Overview

Packaging Overview

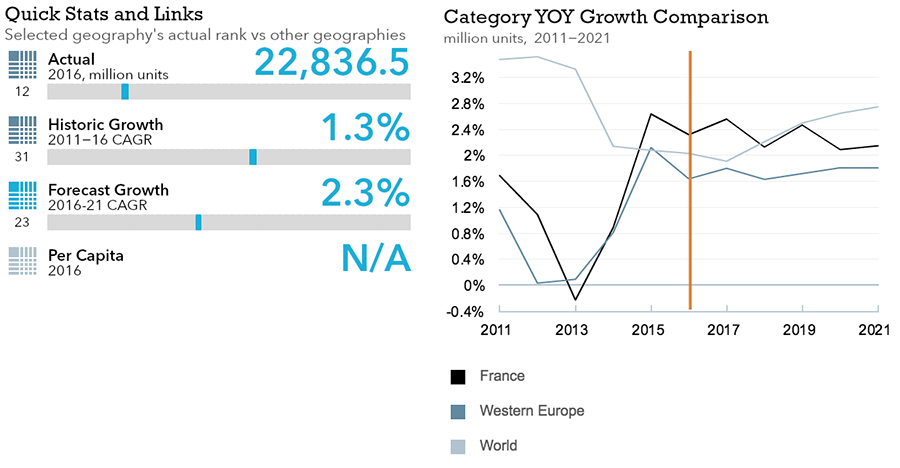

2016 Total Packaging Market Size (million units):

93,579

2011-16 Total Packaging Historic CAGR:

0.4%

2016-21 Total Packaging Forecast CAGR:

0.7%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 22,944 |

| Food Packaging | 63,817 |

| Beauty and Personal Care Packaging | 2,881 |

| Dog and Cat Food Packaging | 2,413 |

| Home Care Packaging | 1,524 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 37,112 |

| Flexible Packaging | 26,475 |

| Metal | 7,808 |

| Paper-based Containers | 9,584 |

| Glass | 9,194 |

| Liquid Cartons | 3,005 |

- Total French packaging market is expected to experience almost current CAGR in 2021, but that number doubles from a low base of 0.4% to 0.7%.

- Food packaging dominates, with beverage packaging far behind.

- Rigid plastic leads in size and growth.

Key Trends

- The cocooning trend increased, with economic uncertainty and reaction to terrorist attacks of 2015 and 2016. This offered opportunities and constraints for packaging: on-trade alcoholic drinks packaging suffered as convenient formats for socializing at home performed well. Sharing packs also benefited in areas such as confectionery and sweet and savory snacks.

Packaging Legislation

- France introduces BPA ban French legislation bans BPA in metal tins and beverage cans in 2015. Alternatives such as acrylic, organosol or polyester lacquer and vinyl were not yet widely used as BPA transitions out.

- Ban on single-use plastic bags The government banned all single-use plastic bags less than 50 microns thick, including biodegradable bags. Plastic bags at least 50 microns in thickness and reusable, for wrapping loose food, disposable bags made of non-plastic material, and plastic bags that are 100% bio-sourced remain legal. It is likely that forecast period legislation will make it mandatory to use biodegradable materials in plastic packaging.

- French authorities perform checks on biocidal products With a focus on fast-moving consumer goods like home insecticides and disinfectants, French authorities checked 600 companies, 28% of whom did not fully conform. The presence of banned active substances and inaccurate or missing labelling, and products that did not meet efficiency tests were most common reasons for failures. Authorities are likely to conduct further checks and renew controls in 2017-2018.

Recycling and the Environment

- Players focus on minimizing waste, sustainable development, over recycling Brand owners and retailers take initiatives to highlight the importance of recycling different pack types to retrieve more raw materials for the production of new packaging.

- Companies in packaged food shift towards local supply Many emphasize products made in France or produced locally.

- Mono-material pack types solve the headache of recycling Brand owners adopt single material simplified packaging to combat rising costs of recycling.

- Packaging manufacturers move towards labels free from mineral oils Concern rises about opaque PET, primarily used for milk and fruit juice, as it can disrupt recycling. Sanctions may be imposed on players using this pack type in the form of additional taxation in 2018.

