Overview

Packaging Overview

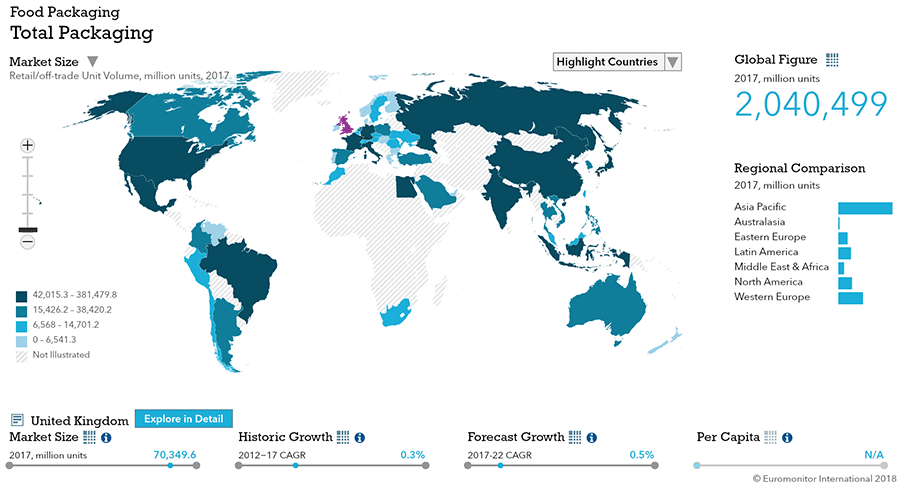

2016 Total Packaging Market Size (million units):

105,163

2011-16 Total Packaging Historic CAGR:

0.8%

2016-21 Total Packaging Forecast CAGR:

