Overview

Packaging Overview

2016 Total Packaging Market Size (million units):

139,143

2011-16 Total Packaging Historic CAGR:

6.9%

2016-21 Total Packaging Forecast CAGR:

5.4%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 60,409 |

| Food Packaging | 63,628 |

| Beauty and Personal Care Packaging | 9,893 |

| Dog and Cat Food Packaging | 31 |

| Home Care Packaging | 5,182 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 38,637 |

| Flexible Packaging | 82,460 |

| Metal | 3,640 |

| Paper-based Containers | 6,670 |

| Glass | 3,218 |

| Liquid Cartons | 3,994 |

- The total Indonesian packaging industry, sized at over139 bn units in 2016, experienced robust growth of 6.9% during the forecast period.

- Moving forward, growth is predicted to slow slightly to a 5.4% CAGR by 2021.

- Food and beverage packaging are the clear leaders of the Indonesian market.

Key Trends

- Packaging design gains importance to attract consumers. Beauty and personal care and home care product players became more competitive over the review period and tapped packaging design to appeal to consumers and drive sales.

- Convenience stores drive sales for small pack size food as llimited shelf space means offer a wider variety of products displayed at once. Indonesian’s busy lifestyles leave little time for supermarkets or time to prepare a meal from scratch. That means fewer large pack sizes.

Packaging Legislation

- Mandatory Product Labelling New legislation mandates use of Bahasa Indonesia for all labelling to eliminate language barriers. The regulation will give domestic brands a short-term competitive edge as international players adjust. However, long term, the requirements will likely help imported brands engage and communicate better with local consumers.

- Tax on drinks packaging Implemented to reduce plastic bottle waste, this tax is believed by many to lead to higher prices and slower volume growth of drinks.

Recycling and the Environment

- Legislation on Waste Management Waste Manufacturers must use green packaging for products and to collect and recycle their own waste if the packaging materials cannot decompose. The government has granted a grace period until 2022 for companies to comply.

- Recycling Codes on Plastic-based Foods and Drinks In 2010, the Ministry of Industry issued legislation governing the display of food grade logos and recycling codes on plastic-based foods and drinks packaging

- More effort to raise awareness on reducing waste In February 2016, the government imposed a national tax on plastic bags aimed to reduce the volume of carrier bags. While still a trial, the attempt represents a first step towards raising environmental awareness and reducing waste.

Packaging Design and Labelling

- Attractive packaging played an important role as newly launched beauty and personal care players differentiated themselves to consumers.

- More soft drinks in PET bottles offer ergonomic design for easier handling. Many of the subtle or significant packaging designs are aimed to provide consumers with more convenience.

- Usage of more characters on packaging labels such as Disney Princess and Star Wars characters to target younger consumers.

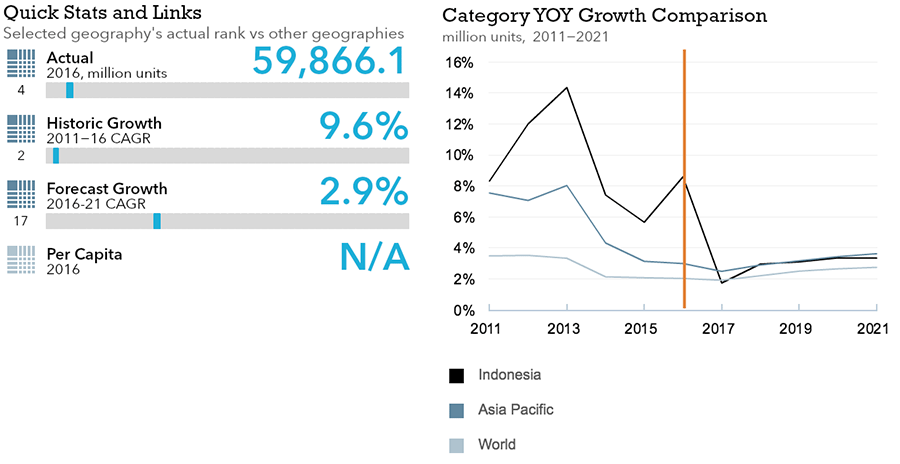

Beverages

Flexible Packaging Landscape

- After the severe blow wrought by Permendag, banning sales of all alcoholic drinks in convenience stores and independent grocers, demand rebounded in 2016 with both beer and RTDs enjoying positive volume growth and packaging performance also recovering.

