Overview

Packaging Overview

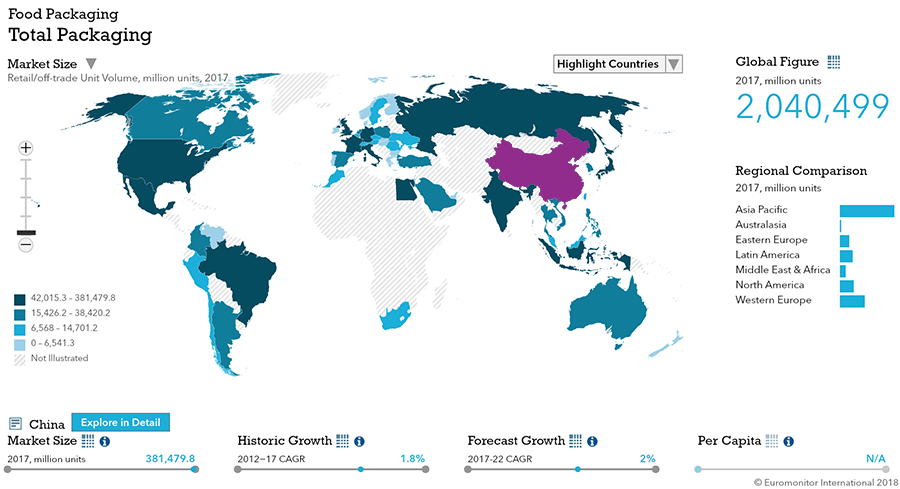

2016 Total Packaging Market Size (million units):

639,388

2011-16 Total Packaging Historic CAGR:

3.6%

2016-21 Total Packaging Forecast CAGR:

2.2%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

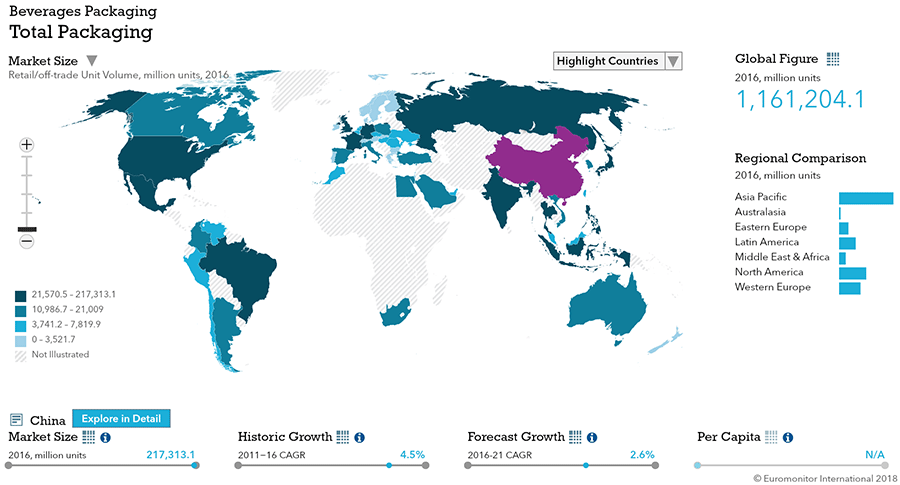

| Beverages Packaging | 232,478 |

| Food Packaging | 379,774 |

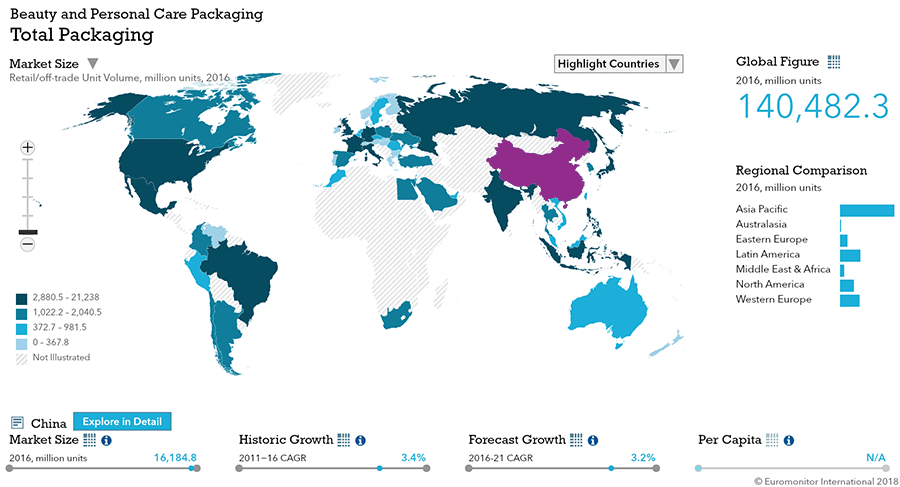

| Beauty and Personal Care Packaging | 16,185 |

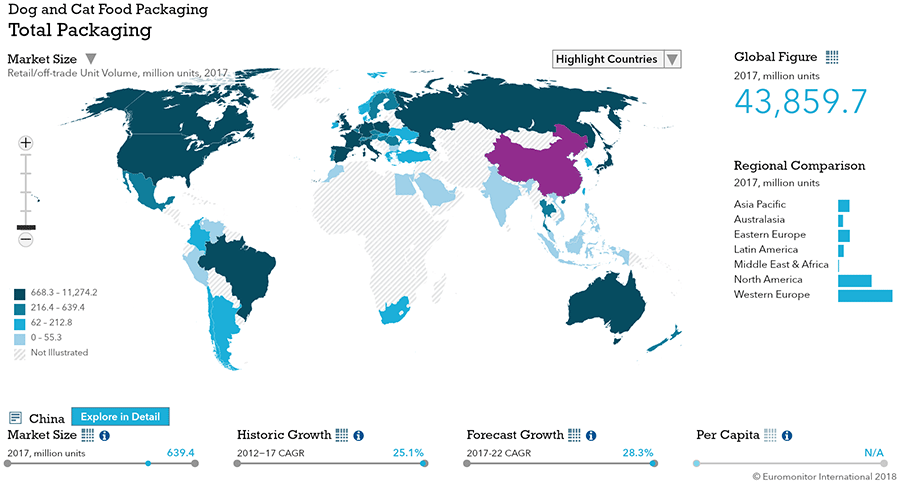

| Dog and Cat Food Packaging | 482 |

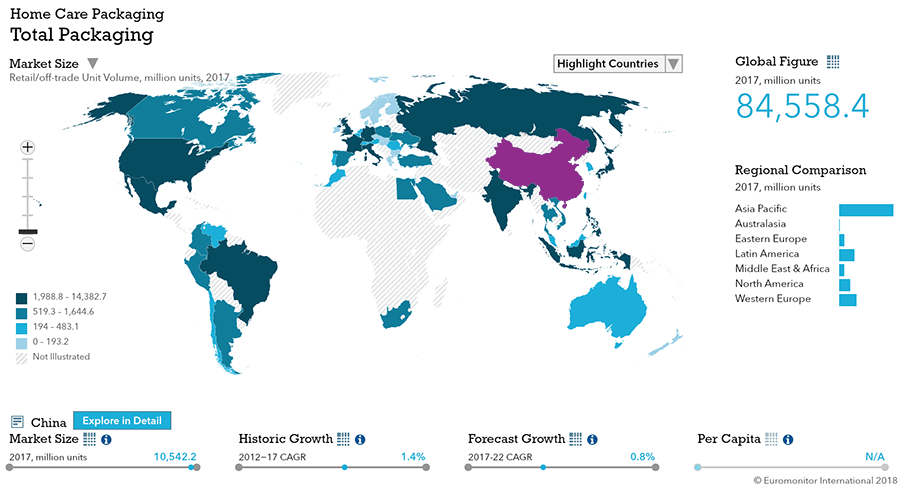

| Home Care Packaging | 10,469 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 188,694 |

| Flexible Packaging | 227,421 |

| Metal | 47,464 |

| Paper-based Containers | 37,774 |

| Glass | 59,572 |

| Liquid Cartons | 76,238 |

- China’s robust packaging industry is expected to see declining growth over the forecast period of only 2% CAGR by 2021, lower than the current 3.6% CAGR.

- Food and beverage packaging are dominate packaging with expected growth over the forecast period.