Packaging Design and Labelling

- Transparent packaging and windows increase in packaged food, reflecting a growing demand for transparency in ingredients, and consumer desire to see food.

- Many consumers idealize a simpler past with tastier, more natural and healthier food. Packaging responded by focusing on vintage or retro styling and materials. More sober and simpler packaging took over in lieu of more eye-catching styles seen earlier in the review period.

- Manufacturers must reconcile consumers' focus on simplicity with increasingly complex labelling requirements, as the range of mandatory information on labels continues to broaden.

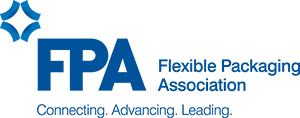

Beverages

Flexible Packaging Landscape

- Total volume sales of alcoholic drinks packaging increase by 1% to reach 7.8 billion units in 2016

- In a market previously accustomed to structural stasis or decline, this improvement stems from the robust growth of 3% in total unit volume sales of beer in 2016

- Packaging volume units in soft drinks increase 3% in 2016 to reach a total of 17.4 billion units

- Hot drinks packaging volume grows 2% to 2.1 billion units in 2016.

Trends

- Metal beverage cans rose 1% in beer, glass bottles rose 4%, were stable in spirits and dropped 3% in wine and bi-polarization continues with bag in box and aluminum/plastic pouches in wine

- Innovation focused on convenience as marketers used small or, conversely, large pack sizes

- Nomadic lifestyles affect volume unit growth of single-portion to outperform larger pack sizes.

- Unfavorable weather negatively affected soft drinks volume sales.

- Soft drinks packaging is innovatively dynamic. For example, multipacks without plastic or linked only with adhesive replaces cumbersome plastic.

- 2016 increased flexible soft drinks packaging, which demonstrated volume growth of 14%. Pouches are easy to take away and provide better storage while soft drinks in cartons and glass declined 4% and 1% respectively. Rigid plastic and metal cans also increased in 2016.

- The on-going development of fresh ground coffee pods and rising tea consumption affects volume growth of paper-based containers and rigid plastic in 2016. Thin wall plastic containers and folding cartons benefited, while glass jars and flexible plastic declined.

- Hot drinks consumers request larger coffee cups during breakfast, increasing pack sizes without affecting single-serve portion trend.

- Plastic pouches represented the fastest-growing pack type in hot drinks in light of consumers’ demand for more convenience.

Outlook

- Total volume sales of alcoholic drinks packaging to record a CAGR of 1% to reach eight billion units in2021 due to the ongoing success of beer, which will see a total volume unit CAGR of 2%.

- Soft drinks packaging set to achieve volume growth of 2% per year on average over forecast period to reach 19.2 billion units in 2021

- Overall total unit volume sees 2% CAGR to reach 2.3 billion units in 2021

- Pod machine systems is likely to be enhanced, with tea particularly popular, as manufacturers reinvent around green, natural, or organic teas, part of a healthy diet.

- Fresh ground coffee pods represent the main contributor to coffee volume growth, is not expected to change over the forecast period, with a 4% volume CAGR expected over 2016-2021.

- Hot drinks packaging bows to ecological awareness. Consequently, plastic stand-up pouches will be the most successful format, achieving 6% primary retail filled volume CAGR over 2016-2021.

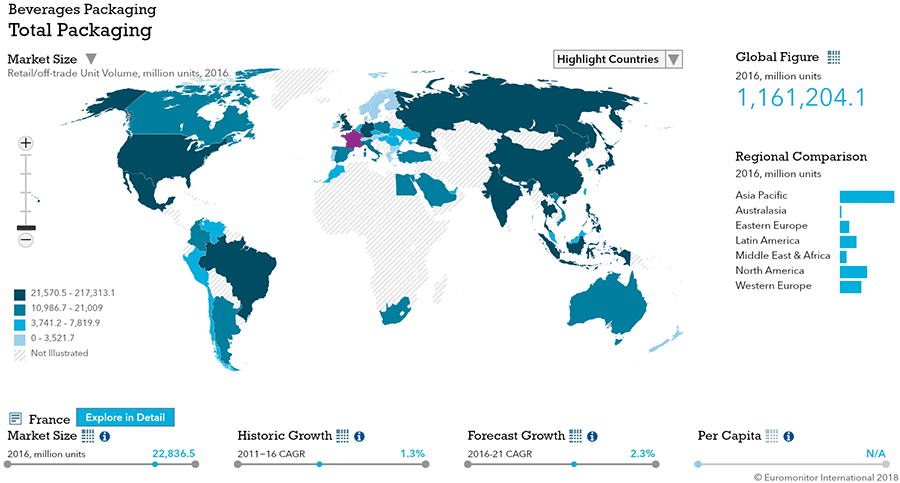

Dog and Cat Food

Flexible Packaging Landscape

- In 2016, dog and cat food primary packaging sees off-trade product volume sales decline 3%

