Overview

Packaging Overview

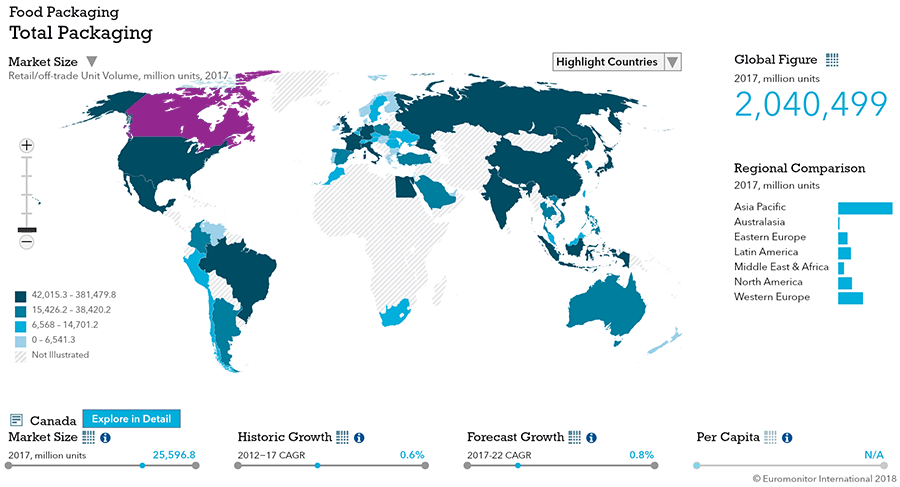

2016 Total Packaging Market Size (million units):

46,488

2011-16 Total Packaging Historic CAGR:

0.6%

2016-21 Total Packaging Forecast CAGR:

