Overview

Packaging Overview

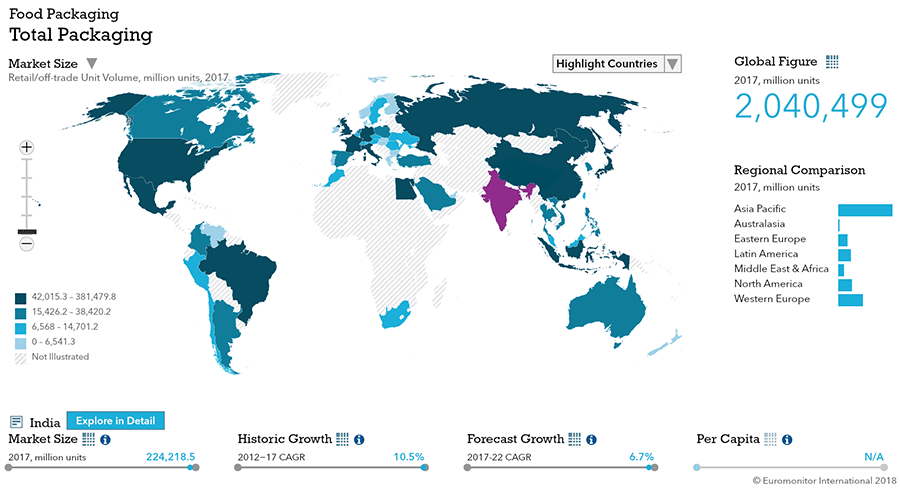

2016 Total Packaging Market Size (million units):

268,960

2011-16 Total Packaging Historic CAGR:

9.9%

2016-21 Total Packaging Forecast CAGR:

7.1%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

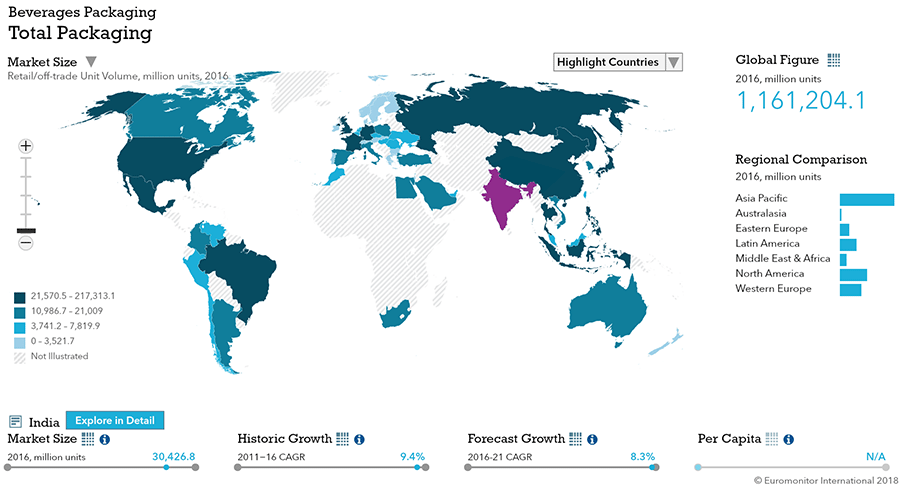

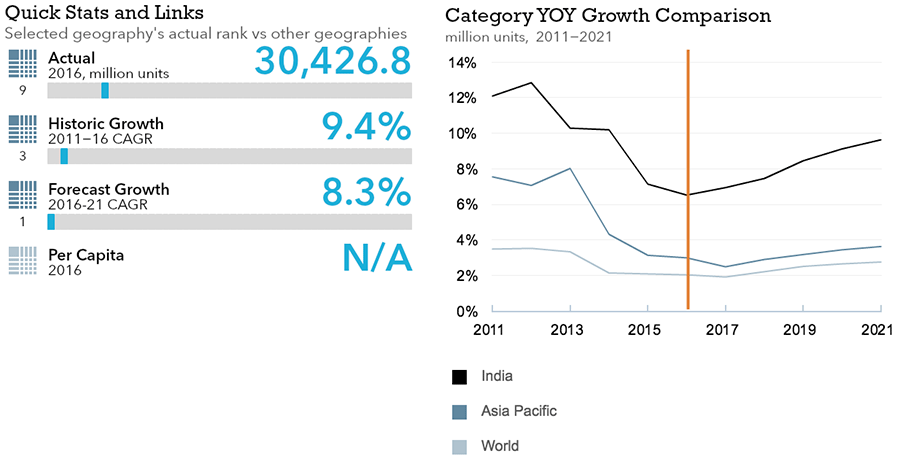

| Beverages Packaging | 28,712 |

| Food Packaging | 205,021 |

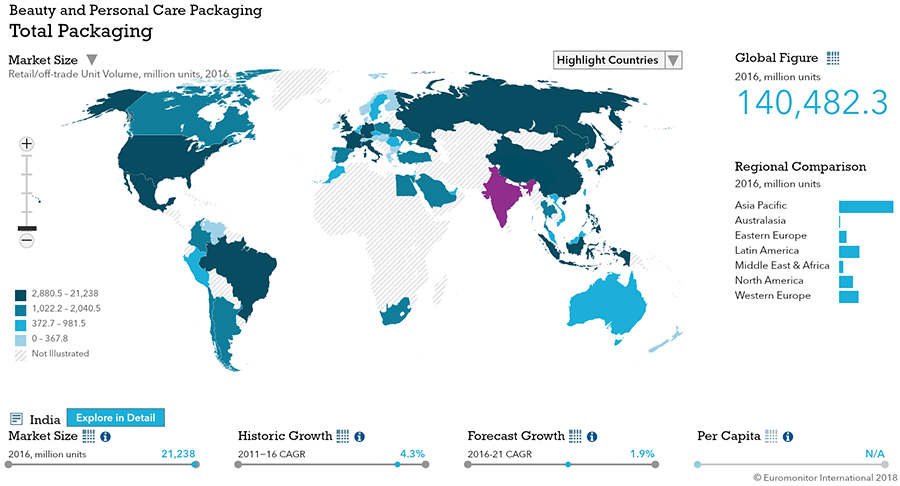

| Beauty and Personal Care Packaging | 21,238 |

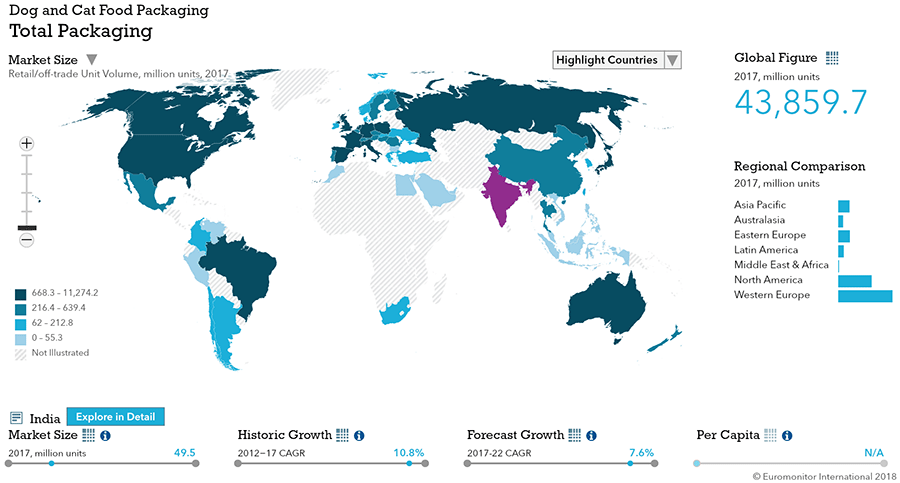

| Dog and Cat Food Packaging | 45 |

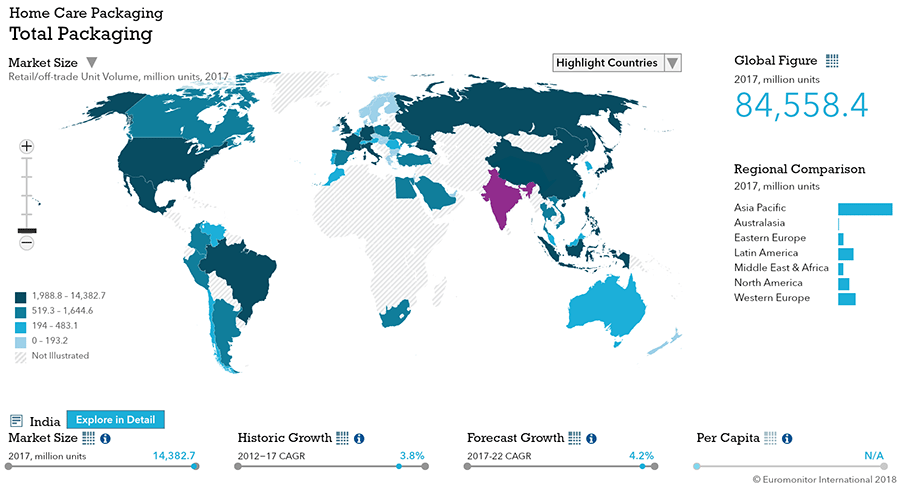

| Home Care Packaging | 13,944 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 24,574 |

| Flexible Packaging | 213,655 |

| Metal | 2,036 |

| Paper-based Containers | 9,792 |

| Glass | 10,948 |

| Liquid Cartons | 7,649 |

- Packaging continued to register positive performance in India during 2016. Growth was driven by the recovering economy and falling inflation.

- Various new packaging formats were launched during the year, though not all were successful, as consumers remained price-conscious and continued to seek value for money. This increased demand for bulk packs, multipacks and smaller packaging, and discounting remained prevalent.

- Beauty and personal care packaging were influenced by the need for convenience.

Key Trends

- Polarization in pack sizes remains the major trend in food and beverages packaging. Multi-packs and larger pack sizes benefit from a growing affluence, which leads Indian consumers to make fewer trips to the grocery. This trend is evident in most food and beverage categories, but most obvious in categories of juice, tea, dairy, rice, and edible oils.

- In other categories, sales move towards smaller formats due to price inflation, making products less affordable for low-income households. Several smaller packs keeps food fresher for longer than one larger pack, an important consideration as increasing numbers of people go grocery shopping fortnightly or monthly.