Key Trends

- Large and small packs are expected to register healthy growth to meet demand from mass consumers. Lower-tier cities and rural areas will remain price sensitive, attracted by large pack sizes. On the other hand, first-tier city consumers will prefer small pack sizes for freshness.

- Chinese consumers embrace simple and convenient packaging in beauty and personal care.

Packaging Legislation

- Drinking water regulation mandates bottled water labelling National Food Safety Standard Packaged Drinking Water requires packaged water to be labelled “water” with no other terms [i.e. “mineral.”] In addition, food additives must be labelled as such next to the product name.

- Manufacturing standard of food contact materials Requires manufacturers to implement product trace and recall systems to better protect consumers unqualified packaging products.

Recycling and the Environment

- Self-service technology in soft drink packaging recycling system TOMRA Sorting Solution modernizes Chinese recycling, producing food grade PET material and launching smart recycling machines for plastic and glass bottles, and aluminum beverage containers in Beijing in 2016.

- Tea package evolves from deluxe to low carbon China’s crackdown on lavish spending and gift giving flattened deluxe tea gift pack sales, which led a shift from heavy and luxurious to light, eco-friendly, and low carbon packaging.

- Green beer package Emerges A new 100% biodegradable pack type reduces waste. Additionally, there is an electronic device embedded with Radio Frequency Identification (RFID) chips, helping consumers identifying product authenticity.

Packaging Design and Labelling

- Beauty and personal care packaging with DIY elements and customization gains popularity.

- Soft drinks products with labelling covering the whole PET bottle have become popular. Fully wrapped bottles leave more surface area for graphic design, presenting opportunities for integrated packaging that can build a high-end image.

- Dairy packages with colorful designs and innovative materials add value for consumers.

Beverages

Flexible Packaging Landscape

- Alcoholic drinks packaging declined 2%, reaching 108.8 billion units as consumers purchased higher quality products in lower volumes

- Total soft drinks packaging volume grew by 3% in 2016 to reach 169.4 billion units

- Total hot drinks packaging retail volume sales grow by 2% in 2016 to reach 14.8 billion units.

Trends

- Glass bottles held 80% share of alcoholic drinks packaging yet continue to lose share to metal and other packaging due to transportation inefficiency. Metal bottles recorded the fastest growth at 62%, thanks to the limited editions beer and grew 5% in soft drinks packaging.

- Rigid plastic packaging, used mainly for economy beer, rice wine, and Baijiu (other spirits), declines as rising manufacturing costs eat into profit margins resulting in reduced production of PET or HDPE packaged products. PET bottles remained dominant in soft drinks with total volume share of 77%, and CAGR growth of 3%.

- Limited edition packaging retained popularity in beer and RTDs, attributed to young consumers’ self-expression and unique feminine designs targeting female consumers.

- Plastic screw closures remained the dominant closures type in soft drinks packaging with total unit volume sales share of 96%.

- Smaller-sized board tubs grew as instant tea and grain milk tea gain popularity.

- Thin wall plastic containers are the most dynamic hot drinks pack type at 64% growth thanks to demand of fresh ground coffee pods as consumers switch from instant coffee.

- Instant tea lost ground to fresh milk tea sold at street stalls amd grain milk tea remained popular thanks to perceived health benefits. Grain milk tea includes a grain bag, which means higher production costs. Some manufacturers have recently reduced pack sizes to cut costs.

- Due to anti-corruption policies and a ban on using public funds to buy gifts, demand for super premium tea products declined during the review period. This had a negative impact on metal tins, the main pack type used for high-end tea products. Retail unit volume sales of folding cartons in tea grew strongly over the review period. Compared with plastic-based pack types, folding cartons have the advantage of being more eco-friendly, as they are recyclable.

Outlook

- Alcoholic drinks packaging is expected to remain stable in volume terms over the forecast period, standing at 109.0 billion units in 2021.

- Total volume growth of alcoholic drinks is predicted to be negatively impacted premiumization, though primary and secondary packaging is expected to remain stable over the forecast period.

- Metal is projected to be the fastest-growing alcoholic drinks pack type at a CAGR of 3% in 2016 to 2021 as plastic packaging loses over the forecast period.

- Soft drinks packaging volume sales are expected to grow at a CAGR of 4% over the forecast period to reach 205.3 billion units in 2021.