0.9%

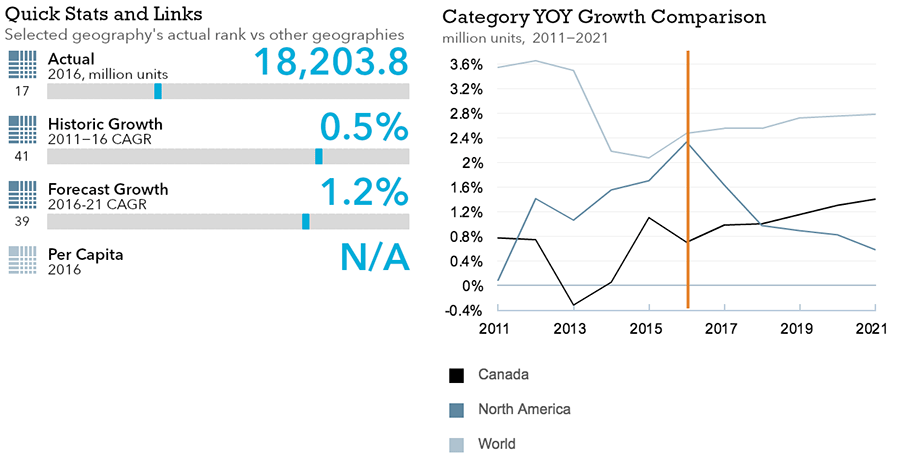

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

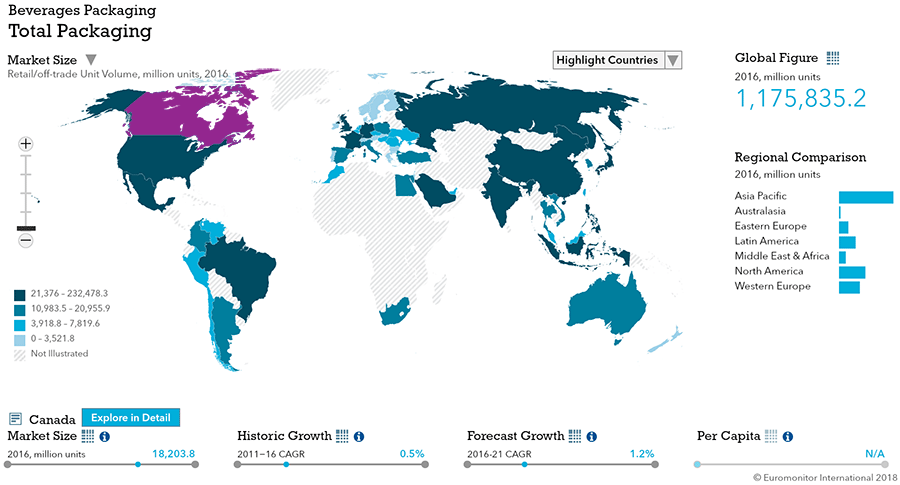

| Beverages Packaging | 18,204 |

| Food Packaging | 25,450 |

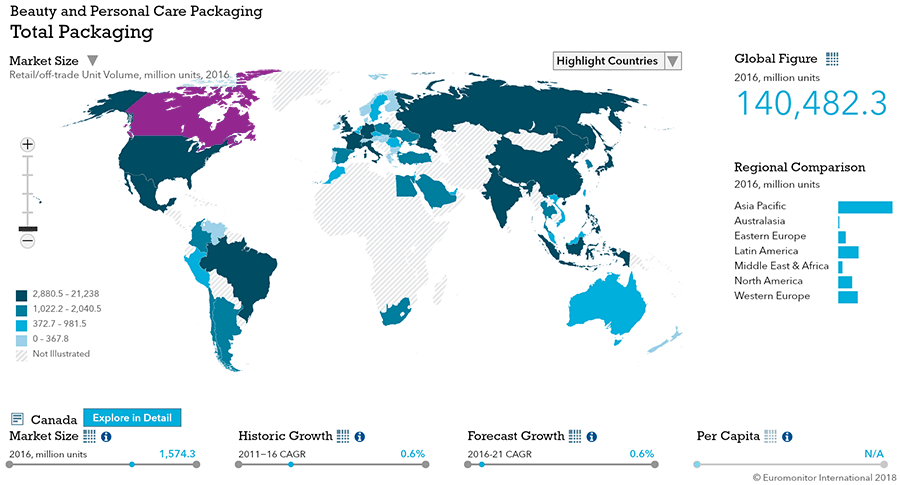

| Beauty and Personal Care Packaging | 1,574 |

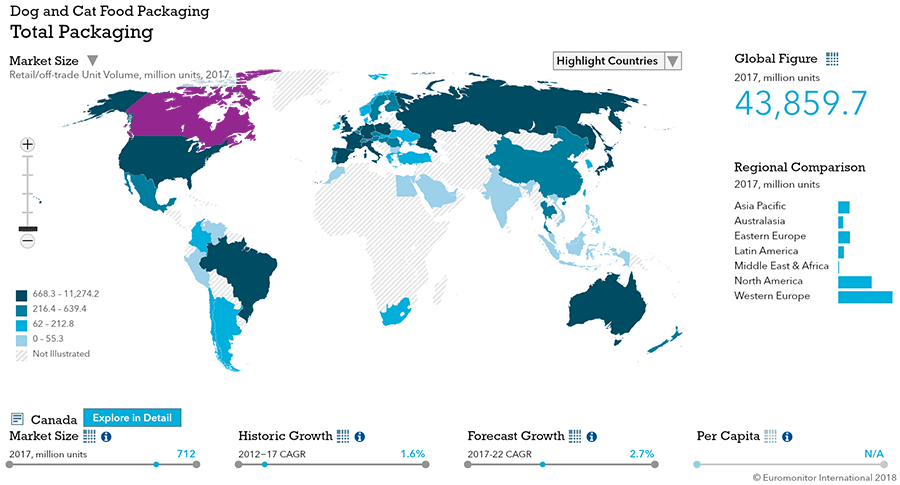

| Dog and Cat Food Packaging | 693 |

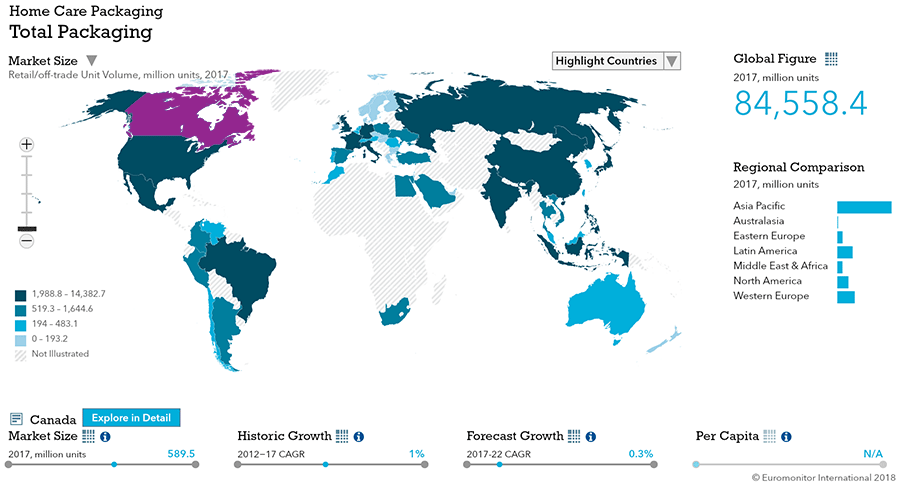

| Home Care Packaging | 567 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 11,984 |

| Flexible Packaging | 13,148 |

| Metal | 8,839 |

| Paper-based Containers | 5,347 |

| Glass | 5,343 |

| Liquid Cartons | 1,825 |

- The total Canadian package industry, sized at 46,488 units, is expected to grow 0.9% during the forecast period.

- Food and beverage packaging continues to dominate packaging.

- Flexible plastic leads in size and growth rate, but rigid packaging ranks second

Key Trends

- Younger generations tend to snack frequently on the go, at work, and while studying.

- Sharing, convenience, easy to reseal, and portion control lead to variety in size and growth potential for plastic pouches, which remain popular across categories.

- Pack sizes are expected to remain split between smaller, convenient containers and larger, more economical packages across categories.

- Convenience remains a key element for Canadians, reflected in packaging formats and shopping outlets. In 2015, pet superstores, supermarkets and hypermarkets remained the leading retail channels with 24%, 22% and 19% value shares, respectively.

Packaging Legislation

- The Government Shelves De-regulation of Food Packaging Regulation food packaging sizes will be lifted. Food products manufactured and marketed in Canada will not lneed to be packaged and sorted into designated sizes in terms of weight or volume. A wide range of products, from honey to baby food will be impacted.

