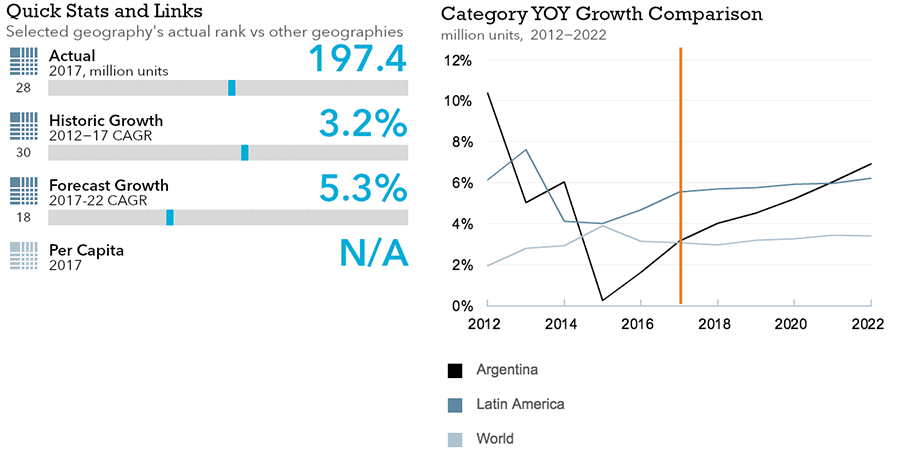

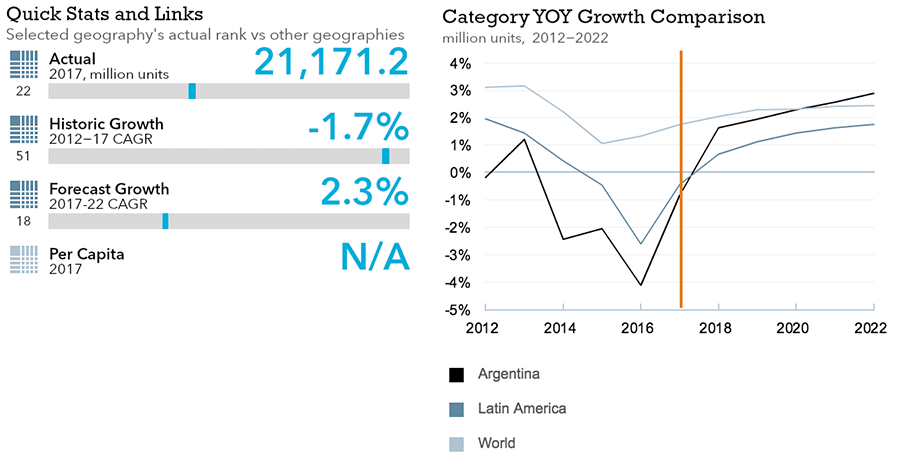

Dog and Cat Food

Flexible Packaging Landscape

- Total dog and cat food packaging volume sales grow by 3% in 2016 to reach 194 million units

- Total dog and cat food packaging volume sales are expected to grow at a CAGR of 6% over the forecast period to reach 255 million units in 2021

Trends

- Dry dog and cat food products, which together accounted for 82% of dog and cat food packaging unit volume sales in 2016, are exclusively marketed in flexible plastic packs, which holds an overall unit volume share of 86% thanks to low cost and practicality.

- Plastic pouches registered growth of 11% in 2016, with volume sales reaching 1.3 million units. The format continues to cannibalise demand for metal food cans.

- PET jars registered a strong performance in 2016, with unit volume sales growing by 9%. It should be noted that volume sales were emerging from a very low base

- Zip/press closures volume sales in dog and cat food packaging in Argentina stood at just over one million units in 2016. However, the presence of this closure type was confined to dog treats.

Outlook

- Total dog and cat food packaging volume sales are expected to increase at a CAGR of 6% over the forecast period. Volume growth will be driven by Argentina’s growing pet populations and rising awareness of nutritional benefits that packaged food provides over home-made food.

- New pack types and sizes in dog and cat food is predicted as economic conditions stabilize and companies start to import a wider variety of products. This will support the emergence of a wider assortment of packaging formats and pack sizes in dog and cat food.

