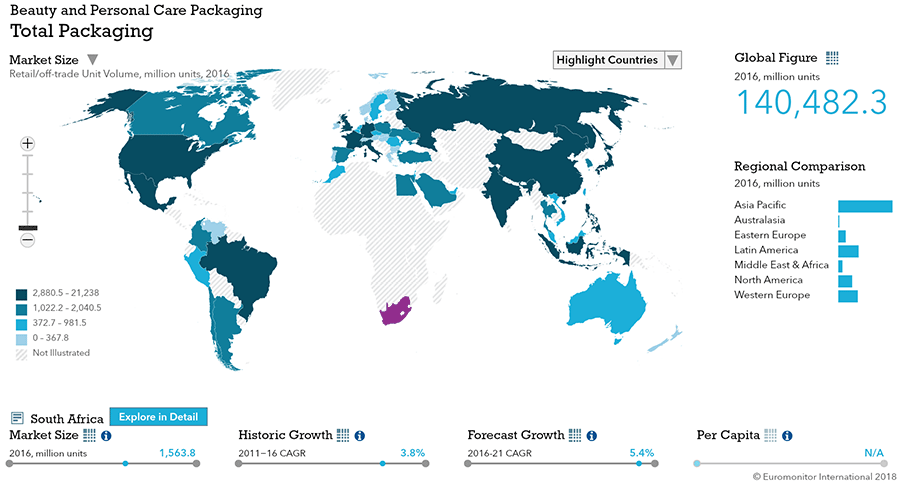

Overview

Packaging Overview

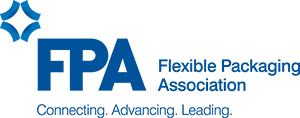

2016 Total Packaging Market Size (million units):

31,575

2011-16 Total Packaging Historic CAGR:

3.9%

2016-21 Total Packaging Forecast CAGR:

3.6%

| Packaging Industry | 2016 Market Size (million units) |

|---|---|

| Beverages Packaging | 14,526 |

| Food Packaging | 14,202 |

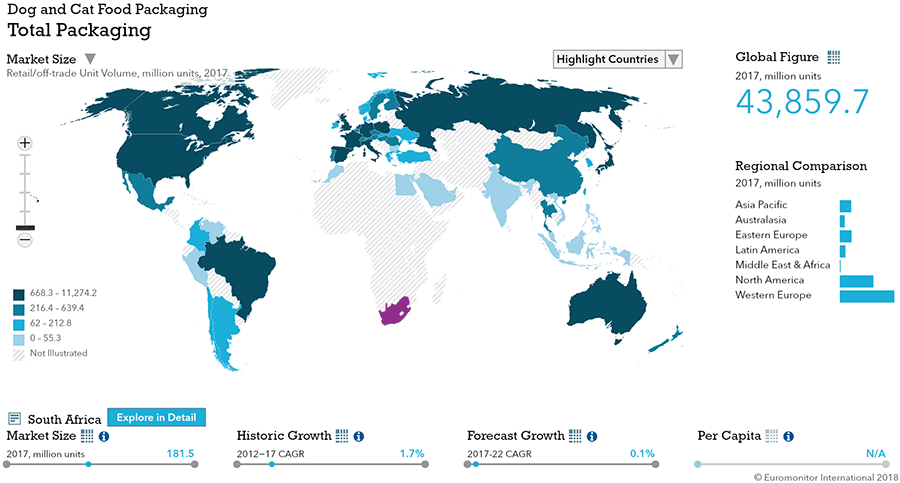

| Beauty and Personal Care Packaging | 1,564 |

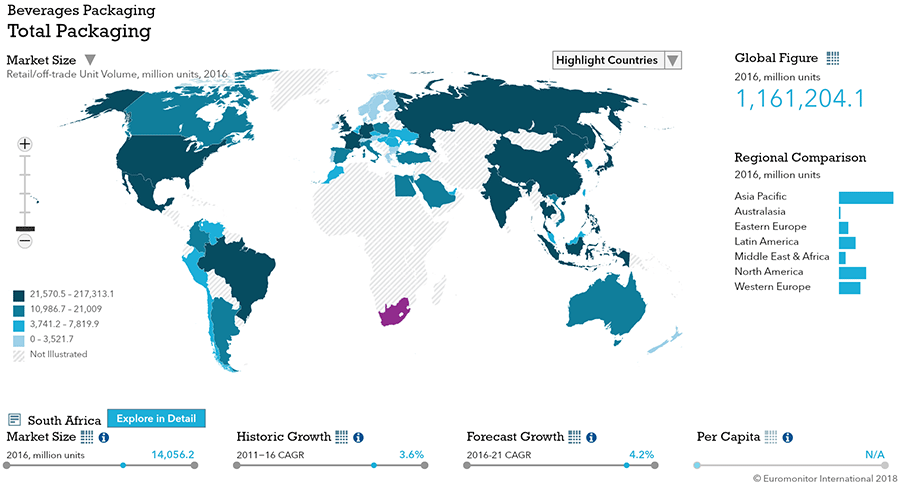

| Dog and Cat Food Packaging | 188 |

| Home Care Packaging | 1,096 |

| Packaging Type | 2016 Market Size (million units) |

|---|---|

| Rigid Plastic | 8,312 |

| Flexible Packaging | 8,941 |

| Metal | 3,507 |

| Paper-based Containers | 1,711 |

| Glass | 7,272 |

| Liquid Cartons | 1,832 |

- The total South African packaging industry, sized at over 31 bn units in 2016, is expected to see strong growth.

- Food and beverage packaging continues to dominate packaging, but beauty and personal care and home care packaging present strong niche growth opportunities.

- Flexible packaging leads in size, but rigid plastic is a close second.

Key Trends

- Convenience is becoming more important for dairy packaging, with cream in metal aerosol cans and cheese in flexible packaging, for example, posting strong volume sales growth in 2016.

- Smaller pack sizes continued to be used as a tool for premiumization in soft drinks in 2016. The growing use of smaller pack sizes was also attributable to soft drinks manufacturers preparing for the implementation of a “sugar tax”, which is expected to take effect in April 2017.

- Paper-based containers posted the strongest performance among the main packaging types with a 14% volume increase to reach 24 million units in 2016. This was thanks to the affordability of bag-in-box wine, which has become a format of choice for consumers who seek value for money.

- Convenience was also a key trend in beauty and personal care packaging in 2016. This was evident in terms of the use of innovative bottles and dispensing formats.

Packaging Legislation

- Updates to the Industry Waste Management Plan expected: An updated Industry Waste Management Plan with targets covering the forecast period is in the process of being approved by the Department of Environmental Affairs (DEA). The Packaging Council of South Africa has been instructed by the government to develop a plan that covers all the elements of the waste hierarchy in terms of reducing, reusing, recycling and recovering energy from waste. Costs that need to be met by the packaging supply chain in relation to these issues will be paid by all concerned parties, including importers of packaging.

- New regulations impact baby milk formula packaging: The introduction of the R991 law covering the advertising and labelling of milk formula, which became effective in June 2013, resulted in retail volume growth slowing slightly for milk formula in the last three years. Players and retailers cannot offer any nutritional guidelines related to infant nutrition, while price promotions are banned, as is free sampling. Labelling and packaging restrictions also became more restrictive from this point, with tamperproof packaging becoming mandatory, and health and nutrition claims being banned. Manufacturers are also required to show the message "Breast milk is the best for infants" on product packaging to promote breastfeeding. This legislation resulted in slower volume growth for milk formula in metal tins.

Recycling and the Environment

- Eco-friendly coffee pod packaging introduced: The concept of coffee pod recycling was first introduced in South Africa by Nespresso in February 2015. Despite the fact that many consumers are not especially mindful about recycling packaging waste, this concept has since gained popularity among other players in fresh ground coffee pods. The trend is expected to gain momentum over the forecast period thanks to awareness campaigns and new launches.

- Recycling rate improves: According to PETCO (PET Recycling Company) the recycling rate for plastic increased from 52% in 2015 to 55% in 2016, reflecting the relative success of awareness campaigns from the South African government and non-governmental organizations.

Packaging Design and Labelling

- Cost and convenience fuel demand for smaller pack sizes: There was a growing focus on offering different pack sizes over the review period with consumers increasingly attracted to single-serve packs for on-the-go consumption, while the lower unit price of larger packs also proved attractive for at-home consumption. Single-serve packs with distinctive and convenient packaging are also likely to be the most successful over the forecast period.

- Innovation is key to standing out in the market: Local and multinational manufacturers continue to look for innovation in order to stand out in the market. For example, a local entrepreneur launched an innovative packaging under the Ella brand in 2017, which allows the customer to carry a barista-quality coffee on the go, providing they have access to hot water. In addition to using innovation to generate convenience brand owners and manufacturers are also developing packaging and labelling which conveys the qualities of the product.

