Overview

Packaging Overview

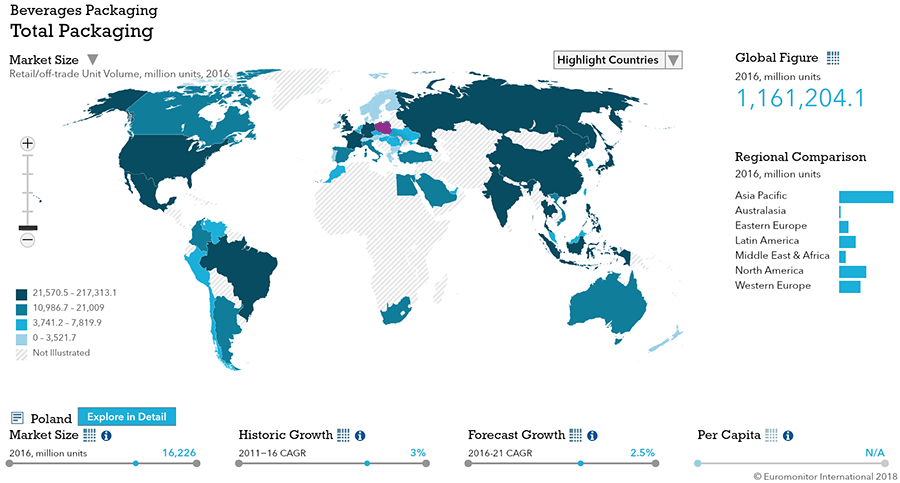

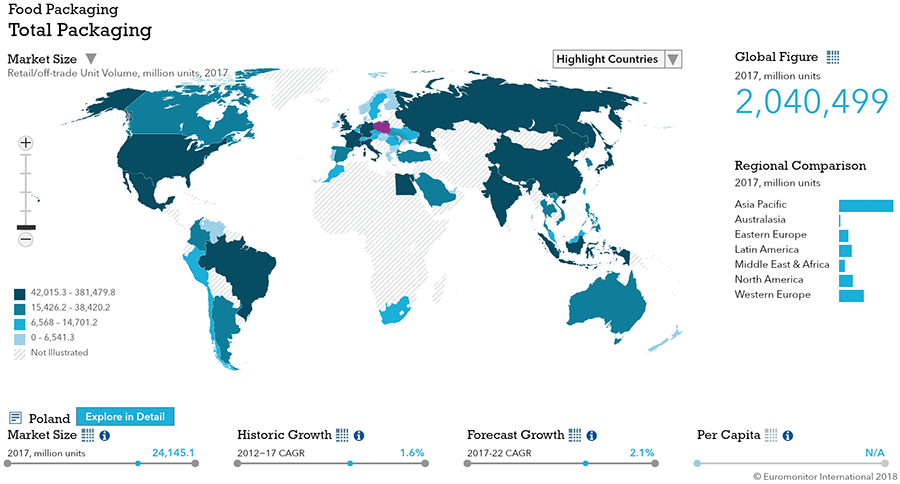

2016 Total Packaging Market Size (million units):

43,582

2011-16 Total Packaging Historic CAGR:

2.4%

2016-21 Total Packaging Forecast CAGR:

2.6%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 16,829 |

| Food Packaging | 23,703 |

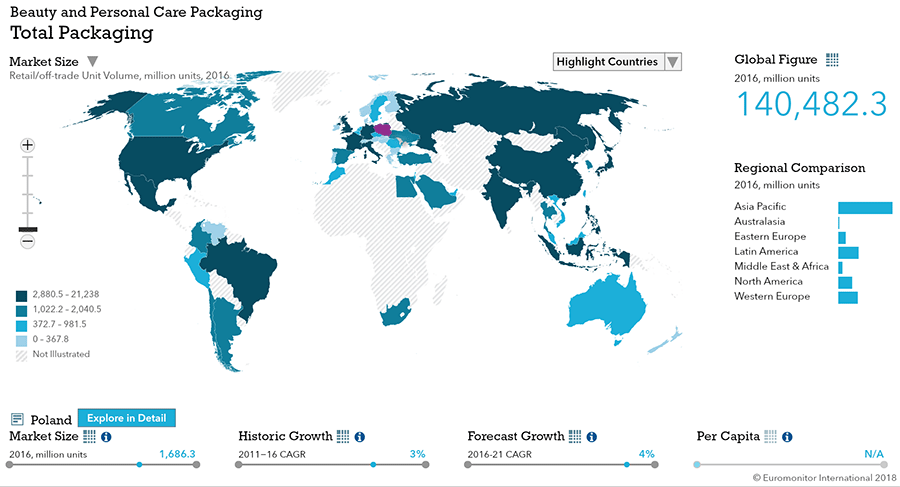

| Beauty and Personal Care Packaging | 1,686 |

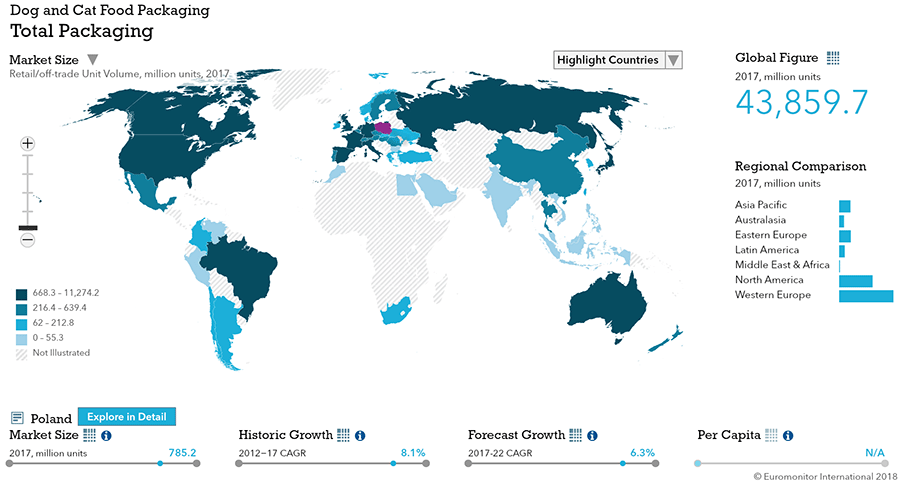

| Dog and Cat Food Packaging | 734 |

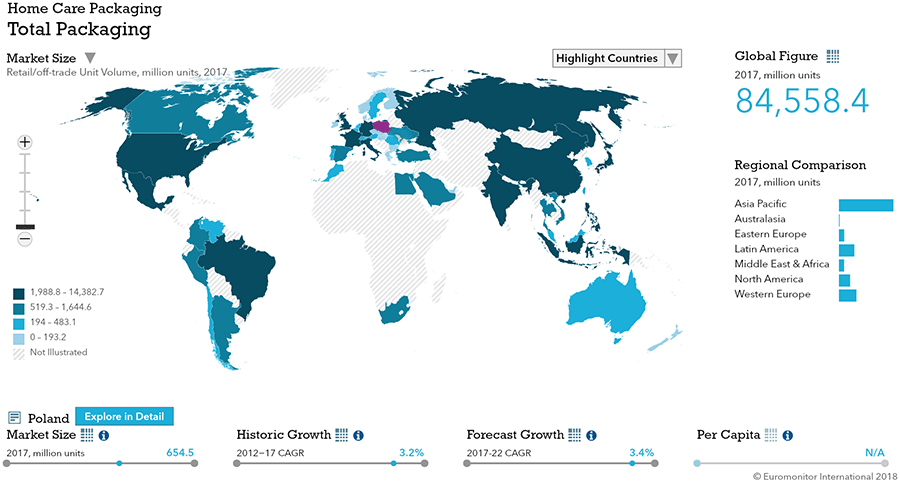

| Home Care Packaging | 630 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 12,219 |

| Flexible Packaging | 15,553 |

| Metal | 4,436 |

| Paper-based Containers | 2,113 |

| Glass | 7,449 |

| Liquid Cartons | 1,812 |

- The total Po'ze, and rigid plastic ranks second.