- Evolving Requirements on Product Labelling In July 2014, the Canadian government introduced plain language labelling regulations and finalized requirements for labelling Halal food products. As part of continuous improvement, the Canadian Food Inspection Agency (CFIA) wishes to support industry compliance and introduced a web-based Industry Labelling Tool in 2014 offering clear guidance on the federal labelling.

Recycling and the Environment

- Environmental and health concerns remain a source of uncertainty for packaging choices in soft drinks. In February 2016, a proposal to ban plastic bottled water was brought forth in Montreal and Quebec. Over 80 towns and cities in Canada have set limits, including Toronto.

- Wider Acceptance of Recycling Programs Multi-Material British Columbia (MMBC), a non-profit established as part of the Extended Producer Responsibility (EPR) programs provides collection services to residents of British Columbia, to increase the access to collection services.

- Packaging Plays Instrumental Role in Food Waste Portion-controlled packaging and informative labelling help consumers stay rationale in food purchases and innovations extend shelf life.

Packaging Design and Labelling

- In Dog and Cat Food category, terms such as “organic”, “natural” and “biologically appropriate” are likely to become increasingly prominent on packaging labels and in advertising.

- The use of clear containers remained popular for beauty and personal care brands looking to emphasize the clarity or a specific product feature of products.

- Packaging innovation in home care is seen in squeezable PET bottles with three holes allowing customers to squeeze the bottle and smell the scent and including a dosing cap, often used in food products, but innovative in home care. Child-resistant packaging for detergent tablets or pods in laundry care and dishwashing also gained popularity.