- In alcoholic drinks, polarization is most evident. 1,000ml PET bottles grew in beer, with total unit volumes rising 47% CAGR. 51% total unit volume growth was recorded in 1,000ml PET bottles in beer, suggesting even higher growth rates during the forecast period.

- Across packaged food, traditional packing materials such as glass and metal are being abandoned in favor of flexible packaging, which offers reduced costs and are lighter and space-efficient. This trend is now spreading to processed meat and seafood, and processed fruit and vegetables, yet records the strongest growth rates in baby food.

Packaging Legislation

- India regulates cosmetic manufacturing, requiring a license and production in the presence of qualified technical staff.

- Health warnings for tobacco products Cigarette packs must have three warnings and three pictorial warnings, and a separate warning plus four pictorial warnings on all smokeless tobacco products with health warnings to cover 85% of of all cigarette packs.

- Food scandal prompts review of labelling guidelines for packaged food After issues emerged with Nestlé’s Maggi brand in 2015, the Food Safety and Standards Authority of India (FSSAI) issued guidelines to ensure quality and food safety and security.

Recycling and the Environment

- Swachh Bharat (Clean India) initiative To increase awareness of recycling, waste reduction, cleanliness, and the environmental impacts of failing to adopt recycling. The government sought assistance of leading industries to achieve the target by 2019.

- Eco-friendly beauty and personal care products become prevalent Social media plays a crucial role in boosting awareness of recycling and eco-friendly products. The accelerated substantially towards the end of the review period and most products are now widely online.

- Rising awareness of recycling and waste segregation The second half of the review period saw numerous state governments and municipal authorities launch waste segregation initiatives to promote the segregation of waste into paper, plastic, metal and wet and promote recycling.

