Overview

Packaging Overview

2016 Total Packaging Market Size (million units)

112,722

2011-16 Total PackagingHistoric CAGR

0.5%

2016-21 Total Packaging Forecast CAGR

1.9%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 47,324 |

| Food Packaging | 57,650 |

| Beauty and Personal Care Packaging | 4,533 |

| Dog and Cat Food Packaging | 448 |

| Home Care Packaging | 2,767 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 33,044 |

| Flexible Packaging | 40,762 |

| Metal | 13,405 |

| Paper-based Containers | 5,998 |

| Glass | 13,736 |

| Liquid Cartons | 5,776 |

- The total Mexican packaging industry, sized at over 112 bn units in 2016, is expected to see moderate growth.

- Food and beverage packaging continues to dominate packaging, but dog and cat food packaging presents a strong niche growth opportunity.

- Flexible packaging leads in size, and rigid plastic ranks second.

Key Trends

- Following the implementation of a tax on high-calorie packaged foods in 2014, packaged food manufacturers are continuing to offer smaller pack sizes to keep prices from rising.

- Similarly, beverage manufacturers are offering smaller pack sizes and returnable packaging as a means of offsetting the Mexican government’s tax on sugar-sweetened beverages.

- In beauty and personal care, squeezable plastic tubes are becoming more popular, particularly for oral care and skin care products.

Packaging Legislation

- New labelling requirements for packaged food and beverages: As of July 2015 packaged food and beverage labels must show products’ saturated fat, other fats, sugar sodium and calorie contents, in that order, on the front face of the package.

- Regulations on alcoholic drinks labelling and packaging: With the aim of improving product traceability and curbing illegal alcohol sales and tax evasion, Mexico now requires that alcoholic drinks labelling include a batch number ID and that alcoholic drinks be packaged in glass, PET, aluminum, laminated cardboard or stainless steel kegs. The Ministry of Health must approve the use of any other packaging materials.

- Strict requirements for beauty and personal care and home care product labelling: The law known as NOM-141-SSA1-2012 enumerates specific requirements for beauty and personal care product labels, including that the product denomination be in Spanish and that the label show the brand owner name and address, country of origin, production batch code. Additionally, product contents must be visible on the main packaging face and the label must show usage instructions or the phrase “read attached instructions and list ingredients in quantitative decreasing order. Products that pose health risks or are corrosive or flammable must be packaged in child-resistant containers. Solid tablets for air care or toilet care, for example, must also be sold in child-resistant packs.

Recycling and the Environment

- Mexico is the global leader in PET recycling: In 2015 Mexico remained the global leader in PET recycling, according to the non-profit Ecología y Compromiso empresarial, recycling 60% of the PET bottles used in the country.

- Returnable bottles become more popular for carbonated beverages and beer: Facing a tough economic environment and while still adjusting to the tax on sugar-sweetened beverages, during 2015 consumers favoured the use of returnable beverage packaging. By saving on the packaging, consumers were able to maintain their consumption without increasing their previous spending.

- Sustainability is gaining traction in packaging: Packaging materials have become an interesting opportunity for companies that wish to share with their consumers their engagement with the environment. Over the review period, several companies developed new pack types using recycled or biodegradable materials. Over the forecast period, the shift towards environmentally friendly packaging is expected to gain steam as companies look for ways to decrease their environmental impact and consumers become increasingly aware of the positive impact they can have on the environment by choosing these types of products.

Packaging Design and Labelling

- Shrink sleeve labelling becoming more popular: Over the review period, the use of shrink sleeve labelling became increasingly visible as manufacturers found it easier to modify their colours and designs in this plastic material versus developing new printed designs or colours for bottles, which usually require more sophisticated equipment.

- Characters on packaging help sell child-specific products: Packaging and labelling featuring popular characters continue to be an effective endorsement for brands to attract the interest of children in child-specific products. Although there are also baby-specific products that add characters and drawings that are attractive for children, the use of characters is less common than amongst child-specific products.

