Overview

Packaging Overview

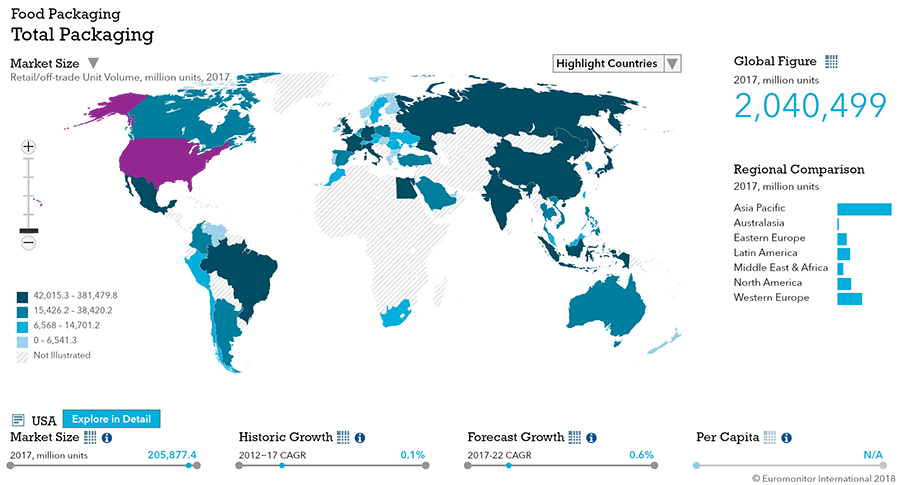

2016 Total Packaging Market Size (million units):

446,058.7

2011-16 Total Packaging Historic CAGR:

0.9%

2016-21 Total Packaging Forecast CAGR:

0.8%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 209,609 |

| Food Packaging | 202,608 |

| Beauty and Personal Care Packaging | 14,638 |

| Dog and Cat Food Packaging | 11,013 |

| Home Care Packaging | 8,191 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 148,793 |

| Flexible Packaging | 118,930 |

| Metal | 107,164 |

| Paper-based Containers | 37,722 |

| Glass | 27,908 |

| Liquid Cartons | 5,542 |

The total US packaging industry, sized at over 446 bn units in 2016, is expected to continue seeing cautious growth.

Food and beverage packaging continues to dominate packaging, but niche growth opportunities exist in both beauty and personal care as well as home care.

Rigid plastic continues to lead in size and growth rate, but flexible packaging ranks second in size and forecast absolute volume growth.

Key Trends

- Plastic pouches are making rapid gains in home care packaging, driven by savings in shipping costs, consumer familiarity with the format, convenient closure designs, and an overall industry shift toward higher concentration, unit-dose products.

- Smaller packaging sizes continue seeing success across beauty and personal care, driven by their ability to broaden access to premium brands, increase product experimentation, provide greater convenience, and reduce waste.

- Metal beverage cans are seeing widespread acceptance in alcoholic drinks due to their superior light protection, better recyclability, and greater transportation efficiency when compared with glass; even wine and spirits have picked up interest in metal.

Packaging Legislation

- Ingredients safety keeps regulators working: In 2016, the Independent Cosmetic Manufacturers and Distributors (ICMAD) pressured lawmakers to pass legislation that would create uniform safety standards for cosmetics, and aims to modernize FDA regulations and create a national standard that ensures consumer safety.

- New legislation gives federal agency expanded powers: New legislation requires the US Environmental Protection Agency (EPA) to confirm the safety of any new chemical before it can be brought to market. The law will likely have its most far-reaching impact on the chemical content of home care products, but could also affect the chemical content of packaging, especially packaging formats that incorporate plastic.

- Laundry pod manufacturers attempt to self-regulate: The federal Consumer Product Safety Commission and representatives of the home care industry worked together to craft the first safety standards for laundry pod packaging. The new (voluntary) standards call for laundry pod containers to be opaque so children cannot see the pods inside, and for closures to be more difficult for children to open.

Recycling and the Environment

- Packaging that saves the planet: Consumers are increasingly aware of their products’ environmental impact. Beauty companies and packaging producers are hence offering greener packaging like compressed deodorants, recycled plastics, refill pouches, and lighter packaging.