Packaging Design and Labelling

- Rising affluence spurs premium packaging. Premium products are seen across categories in beauty and personal care, packaged food, confectionery, alcoholic drinks, and soft and hot drinks, with status signaled through prestigious packaging with more emphasis on glass bottles and high-end HDPE bottles. Labelling is brighter with dark and metallic colors and matte finishes. The economy is expected to continue performing strongly for the foreseeable future.

- Natural, herbal, and Ayurvedic products influence packaging Growth in demand for beauty and personal care products with natural, herbal or Ayurvedic positioning influences packaging and labelling trends. Products with explicit Ayurvedic positioning experienced a significant increase in demand over the course of the review period, with ingredients such as turmeric, sandalwood, aloe vera, henna, seaweed and amla trending as brands highlight ingredients on their packaging.

Beverages

Flexible Packaging Landscape

- Liquid cartons was the most dynamic pack type in soft drinks due to dominance in juice, with shaped liquid cartons recording particularly strong growth. Liquid cartons are light, biodegradable and distinctive on retail shelves, making them increasingly popular.

- Small pack sizes are favored for portability and on-the-go consumption.

- Metal beverage cans was most dynamic in carbonates, rising 11% from a low base. Glass bottles underperform because manufacturers and consumers preferring PET bottles, which increased from 36% in 2015 to 37% in 2016.

Trends

- Soft drinks packaging records total unit volume growth of 13%, reaching 24.5 billion units

- The implementation of the new GST regime and a shift towards healthier soft drinks are the main influences on overall trends in soft drinks packaging

- Growth in soft drinks packaging is supported by the shift towards smaller pack sizes, especially in nectars, juice drinks and RTD tea

- The phasing out of non-recyclable, multi-layered packaging will have profound influence on soft drinks packaging, with liquid cartons as the most dynamic, seeing 18% total volume growth.

- Carbonates was negatively impacted by the shift away from sugary drinks, with companies launching fruit juice-based carbonates. The penetration of carbonates continues in rural areas with a prioritization of glass bottles and smaller pack sizes.

- Volume growth in closures outpaced overall volume growth in packaging because of an increase in the use of closures in liquid cartons. The shift towards more convenient packaging led to liquid carton closures recording 20% volume growth in 2016.

- Multipacks, most prevalent in bottled water and juice, register 23% retail volume growth in 2016.

Outlook

- Soft drinks packaging is set to register a unit volume CAGR of 14% over the forecast period, rising to 46.1 billion units in 2021

- Saturation in first-tier cities means that the majority of India’s soft drinks manufacturers are likely to focus on improving their positions in second and third-tier cities and rural areas. The residents of India’s largest urban areas look beyond carbonates. This is likely to be seen in smaller pack sizes across the board.

- The forecast period is likely to see a continuation of the trend towards multipacks, which are expected to register a retail volume CAGR of 23%, outperforming soft drinks packaging.

- Numerous smaller players are set to enter soft drinks, presenting a challenge to more established players by offering innovative products at lower prices. This is expected to result in strong growth for lower-priced pack types such as rigid plastic.

- There is also set to be polarization across the industry, with premium pack types such as glass bottles and shaped liquid cartons likely to register a strong performance. to 40% by 2021.

