Overview

Packaging Overview

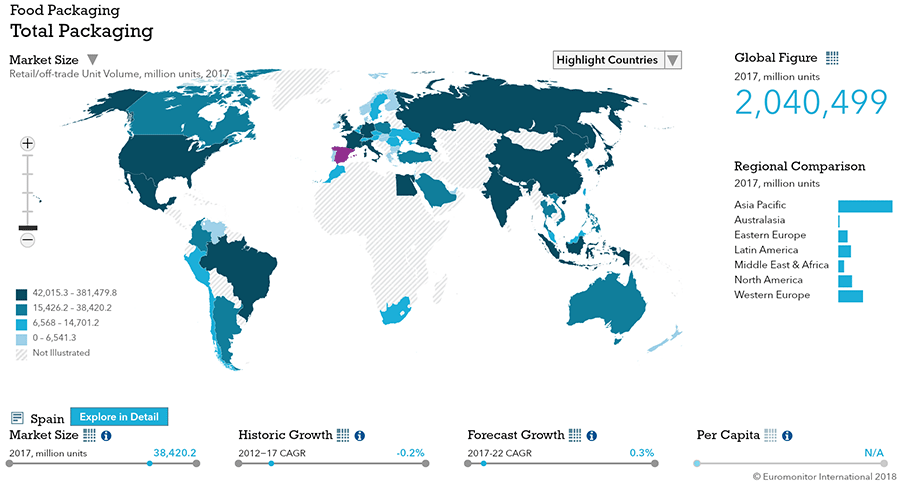

2016 Total Packaging Market Size (million units):

61,674

2011-16 Total Packaging Historic CAGR:

0.1%

2016-21 Total Packaging Forecast CAGR:

