Overview

Packaging Overview

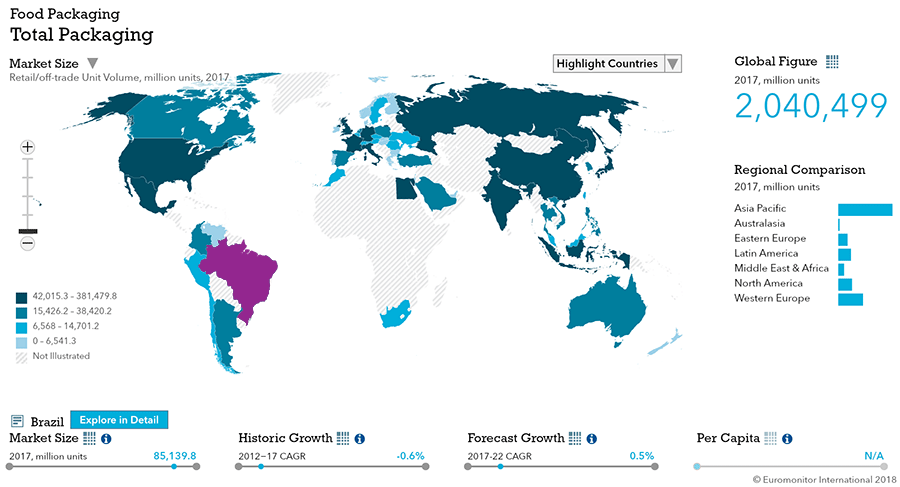

2016 Total Packaging Market Size (million units):

152,119

2011-16 Total Packaging Historic CAGR:

1.1%

2016-21 Total Packaging Forecast CAGR:

1.1%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

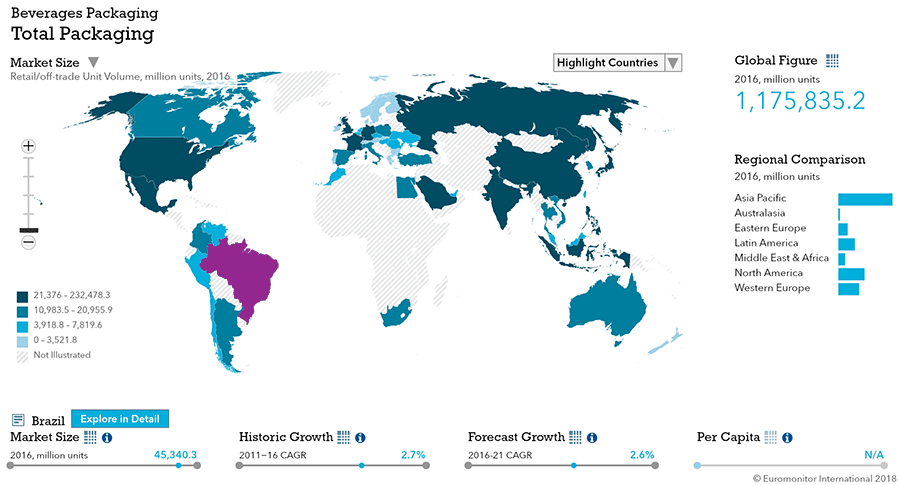

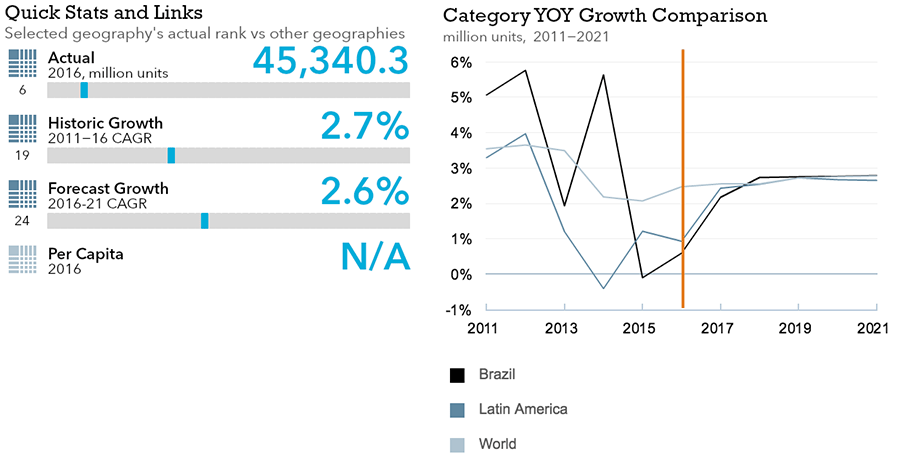

| Beverages Packaging | 45,340 |

| Food Packaging | 87,101 |

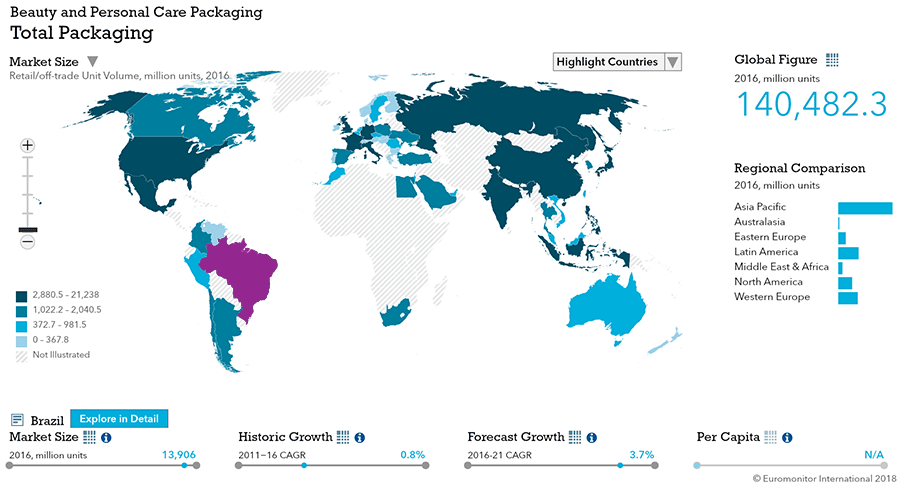

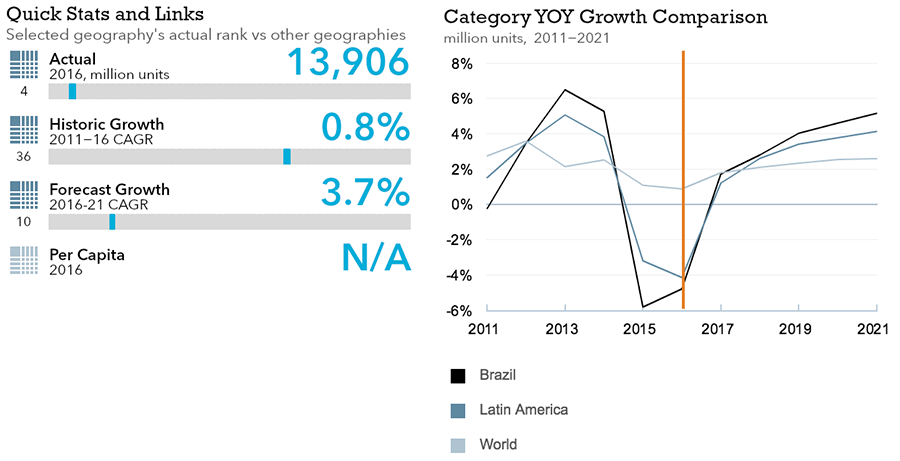

| Beauty and Personal Care Packaging | 13,906 |

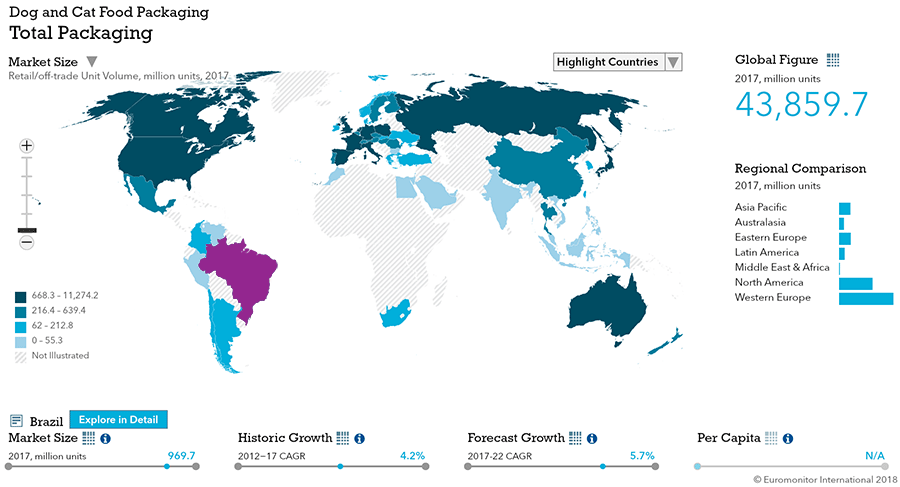

| Dog and Cat Food Packaging | 931 |

