Overview

Packaging Overview

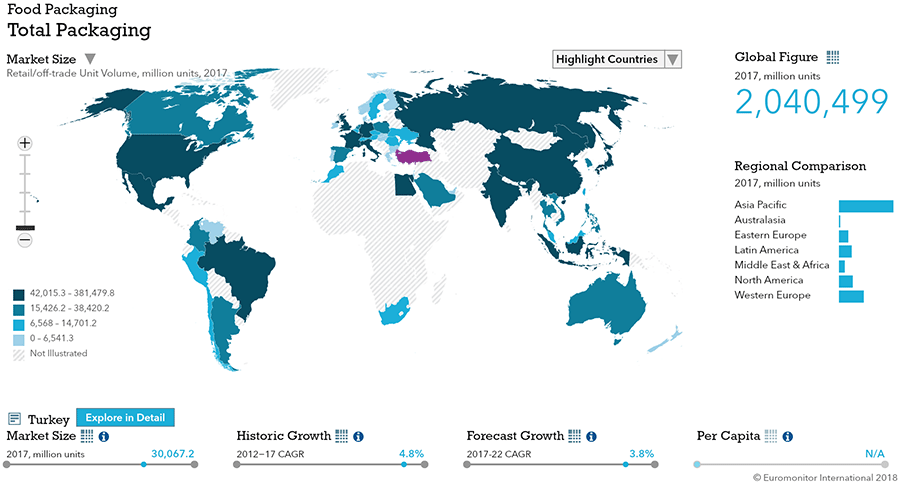

2016 Total Packaging Market Size (million units):

47,203

2011-16 Total Packaging Historic CAGR:

4.9%

2016-21 Total Packaging Forecast CAGR:

4.5%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 15,729 |

| Food Packaging | 28,538 |

| Beauty and Personal Care Packaging | 1,825 |

| Dog and Cat Food Packaging | 58 |

| Home Care Packaging | 1,054 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 10,570 |

| Flexible Packaging | 24,084 |

| Metal | 3,006 |

| Paper-based Containers | 2,075 |

| Glass | 4,457 |

| Liquid Cartons | 3,012 |

- The total Turkish packaging industry, sized at over 47 bn units in 2016, is expected to see strong growth.

- Food and beverage packaging continues to dominate packaging, but dog and cat food packaging presents a strong niche growth opportunity.

- Flexible packaging continues to lead in size, and rigid plastic ranks second.

Key Trends

- The poor performance of the Turkish economy during 2015 led to a consistent devaluation of the lira, which made packaging more expensive. Packaging manufacturers faced higher costs for imported inputs, while the price of imported packaging materials rose sharply. This led many brand owners to reassess their use of packaging in an effort to economize and avoid having to raise the unit prices of their products.

- Stand-up pouches are now emerging as a popular pack type in most fmcg industries as branded players aim to differentiate their products at a time of increasing interest in private label. In packaged food, pouches are becoming especially prominent in prepared baby food, savoury snacks and confectionery.

- Although glass bottles and metal beverage cans remain by far the most important pack types in beer, the use of metal beer bottles doubled over the course of 2016.

- Smaller pack sizes for home care products are becoming more popular as formulas become more concentrated.

Packaging Legislation

- Strict regulation of alcoholic drinks packaging: labelling must be completely accurate and not mislead the consumer in terms of the product’s nature, features, components, quantity, best before date, source country or the production method. The labelling should not in any way state anything that the product does not bear. The content of the labelling must be clear and easy to understand by the consumers. The labelling cannot claim that a product has any health benefits or have effect in terms of treating or preventing an illness of disease.

- Waste control regulations: The Packaging and Packaging Waste Control Regulations came into force in January 2005 and were subsequently amended in 2011. These regulations bring Turkey’s packaging waste legislation into line with EU Directive 94/62/EC. The primary aim of these pieces of legislation is to reduce the amount of packaging waste sent to landfills, and it applies to all packaging materials, including plastics, metals, glass, paper/cardboard and composites. The law also introduced specific recovery targets for all packaging, regardless of whether it is of domestic or industrial origin.