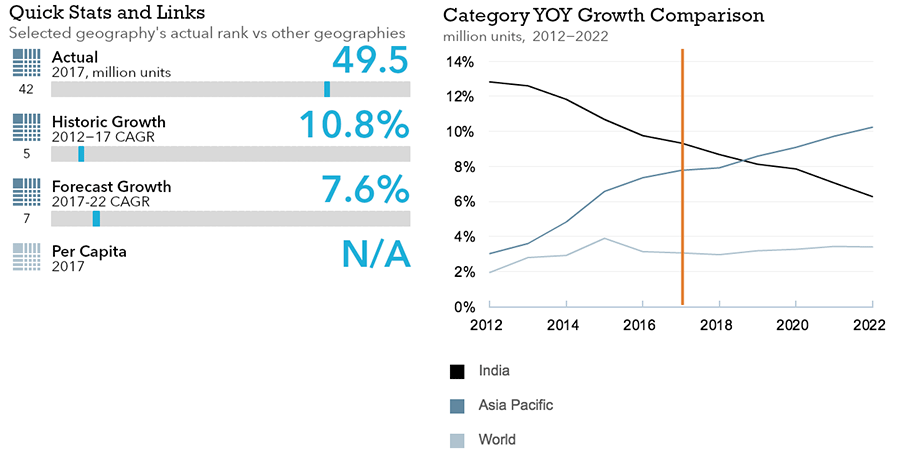

Dog and Cat Food

Flexible Packaging Landscape

- Dog and cat food packaging volumes grow 11% to reach 47 million units in 2016

- Urbanization and sophisticated consumers drive growth for dog and cat food packaging

Trends

- Slight growth for metal food cans in wet cat food which is currently dominated by pouches

- Dog treats and mixers in flexible packaging grows over 6% due to the convenience

- Indians are increasingly treating pets as family members and take pleasure providing good quality food, snacks, and accessories. The percentage of pet owners who give prepared food to their pets instead of table scraps grows, as does dog and cat food packaging market.

- Flexible packaging accounted for an 83% volume share of dog and cat food packaging, aluminum plastic pouches grew 11%, while flexible plastic, which made strong headway over the review period, recorded sales of 17 million units and grew by 13%.

- In addition to being functional, dog and cat food packaging makes products stand out and provides honest information on contents, which helps with brand loyalty.

- Zip/press closures are only used on smaller packs and hence accounted for 6.1 million units in 2016, a 31% growth from the previous year.

Outlook

- Dog and cat food packaging volumes expected to post a CAGR of 9% over the forecast period.

- Strong price sensitivity among middle class consumers is likely to boost growth of affordable domestic brands while the more affluent opt for premium brands.

- Demand for pet food products will remain skewed towards urban regions, which will continue to dominate the market for dog and cat food.

- Dog food packaging will remain the largest category in dog and cat food packaging, and is set to continue accounting for a 98% share of dog and cat food packaging in 2021. Dry dog food will remain the largest category in dog food, accounting for a 64% share of sales.

- Dog treats and mixers packaging is expected to record a 9% CAGR of in volume terms. However, its share will decline slightly, outstripped by dry dog food.