1.1%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

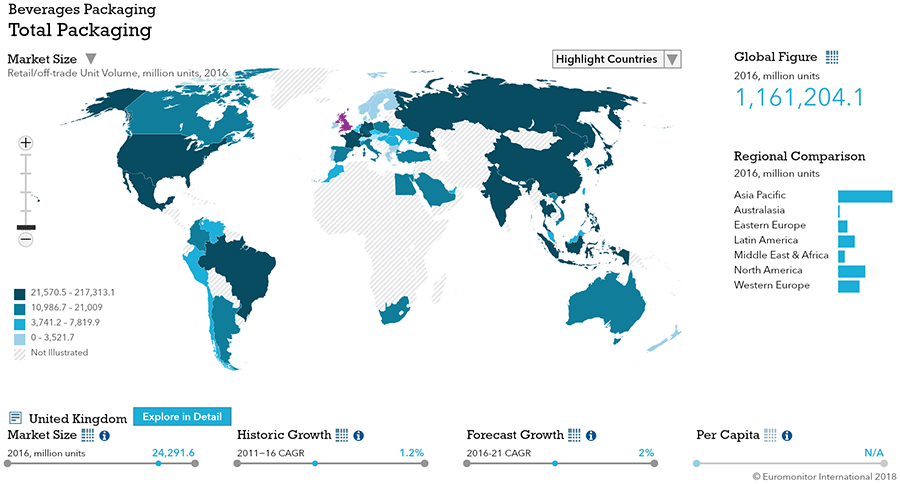

| Beverages Packaging | 24,252 |

| Food Packaging | 69,922 |

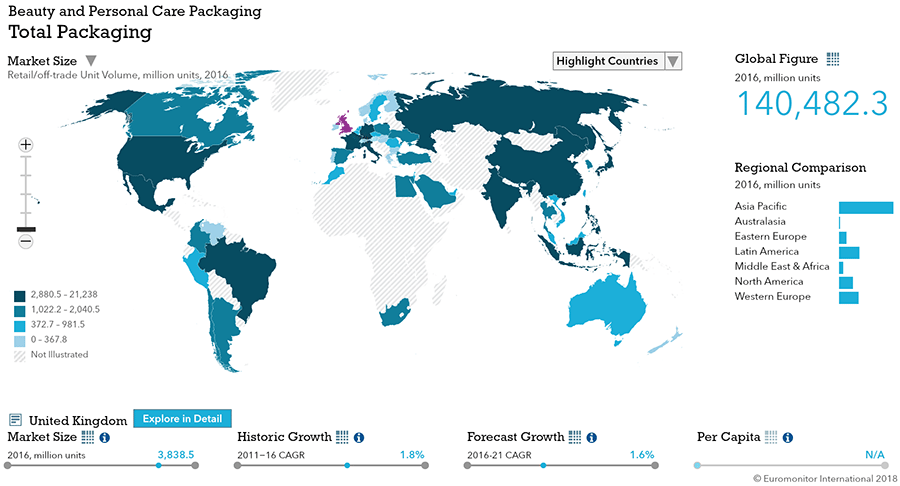

| Beauty and Personal Care Packaging | 3,839 |

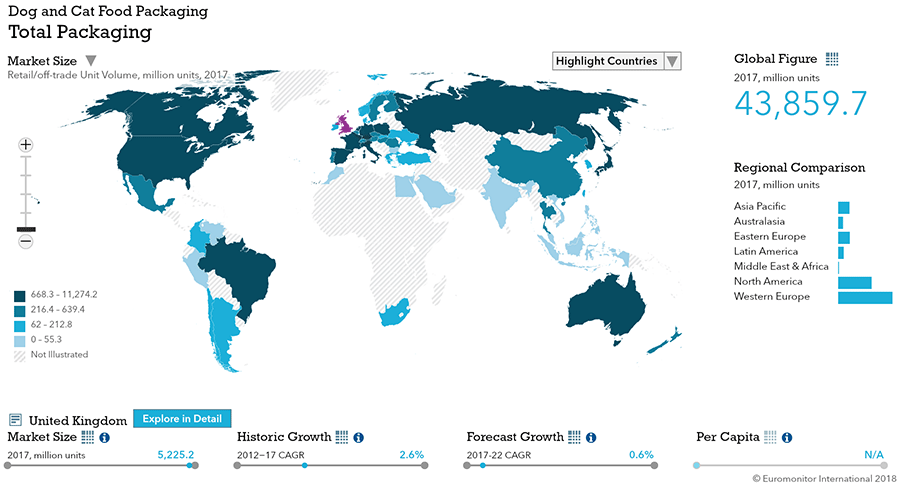

| Dog and Cat Food Packaging | 5,178 |

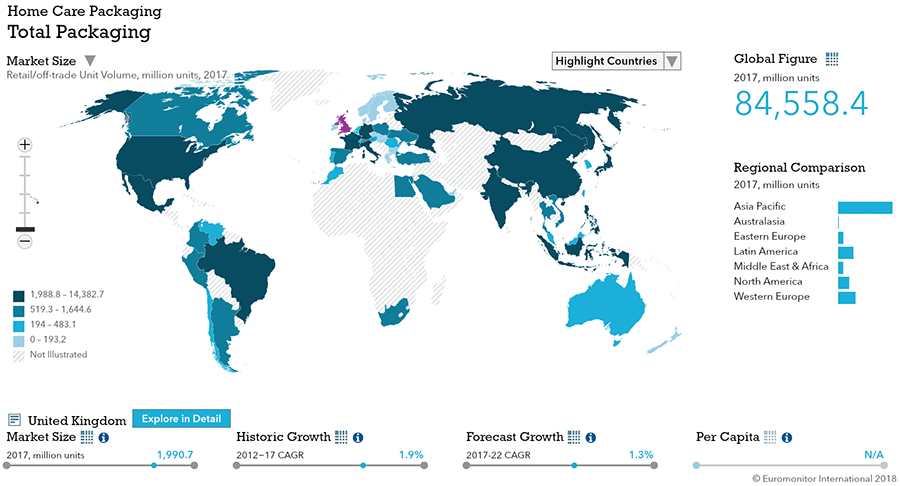

| Home Care Packaging | 1,973 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 28,935 |

| Flexible Packaging | 44,337 |

| Metal | 13,072 |

| Paper-based Containers | 8,513 |

| Glass | 7,540 |

| Liquid Cartons | 2,752 |

- The total UK packaging industry, sized at over 105 bn units in 2016, is expected to see moderate growth.

- Food and beverage packaging continues to dominate packaging, but beauty and personal care and home care packaging present niche growth opportunities.

- Flexible packaging continues to lead in size, and rigid plastic ranks second.

Key Trends

- Premiumization is gathering strength in beauty and personal care packaging. Customized glass bottles and jars are benefiting from this trend, with producers becoming more likely to demand distinctive features on their packaging. Folding cartons within secondary packaging are also seeing a good performance.

- The increasing frequency of occasion-driven consumption is affecting food packaging. Consumers are increasingly eating on the go as a result of hectic lifestyle and diminishing free time for sit-down meals. Packaged food manufacturers are responding to this trend by launching convenient packaging solutions. Product areas impacted by this trend include breakfast cereals and cheese, as well as baby food.