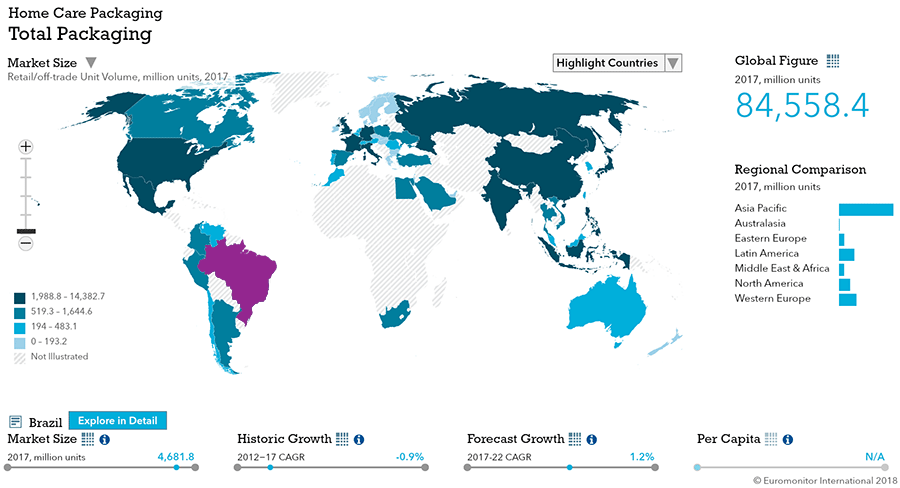

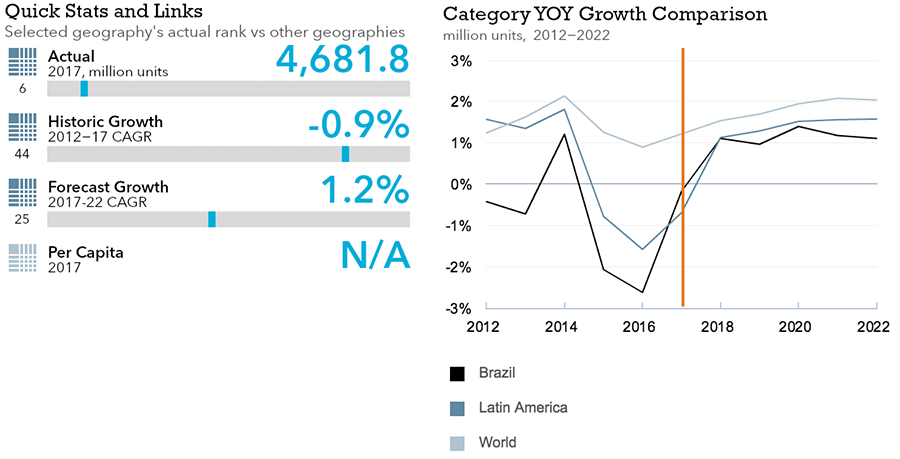

| Home Care Packaging | 4,842 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 42,236 |

| Flexible Packaging | 63,190 |

| Metal | 18,505 |

| Paper-based Containers | 10,087 |

| Glass | 6,732 |

| Liquid Cartons | 11,368 |

- The total Brazilian packaging industry, sized at over 152 bn units in 2016, is expected to see just over 1% growth.