- Limited space for storing pet food favors compact pack sizes over larger formats.

- Zip/press closures is expected to be the most dynamic closures category fueled by economic improvements and demand for added-value pack types that offer greater convenience.

- Plastic pouches are expected to gain prominence in dog treats as import restrictions end enables companies to start bringing a wider variety of products into Argentina. Plastic pouches volume sales are expected to grow at a CAGR of 16% over the forecast period to reach 2.6 million units in 2021.

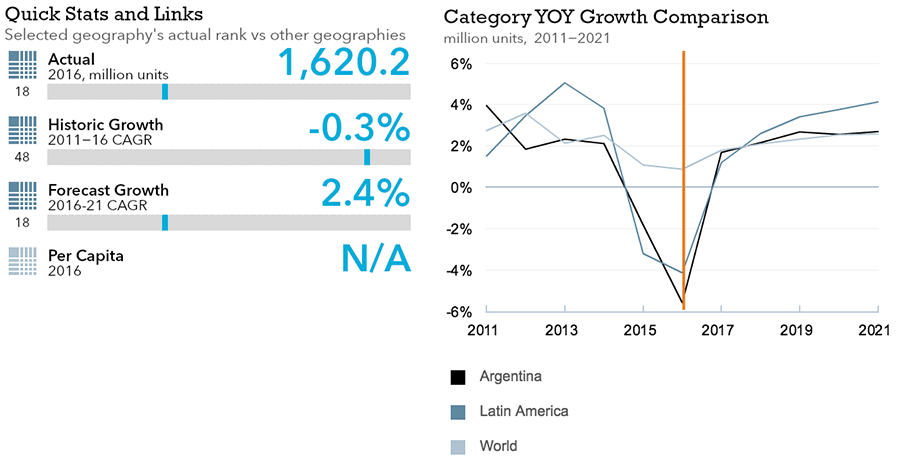

Beauty and Personal Care

Flexible Packaging Landscape

- In 2016, beauty and personal care packaging declines by 6% in volume terms to 1.7 billion units.

- Over the forecast period, beauty and personal care packaging is expected to increase at a CAGR of 2% in volume terms to reach 1.9 billion units in2021.

Trends

- Small glass bottles increase their presence in mass fragrances. Furthermore, glass bottles remains the leading packaging in mass fragrances while rigid plastic remains at only 5% of total units in 2016. Consumers perceive rigid plastic to represent poor quality products, so companies resist using it.

- Plastic dispensing closures is the most important closure in beauty and personal care in 2016.

- All closure types declined in 2016 due to lower volume sales.

- Folding cartons grew by 1% in volume terms over the review period. Folding cartons are commonly used as a secondary packaging to differentiate the better quality brands.

Outlook

- Over the forecast period it is expected that compressed metal aerosol cans – developed by Unilever Argentina SA – will start to gain more share replacing older packaging. This trend will promote increased consumption of deodorants in pack sizes of less than 100ml.

- Small pack sizes are a strategy used by companies to attract low-income consumers; glass bottles in mass fragrances boost this trend, which could expand into other categories such as skin care, benefiting plastic packaging like jars or squeezable plastic tubes.

- Sun protection is expected to register the best performance boosted by the increased awareness of the disadvantages of unprotected sun exposure and is expected to have a CAGR of 5% in unit volume terms predicted for the forecast period.

Home Care

Flexible Packaging Landscape

- Flexible packaging has an historic 5% CAGR, but is only forecast to grow at .7% CAGR by 2021

- Over the forecast period, home care packaging is expected to increase at a volume CAGR of 2% to reach 1.3 billion units in 2021

Trends

- Zip/press closures started to appear in home care packaging in Argentina in 2016. This gives the consumer the possibility of not needing rigid plastic since plastic pouches can be opened and closed thereby maintaining the quality of the product and avoiding spills.

- Options in refill pack types have boosted sales of plastic pouches, which saw 3% growth to reach 173 million units in 2016. Plastic pouches are used as an economical alternative with an attractive price per litre or kilogram compared to traditional packaging.