Key Trends

- The main trend within packaged food in Poland in 2016 was the growth seen in small and large packs across numerous categories. As living standards in Poland continue to improve, many Poles continue to look for products that offer more specialized features to meet growing demand for easy access, clear and detailed information on labels and packs designed for specific target groups.

- Noticeable changes are being seen in the packaging preferences of Polish consumers in 100% juice and nectars. Over the review period, polish people increasingly favored plastic packaging in this category, to the detriment of glass bottles.

- 2016 saw a visible increase in the popularity of vodka, including flavored vodka, and liqueurs in small bottles. The highest growth in spirits packaging was witnessed in 100ml and 200ml, volumes that already represented one-third of sales in the category in 2016.

- A high proportion of Polish consumers pay considerable attention to convenience and ease of use of packaging when purchasing beauty and personal care products. Functionality in beauty and personal care packaging is related mainly to the proper protection of the product contained within during repeat uses.

- PET and HDPE bottles are becoming increasingly popular types of packaging across different fmcg categories, including home care.

Packaging Legislation

- Packaging and Packaging Waste Management Act moves ahead of EU targets: The Packaging and Packaging Waste Management Act requires manufacturers of all products containing dangerous substances such as those that are flammable or poisonous to vouch for the packaging of their products. Pesticides are not covered by this legislation, however, because all EU countries are obliged to establish a separate system of pesticide packaging management. In general, reception of the new Packaging and Packaging Waste Management Act has been positive, with packaging manufacturers being glad of clearer guidelines and stricter controls over unauthorized operators.

- Increased packaging label precision: In accordance with updated EU regulations, information on labels must now be printed in a minimum font size of 1.2mm for most products or 0.9mm for very small packages. All ingredients must also be printed on labels. More than 5% added water or protein must be highlighted on labels.

Recycling and the Environment

- Strong regulation of recycling and recovery: Importers, manufacturers and retailers with outlets with a surface area of more than 500 sq m are all responsible for the recovery and recycling of packaging waste in relation to the products that they introduce into the country.

- Companies must register waste: According to an ordinance enacted in 2016, companies are required to log waste, including packaging waste, in a national database.

- Recycling as a cost-savings measure: The reduced cost of using recycled raw materials conveys important benefits for manufacturers. In times of continuous cost cutting due to the increasingly competitive environment, the lower cost manufacturing products is highly desirable. This, combined with the ecological trend, motivates producers to use ecological packaging materials for their products more frequently.

Packaging Design and Labelling

- Label minimalism and simplification: In terms of packaging design in Poland, there are numerous observable trends, including minimalism, geometric shapes, fun textures and colors, building brand stories and taking advantage of history and nostalgia and the personalization of products.

- Growing interest in eco-friendly packaging: As Polish consumers become increasingly environmentally conscious, manufacturers are more frequently using packaging that is safer for the environment, including limiting artificial components in favor of natural, biodegradable materials.

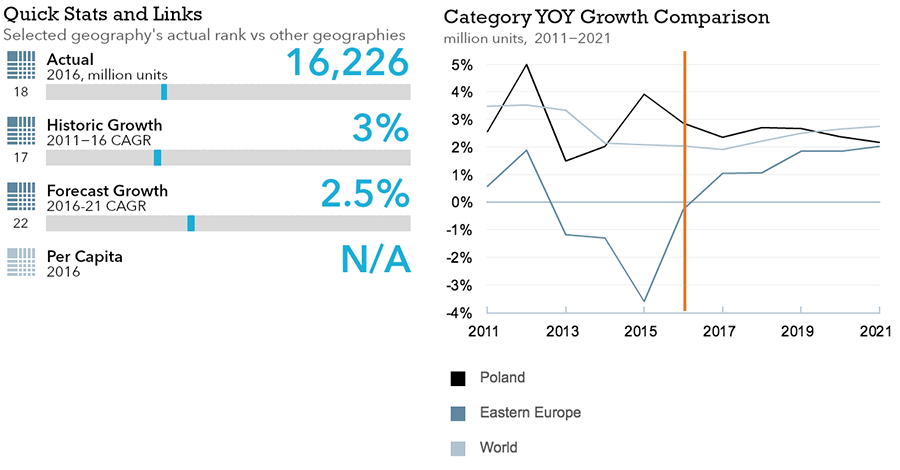

Beverages

Flexible Packaging Landscape

- Total Polish beverage packaging volume is expected to see strong 3.0% CAGR growth through 2021.