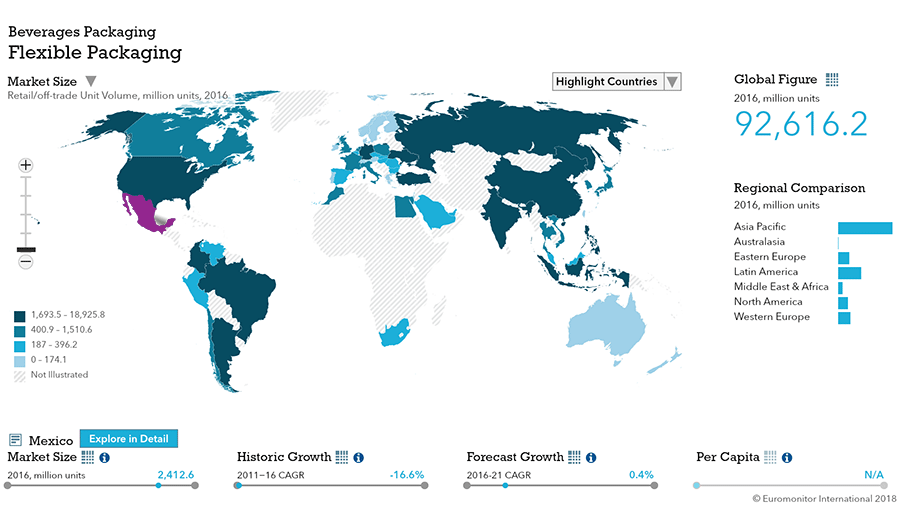

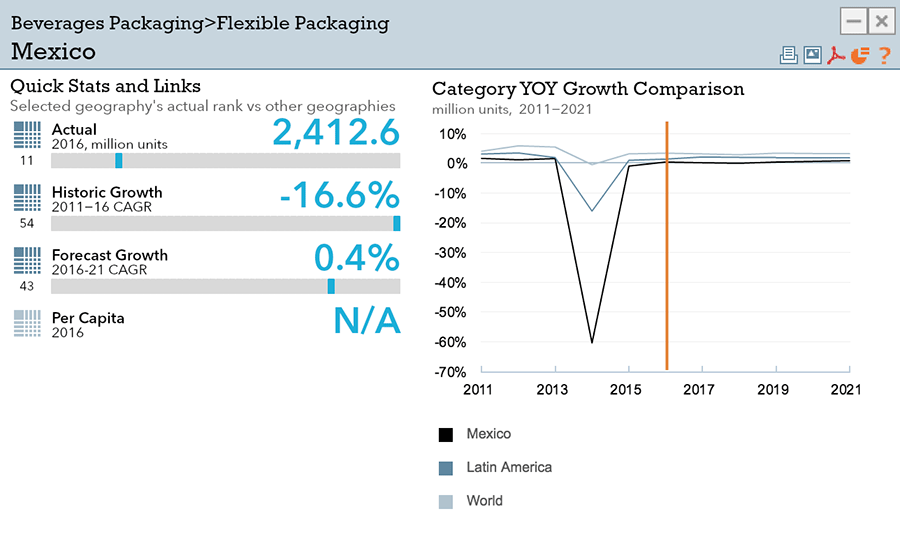

Beverages

Flexible Packging Landscape

- Total Mexican beverage packaging volume is expected to see strong 2.4% CAGR growth through 2021.

- Flexible beverage packaging is expected to see limited volume growth through 2021 at a 0.4% CAGR.

Trends

- In soft drinks, PET bottles are the most common packaging type, but the increasing popularity of coconut water in Mexico fuelled strong growth in brick liquid cartons in 2016.

- In hot drinks, glass remains the leading packaging type due to the popularity of instant coffee, but volume sales of folding cartons and metal tins registered strong growth in 2016, fuelled by robust sales of fresh ground coffee pods, which are sold in those packaging types.

- In alcoholic drinks, glass bottles dominate, but paper-based containers became more popular as secondary packaging for spirits in 2016.

Outlook

- In soft drinks, PET bottles are the most common packaging type, but the increasing popularity of coconut water in Mexico fuelled strong growth in brick liquid cartons in 2016.