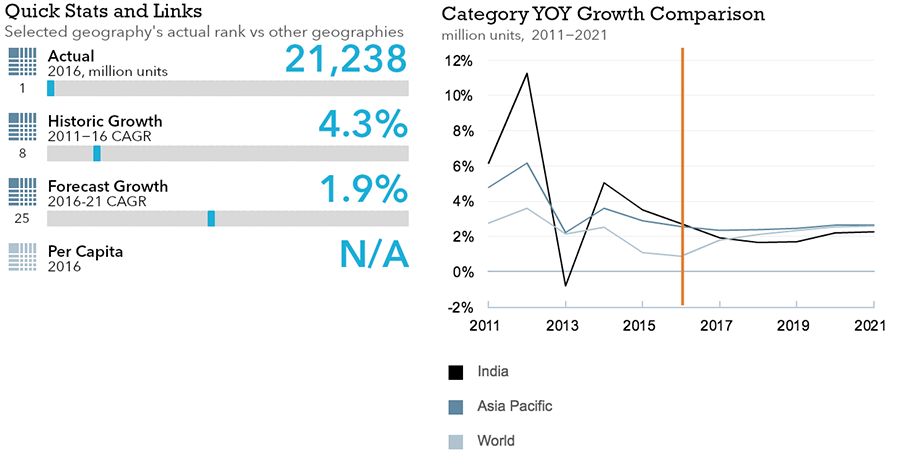

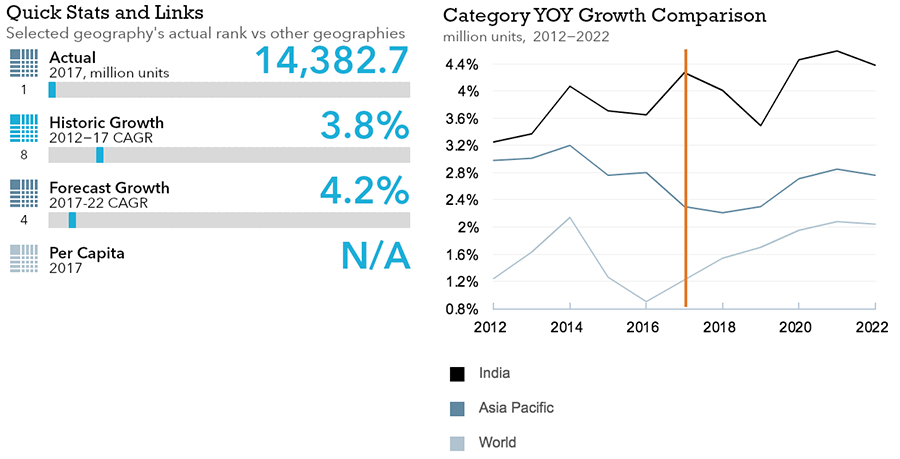

Beauty and Personal Care

Flexible Packaging Landscape

- Beauty and personal care product usage rose among affluent urban consumers, with sun care, facial moisturizers and facial cleansers among the most dynamic categories.

- Flexible packaging and tubes gain popularity, while closure types such as plastic dispensing closures and lotion pumps also become popular as they facilitate usage of products on-the-go.

- Packaging for beauty and personal care increases 3% to reach 21.2billion units in 2016

- Consumer demand for convenience drives growth in beauty and personal care packaging

Trends

- Baby and child-specific hair care in squeezable plastic tubes rises from low base to register fastest retail volume growth of 70% in 2016

- Flexible packaging remains most popular packaging type, accounting for 53%of total beauty and personal care packaging unit volume sales

- The rising trend of premiumization within the beauty and personal care market drove packaging innovations during 2016

- Natural, herbal and Ayurvedic products in the Indian beauty and personal care market impacted packaging and labelling trends, with brands focused on displaying key ingredients

- Facial moisturizers register the 19% growth from a low base in flexible packaging during 2016.

- Bar soaps in flexible packaging remained the most prominent, with sales of five billion units.

Outlook

- Beauty and personal care packaging expected to see a 2% CAGR over the forecast period with sales expected to reach 23.4billion units in 2021

- The major players are expected to focus on convenience and greater brand differentiation through packaging innovation, also driven by the growing premiumization trend.

- Lip liner/pencil in rigid plastic packaging is expected to register the fastest CAGR of 28% over the forecast period, to reach 1.7 million units from a low base by 2021

- Flexible packaging should remain the major packaging type, anticipating a fractionally positive retail volume CAGR to reach 11.5 billion units in 2021. It is expected to account for 49% of all beauty and personal care packaging in 2021.

Home Care

Flexible Packaging Landscape

- Demand in home care is based mainly on price and brand positioning. Packaging has not emerged as a key driver, with trends driven by shifts in consumer behavior such as the rising penetration of automatic washing machines and a shift away from hand wash

- Rising affluence and the subsequent shift away from detergent bars in dishwashing has led to folding cartons giving way to PET bottles, the dominant pack type for hand dishwashing liquids.

- Home care packaging sees total retail volume growth of 4% to reach 13.9 billion units in 2016

Trends

- Bigger pack sizes gain popularity among urban consumers as they offer better value for money

- Patanjali Ayurveda Limited launches laundry care products in HDPE packaging – unique for laundry care products

- As the government restricts use of plastic, manufacturers shift to flexible packaging.

- With disposable income increasing, consumers’ purchasing preferences evolve, shifting from powder to automatic detergents and from dishwashing bars liquids.

- Smaller pack sizes remained the most popular while demand for bigger pack sizes increased.

Outlook

- Home care packaging is expected to register a total retail volume CAGR of 4% over the forecast period to reach 16.6 billion units in 2021

- Consumers are expected to demand premium packaging like folding cartons and PET bottles.

- Increasing demand for air care products is expected to grow metal cans and blister packs over the forecast period.