- Non-alcoholic drinks in PET bottles are well received as more convenient, lighter than glass, and, easier than metal beverage to reseal.

- Total alcoholic drinks packaging grows by 13% to reach volume sales of 527 million units in 2016

- Soft drinks total size grows 9% to reach 44.5 billion units in 2016

- Hot drinks total size grows 8% to reach 20.7 billion units in 2016

Trends

- Metal beverage cans gain volume share as non-alcoholic beer is well received by Indonesian Muslims. It was also the fastest growing pack type in total alcoholic drinks packaging in 2016.

- Alcoholic drinks packaging through on-trade channel grew faster than off-trade sales in 2017 as alcoholic drinks remained more popularly consumed during gatherings.

- PET bottles and brick liquid cartons are most dynamic in soft drinks in 2016

- Lack of major hot drinks packaging innovation as players focus on marketing and advertising.

- Single-serve sachets maintains domination through higher product availability.

- There was a continued l trend towards metal and flexible packaging in hot drinks.

- Metal packaging continued to grow by double digits, driven by coffee sold in metal tin cans.

- Flexible packaging maintained good performance, slightly improving from 2015. This is driven by continued success of sachet packaging of tea and coffee.

Outlook

- Total alcoholic drinks packaging to record a volume CAGR of 9% over the forecast period

- On-trade channels are expected to witness healthy growth due to a growing middle class and more emphasis by manufacturers since on-trade channels are less restricted than with off-trade.

- Glass bottles are expected to remain the most popular alcoholic beverage packaging while metal beverage cans are expected to be the fastest growing pack type, driven by non-alcoholic beer.

- The PET bottle trend will remain strong as convenience fuels sales of PET bottles across various types of soft drinks in Indonesia.

- Glass bottles will continue to lose importance for all types of soft drinks, largely influenced Coca-Cola Indonesia’s announcement to discontinue glass bottles packaging by 2016. Overall, glass bottles will continue to lose share to PET bottles.

- Liquid carton packaging is likely to have good prospects for RTD tea, RTD coffee and juice. Coconut and other plant waters will see the fastest growth over the forecast period.

- Soft drinks companies are expected to continue pushing smaller pack sizes to meet consumers’ budget requirements and affordable prices.

- Metal and flexible packaging are expected to see total sales decline as metal beverage cans lose to PET bottles and flexible packaging suffers and cup packaging loses importance to PET bottles, yet Metal and flexible pack types will be the main drivers of growth in hot drinks packaging.

- Flexible packaging will continue to grow well, driven by sachet packaging.

- Glass packaging will continue the decline and paper-based containers – mostly folding cartons – are expected to see a steady performance driven by tea bags sold in folding cartons.

