Overview

Packaging Overview

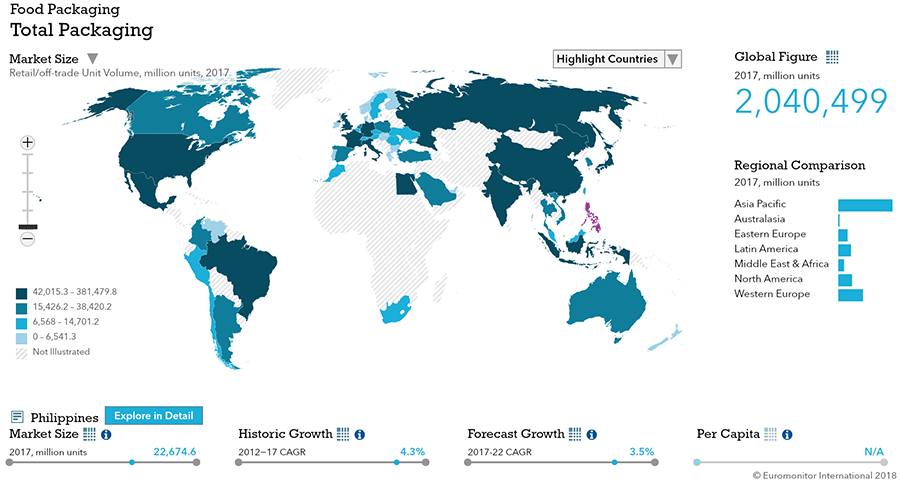

2016 Total Packaging Market Size (million units):

53,954

2011-16 Total Packaging Historic CAGR:

5.2%

2016-21 Total Packaging Forecast CAGR:

3.9%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

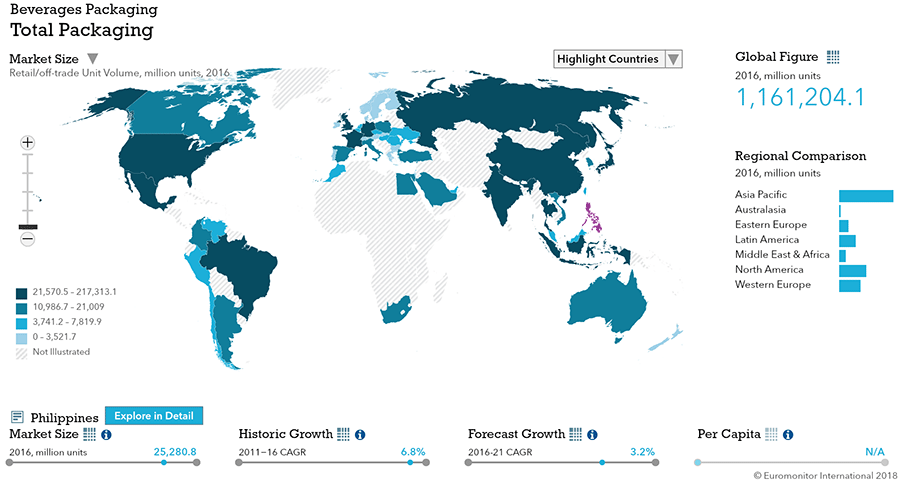

| Beverages Packaging | 23,168 |

| Food Packaging | 21,766 |

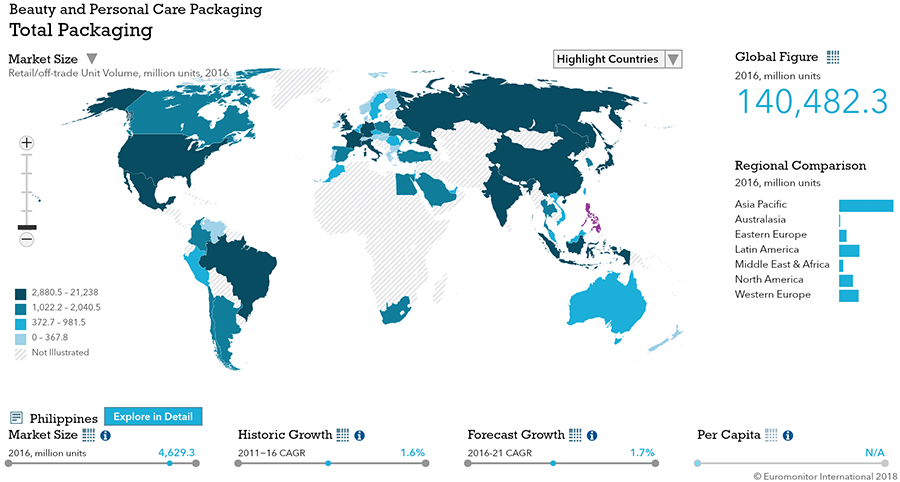

| Beauty and Personal Care Packaging | 4,629 |

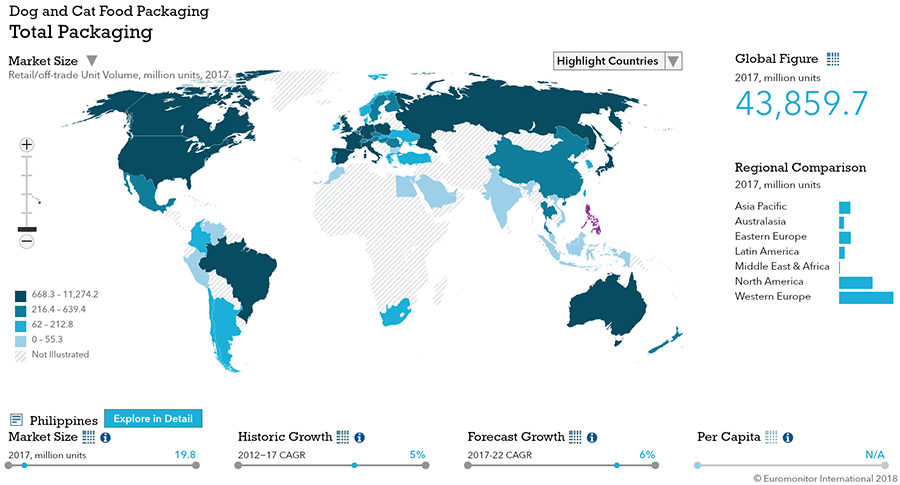

| Dog and Cat Food Packaging | 19 |

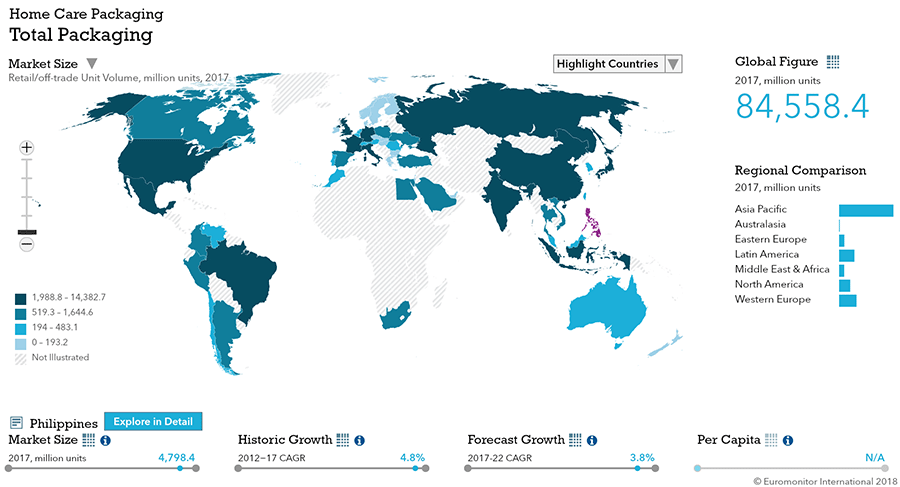

| Home Care Packaging | 4,372 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 9,661 |

| Flexible Packaging | 29,866 |

| Metal | 2,317 |

| Paper-based Containers | 1,749 |

| Glass | 9,931 |

| Liquid Cartons | 392 |

- The total Filipino packaging industry, sized at over 53 bn units in 2016, is expected to see strong growth.

- Food and beverage packaging continues to dominate packaging, but dog and cat food packaging presents a strong niche growth opportunity.

- Flexible packaging leads in size, and glass ranks second.

Key Trends

- As glass bottle packaging continued to be the most popular within the alcoholic drinks industry, this presented an opportunity for metal screw closures. While in beer, products in glass bottles are enclosed by metal crowns, growth of spirits and wine boosted demand for metal screw closures.

- Packaging reduction became a trend within home care in the Philippines against the backdrop of an improving economy. There was an upsizing trend within the home care industry, particularly in the category of dishwashing, according to Kantar Worldpanel.