- Metal is expected to be the most dynamic pack type within soft drinks. PET bottles will remain dominant as bottled water and RTD tea remain the leading soft drinks product types.

- Total unit volume sales of glass bottles in soft drinks packaging are expected to decline to a negative CAGR of 4% as the format loses ground to rigid plastic and metal.

- Other plastic closures will be among the most dynamic formats in soft drinks closures over the forecast period. Compared with plastic screw closures, other plastic closures provide greater convenience for consumers.

- Demand for not from concentrate 100% juice products will grow, creating new opportunities for rigid plastic bottles, which are expected to record a CAGR of 16% over the forecast period.

- Total hot drinks packaging are expected to grow at CAGR of 2% over the forecast period.

- Aside from increasing consumption of RTD alternatives (RTD tea, RTD coffee etc), growth in packaging will be restricted as consumers switch to buying hot drinks from on-trade operators

- Zip/press closures are expected to become more popular in hot drinks packaging over the forecast period.

- Despite the rapid expansion of fresh coffee, tea will remain the most important category in terms of the further development of hot drinks packaging as a whole over 2016-2021.

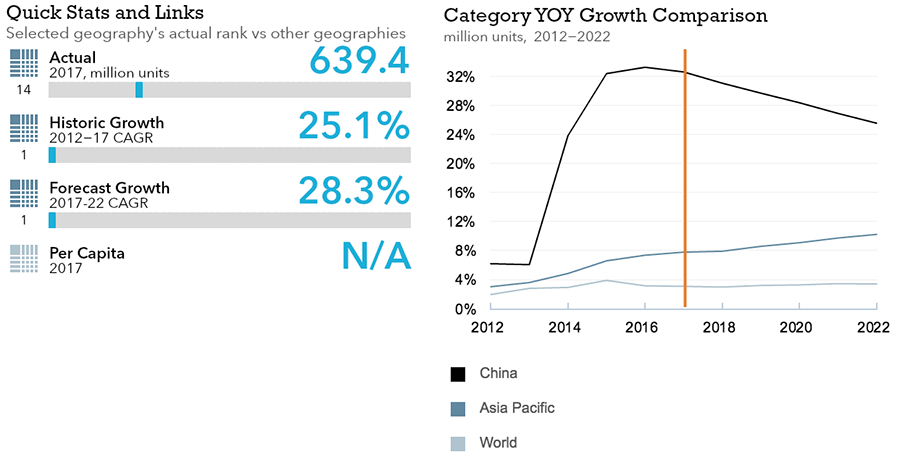

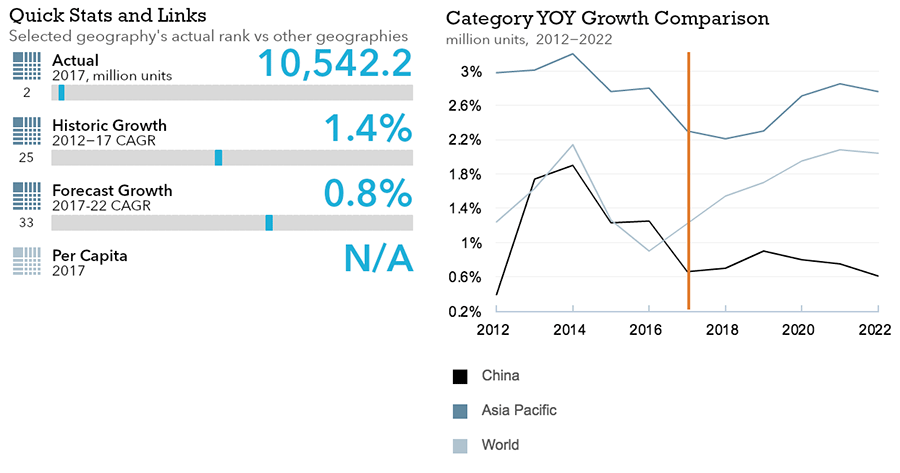

Dog and Cat Food

Flexible Packaging Landscape

- Total dog and cat food packaging retail unit volume sales increase 8% to 274 million units.

- Larger pack sizes for dog and cat food perform well in2016, due to the boom in internet retailing.

Trends

- Flexible packaging represented 73% of total volume sales, enjoys 8%.