1.0%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

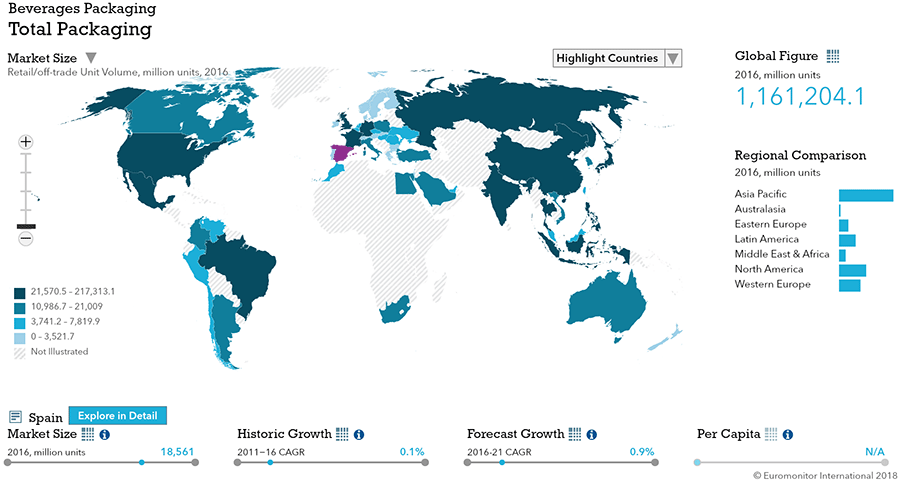

| Beverages Packaging | 18,279 |

| Food Packaging | 38,399 |

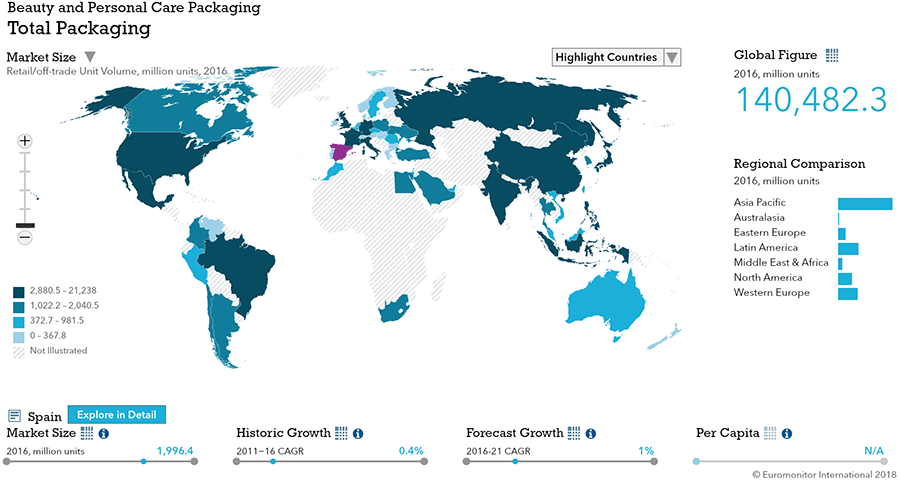

| Beauty and Personal Care Packaging | 1,996 |

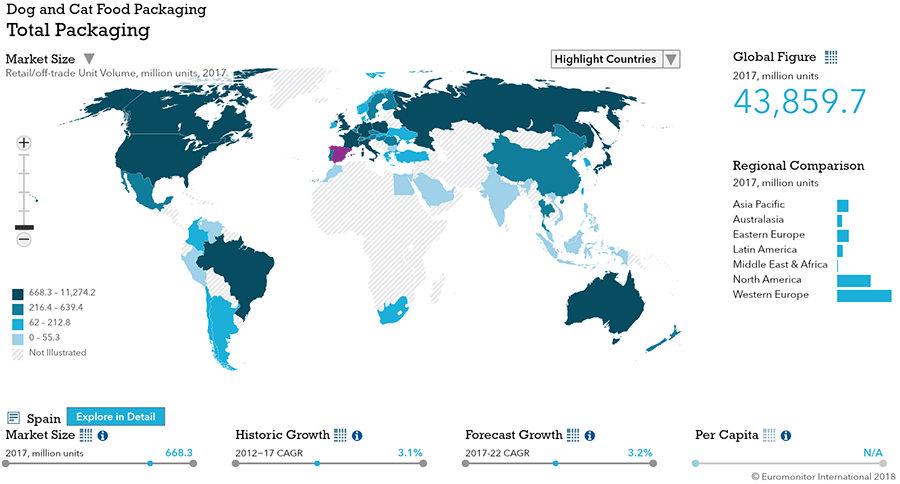

| Dog and Cat Food Packaging | 643 |

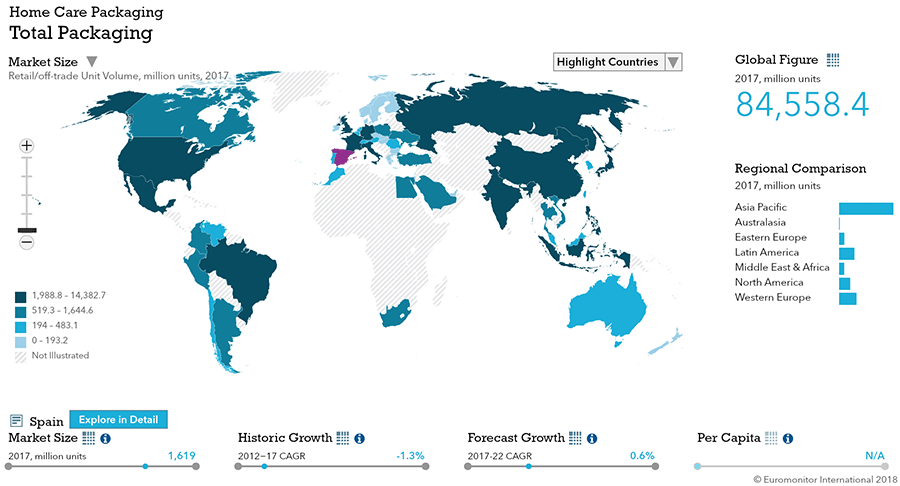

| Home Care Packaging | 2,357 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 22,713 |

| Flexible Packaging | 15,759 |

| Metal | 8,476 |

| Paper-based Containers | 4,015 |

| Glass | 5,791 |

| Liquid Cartons | 4,889 |

- The total Spanish packaging industry, sized at over 61 bn units in 2016, is expected to see moderate growth.

- Food and beverage packaging continues to dominate packaging, but dog and cat food packaging presents a strong niche growth opportunity.

- Rigid plastic continues to lead in size, and flexible packaging ranks second.

Key Trends

- Increasingly environmentally conscious consumers in Spain are driving the use of natural materials, including wood and cotton, in packaging, particularly for premium fragrances.