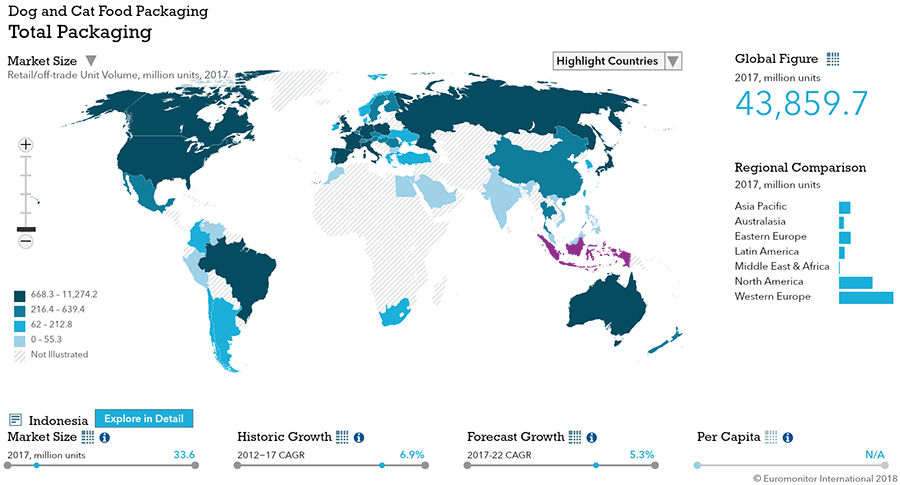

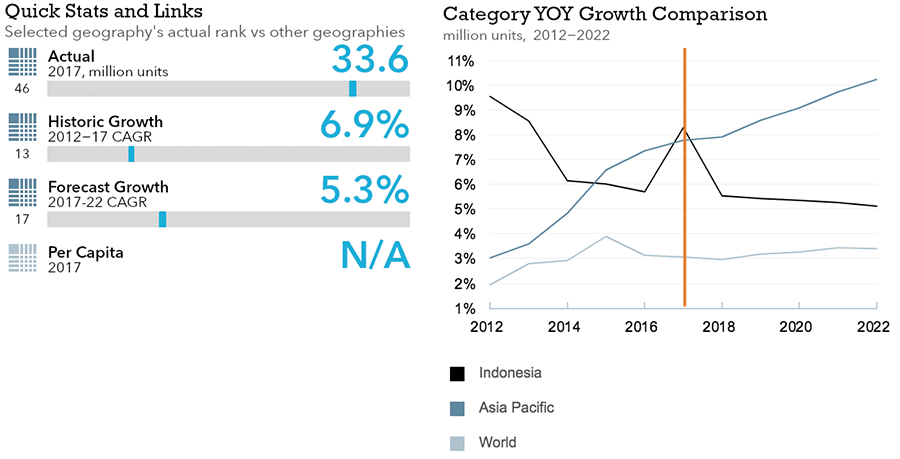

Dog and Cat Food

Flexible Packaging Landscape

- Total dog and cat food packaging volume sales increase 6% in 2016 to reach 31 million units

- Metal packaging remains the most widely used in dog and cat food thanks to traditional popularity in wet dog and cat food

Trends

- Plastic pouches remain the fastest developing category, with total volume sales increasing 13%

- Flexible plastic posts faster growth than metal food cans as dog and cat owners favor dry food over wet variants.

- Growth of pet ownership supports healthy dog and cat food packaging.

Outlook

- Total dog and cat food packaging volume sales are expected to grow at a CAGR of 5% over the forecast period to reach 41 million units in 2021.

- Dog and cat food manufacturers will keep offering smaller pack sizes, especially in premium products.

- Metal food cans and flexible plastic are expected to remain the most popular pack types.

- Plastic pouches look set to remain the most dynamic pack type in terms of total volume sales.

- New packaging developments are likely focus on improved functionality over new pack types. Manufacturers will continue updating package designs to stay competitive.