- In hot drinks, glass remains the leading packaging type due to the popularity of instant coffee, but volume sales of folding cartons and metal tins registered strong growth in 2016, fuelled by robust sales of fresh ground coffee pods, which are sold in those packaging types.

- In alcoholic drinks, glass bottles dominate, but paper-based containers became more popular as secondary packaging for spirits in 2016.

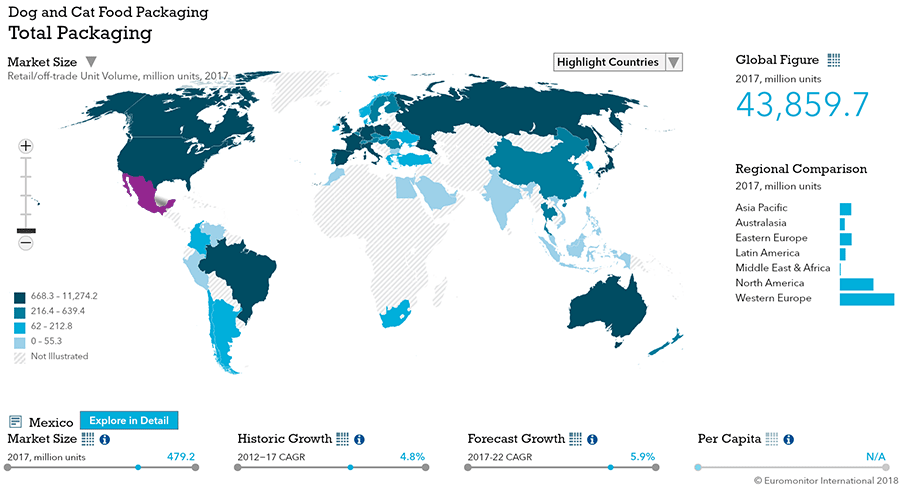

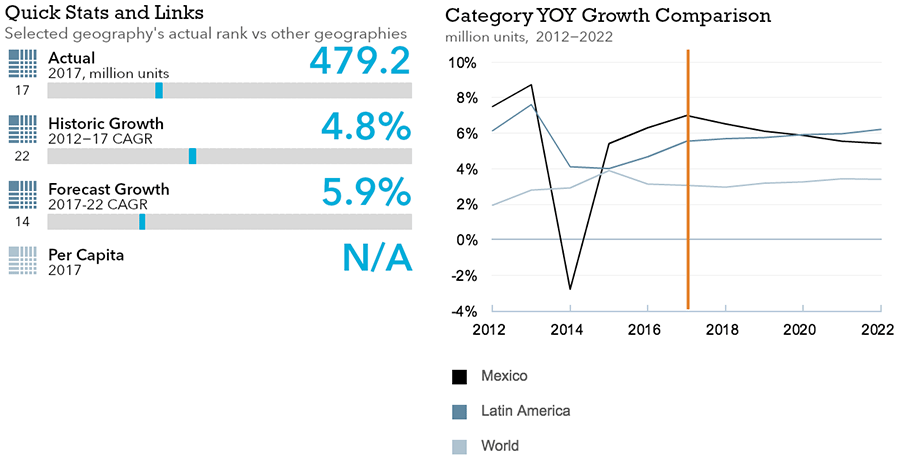

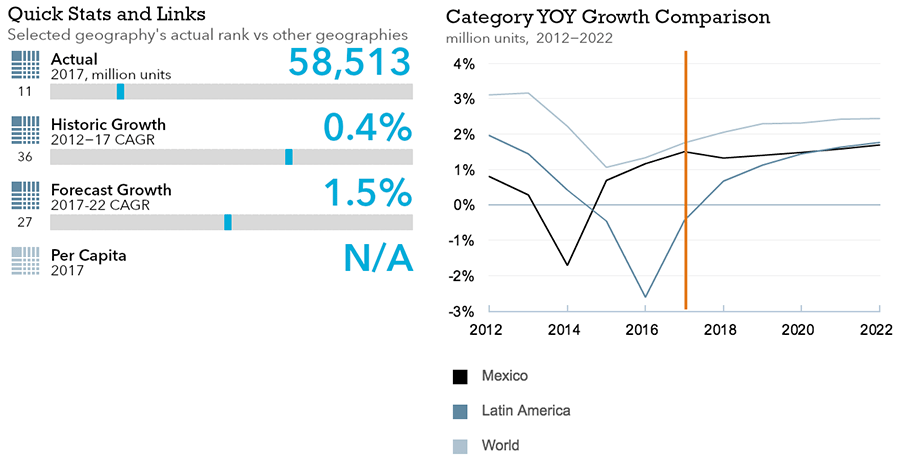

Dog and Cat Food

Flexible Packaging Landscape

- Total Mexican dog and cat food packaging volume is expected to see strong 5.9% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see slightly slower but still strong 5.3% volume CAGR growth through 2022, outpacing the global flexible dog and cat food packaging market as a whole.

Trends

- Unit volume sales increased by 5% in 2016 as Mexican consumers continued to increase spending on pet food and manufacturers launched new products and widened their distribution.

- Pouches in sizes of 100g or smaller continued to gain popularity in wet dog food in 2016. This trend was supported by the success of recently launched products from mid-priced brands like Pedigree and Purina Dog Chow, as well as by improvements in the distribution of such packs via convenience stores (especially the OXXO chain) and independent small grocers.

Outlook

- Packaging volume is expected to grow at a 5% CAGR though 2021, driven by the launch of new brands and products, as well as by the increasing preference among pet owners for products that offer greater convenience, higher quality ingredients, more sophisticated flavors, etc. While many dog and cat owners will continue to buy larger bulk packs to save time and money, smaller presentations will continue to gain popularity among consumers who have limited storage space or want to try out different brands without spending too much money.

- Brick liquid cartons volume sales in dog treats and mixers is projected are projected to perform the best through 2021, growing at a 22% CAGR, followed by aluminum/plastic pouches in wet dog food at an 18% CAGR.