- As macroeconomic conditions in Spain improve, companies in packaged food categories are moving away from larger and more economical pack sizes in favor of smaller and more sophisticated formats that offered higher margins.

- As the number of consumers over the age of 40 grows, producers are increasingly focusing on changing their strategies to attract and maintain their interest, including using vintage designs to evoke nostalgia and introducing formats that are easier to carry, including plastic pouches.

Packaging Legislation

- Increased efforts to curb under-age drinking: In late 2016 the Spanish government announced plans to drastically reduce the rate of under-age drinking in the country, which could impact overall sales of alcoholic drinks packaging.

- Focus on waste management: In December 2013 State Plan for Waste Framework (PEMAR), came into force, requiring communities in Spain to set recycling targets to be met in coming years and plans to reach those targets.

Recycling and the Environment

- Recycling rate increases: The recycling rate in Spain is now the second highest in Europe, trailing only that of Germany. In 2015, Spaniards recycled 1.3 million tonnes of packaging, which accounted for 74.8% of total packaging in that year, according to the association Ecoembes. This represents an increase from the 72% of the total packaging recycled in 2014 although still far from the goal of 80% of total packaging recycled by 2020.

Packaging Design and Labelling

- Aesthetics are increasingly important in alcoholic drinks packaging: Due to the importance of visuals in influencing purchasing decisions, alcoholic drinks manufacturers are increasingly investing in the development of more aesthetic packaging designs, more attractive shapes, higher quality labels, textures and patterns to reflect the intrinsic values of the brand. Packaging design and labelling is a key way in which manufacturers position a specific product as premium, as it allows for higher differentiation on retailers’ shelves.

- Informative labels are on the rise: Growing awareness of the potential side-effects of artificial substances used in personal care products, such as parabens, petrochemicals and toxins, led consumers towards a “greener” approach to beauty. Consumers now look for products that do not harm their skin and their overall health. As a result Spanish consumers are increasingly looking at labels in order to obtain information about the ingredients of the beauty and personal care products they buy.

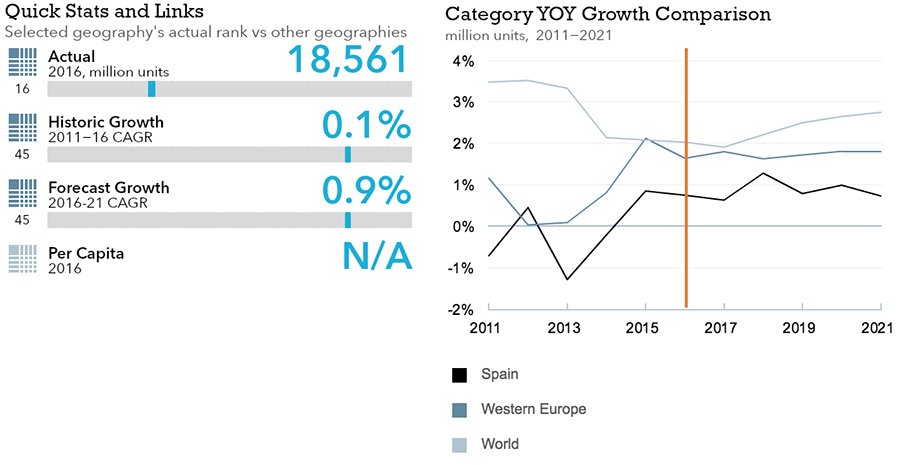

Beverages

Flexible Packaging Landscape

- Total Spanish beverage packaging volume is expected to see strong 2.7% CAGR growth through 2021.

- Flexible beverage packaging is expected to remain essentially stagnant through 2021, with limited 0.1% CAGR growth projected.

Trends

- In soft drinks, PET bottles saw significant unit volume growth versus other packaging types in 2016, driven by increasing demand for sport drinks, RTD tea, juice drinks, bottled water and carbonates as the Spanish economy improved.

- In hot drinks, thin wall plastic containers was the fastest growing packaging format in 2016 due to rising demand for fresh ground coffee pods.

- In alcoholic drinks, PET bottles recorded 19% total unit volume growth in 2016 as packaging manufacturers made further inroads into the category beyond wine-based beverages and beer.