- Cat food in stand-up pouches grew 9%. Stand-up pouches with re-sealable zip/press closures enjoyed growth of 11% and 9% for dog treats and mixers and dry dog food, respectively.

- Aluminum trays with peel foil closures grew 7% and 6% for wet dog and cat food, respectively.

- Dog and cat food trends towards larger pack sizes due to internet retailing, with flexible packaging in 10-15kg pack sizes of dry dog and cat food growing the fastest in 2016.

- Closures accounted for a higher percentage of dry cat and dog food packaging, at 87% and 90% respectively. Easy-open can ends led and Zip/press closures ranked second, growing 9% in 2016.

Outlook

- Total dog and cat food packaging is expected to reach a forecast volume CAGR of 8%.

- Flexible packaging is expected to remain the mainstay, driven by low cost and suitability for dry and wet pet food. The rich variety meets diverse needs for pet food and products. Convenient features such as zip/press closures are likely to boost flexible packaging types such as pouches.

- Dog and cat food in metal is expected to record a retail volume CAGR of 7%, In spite of a healthy outlook, metal packaging is likely to be outpaced in forecast volume growth by total packaging.

- Dry cat food in paper-based containers is expected to continue declining, with negative volume CAGR of 5%.

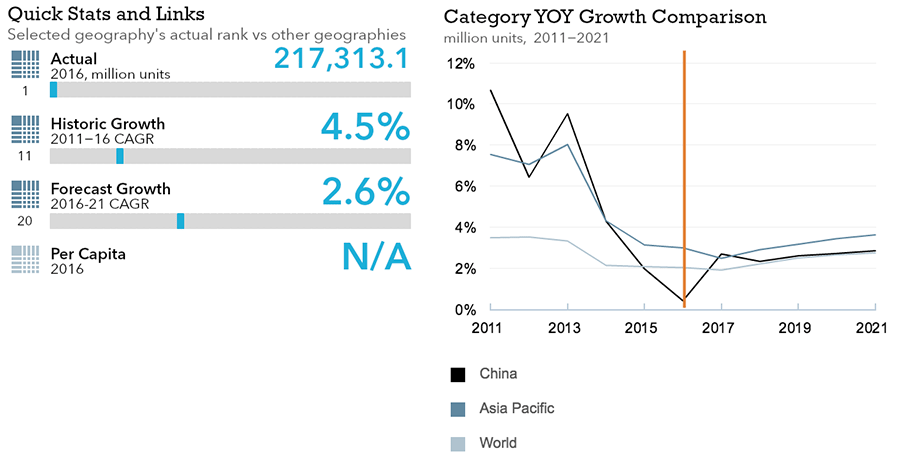

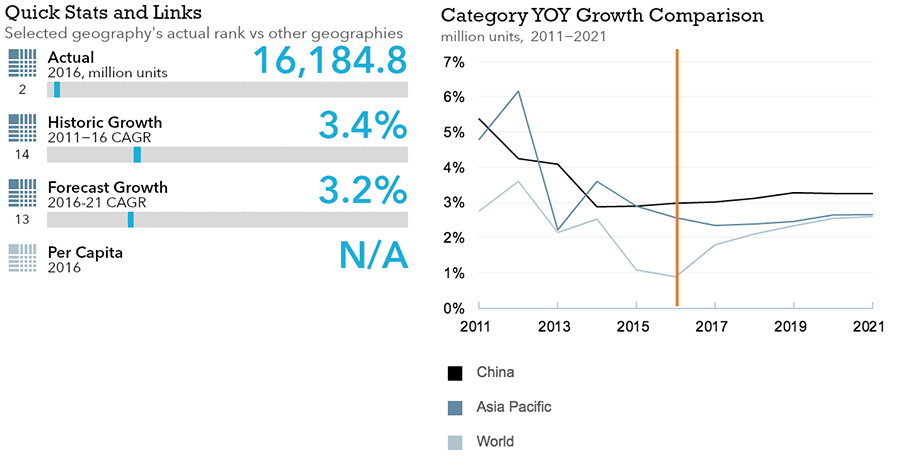

Beauty and Personal Care

Flexible Packaging Landscape

- Beauty and personal care packaging registers growth of 3% to reach 16.3 billion units in 2016.