- Sales of unpackaged cheese are prohibited: As of January 1, 2016, the sale of unpackaged cheese is illegal in Turkey. Furthermore, cheese packaging labels must specify the production and expiration dates of the products.

Recycling and the Environment

- Packaging must be recyclable: Packaging waste control legislation was enacted by the Ministry of Environment in 2011 and this has banned the use of materials that cannot be recycled in product packaging.

- Environmental awareness rises: In recent years, Turkish consumers have become more aware of the environmental threat of posed by packaging, and many people are demanding more environmentally friendly forms of packaging. As consumers have become more interested in the recyclability of packaging and sustainable production, manufacturers in several fmcg industries have begun to invest in packaging which is sustainable and/or recyclable.

- Recycling is becoming more common: Turkey’s packaging and packaging waste management legislation controls all processes of all types of packaging waste and their recycling processes. Manufacturers are increasingly focusing on the separation of waste at source and increasing their recycling rate. In addition, this is frequently mentioned in marketing and communication campaigns as companies seek to tap into the rising environmental awareness among consumers. In particular, paper-based packaging has seen the most dynamic increase in recycling rate, whilst the recycling rates of all types of packaging materials have experienced marked rises in recent years.

Packaging Design and Labelling

- Seasonality affects alcoholics drink packaging: 2016 saw alcoholic drinks producers seeking to attract the attention of consumers by using packaging designs that reflect the season of the year. Examples included the designs on glass bottles for beer, spirits and wine for the New Year and summer seasons. In addition, manufacturers have started using tagging on the packaging for special occasions such as heart shapes for St. Valentine’s Day.

- QR codes become more prominent: Turkey’s large generation of young people are generally very interested in interacting with the online world and this led to the increased the use of QR codes in food packaging during the review period. Turkish consumers are becoming more health conscious and it is important for many people to know the ingredients of the products they are consuming and QR codes on packaging is an instant source of information in this respect.