- Smaller packaging sizes have gained momentum within alcoholic drinks in recent years as a result of the growth in the number of people living alone and consequent demand for convenient formats for single households in retail.

Outlook

- In soft drinks, glass bottles are projected to become more popular as the Spanish economy continues to improve and manufacturers look to target higher-income consumers. Additionally, economic recovery should lead to increased on-trade sales, and small glass bottles are one of the most popular formats for soft drinks in the food-service sector.

- In hot drinks, both fresh ground coffee pods and tea are projected to continue to become more popular; consequently flexible plastic and paper used for secondary packaging of coffee pods and tea bags will register dynamic growth through 2021.

- In alcoholic drinks, metal beverage cans is set to post a strong volume CAGR of 8% across the forecast period due to growing adoption of the format by beer and RTD manufacturers. The versatility of this packaging material and the fact that it can be recycled over and over without altering its properties will drive more manufacturers to adopt it to the detriment of PET bottles.

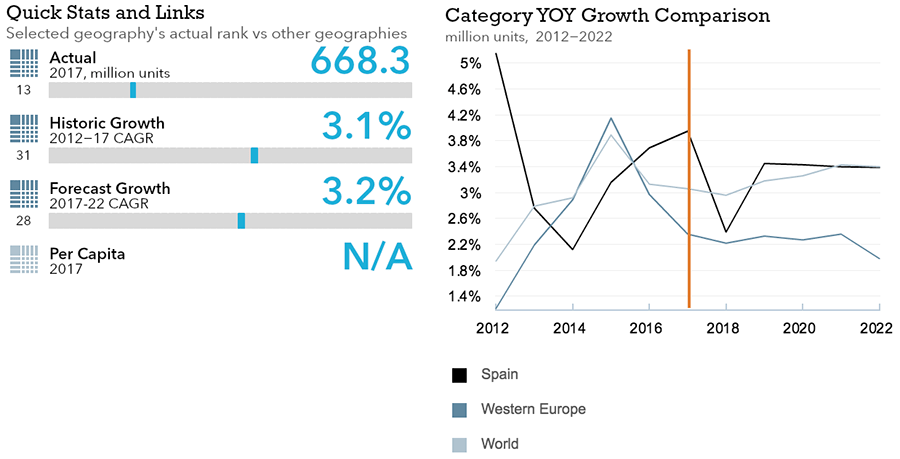

Dog and Cat Food

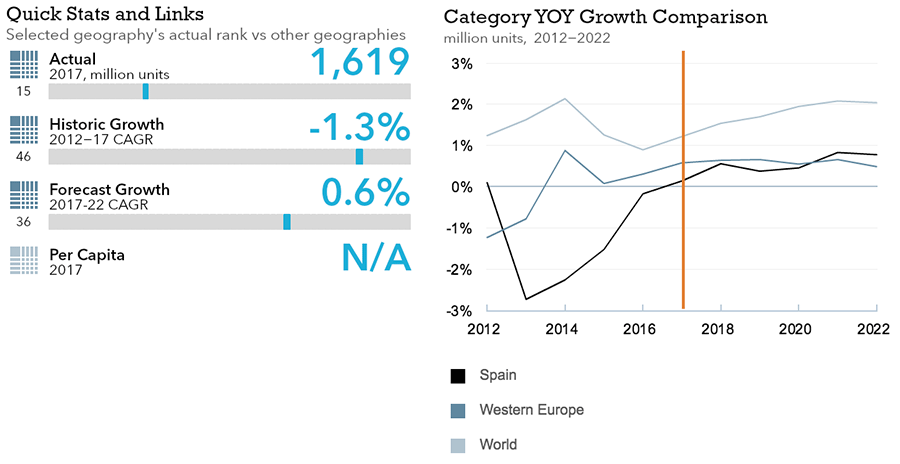

Flexible Packaging Landscape

- Total Spanish dog and cat food packaging volume is expected to see strong 3.2% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see even stronger 3.9% volume CAGR growth through 2022.

Trends

- Unit volume sales increased by 3% in 2016. Other rigid container recorded the highest rate of volume sales growth—but from a very low base. Flexible packaging is extremely important in the dog and cat food space, as most manufacturers have moved or are moving away from paper-based packaging to flexible plastic.

- Due to the growing importance of flexible packaging and pouches, zip closures continued to gain ground in 2016.