Beverages

Flexible Packaging Landscape

- Total South African beverage packaging volume is expected to see strong 3.8% CAGR growth through 2021.

- Flexible beverage packaging is expected to see slower growth than overall beverage packaging through 2020 before declining in 2021.

Trends

- In soft drinks, PET bottles is the leading packaging type, due in large part to the low cost of recycled PET. Smaller pack sizes continued to be used as a tool for premiumization in soft drinks in 2016. Prominent examples of this trend included the increasing popularity of 275ml glass bottles in carbonates, and the growing adoption of 200ml “slim” metal beverage cans in juice-based carbonates and energy drinks.

- In hot drinks, packaging volume sales grew by 8% in 2016, led by aluminum/plastic pouches for instant tea and fresh coffee beans.

- In alcoholic drinks, glass bottles continued to dominate the category with 82% volume share in 2016, but paper-based containers posted the highest volume sales growth rate at 14%, driven by increasing demand for bag-in-box wine, which consumers increasingly view as providing good value for money.

Outlook

- In soft drinks, PET bottles will remain the leading packaging type through 2021 due to their affordability and will likely continue to erode share from glass bottles.

- In hot drinks, folding cartons are projected to record strong volume sales growth at a 7% CAGR through 2021 as new players enter the market.

- In alcoholic drinks, glass bottles will continue to dominate across the forecast period, and paper-based containers are projected to continue to post volume sales growth, driven by increasing demand for bag-in-box wine from lower-income consumers and greater demand from private label companies.

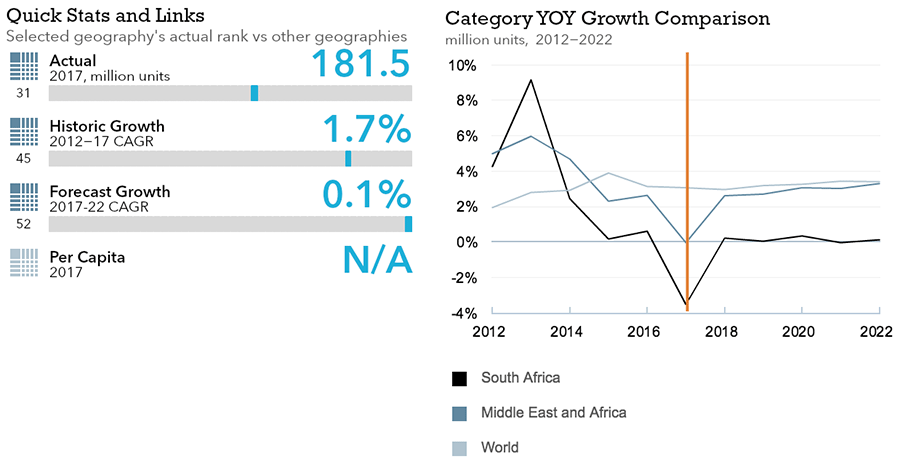

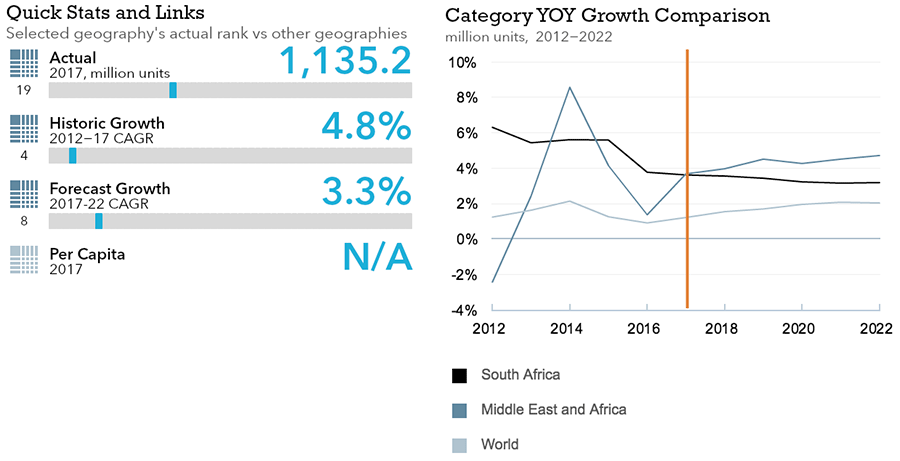

Dog and Cat Food

Flexible Packaging Landscape

- Total South African dog and cat food packaging is expected to see limited 0.1% CAGR growth through 2022.