- The booming growth of convenience stores accelerated in the last couple of years of the review period. The increasingly busy lifestyles of Filipino workers, matched with the preponderance of jobs that involve changing shifts, influenced growth of convenience stores, which typically offer smaller pack sizes of beauty and personal care products.

Packaging Legislation

- Packaging legislation remains lax in most industries: In recent years the government has focused on more-pressing social issues such as waste management, employment, and the control of counterfeit and illicitly traded products rather than packaging regulations.

- Improved nutrition labelling is sought for food and non-alcoholic drinks: With the increasing health concerns of consumers, the government pushed forward with efforts to help consumers make healthier choices through packaging. The non-alcoholic drinks industry had a head start on nutrition labelling, as it had been mandatory since October 2014. Nutritional facts must reflect calories, total fat, saturated fat, trans fats, cholesterol, sodium, total carbohydrates, dietary fiber, sugar and protein in a food or beverage product. The Philippine Nutrition Label Act seeks to require the declaration of allergens in processed food on labels.

Recycling and the Environment

- Manufacturers actively promote re-use and recycling: Bearing in mind that waste disposal incurs costs, manufacturers are going beyond using returnable glass bottles to lower such costs. For instance, the sister company of San Miguel Brewery and Ginebra San Miguel, San Miguel Yamamura Corp, has been producing GLASSlite bottles that require fewer raw materials without reducing quality. Furthermore, the packaging company recovers broken bottles for re-use. Additionally, some companies, including Nestlé Philippines, have implemented their own recycling programs.

Packaging Design and Labelling

- Convenience drives packaging innovation: Increasingly busy and affluent Filipino consumers demand convenience. This trend is evident in the sales growth of soft drinks in PET bottles, which are easy to carry around and resealable, and the increasing popularity of single-serve sachets of instant coffee in flexible aluminum/plastic packaging. Additionally, the packaged food industry also showed an increase in the use of small pack sizes that are more attuned to the purchasing behavior of mass-market consumers, who tend to buy in small quantities more frequently.

- Premiumization through packaging design and labelling continues: Premiumization of packaging design and labelling has been a strategy for manufacturers to justify higher prices, particularly for alcoholic drinks. Within the beauty and personal care industry, the use of metallic colors to convey a certain look of high quality and modernity was evident in 2016. Home care brands also changed the artwork of labels to make them more appealing, particularly to younger consumers.

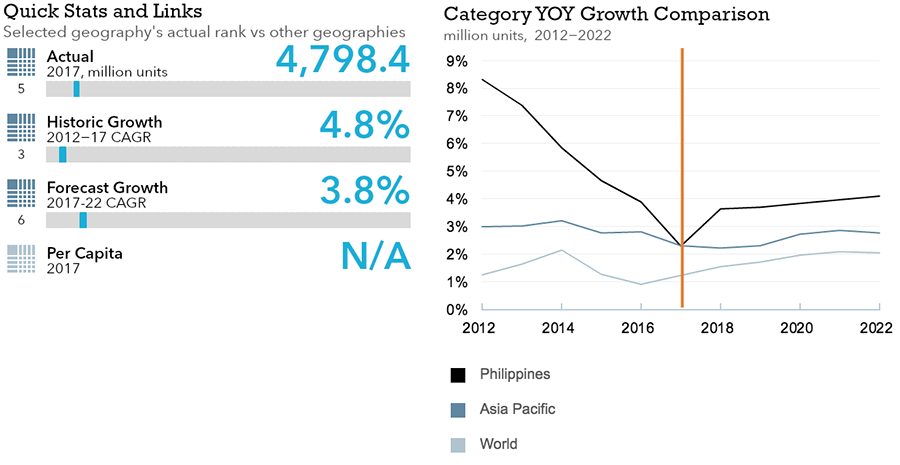

Beverages

Flexible Packaging Landscape

- Total Filipino beverage packaging volume is expected to see strong 4.5% CAGR growth through 2021.

- Flexible beverage packaging is expected to see even stronger 6.2% CAGR growth through 2021, outpacing volume growth for the global beverage packaging market as a whole.

Trends

- In soft drinks, PET bottles led growth in 2016, with total unit volume sales rising by 10% as manufacturers responded to consumer demand by shifting away from less convenient glass bottles.

- In hot drinks, rigid plastic was the fastest growing packaging format in 2016. Despite consumer price consciousness, there is still a niche market for premium hot drinks, which fuelled growth within rigid plastic in 2016, particularly in PET jars.

- In alcoholic drinks, glass bottles remain the dominant packaging type, sustained by strong demand for domestically produced beer and spirits.