Outlook

- Flexible packaging is set to account for the bulk of sales through 2021, and growth will increasingly be driven by pouches, which consumers increasingly view as more convenient.

- Other rigid plastic is projected to record the highest CAGR across the forecast period at 11% as the format continues to expand from its small base.

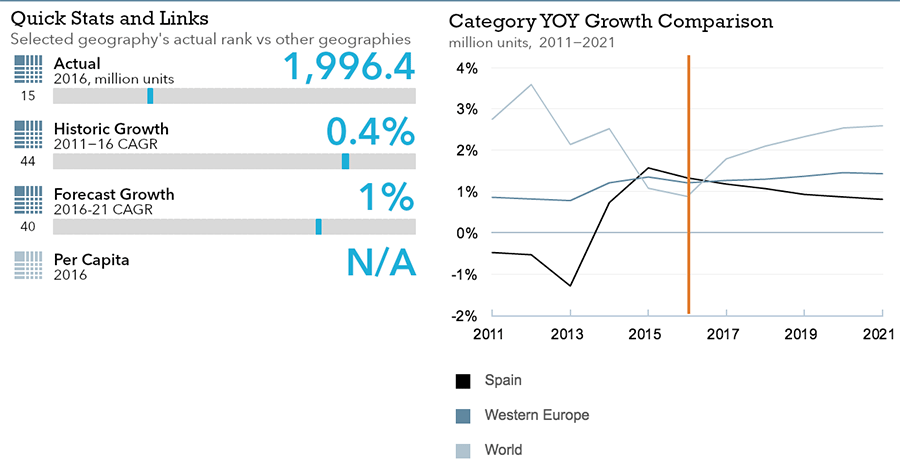

Beauty and Personal Care

Flexible Packaging Landscape

- Total Spanish beauty and personal care packaging volume is expected to see limited 1.0% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see slightly lower 0.9% CAGR growth through 2021.

Trends

- Beauty and personal care packaging volume sales grew by 1% in 2016, led by glass, which posted volume growth of over 3 due to the outstanding results of premium fragrances during the year.

- Spanish consumers are increasingly environmentally conscious, and eco-friendly packaging for beauty and personal care products has become more popular in recent years. Packaging incorporating wood and cotton has been a notable trend in the fragrances space.

- Metal aerosol cans, which are easy to use and recycle, have also become more popular. Due to the success of metal aerosol cans in the sun care category, they are now being used more frequently in other categories, including shower gel.

Outlook

- Glass is projected to be the fastest-growing packaging type through 2021, driven by increasing fragrances sales.

- Stand-up pouches are projected to post sales volume growth through 2021 as more beauty and personal care brands launch refill packs, as L’Occitane and Timotei already have.

- As the Spanish economy continues to improve, consumers will increasingly demand premium products, which will lead manufacturers to choose higher-cost innovative packaging options to differentiate their products.

Home Care

Flexible Packaging Landscape

- Total Spanish home care packaging volume is expected to see modest 0.5% CAGR decline through 2021.

- Flexible home care packaging is expected to similarly modest 0.5% CAGR growth through 2021.

Trends

- Following a range of home care packaging innovations in 2015, 2016 saw very few new options.

- Rigid plastic is the most prominent home care packaging type due to its use for surface care and laundry care products.

- Stand-up pouches continued to benefit from the popularity of dishwashing and laundry detergent capsules. However, the higher unit price of capsules compared with other options these categories limits the sales volume growth of stand-up pouches.

- Trigger closures are the most popular closure type and are used in most task-specific ranges of home care products from bathroom and kitchen cleaners to pre-treaters.

Outlook

- Home care packaging is projected to grow at a 1% CAGR through 2021 as the Spanish economy improves and consumers feel more comfortable by more task-specific home care products.

- Additionally, Spaniards will be less concerned about the cost of using their cars for shopping as disposable income rises, and larger home care product formats will likely gain ground, especially in some categories such as laundry detergents, surface care and dishwashing.

- Plastic pouches will likely benefit from innovations in the manufacturing of washing machines and dishwashers, which will increasingly offer automatic detergent dosing functions that require capsules, which are typically packaged in stand-up pouches.