Trends

- More beauty and personal care brands adopt small-sized packaging and lotion pumps closures expand to toothpaste indicating growing demand for easy-to-use closures

- Small sizes prevailed in multiple beauty and personal care categories.

- Lotion pumps closures was among the stronger performers, reflecting the convenience trend.

- Manufacturers offered diversified packaging tailored to different channels, such as large packages for hypermarkets and supermarkets or sets/kits for personal care products.

Outlook

- Beauty and personal care packaging is expected to register a total retail volume CAGR of 3% to reach 19.1 billion units in 2021.

- Packaging with intelligent technology is expected trend. For example, QR codes enable consumers to track and identify counterfeits and obtain basic information like ingredients. QR codes also allow direct communication between brands and consumers.

- Sets/kits are expected to trend and register fast growth in beauty and personal care.

- Small-sized products will remain popular over the forecast period as business trips and foreign travel increase and mass or masstige brands use small sizes for promotion.

- Package design with DIY elements or limited edition concepts will reshape consumers’ perceptions as costumizable packaging for beauty and personal care products gains popularity.

Home Care

Flexible Packaging Landscape

- Home care packaging sees retail volume growth of 1% to 10.5 billion units in 2016.

Trends

- Plastic pouches with plastic screw closures gain popularity for convenience and price advantage

- PET bottles gain share in hand dishwashing and transparent plastic screws show dosage accuracy in liquid detergents

- Bottled home care products are relatively higher priced as compared to plastic pouches, leading consumers to choose plastic pouches when purchasing refill, launched by manufacturers to increase brand loyalty. Companies added plastic screw closures to plastic pouches to help solve overflow and storage problems and address complaints about accurate dosage.

- Mini-sized products gained popularity for use when travelling.

- Consumers seeking value went for larger sizes in home care products like laundry care and dishwashing. For manufacturers, large packs represent higher profitability due to lower packaging costs.

Outlook

- Home care packaging is expected to grow by a CAGR of 1% over the forecast period.

- Considering high delivery costs from heavy weight and large volume of standard laundry detergents, concentrated products will gain popularity.

- PET bottles are expected to continue to gain share over the forecast period as consumers favor home care products with transparent PET packaging that allows them to view the contents.

- Consumers often use automatic washing machines featuring automated detergent dispensers. Manufacturers may develop small packs designed in tablet format to accommodate this.

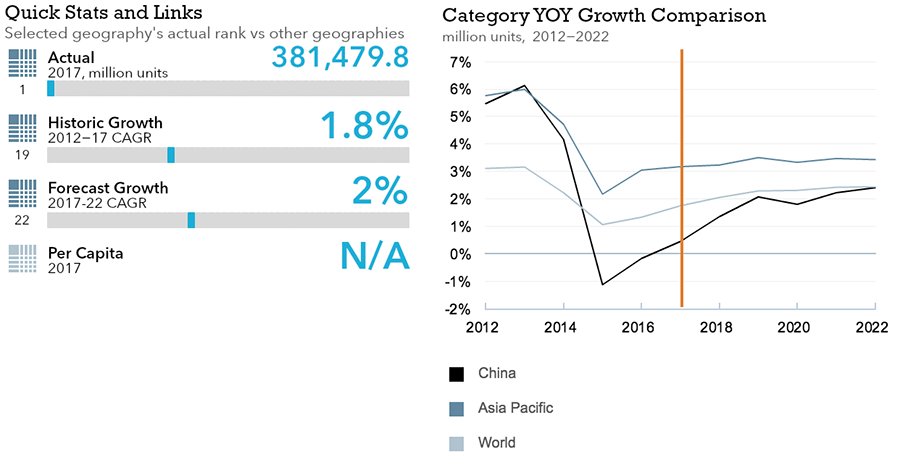

Packaged Food

Flexible Packaging Landscape

- Dairy packaging registers total retail volume growth of 3% to reach 129.7 billion units in 2016.

- Sauces, dressings and condiments packaging registers total growth of 6%

- Processed meat and seafood packaging registers negative total retail volume growth of 5%

- Confectionery packaging registers negative total retail volume growth of 3% in 2016

- Processed fruit and vegetables packaging registers total retail volume growth of 5%.