- Companies continue pushing for recycling: As greener trends get into the industry, big cosmetic and personal care companies continue incentivizing recycling among their customers. For example, the TerraCycle and Garnier partnership created a free recycling program for hair care, skin care, and cosmetic product packaging.

- Efforts to reduce transportation of water in home care products continue: Many home care manufacturers have made a concerted effort to reduce the water content in products by offering more concentrated versions. Reducing water content helps to decrease product weight, hence reducing shipping costs and greenhouse gasses emitted during shipping.

Packaging Design and Labelling

- Empowered consumers seek personalized products: Consumers seek to express their individuality through personalized products, and digitalization allows them to create custom packaging, from pack/label color to custom messages.

- “Less is more” dominates new product launches: New product launches show a simplification trend in packaging design and labelling: One color, simple messages, and clear description of the product is dominating the beauty and personal care sphere.

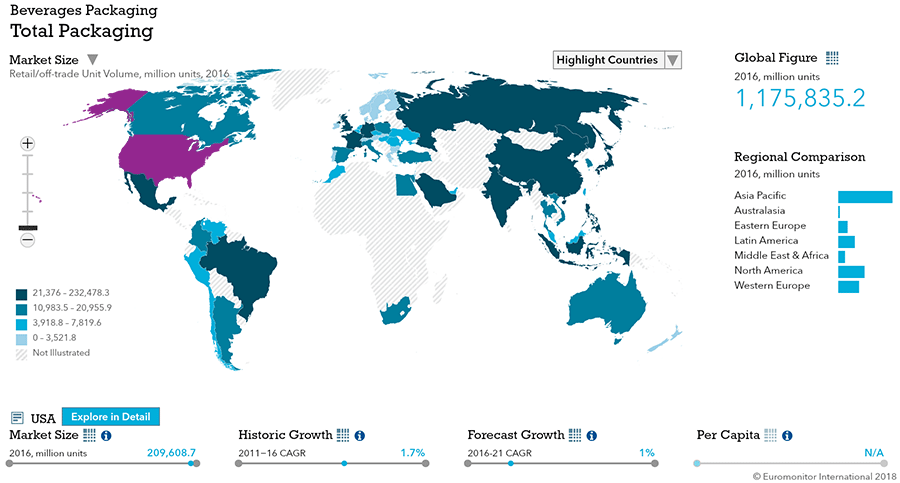

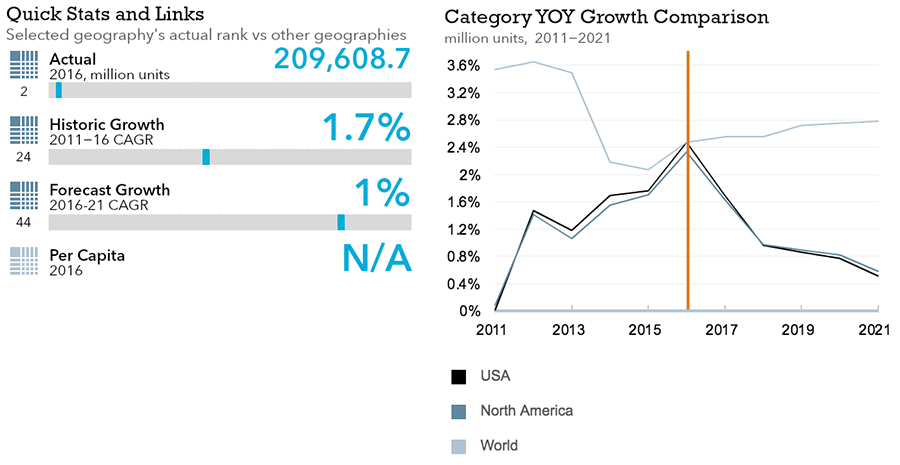

Beverages

Flexible Packaging Landscape

- Total US beverage packaging volume is second highest in the world and expected to see slow but steady 1.0% CAGR growth through 2021.

- Flexible beverage packaging is expected to see limited volume growth through 2018, then accelerate from 2018-21.