- Aluminium/plastic pouches grew at the cost of metal food cans.

Trends

- Wet cat food metal food cans see a rise in peel-off foil closures to attain 13% of total, though metal food declined.

- Plastic pouches in cat treats and mixers exhibit high growth in 2016.

- Reduced dog and cat populations in 2016 and contrasting performances between dry and wet categories, registered heavy product volume falls in 2016 over dry food.

- Dry dog food is dominated by big bag sizes, while treats and mixers evolved towards reduced pack sizes. On the other hand, smaller sizes are more popular among cat food categories.

Outlook

- Dog and cat food primary packaging is set to register a 3% CAGR decline in off-trade product volume sales over the forecast period to attain 907,000 tons by 2021.

- In 2021, metal food cans will account for only 11% of total dog and cat food packaging, compared to 21% in 2016. The development of aluminium/plastic pouches is set to register heavy growth in all categories, reducing costs for manufacturers.

- Premiumization will continue, as aluminium/plastic pouches offer brand differentiation.

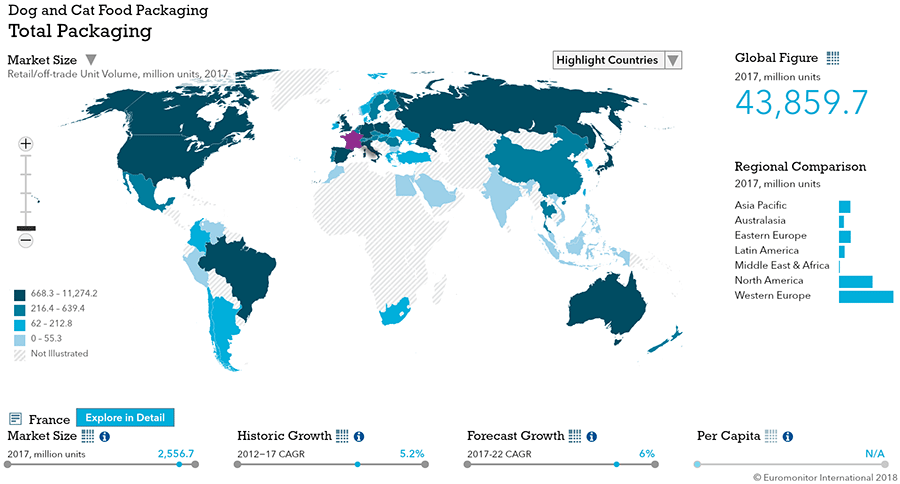

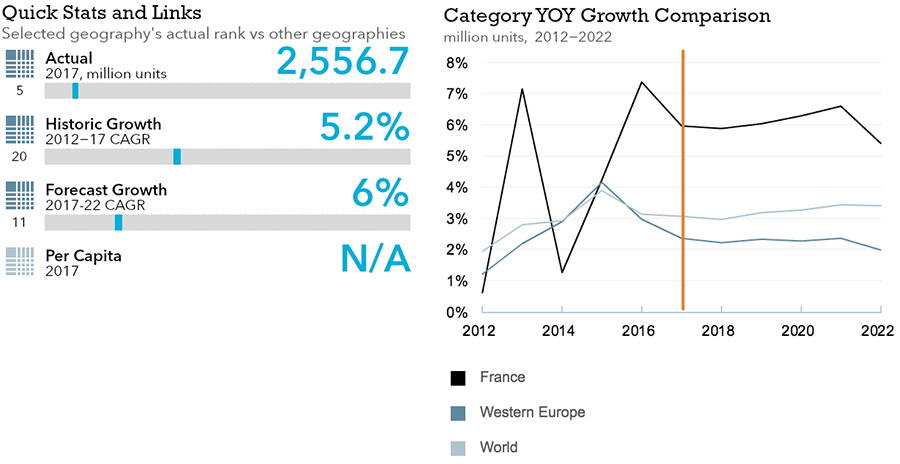

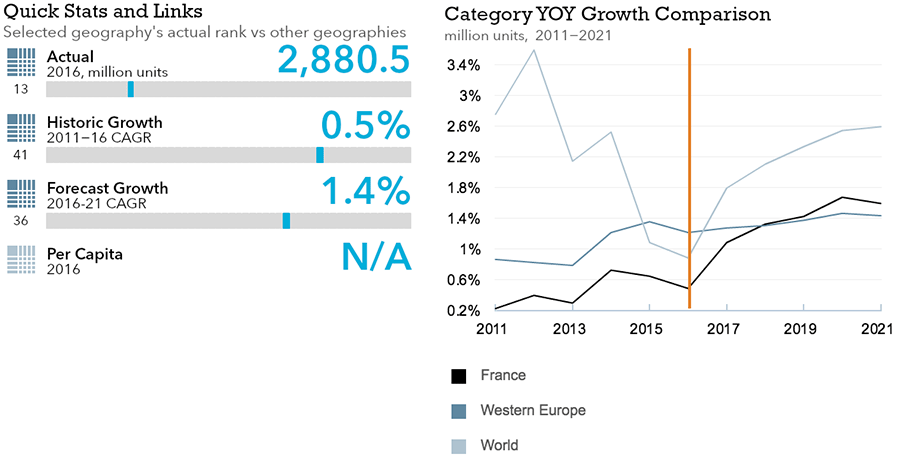

Beauty and Personal Care

Flexible Packaging Landscape

- Less than 1% unit volume growth from 2015 to reach almost 2.9 billion units in 2016.

Trends

- Beauty specialist retailers pioneer mini pack sizes offering on-the-go convenience

- Grocery retailers focus on larger packs as consumers scrutinize unit prices

- Smaller pack sizes see good performance due to convenience for travel, and among baby/child-specific products and sun care. However, there remains little presence in grocery retailers.

- Metal packaging saw good performance with 2% unit volume growth in 2016. Collapsible metal tubes see growth from a low base, with an impressive 7% increase.

- There is a growing focus on convenience within closures - trigger closures perform well in sun care, with an impressive 3% in 2016.

Outlook

- 1% unit volume CAGR expected in forecast period to reach almost 3.1 billion units in 2021.

- Mini pack sizes are expected to see a strong performance, with 50ml and 75ml packs seeing 4% unit volume CAGR.

- Metal will remain the most dynamic pack, seeing over 2% unit volume CAGR

- Within closures, there will continue to be focus on optimizing ease of dispensing. Lotion pumps will be the most dynamic area, seeing 4% unit volume CAGR overall.