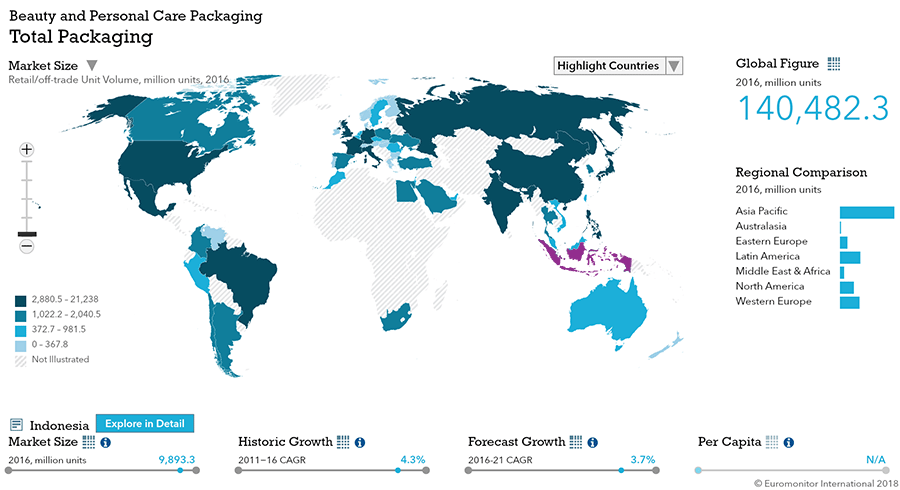

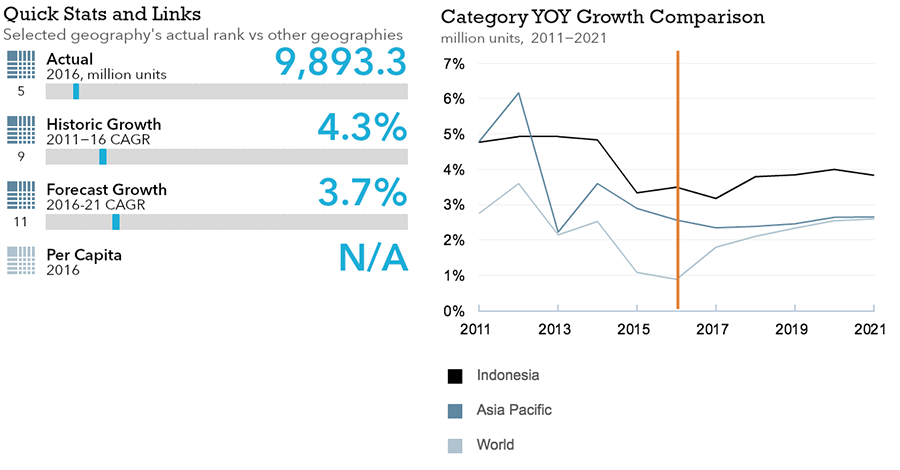

Beauty and Personal Care

Flexible Packaging Landscape

- Beauty and personal care products saw new product developments effect packaging. For example, lotion pump closures grew as liquid face foundation gained popularity.

- Packaging volume sales rose 4% to 10.1 million units in 2016

- Medium sized packaging dominates sales

Trends

- Rigid plastic for men’s skin care products sees dynamic unit volume growth of 25% in 2016

- Lotion pump closures grew in popularity within color cosmetics

- Packaging is primarily HDPE, PET and rigid plastic bottles, all relatively cheap and easy to obtain.

- Glass bottles and jars posted strong volume growth of 21% and 6% respectively. The premium image of glass packaging continued, and manufacturers tapped into willingness to trade up.

Outlook

- Beauty and personal care packaging expects to a 4% CAGR, with sales reaching 12.3 million units

- The improving economy will boost disposable incomes and sales of beauty and personal care products, as will the government’s prioritization of the cosmetic industry.

- Rigid plastic is expected to post a strong 6% CAGR due to its flexibility with regard to design.

- Large and medium pack sizes will remain popular and lotion pump closures will continue to perform well over the forecast period.