- Large pack sizes, particularly in beer and wine, are becoming more prominent in the Philippines. In beer, for example, imported premium lager, which is traditionally only available in 330ml glass bottles and metal beverage cans, can now be found in larger pack sizes.

Outlook

- In soft drinks, PET bottles is expected to continue to dominate sales and to lead growth with a total unit volume CAGR of 5%, driven by increasing demand for soft drinks in convenient packaging.

- In hot drinks, flexible packaging is expected to be the fastest growing format and post a retail unit volume CAGR of 8% over the forecast period, with flexible aluminum/plastic is expected to account for some 98% of the overall increase in hot drinks packaging sales expected by 2021. This packaging format has also penetrated sari-sari stores, the most significant retail channel in hot drinks, with this trend not expected to change over the forecast period.

- In alcoholic drinks, packaging volume sales are projected to post a 10% decline in 2017 but increase again by about 3% year-over-year during the 2018-2021 period. Driven by the popularity of eating out in the Philippines and the demand for draft beer, kegs volume sales are projected to post a 2% CAGR through 2021. However, glass bottles will still dominate the beer category.

- Wine will remain a niche category in the Philippines, and metal screw closures are expected to grow at the expense of corks through 2021.

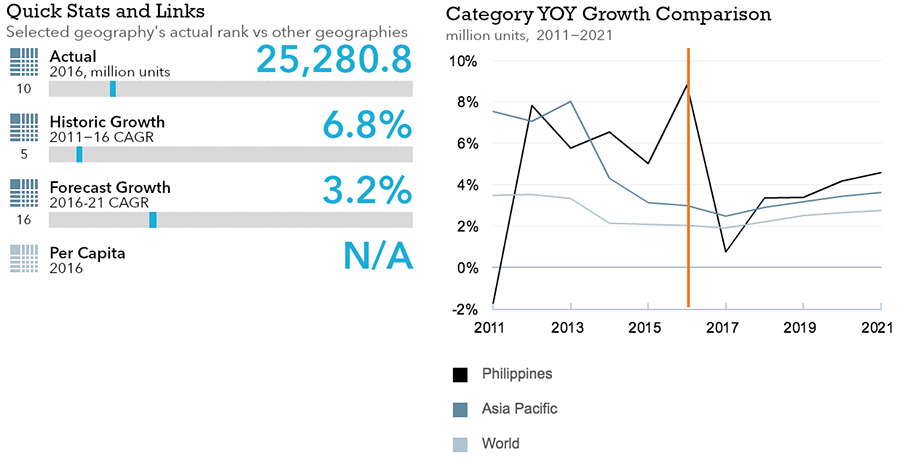

Dog and Cat Food

Flexible Packaging Landscape

- Total Filipino dog and cat food packaging volume is expected to see strong 6.0% CAGR growth through 2022.

- Flexible dog and cat food packaging is expected to see much stronger 9.9% volume CAGR growth through 2022.

Trends

- A growing economy and educational campaigns focused on animal welfare led dog and cat food packaging sales volume growth of 5% in 2016.

- Flexible plastic recorded the fastest unit volume growth in 2016, due to its widespread use in categories such as dry cat food, dry dog food and dog treats and mixers.

Outlook

- Dog and cat food packaging is expected to record a volume CAGR of 6% over the forecast period to reach 25 million units in 2021.

- Flexible plastic is expected to record the fastest unit volume growth over the forecast period, as late adopters are likely to choose affordable options such as dry dog food and dry cat food, which are typically packaged in flexible plastic. Larger pack sizes are likely to become more popular over time, as they are cheaper per unit and require less frequent trips to the store.