Trends

- In soft drinks, shaped liquid cartons were once again the fastest-growing pack type in unit volume, growing by 15% in 2016. The recent trend toward smaller pack sizes is also seen in bottled water, where ≥355ml grew at 6% CAGR while sub-355ml grew at 10% CAGR.

- In hot drinks, folding carton containers represented 100% of primary packaging while thin wall plastic containers accounted for 88% of secondary packaging unit volume for fresh ground coffee pods in 2016, largely due to Keurig’s dominance.

- In alcoholic drinks, glass bottles extended its decades-long volume share decline while metal cans rose to become the dominant pack type, from 53% of total unit volume in 2007 to 61% in 2016. The association of glass with premium is fading, and manufacturers are drawn to metal cans for improved beer preservation, lower distribution costs, and greater sustainability.

- Wine’s immense demand for portable packaging formats lead to more shaped liquid cartons and metal beverage cans, which increased in total unit volume by 16% and 6%, respectively, in 2016.

Outlook

- In soft drinks, glass bottles expect to regain lost ground and record 4% CAGR through 2021 as premium waters and craft carbonates look to visibly demonstrate added value.

- Cold brew coffee is expected to assist RTD coffee in achieving a 7% forecast period CAGR. However, there is no clear, long-term pack type leader, so opportunity exists for one pack type to represent the beverage much like shaped liquid cartons did with coconut waters.

- In hot drinks, packaging movements are likely to be heavily dependent on the growth slowdown in fresh ground coffee pods. Meanwhile, the adoption of sustainable coffee and tea pods is certain to occur over the forecast period due to sharp consumer attention on the matter.

- In alcoholic drinks, poor performance by glass bottles (forecast -1% CAGR) will continue to be driven by beer, which is expected to shift away from glass toward metal cans.

- Wine will continue to drive growth in shaped liquid cartons and metal packaging, which are expected to grow at 8% and 12% CAGR respectively, albeit from a small base; these pack types combined for just 2% of total wine unit packaging in 2016.