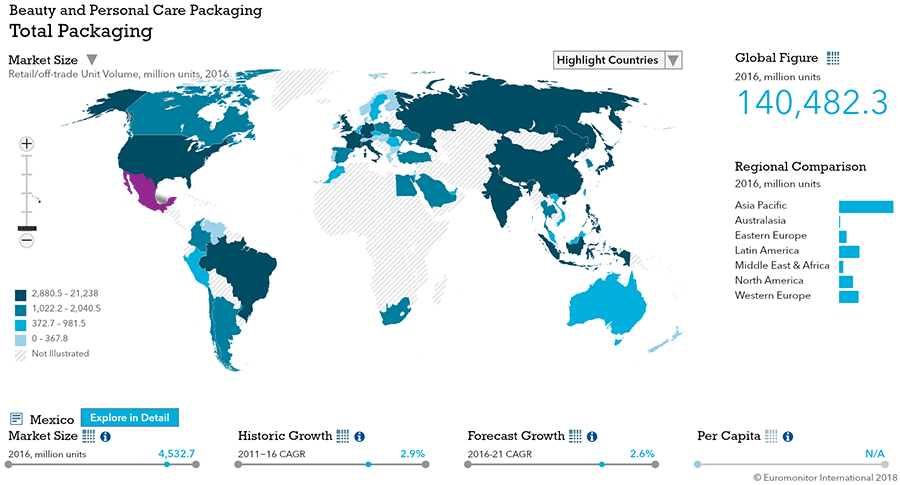

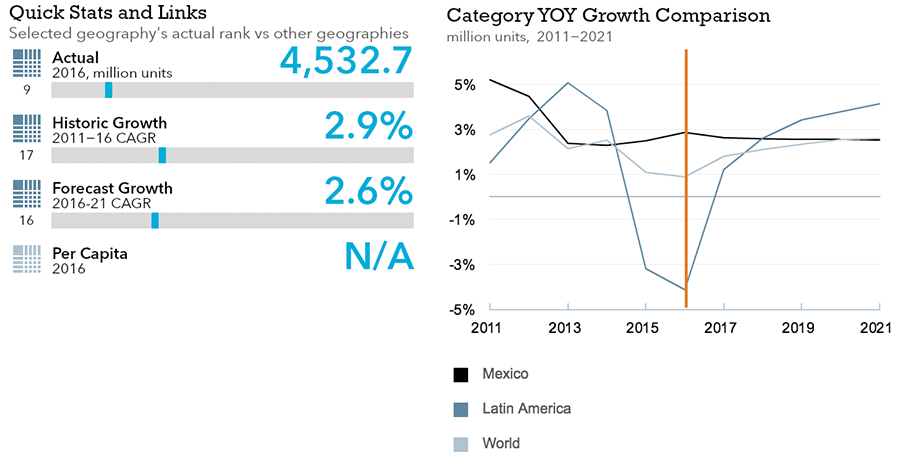

Beauty and Personal Care

Flexible Packaging Landscape

- Total Mexican beauty and personal care packaging volume is expected to see strong 2.6% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see slightly slower 2.1% CAGR growth 2021.

Trends

- Rigid plastic remained the leading pack type in beauty and personal care packaging in 2016, with a 44% share of total packaging retail volume sales with its 2.1 billion units.

- In 2016, paper-based containers posted healthy 3% growth, driven by increased demand for premium color cosmetics, skin care and fragrances, which commonly use paper-based containers as secondary packaging.

- In Mexico, the main closure type in beauty and personal care is plastic dispensing closures. Plastic dispensing closures are mainly used for toothpaste and standard shampoos, but the closure type is also used for conditioners, colorants, baby and child-specific hair care and other products.

Outlook

- Total beauty and personal care packaging is set to see a 3% retail volume CAGR over the forecast period to reach 5.5 billion units in 2021, driven primarily by increasing demand from a growing population.