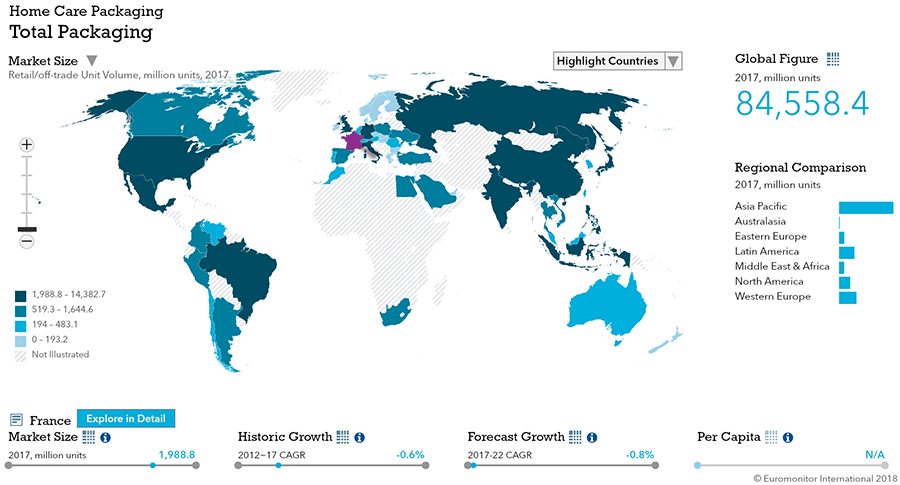

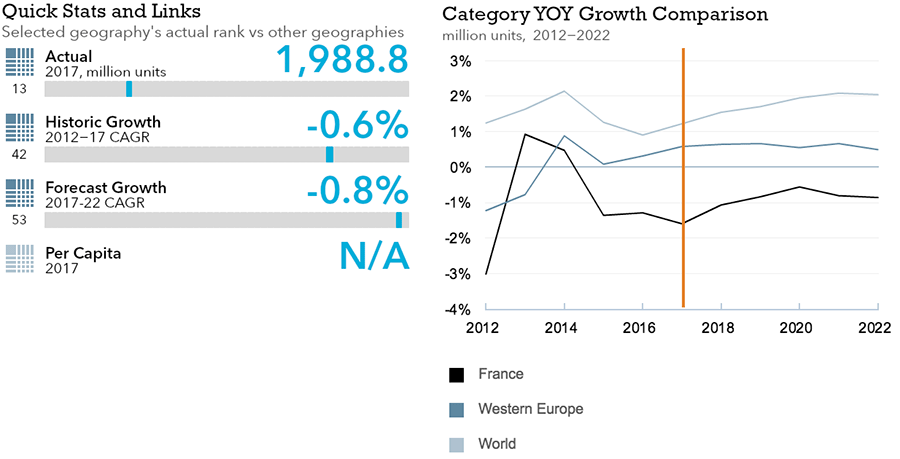

Home Care

Flexible Packaging Landscape

- Home care packaging sees volume decline of 1% to 1.5 billion units in 2016

- Trend towards concentration contributes to decline in volume

- Environmentally-friendly alternatives are gaining ground

- Volume expected to see slight negative CAGR over forecast period.

Trends

- Laundry care and dishwashing are impacted by a transition from concentrated to super- and ultra-concentrated variants.

- The second most significant factor behind the decline in home care packaging volume is the growing preponderance of multi-purpose/versatile products.

- Primary packaging accounted for 97% of packaging volume, as secondary (3% of volume), was further reduced by 1% year-on-year. Industry players try to eliminate unnecessary packaging.

Outlook

- Over the forecast period home care packaging is expected to decline at a CAGR of less than 1%.

- New concentration/compaction recommendations will contribute to reducing the size and volume of packaging; in-store refills and elimination of non-necessary packaging are also expected to diminish volume.