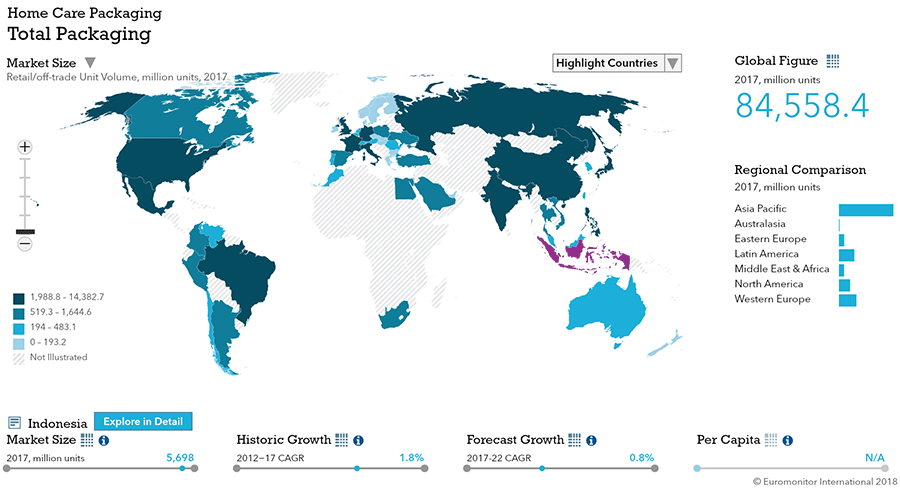

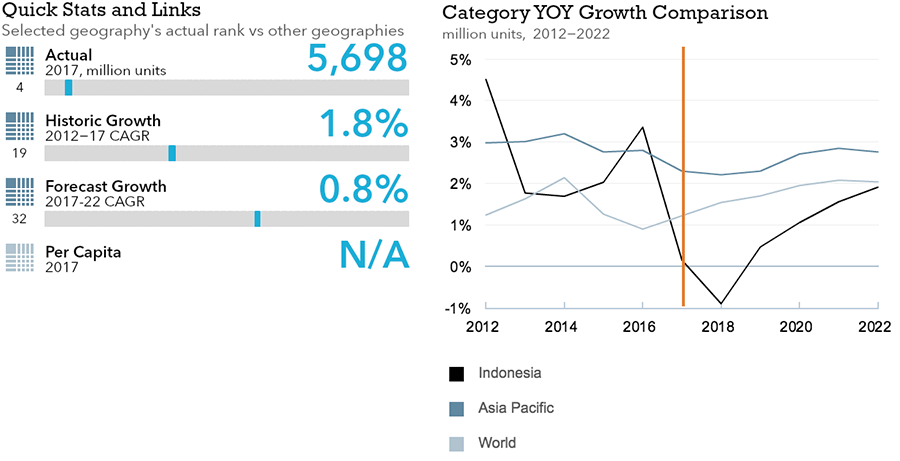

Home Care

Flexible Packaging Landscape

- Refill packs for home care products, perceived as economical, became more attractive to as the cost of living increased and Indonesian consumers opted for refill packs over new purchases.

- Home care packaging sees marginal growth under 1% in 2016 to stand at 5.2 billion units

Trends

- In 2016, packaging operators in home care products focused on product functionality by highlighting additional benefits and effectiveness.

- Metal aerosol cans show fastest growth, due to rise of smaller-sized products

- Flexible plastic remains the largest category in home care packaging.

Outlook

- Home care packaging expected to see modest CAGR under 1% to reach 5.4 billion units by 2021.

- Various types of refill packs will maintain growth momentum over the forecast period as consumers opt for flexible packaging or pouches at lower prices

- As concentrated products will gain ground, home care packaging is set to see higher growth due to lower size per unit.

- Home insecticides and air care products in concentrated format are expected to register strong growth over the forecast period given their competitive pricing and practicality. Aerosol sprays, the main closure format, will enjoy the fastest growth in unit terms over the forecast period.

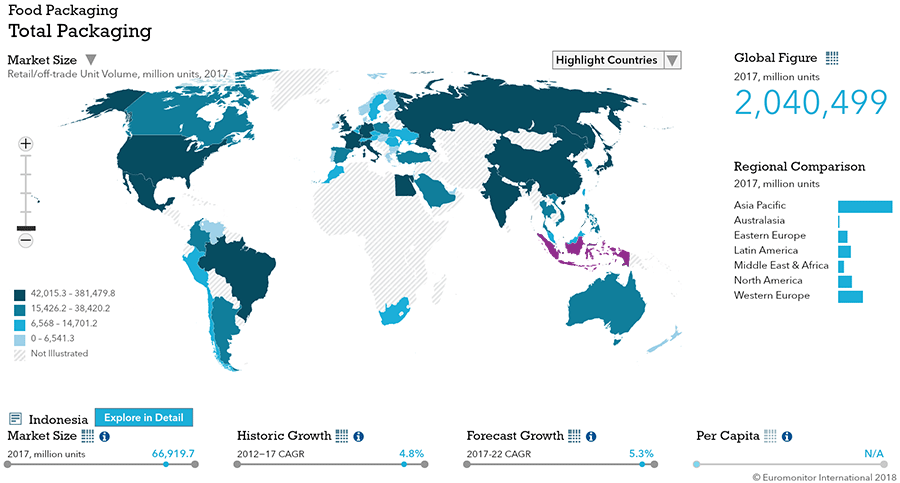

Packaged Food

Flexible Packaging Landscape

- Dairy packaging registers total retail volume growth of 5% to reach 5.9 billion units in 2016.