- Despite a growing number of environmentally aware consumers in Mexico, they continue to represent a small group. Therefore, leading premium brands are expected to continue to offer folding cartons as secondary packaging of most products, with the goal of communicating sophistication and higher quality. As a result, paper-based containers is projected to see a 3% retail unit volume CAGR in total packaging terms over the forecast period.

- Convenience is likely to remain one of main drivers of new product development in closures. In the forecast period, beauty and personal care may continue to see an increase in the presence of more sophisticated plastic screw closures. This type of closure is perceived to avoid spillages/leaks, allow more control when pouring certain products and help consumers to portion the required amount of product.

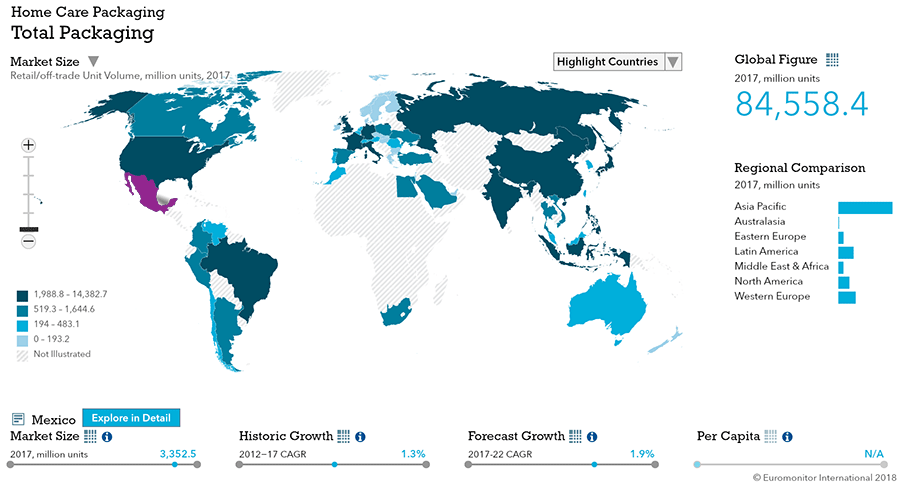

Home Care

Flexible Packaging Landscape

- Total Mexican home care packaging volume is expected to see moderate 1.6% CAGR growth through 2021.

- Flexible home care packaging is expected to see -0.2% CAGR decline through 2021.

Trends

- The most popular packaging type is flexible plastic, due to its frequent use for laundry care products, which is the largest home care category in Mexico.