- Flexible beverage packaging volume is expected to see moderate 1.6% CAGR growth through 2021.

Trends

- In soft drinks, PET bottles continue to dominate with a 61% volume share in 2016.

- In hot drinks, flexible packaging is the leader with 54% volume share in 2016, and flexible aluminum/plastic was the fastest-growing category in 2016 in terms of volume sales.

- In alcoholic drinks, glass bottles continue to dominate, but paper-based containers registered the highest volume sales growth in 2016 at 11%, albeit from a low base.

Outlook

- In soft drinks, PET bottles are expected to remain dominant in coming years, increasing their volume share by 3% by the end of 2021.

- In hot drinks, flexible aluminum/plastic is projected to record robust volume sales growth of 15% through 2021 as fresh coffee bean consumption increases in Poland.

- In alcoholic drinks, paper-based containers are projected to remain niche, but they are projected to record a strong 10% CAGR in volume sales growth through 2021.

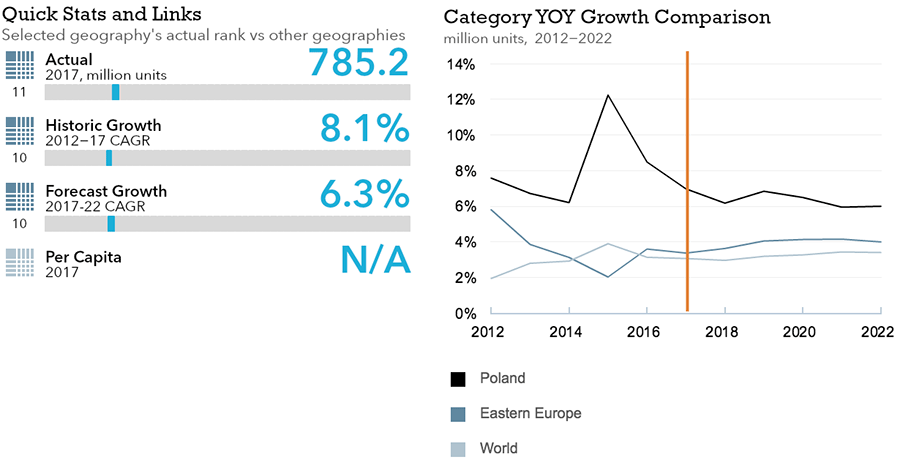

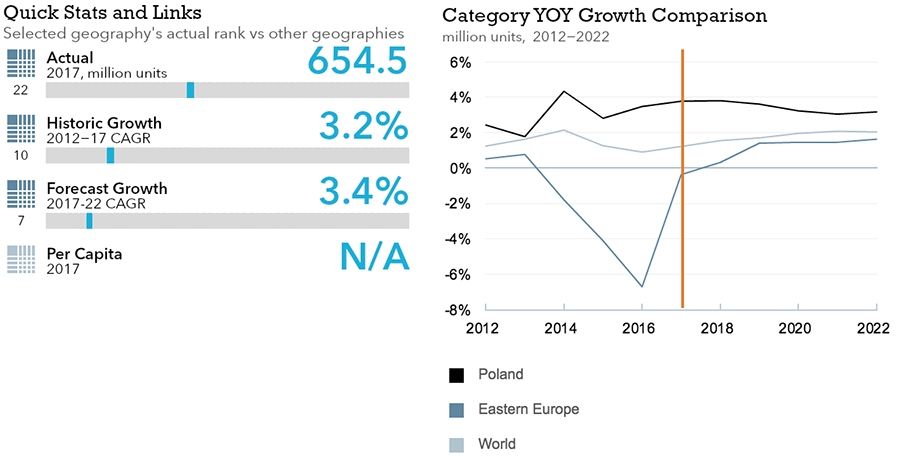

Dog and Cat Food

Flexible Packaging Landscape

- Total Polish dog and cat food packaging volume is expected to see strong 6.3% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see even stronger 6.5% volume CAGR growth through 2022.