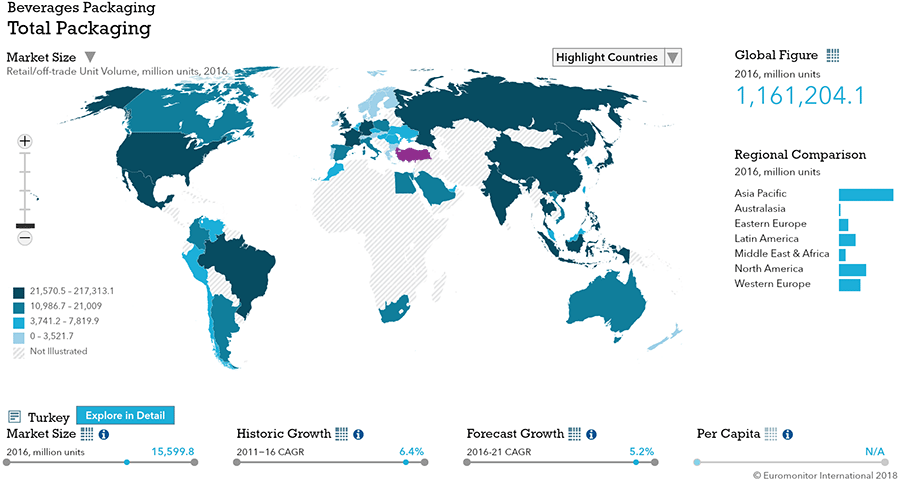

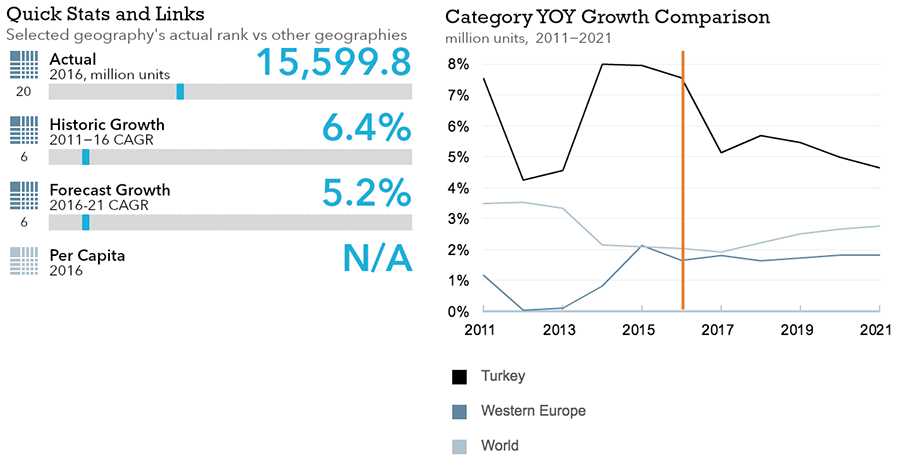

Beverages

Flexible Packaging Landscape

- Total Turkish beverage packaging volume is expected to see strong 5.2% CAGR growth through 2021.

- Flexible beverage packaging is expected to see slightly slower but still strong 4.3% CAGR growth through 2021.

Trends

- In soft drinks, packaging for still bottled water dominates the market, and in 2016 volume sales of PET and glass bottles for bottled water increased while other plastic bottles, primarily used for home bottled water delivery services, declined as consumers increasingly viewed them as unhygienic.

- In hot drinks, flexible packaging was the dominant packaging type, with an 84% volume share due to its predominance as packaging for tea and instant coffee.

- In alcoholic drinks, glass bottles dominate the market but also recorded the steepest drop in volume sales in 2016 as the overall alcoholic beverages market suffered as a result of the adverse economic and political conditions in Turkey, which led to decreased alcohol consumption, particularly in the foodservice sector.

- Smaller pack sizes grew in popularity across the last several years, particularly for more affordable 350ml glass bottles of spirits.

Outlook

- In soft drinks, PET and glass bottles volume sales are projected to continue growing at the expense of other plastic bottles.

- In soft drinks overall, the share of on-the-go products is expected to increase. As a result of shifting demographic factors, such as more Turkish women entering the workforce and the fact that households are getting smaller, Turkish families are spending more time away from home, and demanding products that they can consume while outside the home.

- In hot drinks, flexible packaging will remain the dominant packaging type through 2021. Flexible paper/plastic will remain the dominant packaging type for black tea, and flexible plastic will remain so for instant coffee. As a result of busy urban lifestyles, together with increasing employment and a growing student population, sales of coffee mixtures will increase, which will lead to higher sales of small-portion flexible plastic packaging.

- In alcoholic drinks, improved economic conditions and a projected increase in in-bound tourism through 2021 will result in positive growth in glass bottle volume sales, particularly for beer and spirits.

- Small pack sizes of beer and spirits are projected to grow in popularity through 2021, particularly for beer and spirits, but also to a lesser extent wine.