- However, liquid laundry detergents and, thus, rigid plastic bottles continued to gain volume share in 2016.

- Trigger closures were the most popular closure type in 2016, used in several of the fastest-growing categories – laundry care, air care, furniture polish and insecticides.

- A new closure type for plastic pouches emerged in 2016: a plastic screw or plastic dispensing closure to allow easier handling and storage of the product. Brands that used this closure in 2016 included Vide and Newen.

Outlook

- Home care packaging is expected to register a total retail volume CAGR of 2% over the forecast period to reach 3.0 billion units in 2021.

- Rigid plastic is expected to register the strongest total retail unit volume CAGR of 3% thanks to the increasing popularity of HDPE bottles, PET bottles and other rigid containers in different categories such as surface care, car air fresheners, other air care and toilet liquids/foam.

- Metal aerosol cans are also expected to register strong growth over the forecast period, with a total retail unit volume CAGR of 2%, driven mainly by the increasing presence of smaller formats of aerosol air fresheners (refills) and car air fresheners (solid gel format), as well as increasing consumer interest in aerosol air fresheners and disinfectant.

- With the arrival of more concentrated products in liquid and tablet formats, the prevalence of small pack sizes will likely increase in coming years.

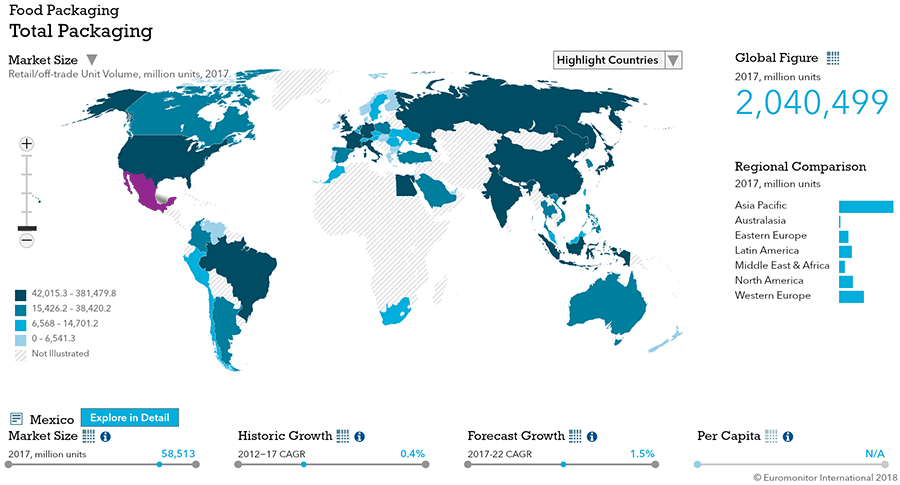

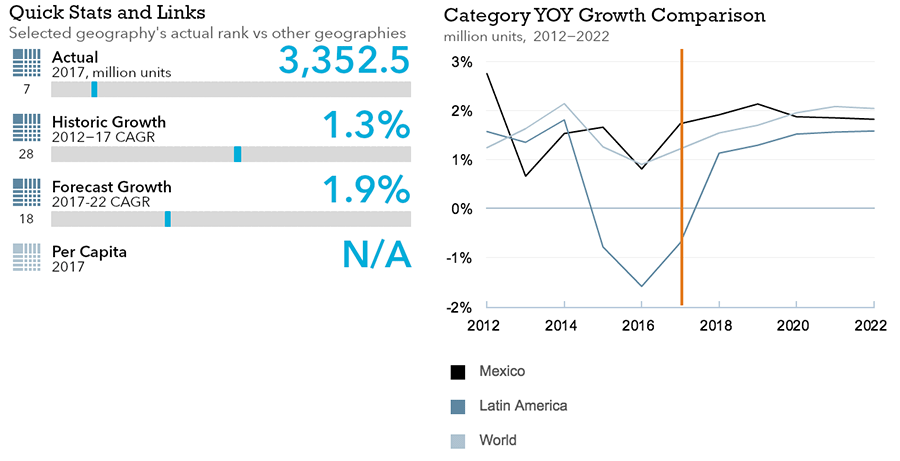

Packaged Food

Flexible Packaging Landscape

- Total Mexican packaged food packaging volume is expected to see moderate 1.5% CAGR growth through 2022.