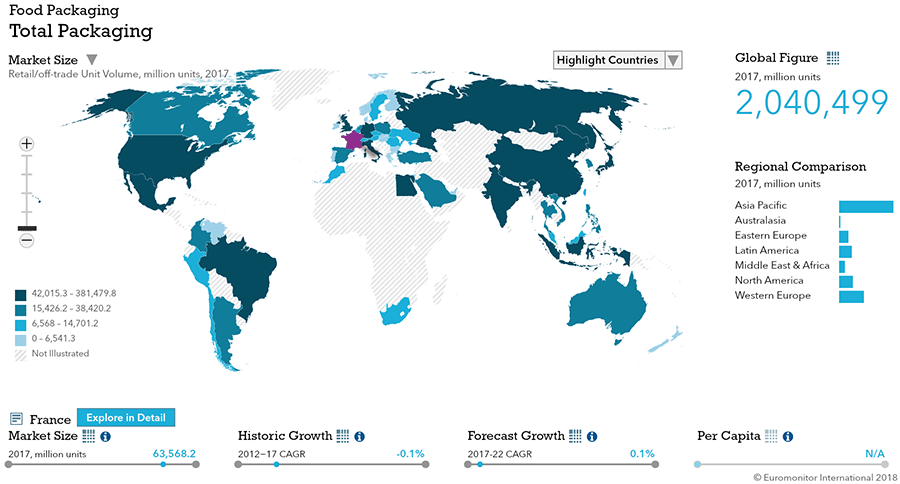

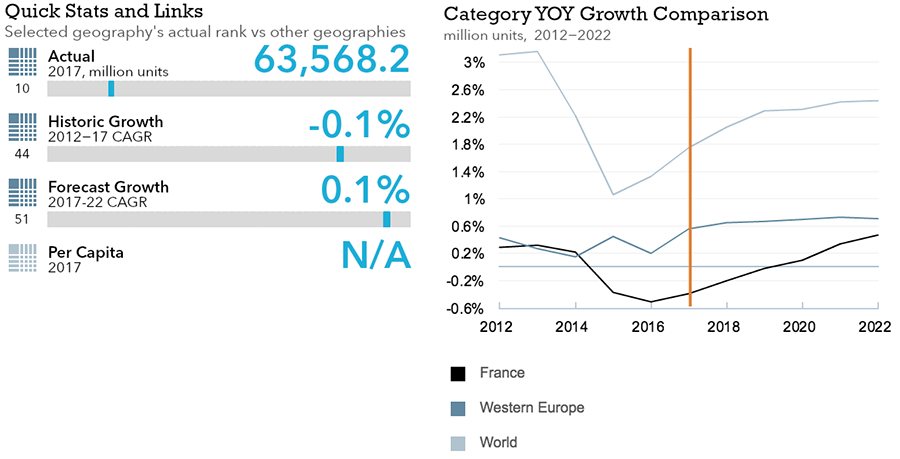

Packaged Food

Flexible Packaging Landscape

- Total retail/off-trade unit volume sales of dairy packaging decline slightly to 24 billion units.

- Packaging retail/off-trade unit volume in sauces, dressings and condiments increases 1%.

- Total retail/off-trade unit volume sales of processed meat and seafood packaging increase slightly to reach 7.1 billion units in 2016.

- Confectionery packaging records static volume growth to remain at 7.9 billion units in 2016

- Total retail/off-trade unit volume sales of processed fruit and vegetables packaging rise by 1% to reach 3.2billion units in 2016.

- Retail/off-trade unit volumes of baby food packaging increase by 3% to 692 million units in 2016.

Trends

- Average dairy weight per unit wanes due to single-serve formats and reducing eco tax.

- Pouches and progression of transparent PET in drinking yogurt and fresh milk bottles and thin-wall containers in yogurt and chilled desserts contribute to this lightening.

- The home cooking trend and need for more convenient formats enable volume sales of sauces, dressings and condiments packaging to grow

- Transparency is the main buzzword in 2016, in the guise of transparent plastic dispensing closures, transparent peel-off foil and the progressive replacement of opaque HDPE bottles with PET bottles. Many mainstream innovations in sauces, dressings, and condiments are packaged in glass jars and glass bottles, which underlines the resilience of glass in the category

- In spite persisting distrust and health warnings about farmed salmon or the carcinogenicity of red meat and processed meat, sales in the category recover in 2016

- Winners in 2016 are PET-based thin wall plastic containers and blister and strip packs and alternatives to declining metal cans, primarily glass jars for foie gras and premium terrines

- Sharing formats perform a bit better than single-portion, due to the ongoing cocooning attitude, a trend which boosts volume sales of plastic stand-up pouches and other rigid containers in chocolate confectionery.

- Due to the mature demand for, and non-modern image of, most products in the category, total primary retail/off-trade product volume stagnates in 2016

- Aluminum/plastic pouches of fruit purées remain the most dynamic packages in volume terms

- Appreciable increases stem from the recovery of baby food from 2015 thanks to reviving consumer confidence and notable success of more convenient pack types

- Plastic and aluminum/plastic pouches see astonishing breakthrough with unit volume growth of 80% and 14% respectively in 2016

Outlook

- Dairy packaging to record unit volume growth of 2% over the forecast period.

- Sauces, dressings and condiments packaging is set to post a unit volume CAGR of 1% over the forecast period to reach a total of 1.8 billion units by 2021.

- Overall unit volume sales of processed meat and seafood packaging are set to register a CAGR of 1% over the forecast period to reach 7.4 billion units in 2021

- Confectionery packaging is set to post a positive volume CAGR of 1% over the forecast period to reach a total of 8.4 billion units

- Processed fruit and vegetables packaging is set to record a volume CAGR of 1% over the forecast period, rising to 3.4 billion units by 2021

- Overall, baby food packaging is set to record a volume CAGR of 3% over the forecast period, reaching 788million units by 2021