- Home care pack sizes are decreasing as formulas become more concentrated, particularly for laundry and dishwashing detergents.

- Smaller soft drink pack sizes are becoming more popular in the anticipation of a tax on sugary beverages starting in 2018.

- Premium packaging is more commonly used to differentiate alcoholic beverages as increasingly health-conscious consumers reduce their alcohol consumption. The craft beer trend is benefiting customized glass bottles, while embossing and engraving are increasingly being used to add a luxurious note to spirits packaging.

Packaging Legislation

- Brexit creates some uncertainty: Most of the UK’s regulations pertaining to packaging originated in the European Union (EU), and there is some degree of uncertainty as to whether those regulations will stay in place after the UK leaves the EU in 2019. However, the UK government has signaled that there will be no sudden changes to regulatory frameworks immediately after the UK leaves the EU.

- Packaging recycling targets are likely to increase in coming years: There are ongoing discussions in the EU regarding the Circular Economy Package, which aims to increase recycling targets and facilitate the reuse of post consumer recycled materials with waste viewed as a resource rather than a burden. The UK Department for Environment, Food and Rural Affairs has thus played a role in negotiations regarding the Circular Economy Package and has stated that it anticipates the UK will adhere to the proposals set forth in this package. As a result, recycling targets for packaging and waste are expected to increase in the forecast period. This bill is also expected to discourage landfill via economic instruments and a ban on land-filling for separately collected waste, while also stimulating reuse and a symbiotic approach to waste across industries and incentivizing the use of more environmentally-friendly options.

- The Packaging (Essential Requirements) Regulations of 2015 have limited impact: The Packaging (Essential Requirements) Regulations came into force in October 2015, replacing the Packaging (Essential Requirements) Regulations of 2003. These regulations seek to reduce the impact of packaging on the environment by minimizing its weight and volume and requiring that packaging can be reused, recycled or recovered (incinerated to produce energy or composted). While company audits increasingly focus on reusing waste, there remains less of a focus on minimizing packaging. Premium packaging often continues to utilize heavy glass and secondary folding cartons. Online sellers are also often likely to use excessive packaging for goods in transit, with these players very difficult for the authorities to monitor.

Recycling and the Environment

- Innovation in environmentally friendly packaging: Striving for more sustainable packaging remains one of the key trends within UK packaging overall, with Coca-Cola notably announcing plans to use 50% recycled PET in its plastic bottles by 2020. The government and many consumers alike are putting pressure on companies to improve their environmental credentials, while environmentally friendly packaging will attract a growing number of customers.

- Growing interest in return schemes for plastic and glass bottles: There are no deposit and return schemes for glass bottles in the UK via the on- or off-trade. However, some link the increases seen in plastic waste to a lack of such schemes, which were previously widely used in the UK until the 1990s. Deposit and return schemes could also be used to reduce costs in the on-trade channel. There are also calls for a deposit and return scheme for plastic bottles in the UK, with similar pilot schemes proving successful in countries such as Germany and Australia. The government called for views on setting up a plastic bottle deposit return scheme in October 2017, with the aim of reducing plastic waste.

- Recycling rates fall in England for the first time: December 2016 saw the announcement that household recycling rates had dropped for the first time in 2015, with EU targets for 2020 thus unlikely to be met. The combined recycling and composting rate for household waste reached 44% in 2015, down from 45% share in 2014. As a result, the government has floated the idea of implementing a tax on packaging manufacturers to fund recycling initiatives.

Packaging Design and Labelling

- Key ingredients highlighted on labels to attract consumers: UK consumers are increasingly aware of a wide range of healthy and unhealthy ingredients and are becoming more likely to scrutinize ingredients lists as a result. Many are seeking more natural and organic options. Labels are thus key in attracting consumers across many areas from beauty and personal care to packaged food.

- Package designs and labelling encourage sharing: Manufacturers in products such as confectionary and savory snacks are increasingly embracing the sharing trend and are adjusting packaging design and labelling accordingly. Nestlé's Kit Kat Snap and Share was, for example, launched to encourage consumers to buy larger packs in order to share with either friends or family.