- Flexible dog and cat food packaging volume growth is expected to keep pace with the overall dog and cat food packaging market in South Africa through 2021.

Trends

- Despite economic challenges, dog and cat food packaging sales volume grew 1% in 2016, due mainly to the fact that many manufacturers reduced pack sizes to keep prices affordable for consumers, which drove more frequent purchasing.

- Zip/press closures are only used on smaller packs, as they are not strong enough to hold a larger pack size closed. Thus they are gaining popularity within dry cat food and, in particular, the Whiskas dry cat food brand from Mars, which is available in a 900g flexible plastic packaging format. They are also increasingly found in the packaging of dog treats sold in flexible packaging as opposed to folding cartons.

Outlook

- Packaging volume is expected to decline slightly through 2021 as consumers trade up to larger packs, particularly for dry dog food.

- Volume sales of folding cartons and flexible packages with zip/press closures will perform well in coming years as dog treats and mixers continue to grow in popularity.

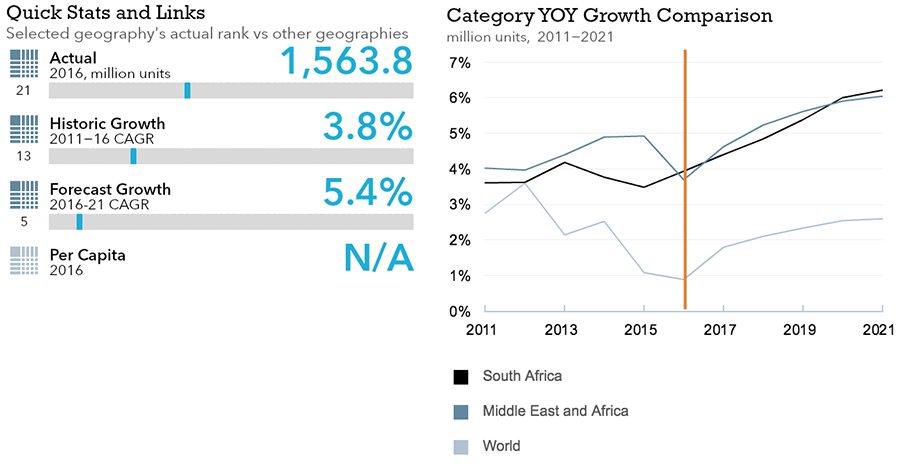

Beauty and Personal Care

Flexible Packaging Landscape

- Total South African beauty and personal care packaging volume is expected to see strong 5.4% CAGR growth through 2021.

- Flexible beauty and personal care packaging is expected to see even stronger 6.8% CAGR growth through 2021.

Trends

- South Africa’s challenging economic environment led many consumers to opt for economical large pack sizes for daily necessities such as shampoo. Conversely, with limited disposable income, consumers are increasingly opting for smaller pack sizes of non-essential items.

- Consumers are also increasingly looking for convenient packaging that make products easier to carry and dispense. Consequently, pocket-sized packs with spray pump closures for items like sun protection products have performed well.

Outlook

- South Africa’s economic climate will continue to be a threat to beauty and personal care packaging volume growth in coming years. However, value pack sizes will likely continue to perform well.

- Convenience is expected to drive beauty and personal care packaging innovation in coming years as consumers increasingly expect ease of use and portability.

- Plastic screw closures are projected to post strong growth as closures for stand-up pouches, as they provide a simple and effective means of dispensing products such as liquid soap.