- Unique and interesting packaging, often used by niche players to differentiate from major brands and provide incentives for trial and repeat purchases. Glass bottle packaging, which caters to nostalgia, is becoming an attraction among consumers who are collecting the bottles and buying lids as collectors’ items from the company website.

- There appears to be an increase in the use of marketing messages on sauce, dressings and condiments packaging to push Canadian origins as a key selling feature on product packaging. Also an effort communicate the latest trends in health and wellness such as using labels to highlight high-quality ingredients, food origin, and how the product is sourced and produced.

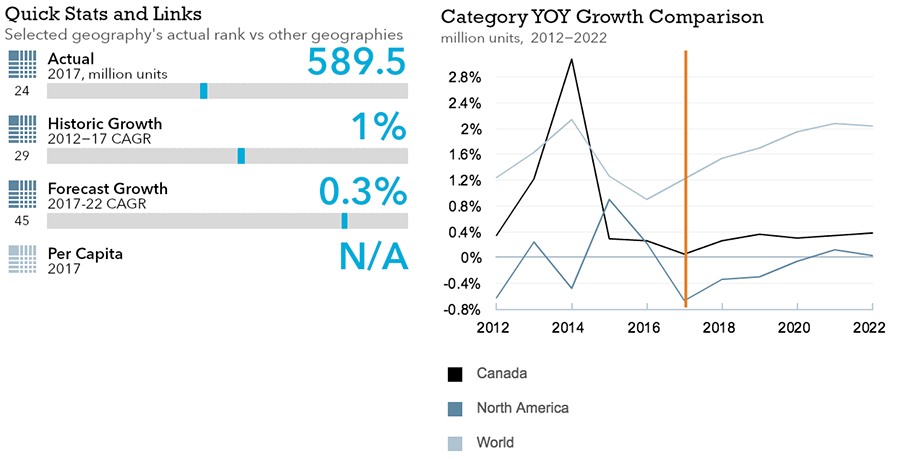

Beverages

Flexible Packaging Landscape

- Metal outpaces other materials in alcoholic drinks while glass sees sustained decline and plastic pouches increase in RTDs due to visual appeal, portability and less air exposure

- Total soft drink packaging increases 1% in 2016 with a 2% expected CAGR by 2021

- Glass packaging loses share, but is preferred for premium brands in carbonates, bottled water, RTD coffee, and juice.

Trends

- Alcoholic drink packaging, for retail and foodservice, primary and secondary, was stagnant in 2016, standing at 7.3 billion units in total unit volume terms. Primary packaging stagnated at almost 7.3 billion units, accounting for 99%, of total packaging unit volume.

- Beer packaging accounted for 83% of total packaging unit volume in 2016. Wine packaging registered growth of 4%, while packaging of spirits and RTDs rose by 2-3%. Cider packaging, recorded another year of double-digit growth, rising by 13%.

- Glass accounts for 64% of total alcoholic packaging volume. This represented sustained contraction over the period from 2011, when glass packaging accounted for 73% of alcoholic drinks packaging unit volume.

- Metal packaging increased 6% in 2016 to reach 2.5 billion units, accounting for 35% of total packaging unit volume in Canada.

- Total packaging for soft drinks, as a whole increased by 1%. The positive growth represents improvement from the previous years of stagnation.

- Rigid plastic, primarily PET bottles for a wide range of categories in soft drinks, surpassed metal for the first time to a share of 40%. Metal beverages cans, saw 1% growth

- Liquid cartons and glass packaging represent 8% and 7% respectively of total packaging in retail.

- Despite the overall decline of carbonates, glass packaging has shown positive growth, increasing 1%and accounting for 6% of total retail unit volume for carbonates.

- Bottled water packaging grew 3% with PET bottles used for 85% of the total.

Outlook

- Alcoholic drinks packaging as a whole is forecast to grow by 1% to reach 7.4 billion units in 2021.

- Glass packaging projected to drop to CAGR of 2%, when it will account for 57% of total alcoholic drinks packaging. Metal is forecast to grow 4% annually by 2021, accounting for 41% of total.

- Liquid cartons expected to trend upwards, a CAGR of 2% in small-sized wine but are projected to shrink at a CAGR of -2% representing 6% of total unit volume in retail for juice packaging, RTD tea and water.