- Food and beverage packaging dominates overall packaging, while package type is dominated by Flexible Packaging and Rigid Plastic.

Key Trends

- High inflation and lower GDP growth in Brazil meant consumers prioritized consumption to increase cost-benefit in every purchase through bulk shopping.

- US dollar valuation against the Brazilian real reflected in price fluctuations on production and packaging costs. Affordable and practical packaging gained participation across categories.

- Brazilians shop less frequently and focus on bulk items to supply their needs.

- While the economy is expected to recover, consumers are expected to remain price-sensitive.

Packaging Legislation

- Milk formula was impacted by new legislation banning advertising for products deemed to pose competition to breastfeeding. This legislation also banned price promotions and photos, drawings or text, while labels must highlight ages the product targets, preparation and hygiene measures and risks of improper preparation.

- Brazil finalized the National Policy on Solid Waste in 2010 to reduce the total volume of waste produced nationally and increase sustainability of solid waste management from a local to a national level. The main categories covered are tires; batteries; residues and packaging of agrochemicals; fluorescent, mercury and sodium vapor lamps; automotive lubricant oils; electronic equipment and computer parts and consumer appliances, among others.

Recycling and the Environment

- Leading players in beer expand program offering discounts on empty bottle returns.

- Consumers are increasingly focused on preserving the environment, with a focus on reducing the volume and weight of packaging, and an expected focus on using recycled content.

Packaging Design and Labelling

- Flexible plastic see 9% retail volume CAGR with viewing windows and transparent to be used to highlight quality.

- Players increasingly view packaging as a means of adding value to products, creating a highly competitive environment, especially for chocolate confectioners who use metallic boxes and foil bows as well as bright colors and distinctive cartoons.

- Growing demand for natural products in processed fruit and vegetables has consumers questioning ingredients used in this area. In response, companies offer stand-up pouches, with a viewing window and eye-catching comic-style graphics.

Beverages

Flexible Packging Landscape

- Alcoholic drinks packaging register a decline of 1%, reaching total volume of 37.4 billion units.

- Soft drinks packaging records 1% total volume growth in 2016, and will likely see CAGR of 3%.

Trends

- 2% fall in beer’s total volume sales negatively impacted metal beverage cans. Glass bottles increased slightly, particularly small bottles and multipacks increased, leveraged by beer and malt-based RTDs sales

- Soft drinks packaging has been negatively affected by the economy, with many beverage categories undergoing severe market reductions. Industry polarization benefits small pack sizes in PET bottles and liquid cartons and family-sizes

- Although sales of cachaça (typical Brazilian spirit) continue to shrink, the product represents 76% of the category’s total volume sales in 2016. The migration to other types of distilled beverages and other emerging products like RTDs/high-strength premixes, continue to negatively affect sales of economy and standard cachaça.

- Sales of alcoholic drinks through atacarejo outlets represented 11% of total sales in 2016, and is expected to increase.

- Sales of bigger pack sizes benefited from more attractive prices per unit and small/individual-sized packs gave focused positioning on indulgence products or niche premium brands.

- 100% juice was the most dynamic packaging category in 216 with 19% increase in total volume units. PET bottles registered total volume growth of 29%.

- Shaped liquid cartons also performed well in 100% juice with an 18% total volume growth rate, leveraged particularly by 330ml and 1,000ml.

- Liquid cartons registered positive volume growth of 3% in 2016, especially through shaped versions for on-the-go consumption.

- Mineral bottled water ranked second in volume growth, at 7%. Sales of small PET bottles and thin-wall plastic cups benefited from low unit price and practical packaging.

- Flexible packaging registered a growth rate of 4%, leveraged by powder concentrates.

Outlook

- Alcoholic drinks packaging is expected to register 1% total volume CAGR. Glass bottles will lose unit shares to metal cans but see a 1% CAGR.

- Soft drink packaging is expected to have a CAGR of 3%, reaching 43.2 billion units in 2021.

- Liquid cartons should remain the most dynamic packaging types, with an expected CAGR of 4% to 2021. This should be driven by sales of 100% juice, coconut and other plant waters, and RTD tea. Brick liquid cartons will register the most positive performance, but shaped and gable-top versions are expected to emerge and consolidate. Wine also drives growth in shaped liquid cartons and metal packaging, both expected to grow at 8% and 12% CAGR respectively.