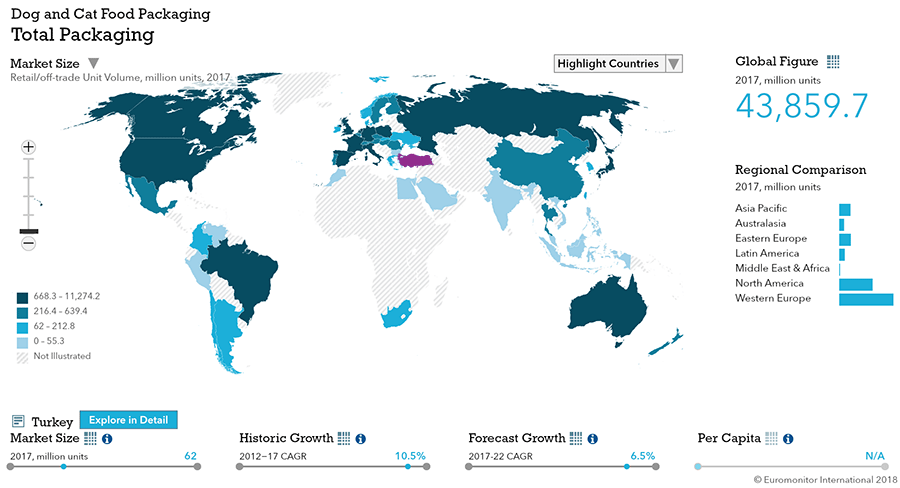

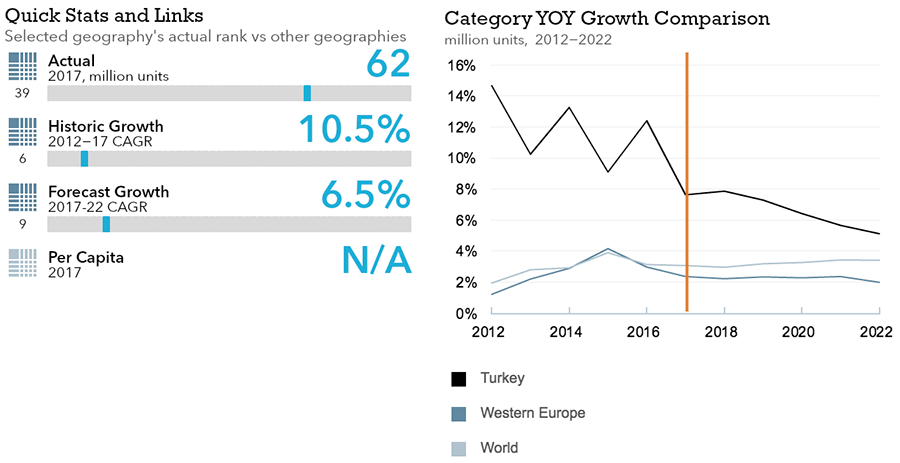

Dog and Cat Food

Flexible Packaging Landscape

- Total Turkish dog and cat food packaging volume is expected to see strong 6.5% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see even stronger 8.4% volume CAGR growth through 2022.

Trends

- Dog and cat food packaging sales volume grew by 4% in 2016, led by flexible aluminum/plastic, which recorded 16% growth.

- Plastic pouches are also increasing in popularity for both cat and dog food. Consumers increasingly prefer stand-up pouches and zip closures for prolonging the freshness of products and for ensuring food hygiene, and both local and multinational manufacturers are offering them.

Outlook

- Packaging volume is expected to grow at a 4% CAGR through 2021 as consumers become more urbanized and switch to feeding their pets specialized food. Preferences will likely shift towards packaging types that can keep products fresh and that are easier to use time and again, such as flexible plastic and plastic pouches with zipped closures.

- Additionally, bigger packages that weight more than 12kg will also come in flexible plastic and plastic pouches, as these are more durable than flexible paper. This could also help drive the growth of these packaging types since Turkish consumers are increasingly showing a preference for more economical bigger packages.