- Flexible packaging offers transparency, cost benefits and lower environmental impact: Flexible packaging benefits from a number of factors in attracting both consumers and producers. Consumers in the UK remain highly price-sensitive as a result of ongoing economic uncertainty, while cost pressures from grocery retailers are increasing for players in fast-moving consumer goods. This is encouraging a focus on lower-cost packaging formats, which is in turn benefiting flexible packaging. Flexible packaging is also benefiting from a growing focus on environmental issues, being light in weight and easy to recycle.

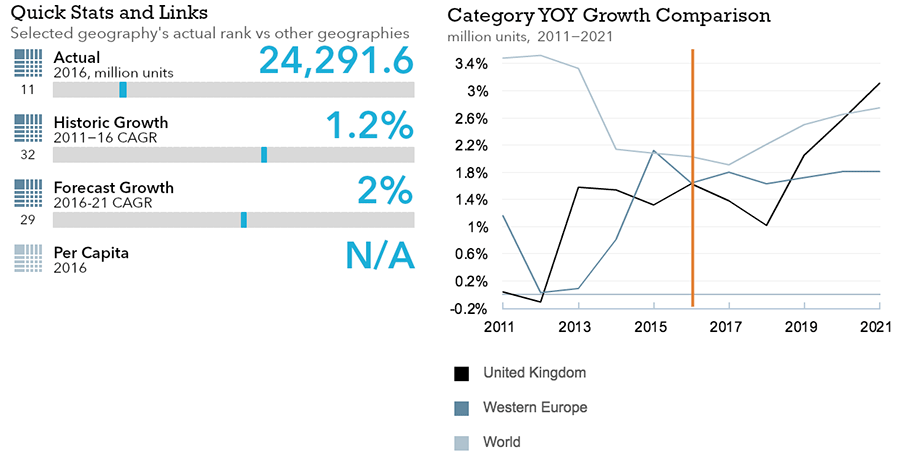

Beverages

Flexible Packaging Landscape

- Total UK beverage packaging volume is expected to see strong 2.5% CAGR growth through 2021, a higher rate of growth than during the 2011-2016 period.

- Flexible beverage packaging is expected to see strong but slightly uneven volume growth each year through 2021.

Trends

- In soft drinks, shaped liquid cartons were the fastest-growing pack type in unit volume, growing by 11% in 2016. The growth of smaller pack sizes intensified further in 2016 in the light of the sugar tax announcement on soft drinks at the beginning of the year.

- In hot drinks, thin wall plastic containers was the most dynamic pack type in hot drinks in 2016, due to the fact that consumers increasingly purchase instant or fresh ground coffee in thin wall plastic packaging to refill their glass or metal coffee containers.

- In alcoholic drinks, glass bottles dominate with 54% volume sales in 2016, but rigid plastic was the fastest growing packaging type with 227% volume sales growth, due to a substantial increase in the use of five-liter rigid plastic containers for wine in the on-trade channel.

- 2016 saw a continuation of the shift towards smaller pack sizes in beer, a trend which first became evident with the rise of craft breweries and significant sales of their products earlier in the review period. In particular, the influence of craft breweries has been most evident in rising volumes of 330ml metal beverage cans.

Outlook

- In soft drinks, shaped liquid cartons, PET bottles and metal cans are projected to record positive volume sales growth through 2021, while volume sales of brick liquid cartons will decline as consumers cut back on high-calorie juice consumption.

- The ongoing decline being seen in the use of glass jars for the packaging of instant coffee is likely to remain the most important trend in hot drinks packaging over the forecast period. Several instant coffee brands are increasingly eschewing glass jars in favor of lighter and more durable pack types such as plastic pouches.

- In alcoholic drinks, overall packaging volumes sales is projected to grow at a 1% CAGR through 2021, due in part to the increasing use of secondary packaging such as metal tins for spirits and folding cartons for multi-packs. Glass and metal are projected to remain the dominant packaging type for alcoholic drinks.