- Total soft drinks packaging expected to see a CAGR of 2%, including small size carbonates, bottled water, RTD tea, and energy drinks.

- Rigid plastic packaging expected to see a CAGR of 3%, representing 44% of total unit volume in retail. Metal packaging will expand by a CAGR of 1%.

- In terms of closures, innovative designs that offer more convenience, allow more customisation and greater functionality will be the focus in soft drinks.

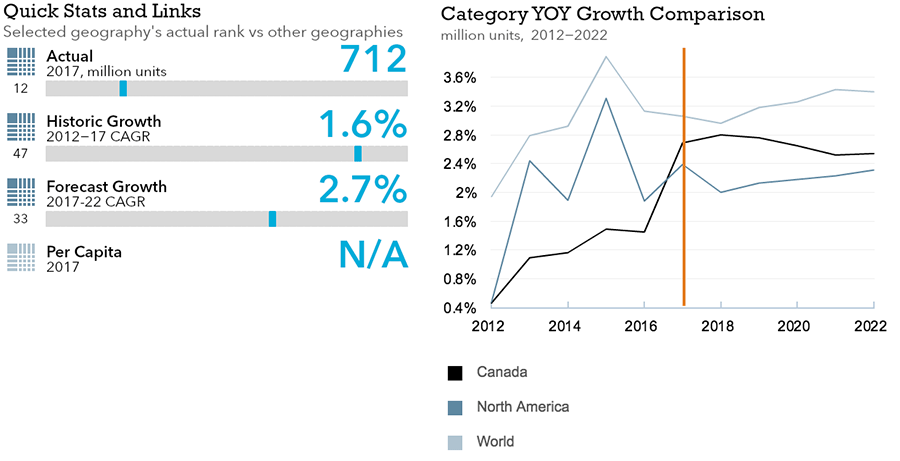

Dog and Cat Food

Flexible Packaging Landscape

- In 2016, dog and cat food packaging records growth of 2%, reaching 694 million units

- Premium pet food and treats remain the most dynamic categories.

Trends

- Flexible plastic posts the strongest growth in 2016, with a 6% rise. While flexible paper is the dominant packaging in dry food, flexible plastic represents 14% of all units in dry dog food, which continues to outperform wet dog food.

- Milk-Bone Brushing Chews treats for daily oral care are packaged in toothpaste-type boxes

- Dog and cat food packaging is posted volume CAGR of 2% in 2016. Treats, mixers, and dry food together posted 2-3% growth and wet food, which accounts for 58% of the category, grew by 1% in the same year.

- Dog population declined marginally in 2016 and ownership of smaller breeds continued to rise at the expense of larger breeds. This trend contributed to 1% growth in dog and cat food in 2016

- Stand-up pouches grew as unit volumes increased 2% across dog and cat food. Shares are 46% in dog treats and mixers and 99% in cat treats and mixers. The format is creating competition for traditional packaging formats such as flexible plastic for dry food.

Outlook

- Dog and cat food packaging is expected to post a unit volume CAGR of 2% in the forecast period. The market is developed and mature and growth will be driven by product development, packaging type updates, and size adjustments. The fastest-growing pack type is set to be flexible plastic with a unit volume CAGR of 6%.

- Dog and cat food is expected to post a value CAGR of 3% at constant 2016 prices. The moderate 1% CAGR in volume terms over the same period indicates the category is mature and saturated.

- Stand-up pouches expected 2% CAGR driven by dry food, dog treats and mixers.

- Flexible plastic in dry cat food represented 11% with an expected increase to 16% in 2021.

- Aip/press closures are set to rise by 23% in volume terms over 2016-2021. Manufacturers are likely to continue integrating them into flexible plastic packaging in dry dog food.