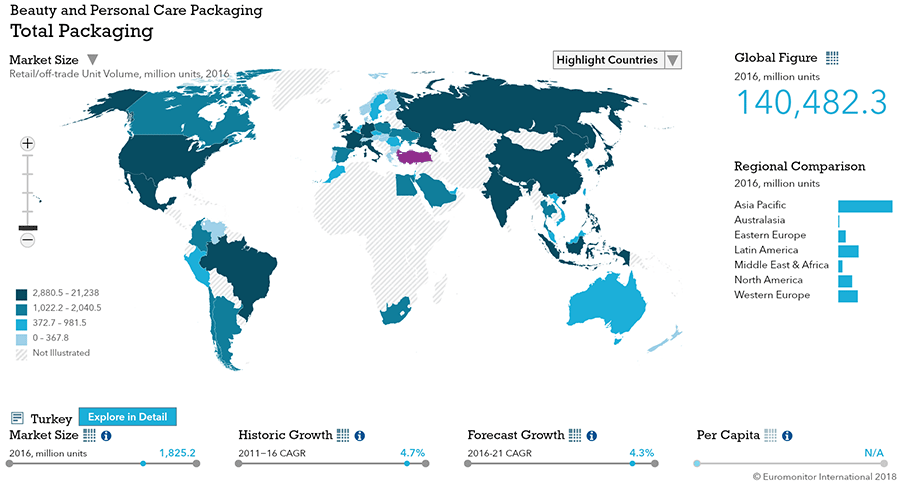

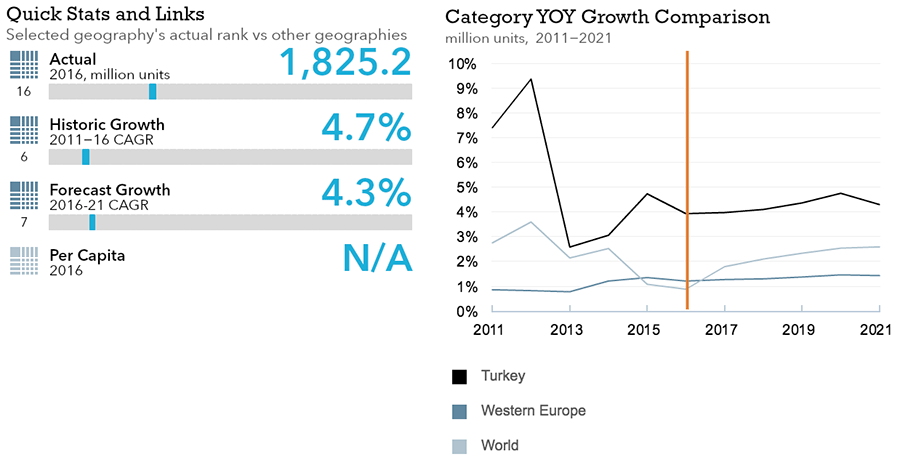

Beauty and Personal Care

Flexible Packaging Landscape

- Total Turkish beauty and personal care packaging volume is expected to see strong 4.3% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see limited 1.1% CAGR growth through 2021.

Trends

- Rigid plastic is the leading beauty and personal care packaging category in Turkey. HDPE bottles, which are mainly for shampoos and toothpaste, generate the majority of volume sales.

- Flexible packaging is the second largest pack type, mainly consisting of flexible plastic and paper packaging, which are typically applied to single-use products such as shampoos or toothpaste.

- Volume sales of folding cartons are also significant in beauty packaging as this pack type is used in many categories, notably skin care and fragrances, as secondary packaging.

Outlook

- Due to the increasing number of working women in Turkey, pack types that are perceived as particularly convenient are expected to post growth over the forecast period as working women have less time for shopping and are becoming busier at work.

- Sales of pack types that offer practical closures are expected to grow over the forecast period. Pump closures is set to boost the sales share of HDPE bottles at the expense of plastic dispensing closures in skin care, hair care and baby care due to the convenience and dosage control features of the format.

- Dropper closures will be another area of growth driven by increasing usage in skin care. Dropper closures will be used in anti-agers, with sales being driven by the growing popularity of serums and oils.