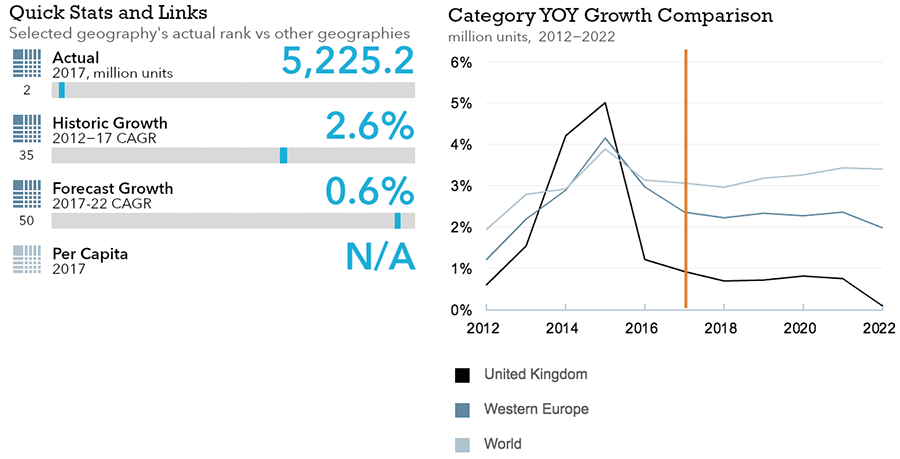

Dog and Cat Food

Flexible Packaging Landscape

- Total UK dog and cat food packaging volume is expected to see limited 0.6% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see much stronger 2.4% volume CAGR growth through 2022.

Trends

- Total dog and cat food packaging in the UK recorded 5% volume sales growth in 2016 to reach 5.4 billion units

- Plastic pouches registered strong growth in 2016, particularly for cat food, due the convenience of portion control and product freshness they provide.

Outlook

- Dog and cat food packaging is predicted to see a volume CAGR of 3% over the forecast period to reach 6.2 billion units in 2021. This performance will be lower than that seen over the review period, mainly due to factors such as greater awareness among pet owners of the health risks associated with excess weight among their animals, and a consequent reduction in portion sizes, coupled with a desire to reduce expenditure on pet food.

- Flexible packaging in cat treats is expected to see strong growth over the forecast period, with a volume CAGR of 9%. The popularity of cat treats along with the increasing range of choice in small pouch packaging formats will contribute to this trend.

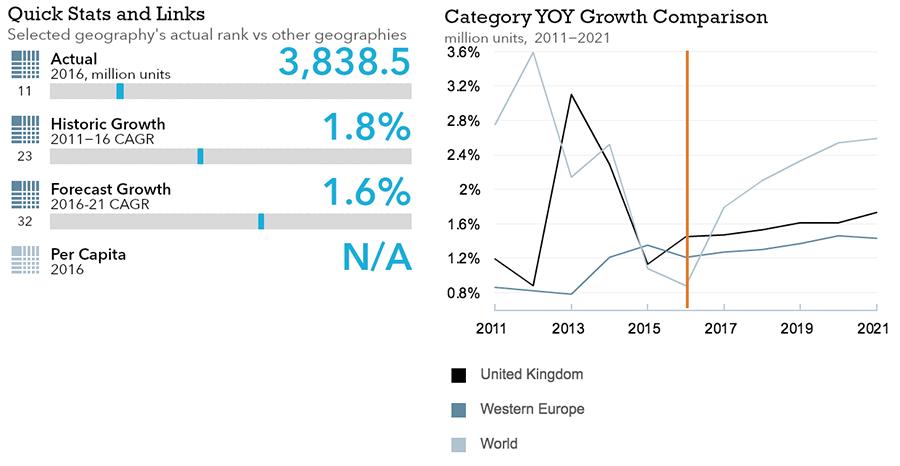

Beauty and Personal Care

Flexible Packaging Landscape

- Total UK beauty and personal care packaging volume is expected to see moderate 1.9% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see stronger growth across the 2016-2021 period, particularly in 2020 and 2021.

Trends

- Beauty and personal care packaging retail unit volume sales increase by 2% to reach 3.8 billion units in 2016, driven in part by increased demand for premium beauty products.

- The increasing popularity of premium beauty products has required manufacturers to deploy more stylish and sophisticated packaging using luxury materials, texture printing techniques and unique formats such as pipettes.

- Recycled packaging and lighter formats are also growing in popularity among the UK’s increasingly environmentally conscious consumers.

Outlook

- Beauty and personal care packaging is expected to register a 2% volume CAGR over the forecast period, with sales reaching 4.2 billion units in 2021, driven by increasing demand for fragrances.

- Glass will be the best performing main packaging type over the forecast period, with unit volume sales set rise at a CAGR of 2%.

- Recycled packaging and lighter formats will continue growing in popularity among consumers through 2021.

Home Care

Flexible Packaging Landscape

- Total UK home care packaging volume expected to see moderate 1.5% CAGR growth through 2021.

- Flexible home care packaging is expected to see a much stronger 3.2% CAGR growth through 2021, outpacing volume growth for global flexible home care packaging market as a whole.