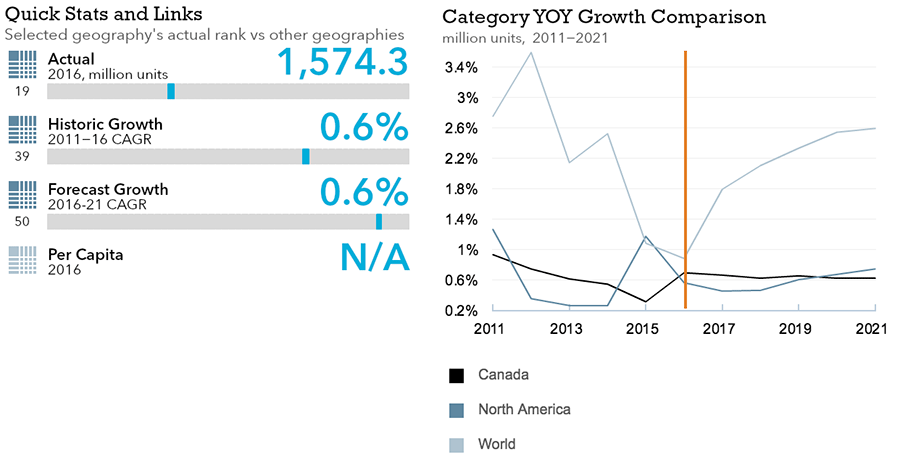

Beauty and Personal Care

Flexible Packaging Landscape

- Total beauty and personal care packaging retail volume sales grow by 1%.

- Specialty skin care and make-up products boost growth in BB/CC creams, among others.

Trends

- Deodorants spray companies differentiate through new and innovative packaging and closures.

- Deodorant sprays saw 3% growth, matched by metal aerosol cans as primary packaging.

Outlook

- Total beauty/personal care packaging retail volume sales to see 1% CAGR.

- Over the forecast period, packaging retail volume sales are expected to increase by 1% CAGR.

- BB/CC creams projected to post 4% CAGR with squeezable plastic tubes an estimated 71% share of primary packaging. Deodorant sprays projected 3% total packaging volume to drive innovations in closures and compressing ingredients into metal aerosol cans.

Home Care

Flexible Packaging Landscape

- Home care packaging registers flat total retail volume growth to stand at 567 million units.

- Downsizing negatively impacts volume in home care packaging in 2016.

Trends

- Plastic pouches continues strong growth in home care, thanks to laundry detergent tablets.

- Downsizing continued in many home care categories due to convenience, cost, and environmental concerns. Bleach registered negative volume growth of 2%.

- Plastic pouches recorded 4% growth, thanks primarily to single-dosage detergents in laundry care and dishwashing. Automatic detergents and dishwashing in plastic pouches grew 4%.

- Laundry care, dishwashing, bleach and surface cleaners all experienced packaging downsizing. Concentrated-formula products gained popularity in these four categories because it saves production costs and addresses environmental issues that concern consumers.

Outlook

- Home care packaging is expected to register a flat retail volume CAGR over the forecast period due to cost reduction and sustainability initiatives.

- The shift from powder and liquid detergents to tablets will continue, though at a slower pace compared to the review period. Powder detergents were mostly packaged in paper-based containers and liquid detergents in HDPE bottles in 2016. Plastic pouches for detergent tablets within laundry care is expected to register a CAGR of 5% over the forecast period.

- Metal aerosol cans is expected to register a 1% CAGR with air fresheners and home insecticides as the major categories. Air fresheners could register growth if there is new fragrance development, while home insecticides will stay flat unless there is an insect outbreak.

- More PET containers will be used in laundry care and surface care over the forecast period thanks to an eco-friendly trend which will result in rising production of PET bottles. Highly sustainable and with the ability to be recycled into new containers or to make new products. the light weight bottle saves fuel and transportation costs.