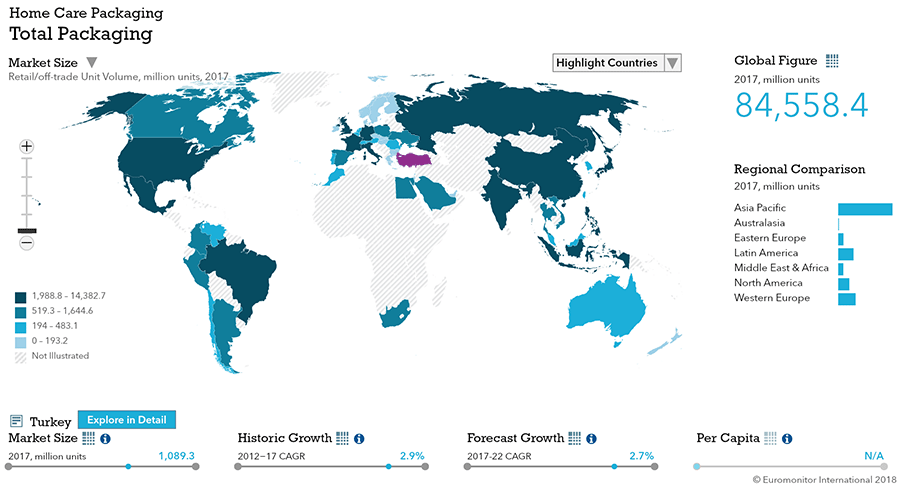

Home Care

Flexible Packaging Landscape

- Total Turkish home care packaging volume is expected to see moderate 2.1% CAGR growth through 2021.

- Flexible home care packaging is expected to keep pace with the overall home care packaging market, with 2.1% CAGR growth through 2021.

Trends

- Home care packaging volume sales registered 3% growth in 2016, driven by increased sales of smaller packs to consumers who are increasingly urban and living in smaller households.

- Usage of shrink sleeve labelling on HDPE and PET bottles rapidly became widespread in Turkey, due to the fact that home care products with shrink sleeve labelling were found to be significantly more attractive compared with those with sticker labelling.

- Consumers’ increasing price sensitivity and the swift spread of discounters in Turkey led many floor cleaner manufacturers to reduce unit costs by switching from HDPE bottles to PET bottles. By the end of 2016, the majority of floor cleaners were packaged in PET bottles.

- Slow growth in air care caused an increasing number of companies to prefer different packaging strategies in order to hold unit costs at a certain level at the end of the review period. As a result, metal aerosol cans continued to lose volume share against rigid plastic, as such packaging was increasingly preferred by manufacturers due to its lower cost in 2016.

Outlook

- Rigid plastic will remain the dominant home care packaging type through 2021 as a result of laundry care manufacturers’ efforts to promote liquid detergent over powdered detergent.

- Plastic pouches will also increase its unit volume share in the country over the forecast period, due mainly to strong forecast growth in automatic dishwashing tablet sales.

- The expected slow growth in air care, which will mainly stem from consumers’ increasing health concerns towards the potential harms of chemicals that air care products contain, and stagnation in the volume sales of polishes, will have a negative impact on metal cans in home care, so its unit volumes share is estimated to decline to a level of below 2% by the end of 2021.