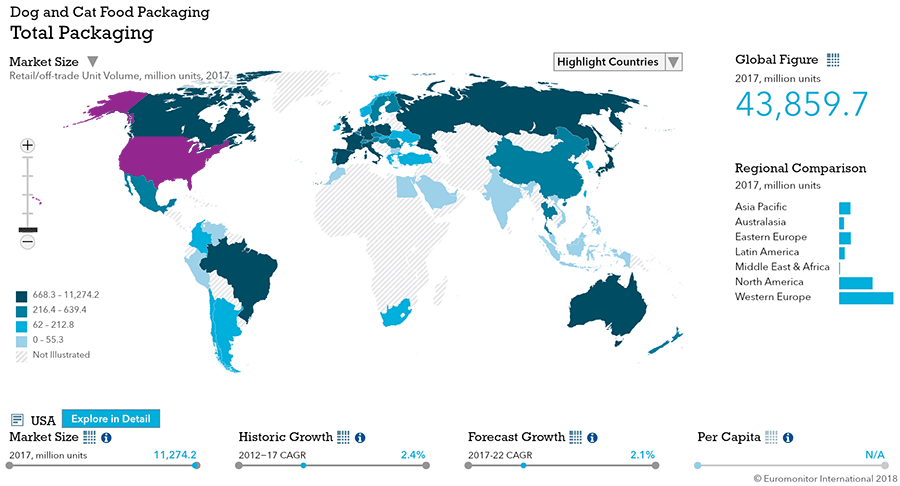

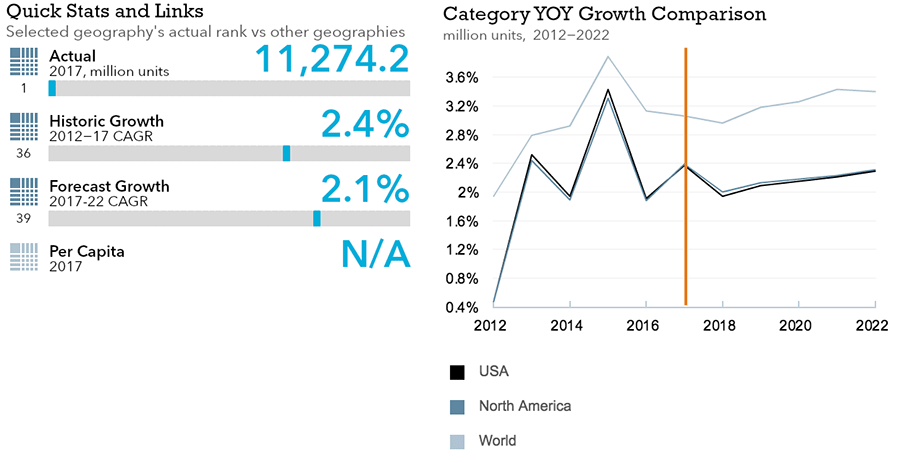

Dog and Cat Food

Flexible Packaging Landscape

- Total US dog and cat food packaging volume is the highest in the world and expected to see strong 2.1% CAGR growth through 2021.

- Flexible dog and cat food packaging is expected to see even stronger 3.1% volume CAGR growth through 2021.

Trends

- Despite weak pet population trends, unit volume sales increased by 2% in 2017, driven by strong consumer demand for wet food. This was driven by smaller dog breeds, as owners are more likely to feed much more expensive wet food to a small dog that eats less. For cats, wet food holds a premium image that is difficult for dry food to replicate. Within wet food, consumers continue to favor premium brands in thin wall plastic packaging.

- Stand-up pouches continued to gain share with 6% volume growth in 2017. Most of this came from treats, which comprised 62% of unit volumes in stand-up pouches in 2017. Cat treats emerged as a star performer in 2017, with stand-up pouch unit volumes jumping by nearly 11%, while new category entrants have also fueled growth.

Outlook

- Packaging volume is expected to grow by 11% though 2021, driven by wet food and treats. Unit volume growth in dry food is projected to remain flat, but wet dog and cat food is forecast to grow by 7% and 12%, respectively, through 2022. Treats are projected to see strongest growth, with unit volumes growing at 3% CAGR for dog treats and 9% CAGR for cat treats through 2022.

- As consumers trade-up to premium brands, average pack sizes are also expected to shrink. In wet dog food and dog treats, the smallest 1.8-4 oz size band is expected to see unit volume CAGRs of 4% and 6%, respectively, compared to 1% and 3% for their total respective categories.