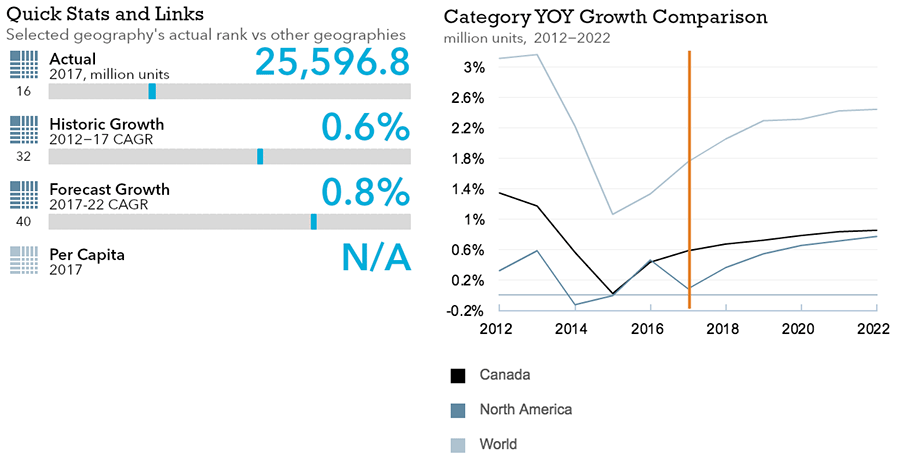

Packaged Food

Flexible Packaging Landscape

- Total dairy and baby food packaging both grow 1% in total volume terms in 2016

- Total sauces, dressing, and condiments grew marginally to reach 867 million units while processed fruit/vegetables packaging grew 1% to see a marginal CAGR.

- In 2016 total processed meat and seafood packaging sees 2% drop in retail volume terms.

- Total confectionery packaging sees 1% rise in retail volume with chocolate pouches and bags seeing the fastest volume growth of 5% in 2016.

Trends

- Thin wall plastic containers return to positive retail volume growth as yogurt sales rise, and rigid plastic accounts for 67% of all primary dairy packaging.

- Liquid cartons have a 15% share of retail volume sales in dairy and saw marginal growth.

- Plastic jugs remained prevalent in western provinces, and 4-litre flexible plastic bags were more common in Ontario and Quebec.

- Cheese packaging rebounded after a decline in 2014 to a 1% increase in 2015 and 2016.

- In 2016, total sauces, dressings and condiments packaging grew marginally in retail unit volume terms as sauce consumption moved away from staple condiments to more ethnic influences.

- Flexible packaging remained dominant at 56% of primary processed meat and seafood packaging, yet sales decreased 3% in 2016.

- Paper-based containers and metal packaging accounted for 23% and 19% share of processed meat and seafood retail unit volume sales of primary packaging in 2016.

- Flexible packaging and paper-based containers accounted for 17% and 10% share of processed fruit and vegetable retail unit volume sales.

- Secondary packaging grew in confectionery; used by brands to improve aesthetics hygienics.

- Total processed fruit and vegetables packaging increased 1%, driven by health-consciousness, price hikes for fresh fruit and vegetables, and a smaller pack sizes.

- Metal, the leading format for processed fruit and vegetables, has 44% share of primary packaging and saw 1% decrease in 2016.

- Stand-up pouches in baby food grows at the expense of glass and other traditional packaging formats while rigid plastic receives a boost as brands seek differentiation.

Outlook

- A 2% retail volume CAGR is expected in dairy primary packaging over the forecast period to reach 6.5 billion units by 2021.

- Dairy primary packaging is predicted to see 1% retail volume CAGR.

- Rigid plastic is set to post 2% retail volume CAGR. Liquid cartons and flexible packaging are estimated to see 1% retail volume CAGR.

- In yogurt, the growing presence of plastic pouches, which will be used to reduce packaging. Stand-up pouch format is also being widely adopted by a growing number of brands in baby food, particularly organic baby food, which is enjoying rapid uptake and saw a significant reshuffle in terms of brand line-up during the review period.

- Total sauce, dressings and condiments is projected to grow by 1% retail volume CAGR with lightweight packaging expected to outpace other packaging over the forecast period.

- Total processed meat and seafood packaging (primary and secondary) is set to see a negative 2% retail volume CAGR over the forecast period to reach 1.3 billion units by 2021

- Total processed meat and seafood packaging is expected to see negative 2% retail volume CAGR

- Total confectionery packaging to see1% retail volume CAGR over the forecast period.

- At constant 2016 prices, retail value sales of confectionery are expected to grow faster than retail volume sales over the forecast period.

- Total baby food packaging is set to grow by 1% CAGR over the forecast period.