Overview

Packaging Overview

Packaging Overview

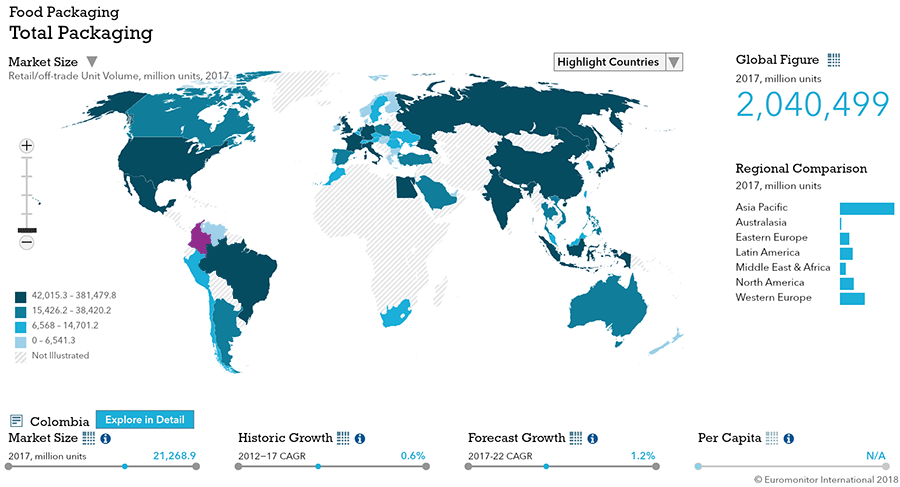

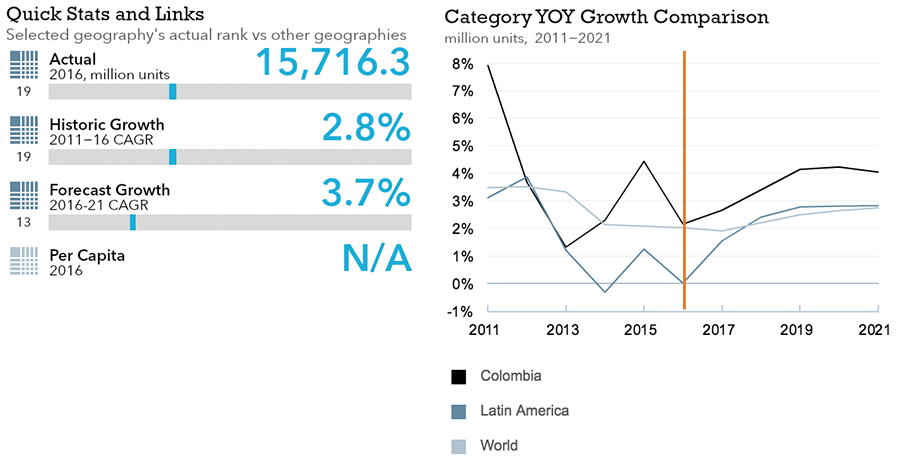

2016 Total Packaging Market Size (million units):

39,873

2011-16 Total Packaging Historic CAGR:

1.9%

2016-21 Total Packaging Forecast CAGR:

2.1%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

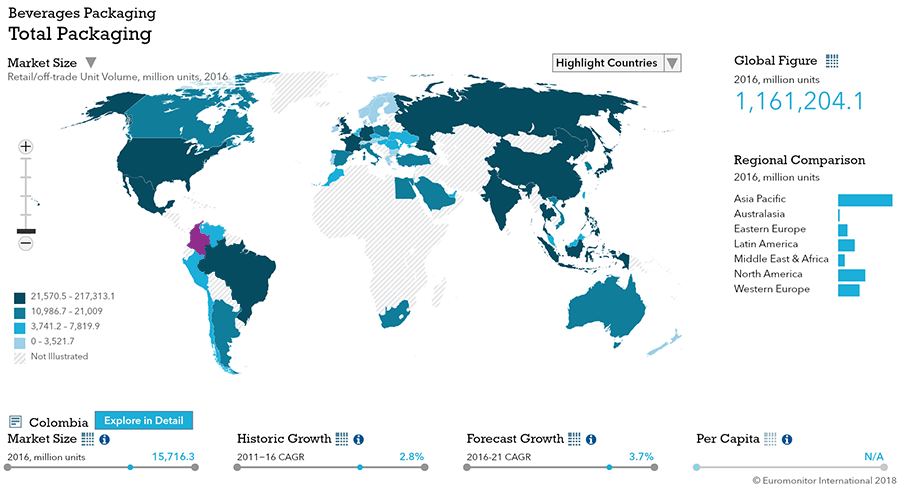

| Beverages Packaging | 16,082 |

| Food Packaging | 21,159 |

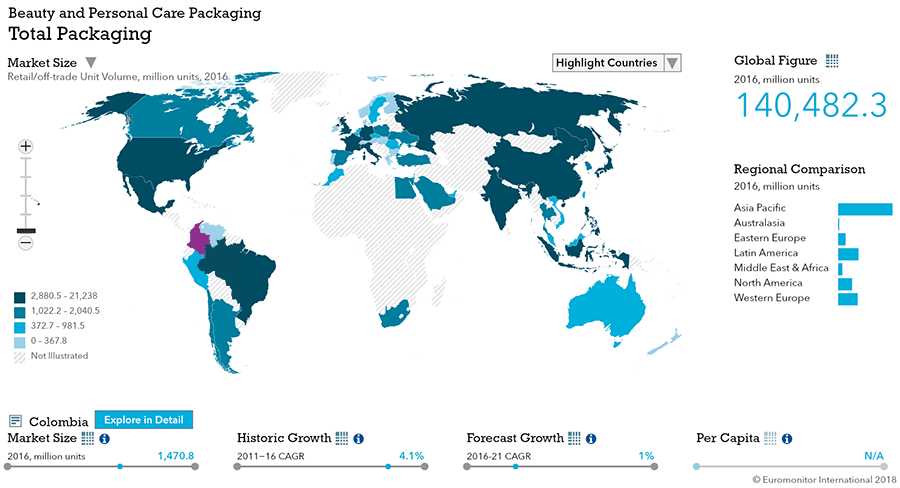

| Beauty and Personal Care Packaging | 1,471 |

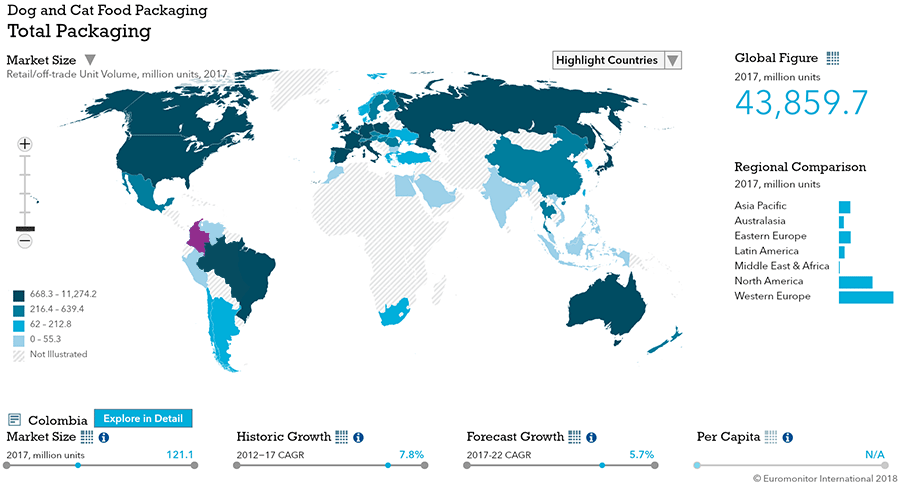

| Dog and Cat Food Packaging | 113 |

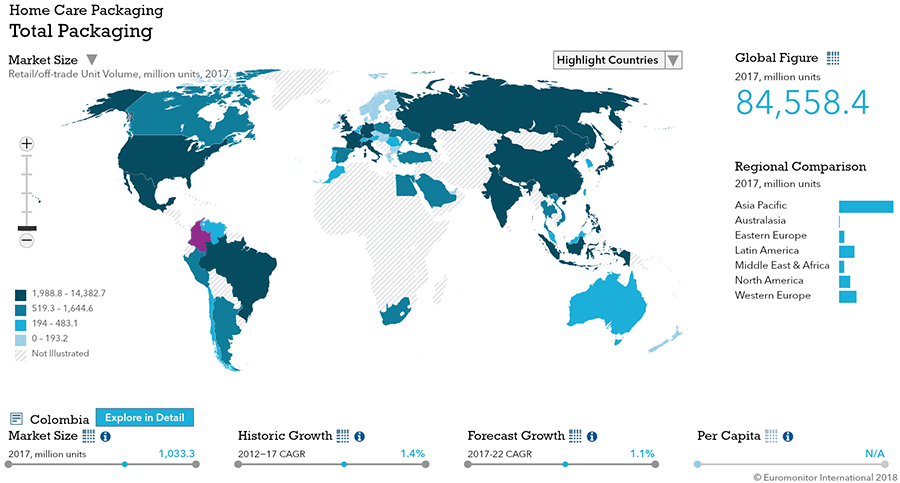

| Home Care Packaging | 1,048 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 7,341 |