- Glass bottles should see a CAGR of 5%, leveraged by sales of 100% juice and premium still bottled water (particularly for foodservice).

Dog and Cat Food

Flexible Packaging Landscape

- Total dog and cat food packaging sees 2% growth in 2016 to just over one billion units.

- Total dog and cat food packaging predicted to see 3% CAGR to reach 1.2 billion units in 2021.

Trends

- The affordability and efficiency of stand-up pouches coupled with visual appeal on shelves combined with the premium perception to lift the category by 11% in wet dog food and 9% in wet cat food.

- Flexible aluminium/plastic saw 6% growth in dry dog food while flexible plastic remained dominant with 577 million units, seeing growth of less than 2%.

- Dog treats saw growth mainly due to the category’s small size, and is primarily offered in small pouch packaging.

- Stand-up pouches see total growth of 5% in 2016, metal cans see slight negative performance as consumers demand convenience.

- Wet cat food in pouch packaging performs well with 9% growth to 25 million units.

Outlook

- Dog and cat food packaging should see a CAGR of 3% to 1.2 billion units in 2021. A continued shift towards higher quality food products and greater demand for convenience will drive it.

- Stand-up pouches are expected to see a unit volume CAGR of 5% or 216 million units in 2021; wet cat food in pouches is expected grow 9% to exceed 38 million units in 2021.

- Stand-up pouches for dog food are expected to see a CAGR of 4% and flexible aluminum/plastic is predicted to see a 5% CAGR.

Beauty and Personal Care

Flexible Packaging Landscape

- Beauty and personal care packaging is set to experience unprecedented growth of 2.3% by 2021

Trends

- The variety of package sizes and colors has been reduced to lower production costs.

- Smaller packaging formats are set to continue recording increases in volume shares over the forecast period.

- The average sizes of products of daily use have increased, while smaller sizes have become more common for products used more sporadically.

- Mass women’s fragrances registered a major volume decline, although as many consumers have started to buy fragrances in smaller packs.

- Deodorants saw a shift towards smaller packaging, mainly in deodorant sprays.

Outlook

- In deodorants, the penetration of deodorant sprays in compressed formats is expected to increase their volume share from 12% in 2016 to 21% in 2021.

- The volume share of special shampoos and conditioners in plastic pouches should increase.

- Smaller packaging formats, including HDPE bottles and plastic jars, can be expected to increase in volume in conditioners.

Home Care

Flexible Packaging Landscape

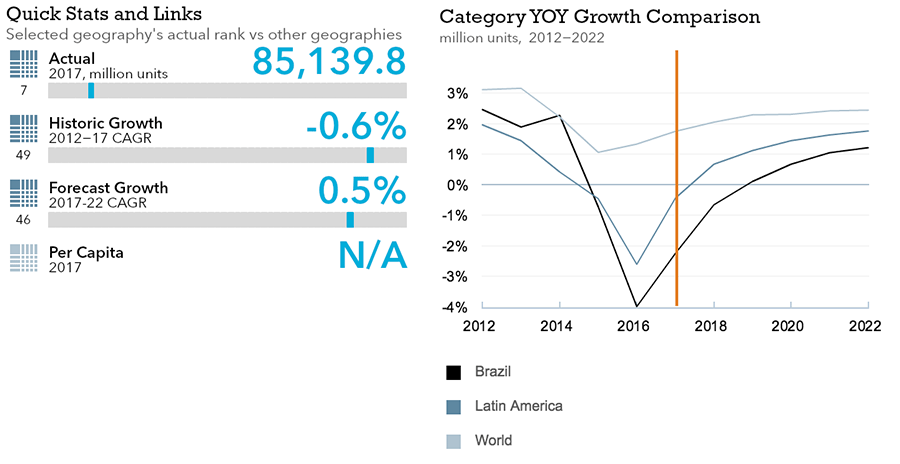

- Home care packaging is expected to post 1% retail volume CAGR in 2021 while flexible packaging is expected to decline by 2.4%, making Brazil demand lower than both worldwide demand and growth within Latin America as a whole.