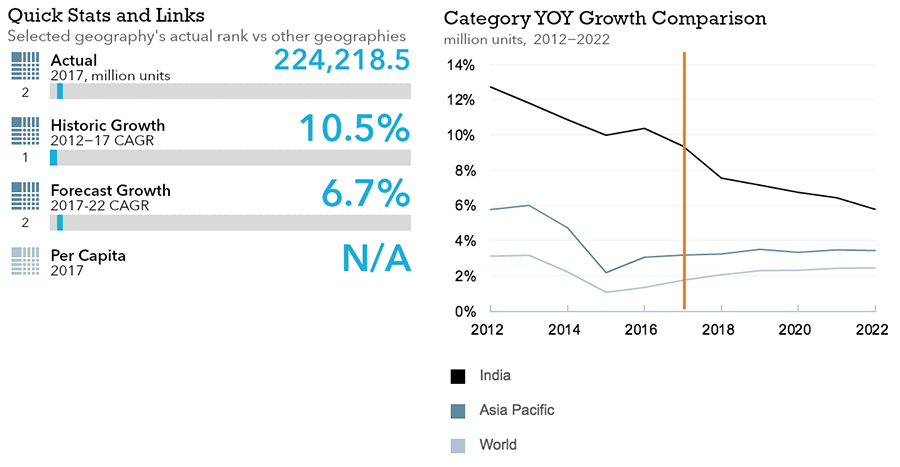

Packaged Food

Flexible Packaging Landscape

- Dairy has 7% total retail unit volume growth from 2015 to reach 38.7 billion units in 2016

- Sauces, dressings, and condiments saw 11% retail unit volume growth to reach 5.9 billion units

- 4% total retail unit volume growth in processed meat and seafood from 2015 to reach 49.2 million units in 2016

- Confectionery saw 11% retail unit volume growth from 2015 to reach 74.9 billion units in 2016

- 3% total retail unit volume growth in Processed Fruit and Vegetables from 2015.

Trends

- The importance of folding cartons continues to rise in baby food, offering affordability and large surface areas for printing images and listing product information.

- More traditional metal tins lose out as refill packs become increasingly popular in baby food.

- Sales benefit as consumers move from unpackaged, home-made dairy to packaged options

- Brick liquid cartons see strong 14% retail unit volume growth in 2016 as mid- to high-income consumers trade up within fresh milk

- Shift from unpackaged to packaged products fuels strong growth in dry sauces and herbs and spices and stand-up plastic pouches see strong growth in ketchup

- Knorr Chef's Masala launched in dry sauces in flexible aluminum/plastic with zip/press closures

- Shift away from use of secondary packaging in processed meat and seafood results in limited unit volume growth in comparison to product volume growth

- Move towards larger pack sizes in flexible plastic impacts unit volume growth in frozen processed meat in 2016 and drives confectionery growth.

- Rigid containers see strong growth in chewing gum and mints thanks to popularity of pellets

- Baby food saw 6% total retail unit volume growth to reach 255 million units in 2016, largely driven by low-cost folding cartons and flexible plastic. Sizing polarization seen across baby food

Outlook

- 6% CAGR in total retail unit volume terms for dairy expected over forecast period with sales reaching 51.8 billion units in 2021

- 11% total retail unit volume CAGR expected for Sauces, dressings, and condiments over forecast period to reach 9.7 billion units in 2021

- 14% total retail unit volume CAGR expected in processed meat and seafood to reach 93.6 million units in 2021

- 10% retail unit volume expected for confectionery with sales reaching 119.8 billion in 2021

- Processed fruits and vegetables see 12% total retail unit volume CAGR expected over forecast period with sales reaching 255.9 million units in 2021

- Growth driven by players expanding distribution in processed fruit and vegetables to reach beyond major cities, with a focus on smaller and more affordable packs

- Flexible plastic soars thanks to strong performance for frozen processed potatoes and vegetables

- Mother Dairy and McCain launch smaller pack sizes as they seek to attract first-time buyers

- Baby Food expects 5% total retail unit volume CAGR expected for forecast period to reach almost 322 million units in 2021