Trends

- Growth in both small and large pack sizes fuelled dog and cat food packaging volume sales growth in 2017.

- Growing competition in dog and cat food and the significant growth possibilities that exist within the category are forcing manufacturers to develop with new ways to distinguish their products from rival brands, including innovative packaging.

- As various types of stand-up pouches are becoming increasingly popular in dog and cat food in Poland, including larger package sizes, zip/press closures are becoming increasingly popular.

Outlook

- Packaging volume growth through 2021 will be driven mainly by increasing demand for prepared pet food as the pet population in Poland increases and pet owners increasingly opt for commercial pet food. Additionally, declining pet food costs will contribute to growth.

- Across dog and cat food, aluminum trays, flexible plastic and plastic pouches are expected to be the best performing packaging types over the forecast period, especially in the packaging of dog treats and mixers and cat treats and mixers, which are set to the among the most rapidly developing categories in dog and cat food in Poland over the forecast period.

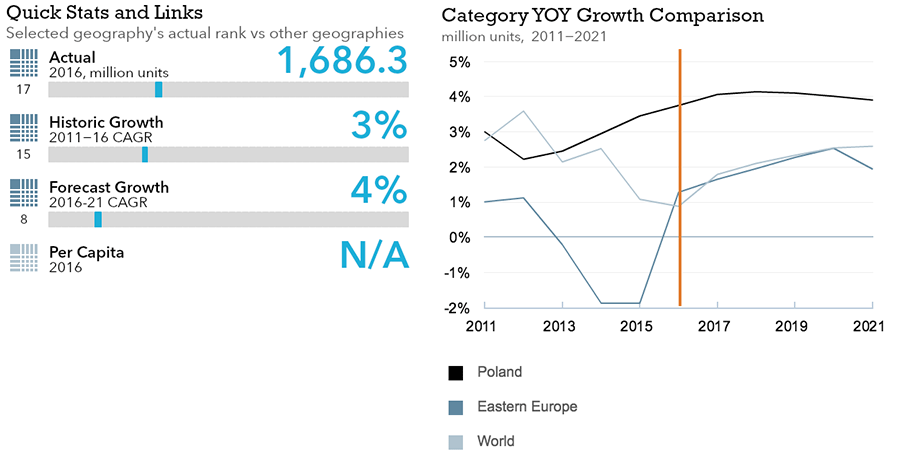

Beauty and Personal Care

Flexible Packaging Landscape

- Total Polish beauty and personal care packaging volume is expected to strong 4.0% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see slightly lower 3.1% CAGR growth through 2021—a rate higher than that of the global flexible beauty and personal care packaging market as a whole.

Trends

- Rigid plastic is the most common packaging type , but glass packaging recorded the highest volume growth rate in 2016 at 5%.

- Increasing demand for convenience is leading manufacturers to combine different product types—for example, face cream and powder—in one pack, which requires innovative packaging solutions that can properly store and dispense different items.

- Larger pack sizes are becoming more popular, particularly for private-label products.

Outlook

- Rigid plastic is projected to remain the most popular packaging type, with a 51% volume share through 2021.

- Glass packaging is expected to continue to post volume growth at a 5% CAGR through 2021.

- Plastic dispensing closures, lotion pumps, spray pumps and trigger closures are expected to become more popular in coming years as consumers increasingly demand convenient packaging for beauty and personal care products.

Home Care

Flexible Packaging Landscape

- Total Polish home care packaging volume is expected to see strong 3.4% CAGR growth through 2021.

- Flexible home care packaging is expected to see stronger 4.8% CAGR growth through 2021.