Trends

- Consumers seek bigger packaging sizes, as purchase frequency decreases over 2016

- HDPE bottles gain relevance in liquid detergents, reaching a 42% share of the market in 2016

- PET bottles gained space over HDPE bottle types, especially in hand dishwashing disinfectants.

- Manufacturers are investing in concentrated fabric softeners and hand dishwashing which use packaging up to 500ml, 1,000ml and 1,500ml. In hand dishwashing, 5,000ml is available in warehouse clubs, a channel that grew fast over the latter part of the review period.

- Brazil suffered an outbreak of zika and dengue during 2016, which caused sales of home insecticides to reach sales of BRL1.3 billion, a 13% current value increase versus 2015.

Outlook

- Consumers want more information on recommended dosages and utilizing home care products, which will lead manufacturers to increase label instructions.

- Manufacturers will continue investing in packaging to decrease operating costs. Bigger formats will be introduced and it is also predicted that smaller sizes will be more present on shelves.

- Plastic pouches are expected to continue gaining relevance within polishes and liquid fabric softeners, laundry aids, and standard powder detergents.

- The fastest growth among home care packaging will come from multi-purpose cleaners in flexible packaging, with an expected retail unit volume CAGR of 20% over the forecast period.

- Metal tins are increasing participation in car air fresheners, representing 9% retail volume sales, a figure that is expected to reach 12% by 2021.

Packaged Food

Flexible Packaging Landscape

- 2% retail volume CAGR expected in 2021 in fruits and vegetables.

- Historic growth of processed fruits and vegetables flexible packaging is predicted to be 0.5%.

Trends

- Smaller packs and rigid plastic gain in fresh and shelf stable milk as consumers seek value and convenience

- Shelf stable vegetables support dominance for metal food cans

- Stand-up pouches see growth in shelf stable vegetables and frozen processed potatoes

- Rigid plastic in fresh and shelf stable milk overtakes flexible plastic, with 4% retail volume decline in fresh milk and 2% decline in shelf stable milk in 2016. PET bottles saw 16% retail volume growth in shelf stable milk in 2016.

- In dairy desserts, two-packs saw 2% decline, six-packs 2% growth. 12-packs grew over 3%.

- Within condensed milk, easy-open can ends and plastic dispensing closures saw 13% and 8% unit volume growth respectively. Cream aerosol sprays and plastic overcaps had 7% growth each. Peel-off foil remains the dominant closure type, with steady growth in 2016 at 1%.

- Stand-up pouches see strong performance in overall sauces, dressings and condiments, with retail volume growth over 6%, accounting for 21% unit volume share in total packaging.

- Aluminum/plastic pouches have 10% growth in cooking and 12% growth from a low base in cooking sauces. This pack type also proved most resilient in declining tomato pastes and purées.

- Glass outpaced total packaging, going up over 4% and 9% retail volume growth in pasta sauces.

- Metal food cans saw sharp annual retail volume decline in overall sauces, dressings and condiments with a drop of 20%. This product achieved its first annual growth of 3%.

- PET bottles, HDPE bottles had growth of almost 3% each.

- Metal lug closures and metal screw closures saw the strongest performance in closures for sauces, dressings and condiments in 2016, growing by 5% and 7% respectively. Metal screw closures are growing by 9% and 10% respectively.

- Shelf stable seafood saw 4% growth in packaging, double the rate of growth for overall processed meat and seafood. Metal food cans account for 99% unit volume

- Shelf stable meat lost share to chilled processed meat, with the latter at 3% unit volume growth, frozen processed meat is at 2% growth.

- Stand-up pouches saw poor performance in processed meat and seafood in 2016, with a decline of 2%. In contrast, aluminium/plastic pouches increase by 16%.

- Easy-open can ends saw 3% unit volume growth and account for 91% of closure units. Standard can ends saw a sharp decline of 7% and peel-off plastic had 33% unit volume growth.

- Stand-up pouches saw 7% growth and "other" plastic trays saw 2% growth yet the strongest retail volume growth was thin wall plastic containers at 24% for confectionary packaging.

- Shelf stable vegetables dominate, growing over 3% to account for 83% of the total, with sweet corn and peas highlighted. Metal food account for 69% of volume but had 1% volume growth.