- Sauces, dressings, and condiments packaging registers total growth of 7%

- Processed meat and seafood packaging registers total retail volume growth of 8% to reach 980 million units in 2016

- Total retail volume growth of 6% is seen by Confectionery packaging in 2016

- Processed fruit and vegetables packaging registers total retail volume growth of 3% yet does not witness much packaging innovation or dynamism in 2016

- Baby food packaging registers total retail volume growth of 4% to reach 1.5 billion units in 2016

Trends

- Shelf presence of small, single-serve pack sizes in dairy continues to grow in 2016

- Drinking yogurt in brick liquid cartons posts retail unit volume growth of 10% from a low base

- Individual sachets continue to gain popularity in line with demand for smaller pack sizes and/or single portions in sauces, dressings, and condiments

- PET bottles and jars register stronger total retail unit volume growth in sauces, dressings, and condiments over glass bottles and jars. However, glass packaging remains resilient in Indonesia

- In line with the popularity of individual sachets of chilli sauce and ketchup in particular, flexible aluminum/plastic packaging continued to grow (7% total retail unit volume growth) faster than flexible plastic packaging (6% growth) in 2016.

- Stand-up pouches continues to lead primary packaging innovation with retail unit volume growth of 12% in 2016

- Metal food cans continues to dominate primary packaging within shelf stable meat and seafood and for processed fruit and vegetables. In processed meat and seafood, plastic overcaps on metal food cans lead innovation for closures while easy-open can ends register strong growth, gradually replacing standard can ends for processed fruits and vegetables

- Flexible plastic packaging for processed meat and seafood registers the strongest growth at 8%.

- Consumers usually prefer smaller pack sizes so that food items can be finished in one sitting.

- The use of metal tins to premiumize confectionery packaging resurfaces as a trend

- Folding cartons is among the top confectionary packaging performers with total retail unit volume growth of 9% in 2016

- Zip/press closures remains the most recent trend across confectionery packaging in 2016

- Confectionery products continued robust growth, driven by expanding base of consumers with disposable incomes. Distribution channels range from traditional to modern.

- The trend towards zip/press closures continued across confectionery packaging as leading brands within medicated confectionery adopted this closure type, which meets consumer demand for functional packaging that helps seal in freshness.

- Folding cartons remains the dominant primary packaging type within baby food while flexible aluminum/plastic continues to dominate secondary packaging

- HDPE bottles emerges as a fast-growing primary pack type for baby food in 2016

- Plastic dispensing closures make a niche appearance within powder milk formula

- Prepared baby food registered total retail unit volume growth of 4% in 2016 while other baby food grew 7% to 120 million units. Glass jars remained the most common primary pack type with a 98% share prepared baby food.

Outlook

- Dairy packaging is set to register a total retail volume CAGR of 7% over the forecast period to reach 8.1 billion units in 2021.

- Sauces, dressings, and condiments packaging is set to register a total retail volume CAGR of 6% over the forecast period to reach 14.3 billion units in 2021

- As lifestyles continue to become busier, consumers are expected to turn to packaged sauces, dressing and condiments for the convenience that they offer.

- Processed meat and seafood packaging is set to register a total retail volume CAGR of 6% over the forecast period to reach 1.3 billion units in 2021

- The limited presence of chilled processed seafood presents opportunities for new players to enter and consolidate their positions over the forecast period and forge a clear direction. As a result, typical packaging types for chilled processed seafood such as flexible plastic (secondary packaging or primary packaging) and folding cartons (primary packaging for greater shelf visibility) may be positively impacted in the long term.

- Confectionery packaging is set to register a total retail volume CAGR of 3% over the forecast period to reach 10.8 billion units in 2021

- Attractive and convenient packaging design remains important for both chocolate and sugar confectionery products and plays a major role in the purchasing decision of consumers.

- Processed fruit and vegetable packaging should register total retail volume CAGR of 3% in 2021. Single-person households are set to grow, which will drive growth as they prefer the convenience of longer shelf lives as compared to fresh perishables.

- Growth is expected to remain positive and relatively healthy as consumers are expected to turn to processed food items for added convenience in light of urbanization and busier lifestyles. However, processed fruit and vegetables will continue to face stiff competition from fresh produce, as consumers grow more health conscious over the forecast period.

- Baby food is expected to register a total retail volume CAGR of 3% over the forecast. Modern lifestyles, rising awareness of the nutritional needs of babies, and an increase working mothers are expected to boost sales of baby food products and packaging over the forecast period.