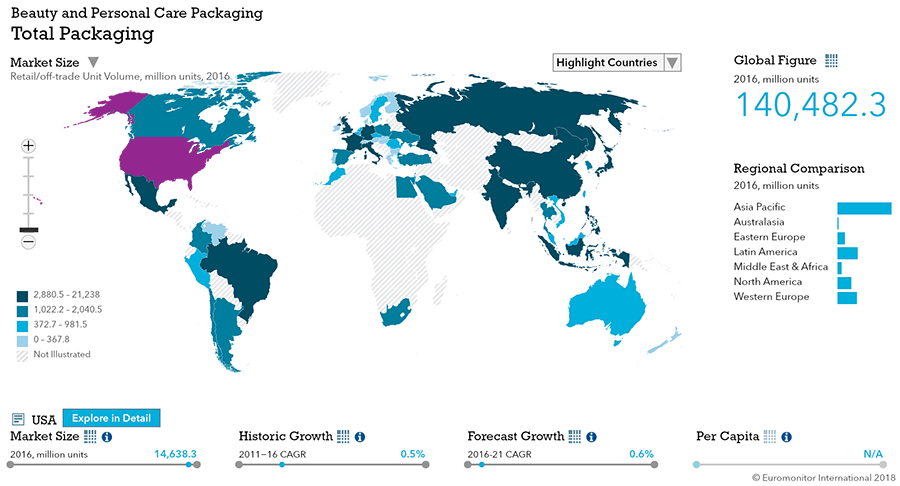

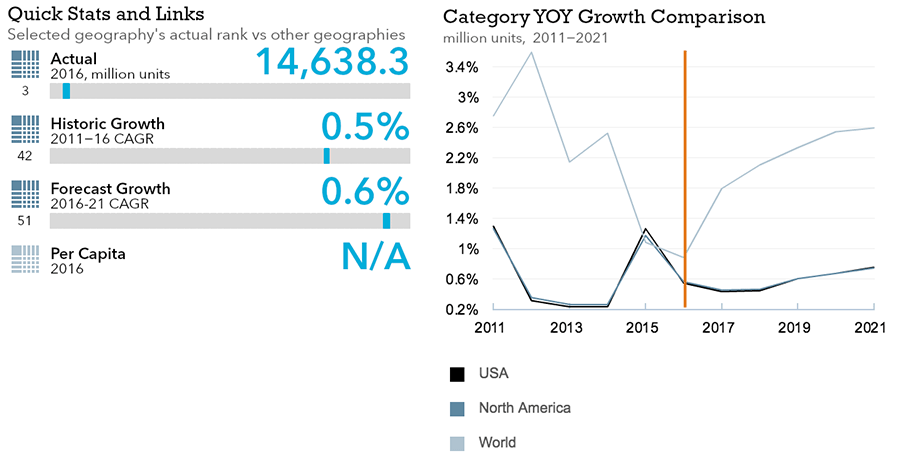

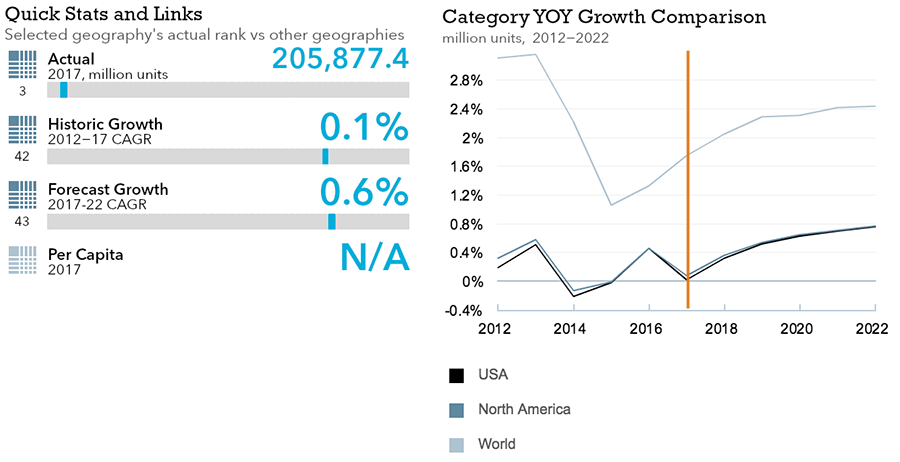

Beauty and Personal Care

Flexible Packaging Landscape

- Total US beauty and personal care packaging volume is the second highest in the world and expected to see limited 0.6% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see continued decline through 2021.

Trends

- 0-50 ml/gr formats showed 5% growth to reach 589 mn units in 2016, making it one of the fastest growing formats. Growth in smaller formats was driven by portability and convenience, and because they allow consumers to try premium brands and experiment with new products.

- Driven by convenience-first lifestyles, smaller packages focus on allowing consumers to open with just one hand. Plastic screw closures continued falling with -2% growth and -2% CAGR, while aerosol sprays grew by 5% in 2016 (7% in skin care and 9% in deodorants).

- Squeezable plastic tubes saw 1% growth in 2016, with 5% growth in color cosmetics and 3% growth in men’s grooming but falls of 2% in bath and shower as well as baby care products.

Outlook

- Smaller formats will keep growing as fast paced lifestyles continue pushing convenience and generating demand for new products as consumers seek to diversify their consumption.

- Zip/press closures is still small in comparison to others, but should continue growing in the near future as they offer easy-to-use and easy-to-carry features. Suppliers are seeing an increase in demand for double-ended packages and packages that offer easy on-the-go application.

- Environment and sustainability will continue influencing beauty packaging. Euromonitor’s 2016 Beauty Survey showed that green features are secondary only to efficacy, suitability, and a quality-price balance in consumers’ decision-making for beauty products, and are more important in purchasing deliberations than low prices and strong brand names.