- Larger pack sizes saw 8% retail volume growth and 500g flexible plastic 15% growth in shelf stable vegetables.

- Within frozen processed fruit/vegetables, flexible plastic accounts for 98% overall unit volume.

- The dominance of metal food cans in shelf stable fruits/vegetables results in easy-open can ends and standard can ends dominating, accounting for a combined 85% unit volume.

- Glass jars remain dominant in prepared baby food, accounting for 98% of unit volume. Growth was muted below 2%. Plastic pouches and thin wall plastic containers saw 15% and 12% retail volume growth respectively while remaining niche pack types.

- Milk formula moves away from traditional packaging; metal tins account for 92% volume in 2016, and 130g plastic pouches saw 19% growth and 500g multipacks saw growth over 20%.

- Peel-off foil and plastic over caps dominate baby food closures, accounting for 53% unit volume share in 2016. A shift towards stand-up pouches impacts demand for these closures, with each seeing 2% decline, equal to the decline seen in plastic screw closures.

Outlook

- Packs are set to see 17% unit volume CAGR in powder milk, while 1kg packs will see 4% CAGR. Larger multipacks of six will see a strong performance in yogurt and dairy desserts, with 5% CAGR and 4% CAGR respectively in unit volume terms.

- Shelf stable milk, shaped liquid cartons and PET bottles are notably likely to see 12% CAGR and 8% retail volume CAGR respectively.

- With the Brazilian economy expected to return to slow growth in the forecast period, the shift away from less convenient pack types is expected to continue. Flexible plastic will struggle as a result and is expected to see 12% retail volume decline in milk and 34% decline in drinking yogurt. This pack type is set to remain strong in powder milk, with 3% unit volume CAGR.

- Easy-open can ends will see 7% unit volume CAGR and plastic dispensing closures will see a similar growth rate. Within cream, aerosol sprays will see over 6% retail volume CAGR.

- Glass is set to see 4% unit volume CAGR as it is used to convey a premium and natural image. A particularly strong performance is expected in pasta sauces with 7% CAGR.

- Stand-up pouches are expecting 7% unit volume CAGR in pasta sauces. Many consumers will likely to opt for stand-up pouches, while buying premium pasta sauces in glass as an occasional treat.

- PET bottles gained over HDPE bottles in sauces, dressings and condiments, but PET bottles expect 2% unit volume CAGR in comparison to 3% CAGR for HDPE bottles.

- Metal lug and screw closures will have 4% and 6% unit volume CAGR respectively.

- Oven-ready packaging will be a strong trend in frozen processed meat and should expand into frozen processed seafood.

- Aluminium/plastic pouches will see 9% retail volume CAGR in processed meat and seafood.

- Confectionery will see players focus heavily on packaging innovation with limited edition packs and flavors and opulent, distinctive designs.

- Flexible plastic will remain the dominant pack type used for confectionery, accounting for 63% share and see 11% unit volume growth in countlines and 4% growth in tablets.

- Stand-up pouches are key success story in processed fruit and due to low production and distribution costs and strong preservation qualities and will thus see a 10% retail volume CAGR from a low base, and a stronger 11% CAGR in frozen processed potatoes.

- Metal food cans will see sluggish growth, with an increase of 2% in comparison to 12% growth during the review period. This pack type accounts for 56% unit volume share in overall processed fruit and vegetables 2021

- Within shelf stable vegetables, bulk 500g packs will see retail volume CAGR of 15%, while single-portion 70g packs will perform with 4% CAGR.

- Metal screw closures will see 3% retail volume CAGR, albeit from a low sales base.

- Stand-up pouches will see 16% unit volume CAGR in dried baby food and prepared baby food, particularly for 150g and 180g sizes, which will see 15% and 16% CAGR respectively in dried baby food in the forecast period, while 113g single-portion pouches will see 11% CAGR in prepared baby food.

- Within milk formula, metal tins will see below-average growth at 3% CAGR. Glass jars will continue to dominate prepared baby food but will see just 2% CAGR.

- Within powder milk formula, 1.1kg packs will see the strongest performance in metal tins, with 6% unit volume CAGR.