| Flexible Packaging | 21,651 |

| Metal | 1,290 |

| Paper-based Containers | 1,301 |

| Glass | 7,392 |

| Liquid Cartons | 891 |

- The Brazilian package industry is predicted to see a steady 2.1% CAGR during the forecast period, just a shade higher than the current 1.9% CAGR.

- Food and beverage packaging continues to dominate the industry, with beauty and personal care and homecare far behind.

- Flexible packaging is by far the most popular pack type, with Rigid Plastic a distant second.

Key Trends

- Price increases due to tax reforms and the economic slowdown of 2016 could impact product sizes as players aim to keep prices competitive.

- Because of their low income a good number of households buy what they need on a day to day basis.

Packaging Legislation

- Government to increase intervention in PK Worried about the health impact of packaged food, regulators are planning to launch measures regulate the way manufacturers produce, label, and advertise. Ministry of Health issued a technical ruling to set up sodium limits.

Recycling and the Environment

- The ongoing relevance of returnable bottles was linked to distribution channels, as independent grocers remained the primary channel.

Packaging Design and Labelling

- Current labelling standards state key nutritional facts at the front products in a visible layout.

- Small discounting outlets shaped packaged food and packaging in 2015 and 2016. Operators favor new private label products – stealthily labeled to appear to as affordably-priced new brands, thus creating an opportunity for private label and packaging manufacturers.

Beverages

Flexible Packaging Landscape

- Total alcoholic drinks packaging increases 9% with glass bottles the most format.

- Soft drinks packaging registers total volume growth of 1% to reach 11.2 billion units in 2016

- Hot drinks packaging registers total volume growth of 3%.

Trends

- Glass bottles account for 87% alcoholic drinks packaging, with returnable bottles at 99% of total.

- Coors Light imported lager introduced a label that changes color from when the beer is cold.

- Seasonality is more relevant in spirits; gift boxes or sets of glasses, shakers, or dice are popular.

- Metal and plastic screw closures continue to be relevant for spirits and other alcoholic drinks while plastic screw closures was dominant for soft drinks sold in PET, HDPE, and glass.

- In Colombia, multipacks in alcoholic drinks are popular in beer and RTDs.

- Brick liquid cartons are relevant in local spirits. PET bottles have limited presence in local spirit-based RTDs, but energy drinks growth favors PET bottles, accounting for 85% of the category.

- Metal beverage cans continued to display a strong performance, increasing by 13%.

- Companies continue to introduce smaller sizes, mainly in carbonates and bottled water

- Soft drinks kept using light bottles with less plastic to benefit environment and reduce costs

- The health and wellness trend continued as consumers reduced intake of carbonates

- Flexible packaging remains the most popular pack type within hot drinks

- Plastic pouches gain in instant coffee with high 17% growth, outperforming flexible packaging.

Outlook

- Over the forecast period, total alcoholic drinks packaging is predicted to see a CAGR of 4%.

- With beer as the most relevant, individual sizes will dominate.

- In beer, larger and smaller glass bottles will grow, yet glass bottles in soft drinks are expected to register negative growth, influenced by a drop in carbonates. The trend may be reverted due to demand for returnable bottles, in carbonates, juice and RTD tea.

- Spirit-based RTDs and beer, will be key drivers for metal beverage cans.

- Brick liquid cartons predict a decline in alcoholic drinks over the forecast period, yet will outperform soft drinks as a whole with a CAGR of 5% driven largely by juice boxes.

- Soft drinks packaging expects total volume CAGR of 3% to reach 12.7 billion units in 2021

- Rigid plastic is expected to a 4% CAGR accounting for a 48% share of soft drinks while PET bottles across all soft drinks categories will continue expanding.

- Hot drinks packaging is expected to register a CAGR of 3% to reach 1.1 billion units in 2021

- Paper-based containers are set to record total CAGR of 6%, underpinned by demand for tea.