Trends

- In 2016 glass bottle as primary packaging and paper-based folding cartons as secondary packaging used for liquid air fresheners recorded the highest rates of growth, each with increases of 211% in volume terms.

- Concentrated products are preferred over standard offerings, resulting in the greater popularity of reduced-size packaging.

- Polish consumers are increasingly demanding eco-friendly packaging for home care products as they become more environmentally conscious.

Outlook

- Environmentally friendly home care packaging, particularly bio-plastics, will continue to be popular as the green trend strengthens and EU waste reduction target dates approach in coming years.

- Manufacturers are likely to look to cut costs by using cheaper and more secure packaging types.

- Trigger closures are anticipated to continue to be the most popular type of closure, together with plastic screw caps, due to their convenience in use. Closures that will allow self-releasing, such as those in air care, are also anticipated to become more popular.

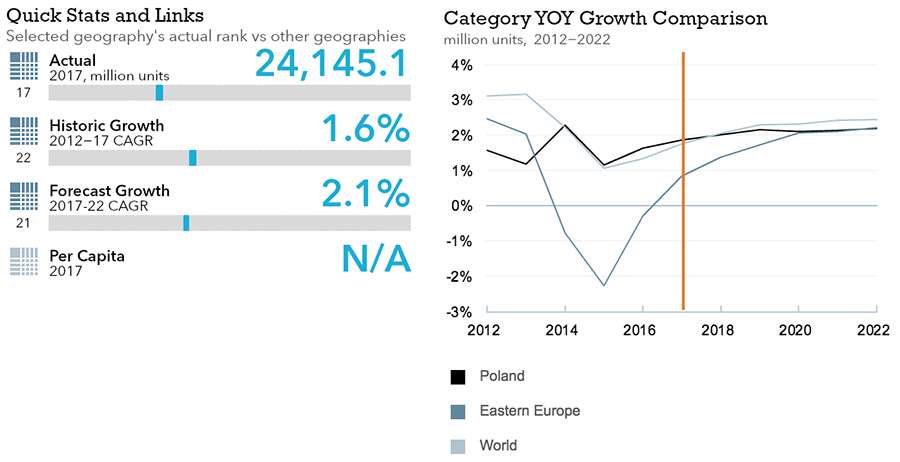

Packaged Food

Flexible Packaging Landscape

- Total Polish packaged food packaging volume is expected to see strong 2.1% CAGR growth through 2022.

- Flexible packaged food packaging is expected to record more moderate 1.8% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, glass jars dominate, but liquid cartons recorded the highest volume sales growth rate in 2016 at 5%.

- In processed meat and seafood, metal food cans dominate shelf-stable processed meat, while flexible plastic dominates chilled and frozen meat.

- In processed fruit and vegetables, flexible plastic is the most popular packaging type overall, but metal food cans dominate shelf-stable processed fruit and vegetables.

- In confectionery, flexible packaging is the most common, but less common rigid containers are gaining share.

- In dairy, flexible plastic and thin wall plastic containers are recording the largest increases among processed cheese products and hard packaged cheese.

- In baby food, glass dominates, but liquid cartons recorded the highest volume sales growth rate in 2016, due to their popularity for liquid milk formula.

Outlook

- In sauces, glass jars will continue to dominate through 2021, but growth will mainly come from flexible packaging as manufacturers increasingly use flexible packaging to cater to consumers’ desire for convenience and easier portability.

- In processed meat and seafood, increasing consumer incomes will lead to higher demand, and flexible plastic for frozen processed seafood and thin wall plastic container for chilled processed meat are expected to gain share.

- In processed fruit and vegetables, consumers’ increasing demand for convenient food options will drive overall growth, and flexible plastic is projected to maintain its majority volume share through 2021.

- In confectionery, plastic pouches are projected to record strong volume sales growth through 2021, driven by increasing demand for affordable, convenient chocolate pouches and bags.

- In baby food, forecast 1% CAGR through 2021 is expected to be driven mainly by growth in liquid cartons and rigid plastic containers, but flexible plastic is projected to gain share at the expense of glass jars.