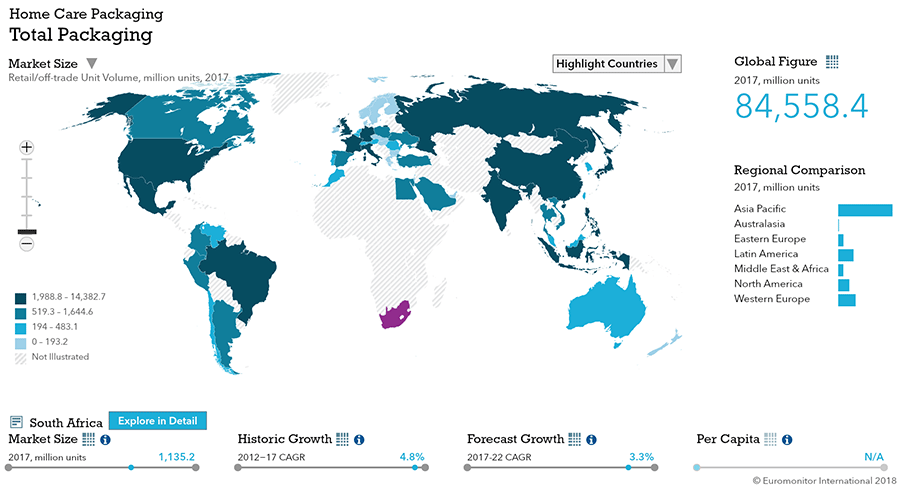

Home Care

Flexible Packaging Landscape

- Total South African home care packaging volume is expected to see strong 3.6% CAGR growth through 2021.

- Flexible home care packaging is expected to see slower but still strong 4.8% CAGR growth through 2021.

Trends

- Plastic pouches continue to gain traction across the home care packaging market; this is in line with cost-saving attempts by suppliers to provide greater overall value to consumers. The market continues to witness expansion of plastic pouches for both branded and non-branded home care products.

- Manufacturers of laundry care products continued to focus on closure systems that aid easy and convenient dosage, with labelling of such products indicating dosage suggestions to users; non-closure dosage caps have become a standard feature in liquid detergents, and this category also witnessed the highest total retail unit volume growth in 2016.

- Consumers increasingly demand more value for money in South Africa’s difficult economy, so manufacturers offer an array of pack sizes from small economy packs to large packs that tout phrases such as “10% extra” or “100ml extra”.

Outlook

- Home care packaging volume sales are projected to grow at a 4% CAGR through 2021, due in large part to the fast growth of liquid laundry detergents and fabric softeners, which are relatively immature categories in South Africa.

- Given the expected continuing consumer demand for value offerings, the market is likely to continue to witness product innovation in terms of more economical pack sizes, including large and small packaging. Promotions across retail channels throughout the year are likely to continue. Demand for value is likely to also result in the sustained penetration of ‘no frills’ packaging.