- Coffee pods in other metal, though the smallest category, will see the strongest CAGR of 32%.

- The strong growth in instant coffee will continue to drive glass jars to a CAGR of 6%.

- Flexible packaging is expected to register a total unit volume CAGR of 3.

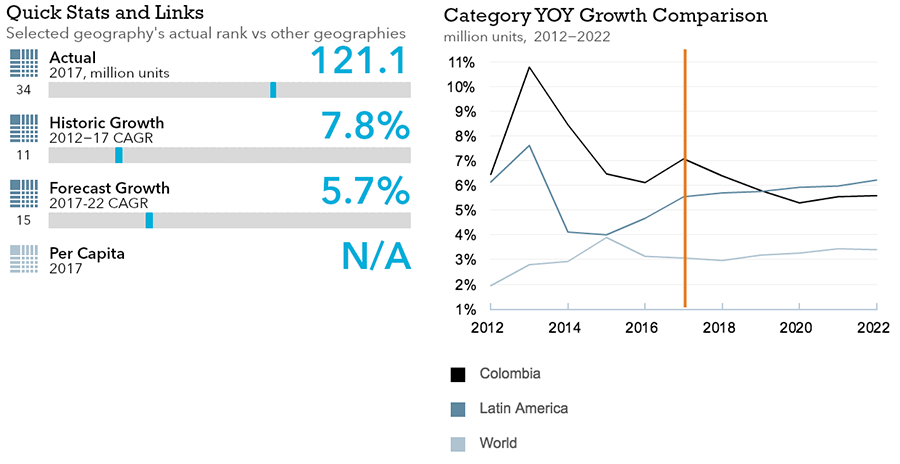

Dog and Cat Food

Flexible Packaging Landscape

- Total dog and cat food packaging volume sales grow by 5% in 2016 to reach 103 million units

- Smaller pack sizes gain ground due rising penetration of dog and cat food in middle- and lower-middle-income households and support from traditional grocery retailers.

Trends

- Flexible packaging remains dominant due to strong preference for dry dog and cat food

- Unit volume sales of aluminum/plastic pouches in wet dog food grow 12%, the highest rate recorded in any single dog and cat food category

- Total sales of metal food cans declined 1%, as smaller-stand-up pouches gained ground.

Outlook

- Total dog and cat food packaging volume sales expected to grow 5% CAGR in 2021.

- Colombia’s pet populations grow as people in single-person households adopt pets for companionship. Single-person households will account for 14% of all households by 2021.

- Growth in total dog and cat food packaging is expected to be slightly lower than observed during the review period due to increasing maturity and further deceleration of the economy.

- Independent small grocers will continue gaining importance. Specialist channels, namely pet shops and superstores, and veterinary clinics, are expected to account for 33% of total dog and cat food retail volume sales in 2021 with pet superstores projected to grow at a CAGR of 10%.

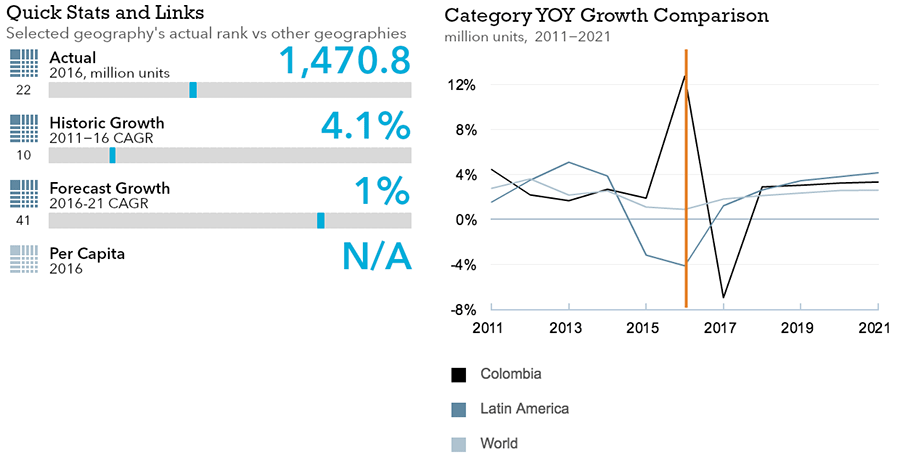

Beauty and Personal Care

Flexible Packaging Landscape

- Beauty and personal care packaging grows by 13% in volume terms to reach 1.5 billion units

- Players innovate in terms of sizes, formats and packaging materials

Trends

- Metal aerosol cans replaced plastic packaging and saw dynamic performance and strong growth in categories like talcum powder in 2016

- Self-dispensing aerosol sprays closures remain key in 2016 across categories

- Plastic dispensing closures and beverage flip-tops revolutionize the way packaging is closed.