Trends

- The trend towards higher concentration of home care products, primarily within laundry care and dishwashing, led to a reduction in packaging volume over the review period, and this continued in 2016.

- One of the major drivers in flexible packaging was the further proliferation of home care wipes. Indeed, these products are most frequently sold in flexible plastic packaging. This type of packaging is considered to be easy to use and store.

- Metal aerosol cans in home care continued to grow in 2016, driven by increased interest in home care disinfectants and oven cleaners in metal aerosol cans. Additionally, surface care products in metal aerosol cans are often regarded as being extra effective, given the powerful spray and wide application range of this packaging format.

- With increased attention being paid to over-dosing in the industry, packaging manufacturers are developing closures to help consumers address this problem.

Outlook

- Home care in glass packaging is expected to see strong growth over the forecast period, driven by air care products – both candle air fresheners and liquid air fresheners.

- Flexible packaging in home care is also expected to see strong growth over the forecast period. The most dynamic growth in this format is expected to occur in liquid air fresheners in blister and strip packs.

- Pack size is expected to see further disparity in most home care categories, especially surface care, laundry care and dishwashing. On the one hand, smaller pack sizes will increase in popularity, due to the fact that an increasing number of people will live in cities in smaller dwellings with less storage space. On the other hand, larger pack sizes will become increasingly popular among suburban and rural consumers with cars to transport larger products and the space to store them at home.

- The burgeoning demand for refill packs is likely to develop into an opportunity for the sale of increasingly sophisticated rigid plastic packaging and closures. Within surface care and laundry care, where the demand for refill packs is most apparent, this is likely to support an increase in sales of rigid plastic packaging and plastic screw closures for the easy transfer of liquids from the refill pack to a primary pack.

Packaged Food

Flexible Packaging Landscape

- Total UK packaged food packaging volume is expected to see limited 0.5% CAGR growth through 2022.

- Flexible packaged food packaging is expected to remain largely stagnant with 0.7% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, total packaging volume sales grew by 1% in 2016, driven in part by growth in thin wall plastic containers for pasta sauce, which are increasingly popular packaging formats for private label pasta sauces.

- In processed meat and seafood, volume sales stagnation in 2016 was due in large part to increasingly health conscious consumers’ declining demand for processed meat, particularly bacon and sausage. The most popular packaging type in 2016 was rigid plastic, led by thin wall plastic containers, which accounted for a 56% volume share.

- In processed fruit and vegetables, a 1% volume sales decline in 2016 was attributable to consumers’ increasing interest in cooking from scratch with fresh produce, which they perceive as healthier than processed fruit and vegetables. Flexible plastic, used predominantly for frozen products, accounted for a 32% of overall fruit and vegetable packaging volume sales.

- In confectionery, the 1% volume sales growth in 2016 was due in part to the premiumization of the category. Flexible packaging remained the most prevalent pack type in primary confectionery packaging in 2016 with a volume share of 88%. Flexible plastic accounted for a 58% volume share of total primary packaging, followed by flexible aluminium/plastic (13%) and folding cartons with 9%.

- In dairy, thin wall plastic containers accounted for a 52% volume share of dairy packaging in 2016. This pack type is mostly used in yoghurt but is also very common in butter and margarine, spreadable processed cheese and dairy desserts.

- In baby food, growth mainly stemmed from brick liquid cartons, which is the predominant packaging type for liquid milk formula.

Outlook

- In sauces, growth will mainly come from PET bottles, which are highly recyclable and popular among increasingly environmentally conscious consumers, brick liquid cartons for tomato pastes and purees and thin wall plastic containers for pasta sauces.

- In processed meat and seafood, total volume CAGR is expected to be 1% through 2021, driven mainly by smaller households more frequently purchasing smaller pack sizes. Folding cartons and flexible plastic will likely remain the most common pack types in the category.

- In processed fruit and vegetables, volume sales are project to post a -1% CAGR through 2021 as consumers increasingly opt for fresh produce. However, frozen processed vegetable packaging is projected to record at 2% CAGR through 2021 as consumers grow more familiar with the quality of frozen vegetables and how they can help reduce food waste.

- In confectionery, the trend toward smaller pack sizes is expected to continue, which accounts in large part for the projected 1% volume sales CAGR through 2021.

- In dairy, volume sales are projected to grow at a 1% CAGR through 2021, driven in large part by new on-the-go formats.

- In baby food, forecast 3% CAGR through 2021 is expected to come from continuous growth of milk formula and other baby foods.