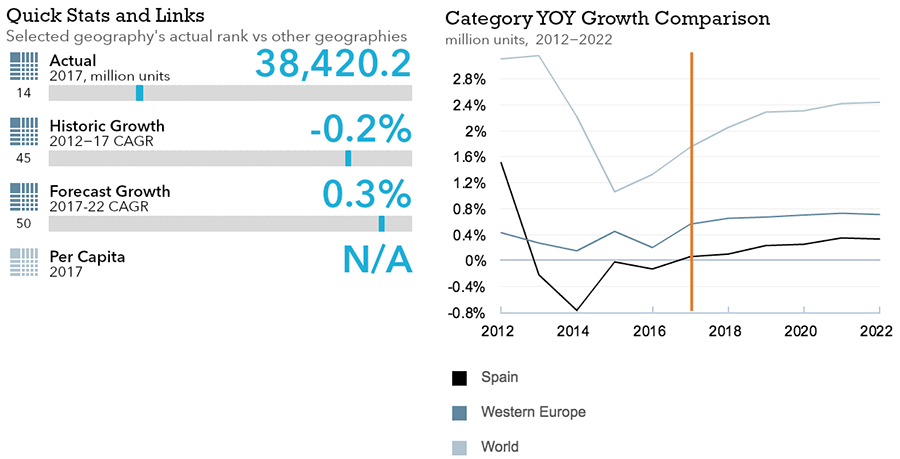

Packaged Food

Flexible Packaging Landscape

- Total Spanish packaged food packaging volume is expected to see limited 0.3% CAGR growth through 2022.

- Flexible packaged food packaging is expected to see modest but slightly higher 0.5% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, brick liquid cartons continued to experience robust growth in unit volume sales in 2016, mainly due to the widespread use of this pack type in tomato pastes and purées. In particular, unit volume sales were bolstered by strong demand for tomate frito products, which are typically packaged in brick liquid cartons.

- In processed meat and seafood, metal cans are the most popular packaging type, accounting for 40% of volume sales in 2016, but glass was the fastest-growing packaging type, as consumers increasingly view it as a more environmentally friendly option.

- In processed fruit and vegetables, glass jars and metal food cans together accounted for 62% of retail product volume sales in processed in 2016, but flexible plastic remained the leading pack type in frozen processed fruit and vegetables, followed by folding cartons.

- In confectionery, flexible plastic is the most popular packaging type, but rigid plastic recorded healthy growth in total unit volume sales in 2016, due mainly to its use by popular brands such as Smint, Tic Tac, Halls, Orbit and Mentos.

- In dairy, negative performance in 2016 was due to declining consumption of cow’s milk and yogurt in Spain. However volume sales of multipacks grew in many dairy categories, most notably drinking yogurt.

- In baby food, packaging volume sales declined in 2016 as the Spanish birth rate continued to fall. Hardest hit were brick liquid cartons, which posted a 10% volume sales decline, as manufacturers and consumers both increasingly view the format as old-fashioned.

Outlook

- In sauces, growth will mainly come from brick liquid cartons as they become more popular options for liquid stocks and maintain their dominance as packaging types for tomato pastes and purees through 2021.

- In processed meat and seafood, metal cans are projected to remain the leading packaging type in coming years, but glass will continue to grow in popularity as disposable incomes rise and processors seek to attract higher-income consumers with premium packaging.

- In processed fruit and vegetables, smaller pack sizes will become increasingly popular as Spanish consumers look for convenient options in smaller sizes that make sense for their smaller households. Glass jars are projected to post steady growth through 2021 as consumers increasingly view them as environmentally friendly and better at preserving contents.

- In confectionery, flexible plastic is projected to remain the most popular packaging type through 2021, but rigid plastic will likely erode flexible plastic’s share due to the growing popularity of brands that use rigid plastic container, including Smint and Orbit.

- In dairy, PET bottles are expected to gain importance in many categories over the forecast period, particularly in shelf stable milk. As economic conditions in Spain improve, dairy companies will continue to move away from price-based competition and adopt more modern and innovative packaging formats in an effort to add value to their products and differentiate them from competitors.

- In baby food, volume sales are projected to continue to decline by another 1% through 2021, as Spain’s birth rate continues to fall before modestly trending up again after 2018. Small pack sizes are expected to continue performing well in baby food over the forecast period thanks to the trend towards busier lifestyles and the growing desire for convenience among Spanish parents.