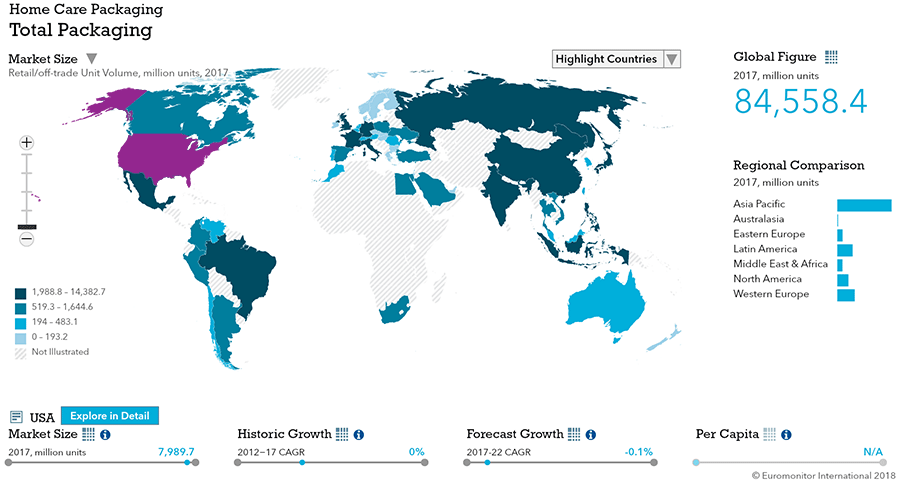

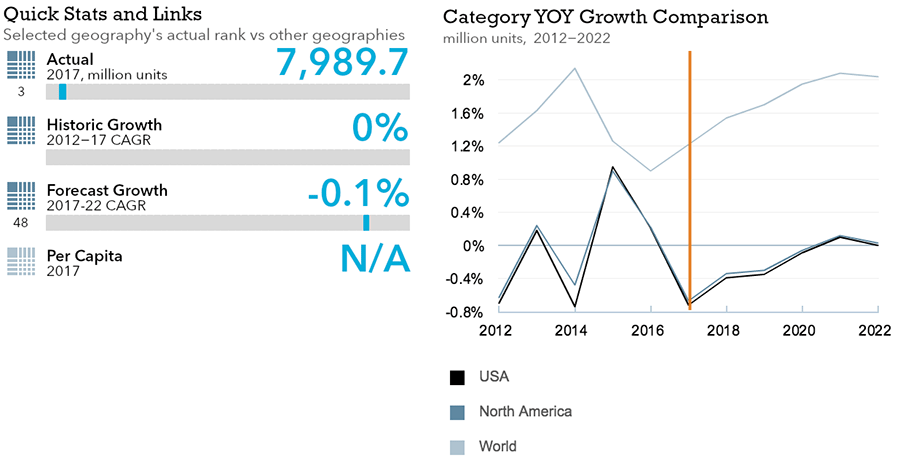

Home Care

Flexible Packaging Landscape

- Total US home care packaging volume is the third highest in the world but expected to see slight -0.1% CAGR decline through 2021.

- Flexible home care packaging is expected to see stronger 1.7% CAGR growth through 2021.

Trends

- Design and performance played major roles boosting sales through brand differentiation and value delivery: Package benefits such as ease of use, low cost, and easy storage remained top consumer priorities in 2016. Easy dispensing and safe use were other key drivers.

- Flexible plastic pouches saw increased penetration in home care as manufacturers moved into concentrated formulas such as dishwashing tablets and laundry care pods. The format is popular because it is relatively lightweight and easy to ship flat, it can offer conveniently resealable zip/press closures, and customers are familiar with it from other categories.

- Plastic screw closures continued to account for the bulk of home care packaging closures in 2016. Laundry care, surface care, and bleach were key contributors to positive performance.

- Lotion pumps and zip/press closures proved to be the most dynamic closures for home care. Lotion pumps benefited from rising demand for precise dosage and dispensing convenience, and zip/press closures from the value and light weight offered by flexible plastic.

Outlook

- Consumers increasingly seek products with added functionality that suit busy lifestyles, whether through pack size or closure type. Packaging that is fun to use (i.e. automatic triggers), comes in bright colors, and allows quick stain removal (i.e. stain-removing pens) is on the radar.

- Products that can be left out and add to the décor is trending. As living spaces shrink, storage space is diminishing and visually appealing packaging not easily recognizable as cleaning products will benefit. Similarly, packaging that is easily stored in tight spaces stand to benefit.