- The rise in temperature increased the need sun care products.

- Plastic screw closures give way to other closures due to the trend towards avoiding waste.

- The industry offers a diversity of sizes, presentation and packaging according to the channel.

Outlook

- Beauty and personal care packaging is expected to see a CAGR of 1% in volume terms to reach 1.6 billion units in 2021.

- Small packaging and lower-priced private label products are expected to boost industry's growth

- Repackaging products such as liquid soap may create a boom for flexible plastic packaging, a trend which may also be imitated by other categories that use liquids and wipes.

- It is expected that each company will adjust packaging size and type according to retail channels.

- The most interesting opportunities for closures will be those with practicality in opening and closing, allowing the user to save time, avoid waste, and make efficient use of the product.

- The variety in hair care products presents an opportunity for beauty and personal care packaging because of a lack of practicality in use.

Home Care

Flexible Packaging Landscape

- In 2016, home care packaging sees an increase of 2% in volume terms to reach 1.0 billion units

- The boost provided by liquid soap for dishwashing and refills invigorates flexible packaging.

- Products are offered in multiple packaging types and different sizes.

Trends

- Economic options, ease of use, and conservation led consumer priorities in 2016 and help lead the popularity of refills, especially in laundry and surface care.

- Pack sizing trends in home care included very small sized formats of 25ml in flexible plastic.

- Powder detergent closures gain momentum with plastic screw closures on bags while hand dishwashing products boosted push-pull closures.

Outlook

- Home care packaging expected to increase 3% CAGR to reach 1.2 billion units in 2021.

- Flexible plastic is the most dynamic packaging, thanks to possibility for reuse of previously purchased PET packaging or rigid plastic and offer of extra content as a promotional tool.

- Products from categories such as surface care, air care and laundry will boost packaging types and sizes, predicted to boost to flexible plastic, aluminum and plastic pouches.

- The most interesting closure opportunities are plastic screw closures, which will continue adapting to different packaging, and be popular in liquid detergents and fabric softener.

- An interesting packaging opportunity in one or more home care categories lies in metal aerosol can and flexible packaging.

- Metal aerosol cans are popular as mosquito related diseases drove the use of insecticides. Air care, laundry, polish and surface care, create further opportunities for this package type.

- Flexible packaging gives to consumers the ability to add additional content at the same price and offers a variety of sizes that fit the economic needs of households.

Packaged Food

Flexible Packaging Landscape

- Retail volume sales of dairy packaging declined marginally to 5.0 billion units in 2016.

- Retail volume sales of sauces, dressings and condiments packaging declined by 1% in 2016

- Processed meat and seafood packaging (primary and secondary) record 1% growth in 2016.

- Retail volume sales of confectionery packaging declined 2% to reach 4.9 billion units

- Processed fruit/vegetables packaging (primary and secondary) declines 1% to 62 million units with metal food cans the most popular pack type.

- Manufacturers are aiming to develop frozen fruit and vegetables

- Retail volume sales of baby food packaging (primary and secondary) decline by 2%

- Baby food shifts from glass and metal to flexible packaging and paper-based containers in 2016

- Pack sizing is expected to continue heading towards personal sizes which can be consumed as snacks or whilst on the go.

Trends

- Key dairy brands aim to reduce the price gap between brick cartons and flexible plastic in 2016

- Brick liquid cartons are revamped due to increasing interest in milk alternatives.

- Functional yogurt uses HDPE, regular yogurt thin wall plastic containers, which, along with size, differentiates the two. HDPE bottles are considered a “finer” pack, helping justify a higher price.

- Competitively priced brick liquid cartons offered at the same price as flexible plastic are expected to reduce the long-term trend favoring flexible plastic.

- Small-sized formats led to new dairy products using multipacks and individual sizes

- Amidst economic deceleration, pasta is an economic, tasty and versatile meal, favoring pasta sauces, tomato pastes, and purées packaging in 2016

- Pouches are the most popular pack type in sauces, dressing and condiments.