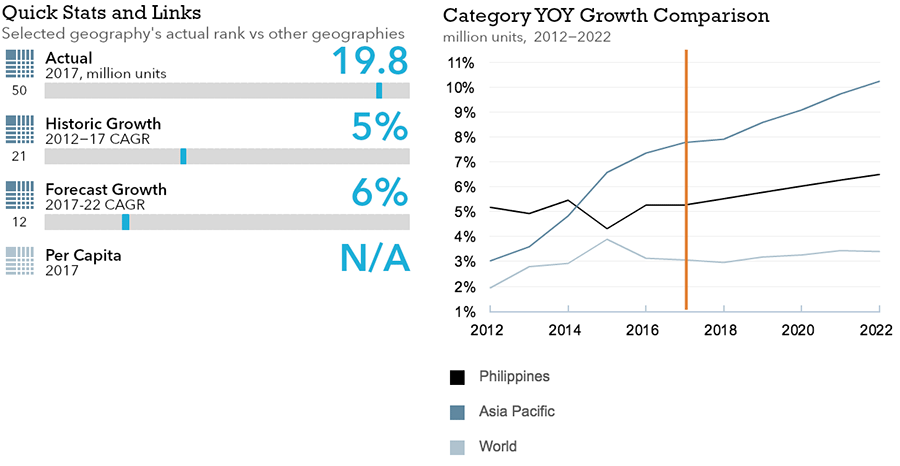

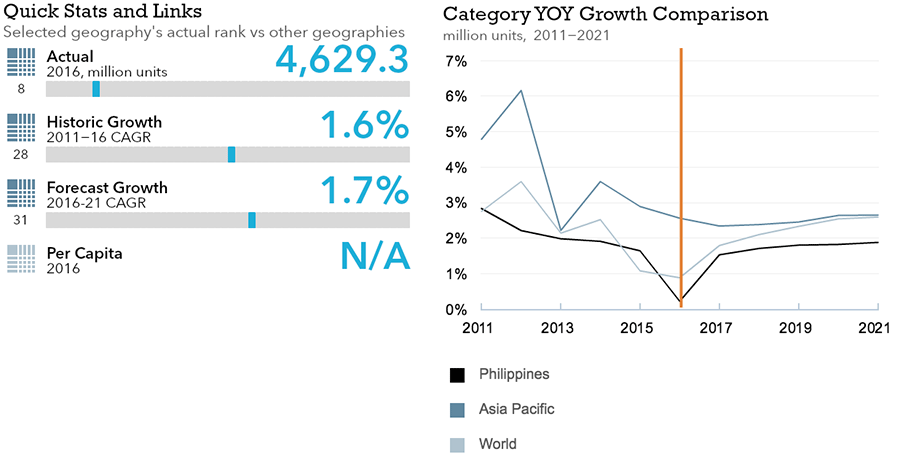

Beauty and Personal Care

Flexible Packaging Landscape

- Total Filipino beauty and personal care packaging volume is expected to see moderate 1.7% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see slightly lower 1.3% CAGR growth through 2021.

Trends

- Beauty and personal care packaging volume sales increased slightly in 2016 to reach 4.7 billion units, driven by the prominence of beauty and personal care products in Filipino consumers’ daily routines, rising disposable incomes, and younger consumers’ increasing image consciousness.

- Glass jars led sales volume growth in 2016, increasing by 8% as consumers sought more sophisticated products.

- Lotion pumps are becoming more visible in plastic bottles of baby and child-specific products and skin care, including facial care and bath and shower products.

Outlook

- Beauty and personal care packaging sales are expected to rise at a volume CAGR of 2% over the forecast period, boosted by rising consumer sophistication and image consciousness.

- Glass jar packaging is expected to perform well over the forecast period and post a volume CAGR of 8%. Companies are looking to take advantage of the growing number of consumers who are willing to purchase products that offer greater potency and quality and are packaged to look more like premium brands.

- Rigid plastic packaging is projected to post a volume CAGR of 4% over the forecast period, driven by increasing demand for color cosmetics.

Home Care

Flexible Packaging Landscape

- Total Filipino home care packaging volume is expected to see strong 3.9% CAGR growth through 2021.

- Flexible home care packaging is expected to see slightly lower but still strong 3.5% CAGR growth through 2021.

Trends

- Consumers increasingly demand affordability and portability, which has sparked a packaging reduction trend in home care products.

- As a result, flexible packing recorded 4% year-over-year volume sales growth in 2016.

- The sachet type was especially successful in the Philippines, not only due to its low cost but because it fits in a small sari-sari store, where customers only choose products behind a barrier.

Outlook

- Over the forecast period more brands in several home care categories are expected to join the packaging reduction trend in the country. As disposable incomes continue to rise, consumers will want to distribute their spending power among different goods, so it is a wise move to enable them to choose to buy small pack sizes and allocate money for different expenses.

- The volume CAGR of primary flexible packaging is expected to stand at 4% over the forecast period. Liquid fabric softeners in stand-up pouches will contribute highly to the growth, posting a 9% CAGR as the popularity of pouches continues to rise among consumers who do not want to pay the extra costs of a rigid bottle.

- The volume CAGR of secondary flexible packaging will likewise reach 4% over the forecast period. Secondary packaging paper-based containers is projected to see a 3% CAGR over the forecast period, mainly due to floor polishes in folding cartons.