- As consumers become more accustomed to seeing plastic pouches in home care, acceptance of liquid home care products in plastic pouches is expected to rise accordingly. Hence, more home care brands will likely to begin experimenting with plastic pouches over the next few years.

- As more home care products are manufactured in higher concentrations or in solid form, the migration of packaging from HDPE bottles to plastic pouches will continue. HDPE bottles were by far the most popular home care packaging format in the US in 2016, but year-over-year unit volume sales growth was flat whereas plastic pouches grew by double digits.

Packaged Food

Flexible Packaging Landscape

- Total US packaged food packaging volume is the second highest in the world and expected to see limited 0.7% CAGR growth through 2021.

- Flexible packaged food packaging is expected to remain largely stagnant with 0.8% CAGR growth through 2021.

Trends

- In sauces, dressings and condiments, the premiumization trend continues to benefit brick liquid cartons for liquid stocks and foods as they communicate freshness and natural ingredients. Stand-up pouches saw the second most dynamic growth in 2016 due to the convenience trend, and has seen experimentation by Kraft Heinz with portable 3.2 oz pouches.

- In processed meat and seafood, 1% total packaging volume growth is attributed to growth in flexible packaging, which accounted for 59% of total volume share. Within flexible packaging, blister and strip packs was the star with 5% total volume growth in 2016 and 22% of total flexible packaging volume share. This growth is linked to the ongoing snacking trend, with 12 g and 156 g on-the-go formats each reporting dynamic total volume growth of 9% ion 2016.

- In processed fruit and vegetables, negligible total volume growth came mainly from flexible packaging, which accounted for 26% of total packaging volume sales. Within flexible packaging, stand-up pouches saw dynamic total volume growth of 7% in 2016 while flexible plastic declined by 1%. In frozen processed fruit and vegetables, flexible plastic bags and pouches with zipper closures are growing: 454 g, 340 g, and 283 g pack types accounted for 44% of volume sales.

- In confectionery, strong total volume growth of 13% in stand-up plastic pouches favored re-sealable upright pouches, which stand out on retail shelves and help consumers with portion control and calorie counting. In line with the popularity of sharing packs, other rigid containers saw 10% total volume growth.

- In dairy, static performance resulted from decline in yogurt, and hence in rigid plastic. However, aluminum/plastic pouches saw total volume growth of 43% in 2016 due to demand for on-the-go drinking yogurts from Dannon and Chobani. Cheese is a robust category and saw 2% volume growth in 2016. This favored sales of flexible plastic, which saw 3% volume growth and accounted for 58% of total cheese packaging volume.

- In baby food, growth mainly stemmed from thin wall plastic containers and stand-up pouches, which accounted for a combined 78% of total prepared baby food packaging volume share in 2016 (vs. 17% for glass jars).

Outlook

- In sauces, growth will mainly come from rigid plastic and glass, which will combine for 75% of total packaging unit sales in 2021. Thin wall plastic containers is expected to grow at 4% CAGR through 2021, while brick liquid cartons are expected to see strongest total volume CAGR of 6% as it continues to take sales from metal packaging.

- In processed meat and seafood, total volume CAGR is expected to be 1% through 2021, led by blister and strip packs with projected 4% CAGR. Stand-up pouches is set to see total volume CAGR of 3%, with the majority of sales accounted for by shelf stable seafood, while metal packaging is set to continue declining with negative total volume CAGR of 1% through 2021.

- In processed fruit and vegetables, a continued shift to stand-up pouches is expected to drive increasing volume share. In contrast, metal cans, rigid plastic, and glass are expected to see negative total volume CAGRs of 1%, 4%, and 1%, respectively.

- In confectionery, re-sealable stand-up plastic pouches are expected to continue gaining favor by encouraging sharing and keeping unused portions fresher than conventional flexible packaging.

- In dairy, shaped liquid cartons are expected to see strongest total volume CAGR of 12% through 2021, followed by plastic/aluminum pouches with 10% CAGR.

- In baby food, forecast 1% CAGR through 2021 is expected to come from continuous growth of stand-up pouches and thin wall plastic containers, which will combine for 63% of total volume sales in 2021 (up from 58% in 2016).