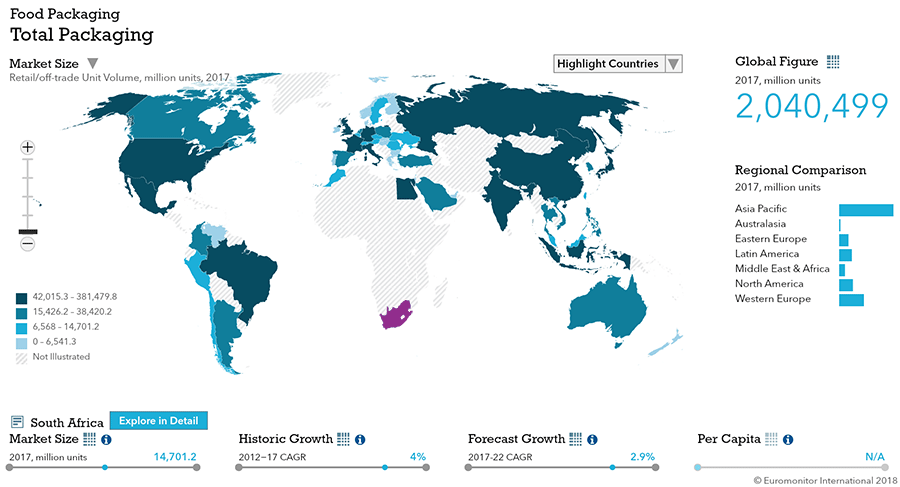

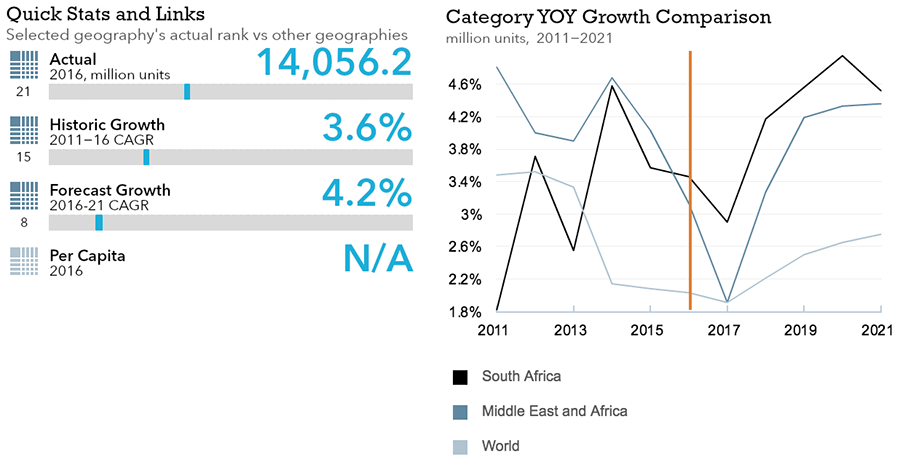

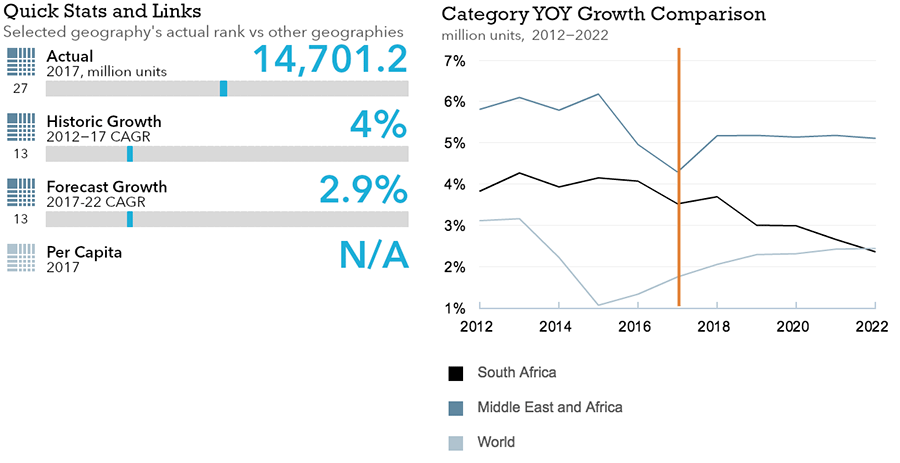

Packaged Food

Flexible Packaging Landscape

- Total South African packaged food packaging volume is expected to see strong 2.9% CAGR growth through 2022.

- Flexible packaged food packaging is expected to post even stronger 3.2% CAGR growth through 2022.

Trends

- In sauces, dressings and condiments, liquid cartons recorded the highest volume sales growth in 2016 at 30%, albeit from a low base, as pasta sauces were increasingly sold in liquid cartons rather than glass jars for portability and affordability reasons.

- In processed meat and seafood, metal food cans continued to be the most popular packaging type in 2016 with 44% of volume sales. Additionally, metal food can volume sales increased by 6% in 2016, fuelling overall processed meat and seafood packaging volume sales growth.

- In processed fruit and vegetables, metal food cans continued dominate sales volume in 2016, accounting for 100% of retail volumes in categories such as shelf stable beans and shelf stable vegetables. However, flexible packaging accounts for 100% of frozen vegetables volume sales.

- In confectionery, flexible packaging has long dominated and accounted for 90% of volume sales in 2016, posting 3% growth over the previous year.

- In dairy, packaging volume sales increased by 5% in 2016, driven in large part to the proliferation of smaller pack sizes in light of the ongoing snacking trend in South Africa. Consumers increasingly demand convenient packaging, which led to an 8% increase in volume sales of cheese in flexible packaging in 2016.

- In baby food, flexible packaging posted 35% volume sales growth in 2016, fuelled by a significant shift from packaging baby food in glass jars to stand-up pouches, which now account for 22% of total baby food packaging volume sales.

Outlook

- In sauces, growth will mainly come from liquid cartons through 2021, but flexible packaging volume sales are projected to grow at a 6% CAGR through 2021 in light of increasing consumer demand for convenient and affordable products.

- In processed meat and seafood, metal food cans will continue to be the most popular pack type and will drive overall category growth in coming years. However, stand-up pouches volume sales are projected to grow at a healthy 8% CAGR through 2021, driven primarily by increasing demand for shelf-stable seafood in convenient and affordable packaging.

- In processed fruit and vegetables, metal food cans will continue to dominate the category as a whole, and flexible packaging will continue to dominate the frozen vegetables space.

- In confectionery, flexible packaging will continue to dominate, with volume sales growing at a 2% CAGR through 2021, driven by its affordability and lightness.

- In dairy, packaging types that offer consumers portability and easy storage will perform well. As such flexible packaging is projected to post strong sales volume growth through 2021, notable in the cheese and butter categories.

- In baby food, stand-up pouches are projected to continue increasing in popularity, with volume sales growing at a 6% CAGR through 2021.