- Further opportunities in home care packaging in the Philippines lie in the addition of plastic screw closures to laundry care and dishwashing stand-up pouches, as well as the addition of small pack sizes to home insecticide, home disinfectant, and air freshener metal aerosol cans.

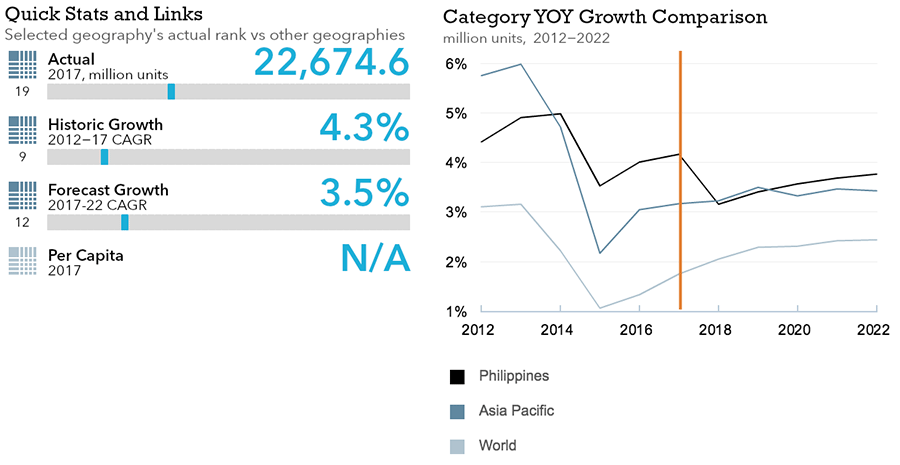

Packaged Food

Flexible Packaging Landscape

- Total Filipino packaged food packaging volume is t expected to see strong 3.5% CAGR growth through 2022.

- Flexible packaged food packaging is expected to see even stronger 3.7% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, sachets and single-serve packs are widely used, since many low-income consumers will only purchase products in quantities that are sufficient for their immediate needs. Small pack sizes also allow for brands to be sold in traditional grocery retailers outlets such as sari-sari stores.

- In processed meat and seafood, metal food cans recorded 8% sales volume growth in 2016—the highest of any packaging type. As the dominant pack type in shelf stable meat, metal food cans benefit from the enduring popularity of product types such as corned beef, luncheon meat, meat loaf, Vienna sausage and carne norte (Asian corned beef) among Filipino consumers of all income levels.

- In processed fruit and vegetables, Processed fruit and vegetables packaging retail volume sales grew by 4% in 2016. Volume growth was slightly faster than in 2015, despite the fact that processed fruit and vegetables consumption was adversely affected by the wide availability of fresh alternatives. The modest improvement in the packaging volume growth rate was partly due to the increasing popularity of various pack types and pack sizes used by key brands, including Dole.

- In confectionery, overall packaging volume sales grew by 3% in 2016, led by other rigid containers, which posted 8% growth in 2016, driven primarily by the popularity of the Tic Tac brand.

- In dairy, brick liquid cartons posted the highest volume sales growth in 2016 at 6%, due to the popularity of shelf-stable milk, which contributed to overall dairy packaging volume sales growth of 2%.

- In baby food, growth mainly stemmed from metal tins of powdered milk formula, which grew by 3% in 2016.

Outlook

- In sauces, aluminum/plastic pouches will remain an important pack type over the forecast period. Companies will continue to use them alongside flexible aluminum/plastic packs in order to cater to price-sensitive buyers.

- Processed meat and seafood consumption will continue to be adversely affected by the health and wellness trend, which is encouraging many Filipinos to purchase more fresh foods. Most categories within processed meat and seafood packaging are expected to see retail volume sales growth slow over the forecast period. The only exception is frozen processed seafood packaging, where retail volume sales are expected to grow at a CAGR of 5%, due mainly to increasing demand for frozen processed seafood, which tends to be less processed than processed meat.

- In processed fruit and vegetables, thin wall plastic containers in shelf stable fruit will drive overall growth, as consumers increasingly opt for shelf-stable fruit bowls as healthy snack options.

- In confectionery, packaging volume sales growth is project to record a 4% CAGR through 2021, driven mainly by growth of other rigid containers as the Tic Tac brand continues to grow in popularity.

- In dairy, glass bottles are expected to see the strongest total volume CAGR of 7% through 2021, due primarily to increasing demand for soy milk.

- In baby food, forecast 2% CAGR through 2021 is expected to be led by metal tins in the powdered milk formula category.