- Flexible packaged food packaging is expected to post moderate 1.2% CAGR growth through 2022.

Trends

- In sauces, Metal food cans remain the leading pack type in sauces, dressings and condiments with an overall retail unit volume share of 42%.

- In processed meat and seafood, the overall retail unit volume share of metal food cans declined by five percentage points over the review period to reach 43% in 2016, due in part to strong growth in demand for chilled and frozen products, which are typically offered in folding cartons and flexible or rigid plastic packs. Additionally, in shelf stable meat and seafood, metal food cans faced increasing competition from other pack types such as aluminum/plastic pouches, which offer greater convenience in terms of storage, handling and transportation.

- In processed fruit and vegetables, metal food cams dominated in 2016 with an overall retail unit volume share of 76%. Manufacturers prefer to use metal food cans due to their time- and cost-savings benefits, and consumers appreciate metal food cans’ ability to preserve food for long periods of time.

- In confectionery, flexible plastic remained the most popular pack type in confectionery in 2016 with an overall retail unit volume share of 51%. Flexible plastic is widely used in packaging for single portion and multipack presentations in sugar confectionery, gum, tablets and countlines. However, in 2016 total flexible plastic retail unit volume sales in confectionery packaging declined by 1%, due in part to falling demand for gum and sugar confectionery products, as well as the growing popularity of other pack types.

- In dairy, rigid plastic remained the leading material in dairy packaging in 2016 with an overall retail unit volume share of 52%. HDPE bottles accounted for 51% of rigid plastic retail unit volume sales. This was mainly due to their dominance in drinking yoghurt, though HDPE bottles were also widely used in fresh milk.

- In baby food, glass remained by far the most popular pack type in 2016 with an overall retail unit volume share of 63%. Although pouches and PET bottles are lighter than glass jars, most parents still prefer glass, which they perceive as a “cleaner” material that also allows them to see the product contents.

Outlook

- In sauces, metal food cans are projected to remain the most common packaging type, increasing their volume share by one percentage point to 43% by the end of 2021. However, brick liquid cartons and flexible plastic pouches are also projected to increase in popularity in coming years.

- In processed meat and seafood, retail volume sales are expected to grow at a CAGR of 3% over the forecast period to reach 3.1 billion units in 2021. The overall retail unit volume share of stand-up pouches is projected to increase by a total of two percentage points to reach 7% in 2021, driven by a growing appreciation among consumers and producers of stand-up pouches’ benefits, including their light weight and ease of storage, transportation and handling.

- In processed fruit and vegetables, metal food cans are projected to remain the leading packaging type through 2021, but their overall retail unit volume share will decline as chilled and frozen product types continue to gain popularity among Mexican consumers. Moreover, the shift from metal food cans to pouches is likely to accelerate as more companies adopt pouches pack type to help new launches stand out from competitors.

- In confectionery, blister and strip packs are expected to register the fastest growth in overall retail unit volume sales within confectionery packaging over the forecast period, due to its ability to prevent the sugar coating on individual gum pieces from melting or rubbing off, even when the pack is carried in the pockets of clothing. Similarly, chocolate confectionery packs with plastic trays that help to maintain the form of the chocolate, even if carried in a purse or a gym bag, could also gain popularity among consumers towards 2021.

- In dairy, rigid plastic will remain the leading pack type in dairy packaging in 2021 with an overall retail unit volume share of 52%. Shaped liquid cartons are projected to be one of the most dynamic pack types in dairy packaging over the forecast period, with retail unit volume sales projected to grow at a CAGR of 6%. While this is partly because unit volume sales are still emerging from a low base, growth will also be bolstered as more brands adopt shaped liquid cartons in an effort to differentiate their products from those of competitors

- In baby food, glass is projected to remain the most common packaging type, but aluminum/plastic pouches are projected to post the highest volume sales growth rate (24% CAGR) through 2021, due to the ease with which they can be transported and their lower risk of breakage compared with glass jars.