- Other rigid containers in liquid tablet detergents, available in packages of 20 and 57 units, saw a sharp fall of 20% in unit volume terms in 2016. The high price in relation to other options and the inability to use a dosage lower than the recommended amount has limited the sales of other rigid containers in liquid tablet detergents and folding cartons in floor cleaners.

- In mid-2016 SC Johnson & Son introduced the most innovative launch when presenting its brand Glade in a metal tin in gel air fresheners. This metal tin has a closure that allows the consumer to control the intensity of the fragrance, unlike the other pack types available in gel air fresheners. In addition to being an innovative packaging, it is also the most economical option in gel air fresheners.

- Aerosol sprays saw the largest increase within closures in 2016. This is explained exclusively by the strong demand for home insecticides stemming from the need to combat mosquitoes transmitting Dengue and Zika.

Outlook

- Packaging will continue to be key to attracting consumers over the forecast period. Although a recovery in the economy and an improvement in real income is expected, a greater variety of refill options is expected that will be of benefit mainly to plastic pouches.

- Over the forecast period the increased demand for liquid detergents at the expense of powder detergents will have a significant impact on home care packaging in Argentina. Flexible plastic, which is used in powder detergents, will therefore likely be the worst performing pack type in the forecast period. In contrast, the stronger preference for liquid detergents will likely boost demand for HDPE bottles and PET bottles as well as plastic pouches as an economical alternative.

- Argentines will continue to replace traditional hand dishwashing products with concentrated hand dishwashing products over the forecast period. This trend will favour PET bottles exclusively since it is the main pack type used in concentrated hand dishwashing. HDPE bottles and other plastic bottles will likely decline as they are used by traditional hand dishwashing brands.

Packaged Food

Flexible Packaging Landscape

- In 2016 total dairy packaging sales decrease by 1% in retail volume.

- Falling demand for drinking yoghurt sees HDPE bottles decline by 8% in retail unit volume terms in 2016.

Trends

- In 2015, for the first time since 2008, there is a pack size of over one litre in milk in Argentina. RPB launched shelf stable milk in 1.5-litre brick liquid cartons with liquid carton closures.

- High inflation led consumers to acquire milk in brick liquid cartons. They stocked up on milk in brick liquid cartons at the expense of flexible plastic, which, despite being a more economical option, has very fast expiration. As a result, brick liquid cartons increased considerably, accounting for a 50% share of total units sold in milk in 2016, followed by flexible plastic with 48% and HDPE bottles with 2%.

- 125g thin wall plastic containers made a strong entrance in fruited yogurt in 2015, accounting for a 16% share of sold units of fruited yogurt in 2016.

- Glass jars registered the worst performance in dairy packaging with a 12% decrease in retail unit volume sales in 2016. This pack type is used mainly for spoonable yogurt, which is dominated by thin wall plastic containers.

- Multipacks in dairy packaging could not reverse a downward sales trend, registering a drop of 7% in retail unit volume terms to reach 404 million units in 2016. This decrease was mainly due to the lower consumption of flavored yoghurt and probiotic drinking yogurt.

Outlook

- Following RPB’s launch of 1.5-litre brick liquid cartons in shelf stable milk, many companies are interested in adopting pack types of more than one litre in drinking milk products. The intention is to offer consumers a cheaper alternative in per litre terms. Consequently, in the short term, new pack types and sizes are anticipated in drinking yoghurt, fresh milk and shelf stable milk.

- Flexible plastic is expected to lose further ground in milk and drinking yoghurt to liquid cartons over the forecast period. With the recovery of the national economy and, therefore, consumer purchasing power, liquid cartons isperceived to offer advantages in terms of practicality and closures.

- Shaped liquid cartons is expected to post the fastest retail volume CAGR of 12% over the forecast period to reach 85 million units in 2021. This growth will be driven by two product types. Firstly, drinking yogurt, and secondly, soy drinks.

- Over the forecast period, liquid carton closures offers strong growth potential due to its recent adoption by leading brands.

- Tetra Pak is expected to remain the sole supplier of liquid cartons in dairy in the medium term in Argentina.