- Baby food packaging registers total retail volume growth of 7% to reach 2.6 billion units in 2016

Trends

- Rising demand for shelf stable yogurt benefits shaped liquid cartons.

- Plastic pouches gain popularity among yogurt products.

- Dairy manufacturers seek new packaging innovations for differentiation.

- Growth for sauces, dressing, and condiments slows due to demand for healthier, fresher food.

- PET bottles continues to witness robust growth in soy sauces in 2016, outpacing glass bottles.

- Small/medium sauces, dressings and condiments packaging sizes gain share due to growth in single-person households decreasing household sizes.

- Flexible plastic packaging dominates in different categories of processed meat and seafood.

- Thin wall plastic containers is a notable innovation in chilled processed seafood.

- Packaging volume experiences negative growth due to maturity in confectionery and growing consumer demand for healthy diets in China.

- Premiumization leads to greater use of plastic pouches and experimental adoption of glass bottles in confectionary packaging.

- Gift packaging in confectionery witnesses significant innovation through crossover with fashion brands in response to mization and to upgrade brand identity.

- Small packs gain share of confectionary packaging because of increased demand for convenient, portable food and growing awareness of portion control.

- Glass jars continue to dominate shelf stable fruit while metal food cans remains the most popular packaging type in shelf stable vegetables

- Thin wall plastic containers gain share in shelf stable fruit

- Packaging innovation was limited due to lack of awareness among local manufacturers

- The rising quantity of imported baby food leads to more diverse pack types

- In baby food packaging consumers do not quickly become familiar with innovative packaging, thus innovation was minimal in 2016.

Outlook

- Dairy packaging is expected to register a total retail volume CAGR of 4% over the forecast period to reach 158.2 billion units in 2021.

- Sauces, dressings and condiments packaging is expected to register a total retail volume CAGR of 5% over the forecast period to reach 14.5 billion units in 2021

- Processed meat and seafood packaging is expected to register a negative total retail volume CAGR of 2% over the forecast period to reach 20.1 billion units in 2021

- Confectionery packaging is expected to register a total retail volume CAGR of 1% over the forecast period to reach 41.9 billion units in 2021

- Processed fruit and vegetables packaging expected to register a total retail volume CAGR of 5% over the forecast period to reach 1.2 billion units in 2021

- Baby food packaging is expected to register a total retail volume CAGR of 9% over the forecast period to reach 4.0 billion units in 2021

- Multipacks containing small-sized products are expected to become popular in dairy packaging.

- Awareness of the nutritional value of dairy products such as probiotic drinks increased, among Chinese consumers. This is expected to drive up the share of rigid plastic and HDPE bottles.

- Traditional dairy products introduced plastic pouch packaging targeting young consumers, especially children. This pack type is expected to gain popularity over the forecast period.

- Although glass bottles remained dominant in soy sauces over the review period, PET bottles are expected to become more pervasive, particularly at the low-to-middle end of the category due to lower cost and high pressure resilience

- Glass bottles, with a premium look, high stability and airtight capability, are set to remain primary premium packaging for higher-end products and brands for sauces, dressings and condiments that require long-term airtight storage.

- Plastic pouches anticipate dynamic growth, thanks to usage in Western-style sauces, dressings and condiments and vacuum flexible plastic are expected to dominate shelf stable processed meat and seafood packaging over the forecasted period.

- For snack products, packaging is expected to prioritize portability, sharing and fun, which will contribute to smaller pack sizes and creative pack designs.

- Seasonal confectionery packaging such as metal tins, thin wall plastic containers, and folding cartons is expected to register healthy growth over the forecast period.

- There is less potential for packaging innovation in shelf stable fruit and vegetables due to local players’ focus on manufacturing over branding. Traditional packaging is expected to retain a dominant share.

- Thin wall plastic containers are expected to gain share in shelf stable fruit, while plastic pouches are set to become more pervasive in packaged dried fruit

- A future trend in baby food packaging will be plastic dispensing closures with a scoop. The scoop offers more accurate measuring and dispensing of the product.

- Liquid milk formula is a comparatively new product and has changed feeding habits fundamentally. The packaging is different from existing dairy products as it comes with a nipple to feed the baby, a material which must be sterilized and capable of being reheated. New players are expected to enter the infant formula ready-to-feed category, which will lead to the introduction of innovative packaging.