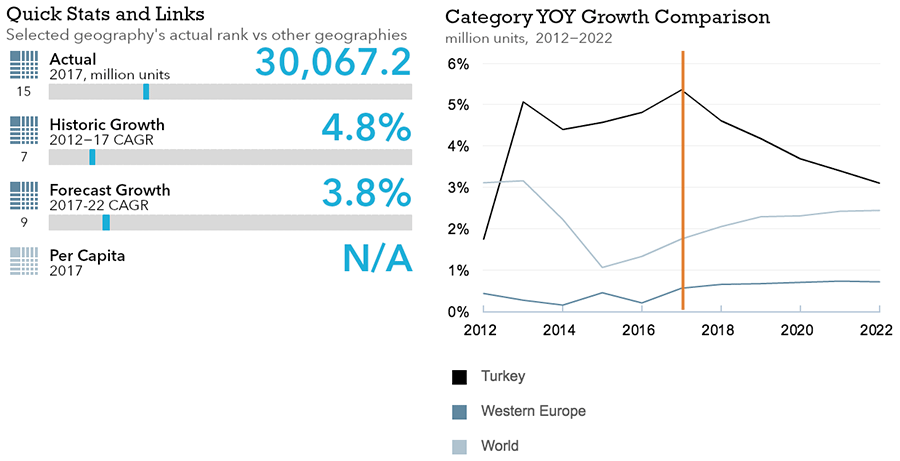

Packaged Food

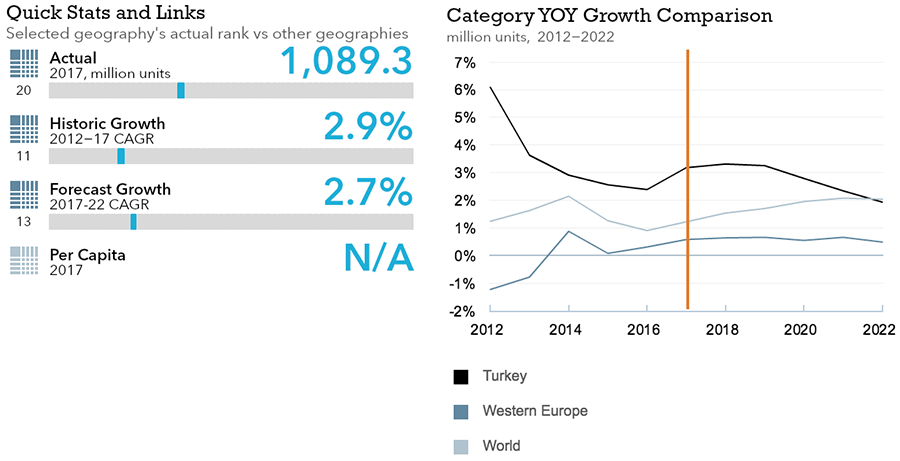

Flexible Packaging Landscape

- Total Turkish packaged food packaging volume is expected to see strong 3.8% CAGR growth through 2022.

- Flexible packaged food packaging is expected to record a slightly lower 3.7% CAGR growth through 2021—a higher growth rate than that of the global flexible packaged food packaging market as a whole.

Trends

- In sauces, dressings and condiments, HDPE remained the leading pack type in both ketchup and mayonnaise with significant total volume shares of 86% and 80%, respectively, in 2016.

- In processed meat and seafood, 8% volume sales growth in 2016 was due to a ban on the sale of unpackaged processed meat. For processed meat, metal food cans remained typical in the shelf stable category with flexible plastic mostly used in chilled and frozen, thin wall plastic containers in chilled, and folding cartons in the frozen category.

- In processed fruit and vegetables, 4% volume sales growth in 2016 was due to increasing demand from increasingly busy consumers. Glass jars continued to be the most popular packaging type, followed by flexible packaging.

- In confectionery, strong total volume growth of 5% was led by the increasing popularity of chocolate in stand-up pouches.

- In dairy, glass became the most common packaging type with 35% volume share in 2016, as consumers increasingly view it as the most healthy option, while they increasingly view PET bottles as the least healthy option.

- In baby food, glass jars registered the highest sales volume growth in 2016 at 14%, as consumers view them as the healthiest packaging types. However, stand-up pouches are also growing in popularity.

Outlook

- In sauces, glass is projected to remain the most popular packaging type through 2021, but stand-up pouches volumes sales are projected to increase as consumers increasingly seek convenience.

- In processed meat and seafood, total volume CAGR is expected to be 6% through 2021, driven by the increasing use of smaller pack sizes. Aluminum/plastic pouches will be the most dynamic packaging type, with a 13% CAGR during the forecast period, due to their lower cost to processors.

- In processed fruit and vegetables, glass jars will continue to drive growth through 2021, as consumers continue to prefer their appearance and associate them with superior products.

- In confectionery, flexible plastic is projected to remain the most popular packaging type through 2021 due to its low cost, and companies are expected to introduce more sizes.

- In dairy, glass will continue to grow in popularity through 2021, particularly for fresh milk, but flexible plastic packages with zip press closures for cheese is expected to appear in the market by the end of 2021.

- In baby food, stand-up pouches are projected to increase in popularity through 2021 as more manufacturers offer them in small sizes.