- The threat of power rationing and health and wellness megatrends helped metal food cans in 2016, the key pack type used in shelf stable meat and seafood.

- Health concerns favor smaller pack sizes in confectionery in 2016 with large sizes (over 50g) increasingly observed only in premium chocolate

- Paper-based containers outperform the overall category as confectionery is regarded as an important gift alternative.

- Flexible plastic significantly displaced rigid containers in sauces, dressings and condiments.

- Glass gives way to stand-up pouches in key categories, but is the preference in pasta sauces.

- Plastic dispensing closures and plastic screw closures are the most popular closures in PET bottles and stand-up pouches. Products in flexible plastic prove useful for refills or other uses.

- Electric infrastructure instability led shelf stable meat and seafood purchases and a decline in processed fruit and vegetables, where affordable fresh fruit and vegetables was preferred by consumers to chilled and frozen fruit and vegetables.

- Easy-open closures has overtaken standard can ends in shelf stable meat and seafood.

- Safety and well-established manufacturing capabilities helped to preserve the place of flexible packaging and metal cans in larger categories, such as chilled processed red meat and shelf stable seafood.

- Increasing inflation led to higher unit prices of fresh and packaged fruit and vegetables. A transport strike led to a scarcity of fresh food and vegetables for more than one month and available products were expensive. As such, consumer demand for packaged fruit and vegetables increased for a short period. The net effect on packaging was an decline in 2016.

- Self-standing pouches in prepared baby food boom as they portability and independence.

- Enfamil/Enfagrow offers smaller sizes in folding carton, useful for single or smaller meals by reducing the risk of contamination and increasing portability.

- Other baby food like yogurts for babies helped thin wall plastic containers and peel-off foils.

Outlook

- Total dairy packaging is expected to record a retail volume CAGR of 1% over the forecast period to reach 5.3 billion units in2021.

- Expanding infrastructure of local dairy players will lead to more milk in brick liquid cartons.

- Milk alternatives, margarine and spreads and flavoured milk drinks are expected to record the strongest packaging volume growth in 2016.

- Peel-off foil has proven versatile and is will so during the forecast period. It has traditionally been used in thin wall plastic containers in which yogurt, but is suitable for HDPE bottles.

- Total sauces, dressings and condiments packaging is expected to record a retail volume CAGR of 1% over the forecast period to reach 461 million units in2021

- Total processed meat and seafood packaging is expected to record a retail volume CAGR of 2% over the forecast period to reach 919 million units in2021

- Total confectionery packaging is expected to record a retail volume CAGR of 1% in 2021

- Total processed fruit and vegetable packaging is expected to record a retail volume CAGR of 1% over the forecast period to reach 63 million units in 2021

- Total baby food packaging is expected to record a retail volume CAGR of 3% over the forecast period to reach 82 million units by 2021

- The decline of glass in sauces, dressings and condiments over the forecast period will be cushioned as more expensive sauces, herbs and condiments are expected to regain momentum.

- The relative significance of the largest table sauces categories in terms of will likely lead rigid containers paling against flexible packaging.

- The threats of power shortages will likely remain and is expected to help shelf stable categories and metal food cans to remain in good shape in terms of volume sales over the forecast period.

- Per capita fish consumption is expected to grow at a double digit CAGR over the forecast period.

- After shelf stable meat, frozen processed meat packaging is expected to record the strongest volume CAGR over the forecast period, and will likely be packed mostly in flexible plastic.

- Easy-open can ends in shelf stable meat and seafood is expected to continue to consolidate.

- Frozen processed seafood, mostly packaged in flexible plastic, is expected to be an interesting packaging opportunity due to growing per capita consumption.

- Seasonality is set to continue to mark innovation in confectionery. Other sugar confectionery packaging is expected to record the strongest increase in total retail volume sales. Closures will need to be as innovative as primary packaging.

- The consumption culture of processed fruit and vegetables will likely remain weak, limiting volume sales of its packaging.

- Metal food cans is expected to record strong growth in shelf stable beans, an important part of the local diet.

- The growth in the number of single households and small families will benefit smaller sizes (less than 400g) in processed fruit and vegetables

- The price gap which has limited sales of stand-up pouches is likely to be reduced over the forecast period, bringing more consumers who currently purchase prepared baby food in glass. Glass jars will resist being replaced by pouches, simply because brands use this pack type to offer more expensive products with higher positioning.

- Consumers are expected to become more confident in the newer pack types in milk formula, such as composite containers and folding cartons.